Instead of doing a naked put, I'd go with a bear put spread.I'm looking for feedback on a diagonal collar to limit short term paper losses financed by writing a medium term call at a higher price. There's still downside risk but a lot of potential upside gains with P&D and ER coming out.

The diagonal collar is free but I've never tried it.

For example, for every 100 TSLA ($122 currently) I buy, I limit SP drop to $110 in Jan with max upside of $165 until April. The loss/gain would be limited to -12/+43 share for Jan / April to combat short term risks. If SP shoots up, I could always roll the April call, but making 34% gains with low downside doesn't sound bad either.

100 TSLA

-165c Apr 21 and +110p Jan 27 = $.20 credit

Opinions?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

EVNow

Well-Known Member

Thats close. I've -c125 I'm hoping to buy back for a few pennies in the last hour of trading.decision time for my 12/30 -c122 B/W, cost basis 122... to roll or not to roll, that is the dilemma

if it expires today, i don't want to carry these shares into next week in case P&D is bad

on the other hand, i want these shares moved to next week (good 5.60 credit)

thinking

thinking

SP seems to be hovering around 122 (yesterday's close).

I'm also completely out. Sold all my shares and closed all my BPS at large loss. Looks like I will sell my house, and be able to deduct all the losses from the capital gains so I won't have much of a tax bill on the house. Enough money to move somewhere else and retire with plenty of cash left even if things didn't recover. Have to wait out a month for the wash sale rules before I can re-enter and then slowly buy back into TSLA whenever the economy recovers. Hopefully regain at least half my losses within a few years.Well, they say market only bottoms after most people have given up. This retail (me) had already given up. I stopped checking the SP first thing every morning and accepted it may just go down and I was ok with that. I talked to my SO about temporarily lowering our standard of living for a year or 2. Now we can go up - I say this in the most dispassionately manner possible.

But much less stress now, don't have to watch the stock every day. Learned a lot of lessons, shouldn't have let the BPSs roll out and stack up potential future losses so far out, didn't realize assignments would start happening so quickly and screw up things with wash sales. Got screwed by Fidelity's shitty system that wouldn't show assigned lots immediately and caused me to not be able to select the right lots to sell, causing huge amounts of lost losses. Have to call them every day to try to fix things up. Will move all my Fidelity accounts over to Etrade in February. Should have started cashing out sooner when things were dropping to preserve enough cash to maintain current lifestyle.

If we close above 120 today then it would potentially indicate a change of tactic from the Wedgies - over recent months they've been defending calls like crazy, not caring for puts. 120 is the last put-wall, but there are plenty of calls below that

Dead cat bounce: DCBs lead to lower lows. Just because we haven't seen consolidation doesn't mean we're in a DCB. We may very well go down again to near the low and chop around for a bit. That'd be the consolidation needed. I think we went way past the point of consolidation, though, as this crash in TSLA stock is beyond reasons. Past 160, market participants have had ample time and opportunities to load up on the stock on zero valid fundamental concerns at all so if we have a good P&D, I say we just rocket up from here. No lookie backsie.

In term of wave count, I don't agree with Mauro. See, if the market has seen terrible P&D and ER and decided the stock should crash below 160 then yes, we can talk about wave counts which are interpretations followed by predictions of human psychology. In this case, the market hasn't seen P&D or ER. It hasn't seen demand destruction but the deed has already been done. I'm more in Cory's camp. At this point, it's a screaming buy.

Thank you for this breath of fresh air! Very encouraging after so much external darkness. So basically we pre-crashed 2023 and might survive hanging out in or over the $150-$175 or dare I say higher range while all other big tickers get their turn on the clapper in the coming months.

Are you up to selling TSLA calls yet. If yes, when and what DTE and strikes are you favoring?

BTC 12/30 -100c ($21.19 debit) SP around $121.25. Net profit from the trade $8.56 before commission. Decided maybe it is a bounce so I won't roll this one and let those shares be uncovered. Keeping my 1/6 bandaid's in case P&D flops/macro.Took this green day to switch to a bigger bandaid to the gunshot wound.

BTC 12/30 -140c ($0.04 debit)

STO 1/6 -100c ($14.20 credit) SP around $110.32

Positions

12/30 -100c ($29.75 credit)

1/6 -100c ($14.20 credit)

1/6 -80c ($32.52 credit)

Positions

1/6 -100c ($14.20 credit)

1/6 -80c ($32.52 credit)

I'm selling 150C's expiring next week but ready to roll out 6 months if we get a huge P&D print. This crash over the last 2 months has cleared out all the leap calls I shorted prior so have a lot of room for rolling. Keep in mind, though, that I'm trading on a Portfolio Margin account so I can roll these out and go right back to selling fresh weeklies. In fact, this flexibility is what allowed me to hedge very effectively against the crash.Thank you for this breath of fresh air! Very encouraging after so much external darkness. So basically we pre-crashed 2023 and might survive hanging out in or over the $150-$175 or dare I say higher range while all other big tickers get their turn on the clapper in the coming months.

Are you up to selling TSLA calls yet. If yes, when and what DTE and strikes are you favoring?

If it wasn't a P&D week, I'd have sold 140C's.

P/S: my wife just walked in and asked "so they gave you access again?" since I was banned for 3 days.

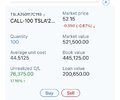

Instead of doing a naked put, I'd go with a bear put spread.

View attachment 890411

Great suggestion. No sense protecting TSLA down to $0, and there's a huge put wall at 100 as a backstop.

intelligator

Active Member

Thinking of liquidating more shares to close out two more DITM BPS, reduces stress, would start the new year with less baggage. Based on Fidelity Margin Calculator, the account value would increase and end with a margin credit, margin interest payments would go away as well. There'd be two remaining positions, a Jan '25 -240/+180 BPS and a Sep '24 -290 CSP. The BPS has good extrinsic to survive down to $100 SP, the CSP doesn't. I need to fix that to avoid shares put to me, introducing another wash sale, losing two ways. Any ideas? I'm not seeing a reasonable way out of it other than rolling down and in some after I clean up the account and get margin back to cover that roll.

Although I have almost immediate seller remorse, I did it to avoid true loss should we dip down to the low 100's. I ended up selling enough shares at 121 to close out Jan '25 9x -280/+230 BPS and Jan '25 7x -280/+230 BPS that were eating away. The Jan '25 10x -240/+180 BPS and a Sep '24 6x -290 CSP remain. Still stinks like dog doo.

I'm looking for thoughts on how best to mitigate the CSP. Not only do I not want shares at 290, if that hits, I lose the capital gains loss. I have about -70k to work with, so thinking of selling some calls on ramaining shares that I will not let go of. Will buy more at whatever price after 31 days have passed.

Last edited:

Although I have almost immediate seller remorse, I did it to avoid true loss should we dip down to the low 100's. I ended up selling enough shares at 121 to close out Jan '25 9x -280/+230 BPS and Jan '25 7x -280/+230 BPS that were eating away. The Jan '25 10x -240/+180 BPS and a Sep '24 6x -290 CSP remain. Still stinks like dog doo.

I'm looking for thoughts on how best to mitigate the CSP. Not only do I not want shares at 290, if that hits, I lose the capital gains loss. I have about -70k to work with, so thinking of selling some calls on ramaining shares that I will not let go of. Will buy more at whatever price after 31 days have passed.

Roll it to a 1/2025 to gain a little more time value and maybe take a small loss to decrease it to 280 or lower.

Or split roll forward and turn it into a spread.

Add a CC or two for either of the above to bring down the strike without taking a loss.

SebastienBonny

Member

If you have the cash: why not convert those 6 290 sold puts to 12 200’s? Needs around 50K cash more if that’s an option.Although I have almost immediate seller remorse, I did it to avoid true loss should we dip down to the low 100's. I ended up selling enough shares at 121 to close out Jan '25 9x -280/+230 BPS and Jan '25 7x -280/+230 BPS that were eating away. The Jan '25 10x -240/+180 BPS and a Sep '24 6x -290 CSP remain. Still stinks like dog doo.

I'm looking for thoughts on how best to mitigate the CSP. Not only do I not want shares at 290, if that hits, I lose the capital gains loss. I have about -70k to work with, so thinking of selling some calls on ramaining shares that I will not let go of. Will buy more at whatever price after 31 days have passed.

Or even lower strike if you’re willing to go to 25.

intelligator

Active Member

I don't have the cash; used the proceeds of share sales to close out losing BPS. Have now -63k of realized loss (selling something against today would be good), left with 1200 shares to write SAFE CC against , lot's of margin that I am trying to stay away from unless I can put to extremely good tactical but retractable use.If you have the cash: why not convert those 6 290 sold puts to 12 200’s? Needs around 50K cash more if that’s an option.

Or even lower strike if you’re willing to go to 25.

Last edited:

Well, they say market only bottoms after most people have given up. This retail (me) had already given up. I stopped checking the SP first thing every morning and accepted it may just go down and I was ok with that. I talked to my SO about temporarily lowering our standard of living for a year or 2. Now we can go up - I say this in the most dispassionately manner possible.

When I was skiing with the family and in the 200k margin call territory if I didn’t sell ATM CCs for 6/1, I didn’t even answer the phone in the morning while going down the slopes having family Funtime with the kids in nice powder snow, my investment was dead to me and I didn’t mind my broker liquidate me all shares and that I start from scratch from here. I was back to square 0 in my heart, accepted it and had fun for the whole day. I was greatly surprised the following days when the stock price came back up when everyone was screaming a $60 target price straight away.

bkp_duke

Well-Known Member

The SP is discounted for a Peloton stop of production scenario.The market has already set up for a buy the news on the P and D. The SP was discounted to disaster.

It will not be a disaster. That would be below 370 deliveries (still a record lol).

400 feels pretty tepid.

420 and above starts looking nice.

A tepid report may allow the market to retest the lows of past week. Don't see how it can break through that without a disaster.

450 and above may send the SP soaring to above 150 FAST (and then we would have gaps to worry about...).

Based on the SP reset of the past month, hard not to tilt bullish for the P and D report. Sell the rumor, right? And boy was it sold...

Those LEAPS must be doing very nicely @OrthoSurg

TSLA swimming against the tide once again, whales still feeding? If I'd shorted below this price I'd be quite concerned right now...

I have 26x -c150's expiring today, I'm not expecting they'll come into play

Yes I enjoy LEAPS

My first experience

Attachments

Back in 2019 I had 10x LEAPS that I bought for $1 each, they went up 220x in three months... I stupidly sold them, because if I had held until expiry they were 3600x, yes, I could have made $3.6million from $1000, but I had no clue what I was doing back thenThe SP is discounted for a Peloton stop of production scenario.

Yes I enjoy LEAPS

My first experience

Not sure I do now either, but that's another discussion...

Edit: Hedgies got some work to do here, unless they've abandoned 120

corduroy

Active Member

I've been on the fence about what to do about my DITM CSPs. They have been assigned 5 times and I keep selling back in the last couple weeks - mainly as a way to keep stalling and see what happens. Will we recover coming into earnings or head back down under $100? Who knows.

Since I couldn't decide, I just did a half capitulation. Closed out half of them and sold 20% of my shares to cover. This way if we head down again, I'm less leveraged and in better shape. If we shoot back up, half of my puts could recover and well, at least I didn't sell 40% of my shares.

Since I couldn't decide, I just did a half capitulation. Closed out half of them and sold 20% of my shares to cover. This way if we head down again, I'm less leveraged and in better shape. If we shoot back up, half of my puts could recover and well, at least I didn't sell 40% of my shares.

Last edited:

I guess depends on your broker fees and taxes (here I pay 0.3% tax for share buy/sells and a 0.35% broker fee on option exercise), but if the costs are low then continually reselling them they'll go OTM one day, no?I've been on the fence about what to do about my DITM CSPs. They have been assigned 5 times and I keep selling back in the last couple weeks - mainly as a way to keep stalling and see what happens. Will we recover coming into earnings or head back down under $100? Who knows.

Since I couldn't decide, I just did a half capitulation. Closed out half of them and sold 20% of my shares to cover. This way if we head down again, I'm less leveraged and in better shape. If we shoot back up, half of my puts could recover and well, at least I didn't sell 40% of my shares.

Well, they say market only bottoms after most people have given up. This retail (me) had already given up. I stopped checking the SP first thing every morning and accepted it may just go down and I was ok with that. I talked to my SO about temporarily lowering our standard of living for a year or 2. Now we can go up - I say this in the most dispassionately manner possible.

Around two weeks ago, I sold off most my shares and options, and bought protective puts for remaining assets. Then I sold the remaining shares, leaving just my convertible bonds, and was net short TSLA for a little while. That's more than complete capitulation.

The recent drop likely from one or more large holders, Elon addressing shareholder concerns by stating he's not selling for a year or two, and many Tesla supporters turning negative are signs that capitulation has begun.

I've started buying shares and writing puts and am cautiously bullish. My portfolio is unlikely to ever reach the heights it did last year, but I'm optimistic for 2023.

decided to de-risk in case of P&D miss... i BTC 12/30 -c122 B/W and sold all the shares, +75% gaindecision time for my 12/30 -c122 B/W, cost basis 122... to roll or not to roll, that is the dilemma

if it expires today, i don't want to carry these shares into next week in case P&D is bad

on the other hand, i want these shares moved to next week (good 5.60 credit)

thinking

thinking

if next week is green instead, no regrets... STO B/W according to the price action at that time

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K