Much of the trading action on CPI days happens in the pre-market (after the release at 8.30am) and can be the opposite of what happens during regular trading. For example on the 13th of December 22 release, TSLA gapped up in pre-market from the previous close of $167.82 to open at $174.87 and then proceeded to sell off. So @Yoona if it's possible to include pre-market action from the previous close in your table, then we could get a better picture of what can happen.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

EVNow

Well-Known Member

While I'm in wash-sale timeout for January, I'm trying to find some funds I could trade in that are closely correlated to TSLA so I can catch any jumps from P&D, earnings or whatever. Anyone have suggestions?

Best I can find that are slightly correlated:

Fidelity Electric and Future Transportation ETF (FDRV)

KraneShares Electric Vehicles & Future Mobility ETF (KARS)

The Future Fund Active ETF (FFND)

And then these leverage ETF funds, which could be good but look very risky:

TSLH. Innovator Hedged TSLA Strategy ETF

TSLL. Direxion Daily TSLA Bull 1.5X Shares ETF

Just did a bit of search on these ... here is the last 1 year return on these.

TSLA : -66%

FDRV : -36%

FFND : -32%

TSLL: -79%

TSLH: -34%

Only TSLL lost as much as Tesla, meaning that is the one I'd expect to go up along with TSLA as well. Don't have 2 year history to confirm. But FDRV and FFND didn't raise as much as TSLA. For eg. FDRV went up by 25% between May & Nov, 2021 - when TSLA went up 70%. FFND went up only 7%.

So, I think FDRV and FFND are more like Nasdaq/S&P. TSLH is tiny ($2.6M). TSLL at 133M is slightly better.

Ofcourse, if audited, the agent can (I think legit) claim TSLL is very similar to TSLA.

EVNow

Well-Known Member

Or just comparison to prev-close.then proceeded to sell off. So @Yoona if it's possible to include pre-market action from the previous close in your table, then we could get a better picture of what can happen.

I know Ihor's methodology isn't seen as the most reliable, but interesting to see his take anyway:

$TSLA short interest is $9.59B

80.72M shares shorted

3.01 % SI% of Float

2.92 % S3 SI% Float

0.30 % fee

Shares shorted up +2M shs, worth $260M, 2.79 %, over the last week.

Shorts down -$26M in 2023 mark-to-market losses; including -$349M on today's +3.55 % move.

$TSLA short interest is $9.59B

80.72M shares shorted

3.01 % SI% of Float

2.92 % S3 SI% Float

0.30 % fee

Shares shorted up +2M shs, worth $260M, 2.79 %, over the last week.

Shorts down -$26M in 2023 mark-to-market losses; including -$349M on today's +3.55 % move.

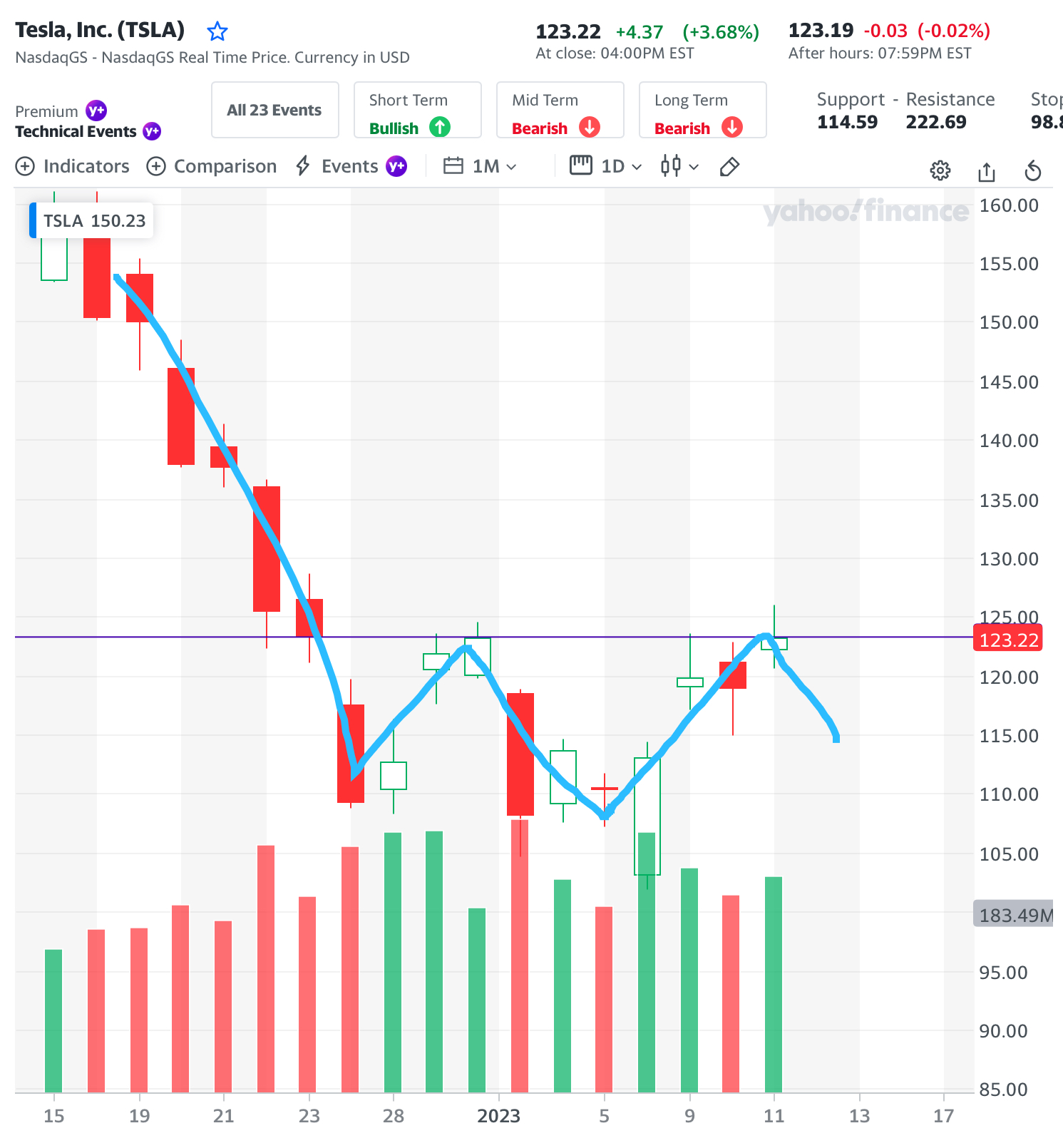

We got rejected today at the 126 level, previously 127 but these things move down gradually as the SP stays below them for an extended period of time. Have you hedged?

The next resistance level, previously 140, is now 136.6. By the time we get there, it may have moved down to 135 or lower. Tomorrow is CPI and I think majority of people, myself included, are expecting a deflation / disinflation reading, which means there's little room for a sustainable upmove unless the print surprises by 0.3% or more.

The next resistance level, previously 140, is now 136.6. By the time we get there, it may have moved down to 135 or lower. Tomorrow is CPI and I think majority of people, myself included, are expecting a deflation / disinflation reading, which means there's little room for a sustainable upmove unless the print surprises by 0.3% or more.

Last edited:

Who you asking?We got rejected today at the 126 level, previously 127 but these things move down gradually as the SP stays below them for an extended period of time. Have you hedged?

The next resistance level, previously 140, is now 136.6. By the time we get there, it may have moved down to 135 or lower. Tomorrow is CPI and I think majority of people, myself included, are expecting a deflation / disinflation reading, which means there's little room for a sustainable upmove unless the print surprises by 0.3% or more.

That wise-guy, @ZeApelido, posted in the "other" thread that it's forecast, buy someone that forecast out right the last 8 readings, to come 0.3% above estimate

Whatever, it's going to be choppy...

dc_h

Active Member

Very helpful chart, that is a lot of volatility. Could be hard to be patient with positions tomorrow. I have one 120 put, 5 120 CC's, 130 and 135 CC's. I also have 120 calls that used to be leaps coming due in February. A rally would help roll these out for a bigger run, or if enough run now, to convert to shares. Was feeling 120 max pain to 125 was pretty safe, but any surprise could push is 10% in either direction.

Remember, it is hard, but usually better to sell CC's when the stock has risen and sell when it falls. It goes against your emotions. Not always my forte and I may get swept on a lot of CC's tomorrow. My Feb calls will be happy though and I'll sell a ton of puts next week and expect a pullback. Could be famous last words on a run to new ATH, but I doubt it.

Long term catalysts are announcements that will reinforce 40-50% YOY growth in 2023 - 2025. That could cause a big run and short covering. I'm enjoying the CC income, but concerned I don't play the game too long. Will probably take a hit and start only selling 15-20% out on weeklies. Easier to roll if needed.

Have to admit I had forgotten about it and wise guy @ZeApelido reminded us for which I am grateful.Who you asking?

That wise-guy, @ZeApelido, posted in the "other" thread that it's forecast, buy someone that forecast out right the last 8 readings, to come 0.3% above estimate

Whatever, it's going to be choppy...

It is true, this guy has been right on for months. Where do these 'expected' prints come from anyway, and why do they matter so long as the trend continues down every month?

A 0.3% to the upside will probably give us a 50 basis point hike and two ugly weeks of macros. Interesting to see if Truflation is wrong this time, as everyone and their mother is expecting a soft print tomorrow.

In deference to Truflation's string of correct predictions, I did purchase puts in AMZN and SPY at the close. BTW, when does AMZN get spanked to a 40 PE with its relatively pathetic growth rate?

Yeah. I don't know about rolling much anymore on the CCs. I sell far out as it is, and if TSLA goes back in an uptrend, perhaps the right course of action is to accept you are wrong and take the loss when your target suddenly flies to underwater. The way this stock moves can be absolutely outrageous.Very helpful chart, that is a lot of volatility. Could be hard to be patient with positions tomorrow. I have one 120 put, 5 120 CC's, 130 and 135 CC's. I also have 120 calls that used to be leaps coming due in February. A rally would help roll these out for a bigger run, or if enough run now, to convert to shares. Was feeling 120 max pain to 125 was pretty safe, but any surprise could push is 10% in either direction.

Remember, it is hard, but usually better to sell CC's when the stock has risen and sell when it falls. It goes against your emotions. Not always my forte and I may get swept on a lot of CC's tomorrow. My Feb calls will be happy though and I'll sell a ton of puts next week and expect a pullback. Could be famous last words on a run to new ATH, but I doubt it.

Long term catalysts are announcements that will reinforce 40-50% YOY growth in 2023 - 2025. That could cause a big run and short covering. I'm enjoying the CC income, but concerned I don't play the game too long. Will probably take a hit and start only selling 15-20% out on weeklies. Easier to roll if needed.

TSLA on CPI DaysMuch of the trading action on CPI days happens in the pre-market (after the release at 8.30am) and can be the opposite of what happens during regular trading. For example on the 13th of December 22 release, TSLA gapped up in pre-market from the previous close of $167.82 to open at $174.87 and then proceeded to sell off. So @Yoona if it's possible to include pre-market action from the previous close in your table, then we could get a better picture of what can happen.

It remains the primary source of my frustration. I guess they weren't lying when they called it the Wall Street darling.BTW, when does AMZN get spanked to a 40 PE with its relatively pathetic growth rate?

As others have said, this is a dangerous game and any option plays you do, any at all, carry the risk of massive losses

However, if I were wanting to increase my share count in your position then I would sell weekly covered-calls at a premium that will buy you 12x TSLA. You'd need around $1500 to do that, so you could go for 15x $1 premiums, -c140's for next week, or 40x 0.38, which would be -c150's, or any other permutation that suits your risk tolerance

The benefit of writing a smaller %age of your shares is that you can roll ITM's up and out, but still have contracts available to write for the next week. The benefit of writing 40x low premiums is that based on history, the SP hasn't moved more than 23% up Friday to Friday

But history means nothing and we're at a very low share price now. Just needs good CPI, DED pivot, strong Tesla earnings and guidance, CyberTruck order page, etc., and TSLA could go up 5% daily for a month. We've seen this before, we'll (hopefully) see it again. Then what will you do and how ill you feel? At least you can get wiped-out like with puts or spreads, but you could lose out on a lot of potential gains

Be very, very careful. If you do play this game, start small, play safe, take profits sooner rather than later

You will ge burned, we all got burned, some of us fatally

Edit: to add, you can also sell puts at the strike you sold your shares for, or slightly lower, it might not bring much, but it's essentially risk-free premiums... so if you sold at the absolute low, $101.20 then 6x 1/20 p-100's would net you $200, and a lower CDA if they were to exercise

I just started writing calls and puts last day of Dec and am having a blast trading them. Other than writing weekly bull spreads, I view writing puts/calls as lower risk than buying calls/puts/spreads, assuming I'm willing to be assigned at my strikes.

I'm surprised about all the dire warnings. Am I missing something?

I just started writing calls and puts last day of Dec and am having a blast trading them. Other than writing weekly bull spreads, I view writing puts/calls as lower risk than buying calls/puts/spreads, assuming I'm willing to be assigned at my strikes.

I'm surprised about all the dire warnings. Am I missing something?

Probably that selling calls on shares for a strike below their CB is ill-advised and selling CSP for a strike where your don’t have the cash or margin to cover if it goes ITM and gets assigned. Both of these blow up plenty trader’s accounts.

For example, the lowest CB shares I have are $243ish and so selling calls sounds like fun except anything above $234 pays pennies it’s not worth it, and anything below, like $145–160, pay more but are risky to lose the shares to and lock in tremendous losses (between 145-160 and 243) that the premium is not worth it.

When the shares trade again in the 250-300 range, then selling covered calls will begin to make sense for me.

If you have shares with a CB of 110-120 then sure, have fun selling CC’s above 125, etc. Just be careful, your shares might get called away and you may never get a chance to buy it at those low prices again in case you intended to hold onto them long term.

I just started writing calls and puts last day of Dec and am having a blast trading them. Other than writing weekly bull spreads, I view writing puts/calls as lower risk than buying calls/puts/spreads, assuming I'm willing to be assigned at my strikes.

I'm surprised about all the dire warnings. Am I missing something?

Awww, the good 'ol days! That's so 2021! This thread was so full of hope! We were experimenting, learning, and trying all sorts of trading ideas and methods. Almost like Woodstock! If you have the patience, read the posts (on this thread) from Oct of 2021, right around when the Hertz deal got announced.

Anyway, if you're willing to be assigned at your strikes, then you should be fine.

intelligator

Active Member

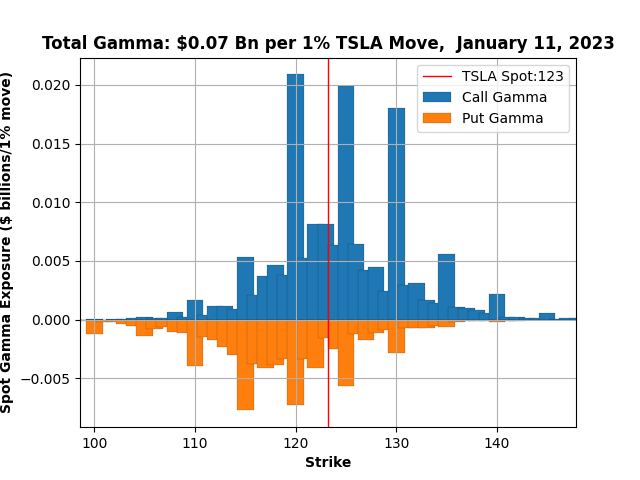

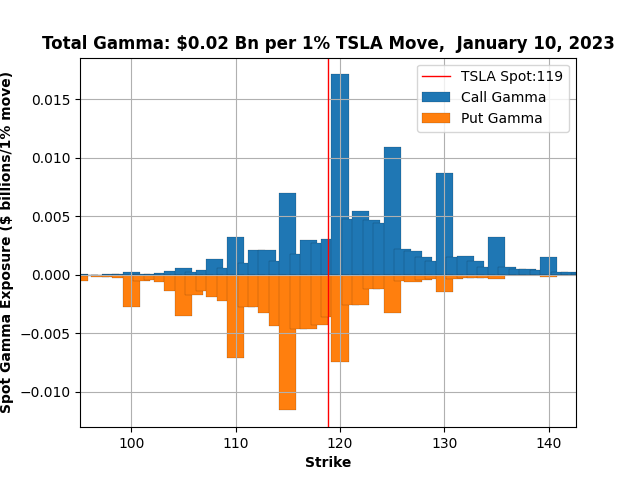

Put interest dried up ... from a gamma exposure perspective. Seems upside hardened at 130. Positive gamma, MM are typically selling shares. On CPI days, all bets are off. If I read @Yoona analysis correct, 50% chance of red/green before noon, 67% green probability into the close? Assuming red morning, I may open another BPS if we dip hard. The afternoon, assuming green, I'll close the +105/-110 BPS and open a 1 DTE -132/+137 BCS.

R

ReddyLeaf

Guest

Ok, this TA guy has been very accurate every time I’ve watched him. He was worried that macros would rally into CPI (they did), and then crash after (TBD tomorrow). Pretty much all signals are for a possible brief gap up tomorrow, followed by a dump. All stocks (except TSLA) are at or very close to significant resistance and he expects the market to dump. Only TSLA is not quite at his resistance level, so he opened a small hedge position (probably bought 1/13 calls) just in case he’s wrong on the CPI.

Personally, I don’t agree with his TSLA resistance levels; and I think we are already AT RESISTANCE now with after hours today ($123.19) at the same price as the 12/30 close ($123.18). What better way for the CNBC talking heads to say that Tesla is still down YTD. Sure, if you look back to Sept 2021, pre-S&P addition, you can see the SP 130-140, but I wouldn’t call that resistance for this week. I still expect the SP to drop post-CPI and tag $120 again, maybe even $115, to MaxPain. Stay safe out there and GLTA.

Personally, I don’t agree with his TSLA resistance levels; and I think we are already AT RESISTANCE now with after hours today ($123.19) at the same price as the 12/30 close ($123.18). What better way for the CNBC talking heads to say that Tesla is still down YTD. Sure, if you look back to Sept 2021, pre-S&P addition, you can see the SP 130-140, but I wouldn’t call that resistance for this week. I still expect the SP to drop post-CPI and tag $120 again, maybe even $115, to MaxPain. Stay safe out there and GLTA.

Last edited by a moderator:

...assuming I'm willing to be assigned at my strikes.

That's the key part. The problem is willingness to be assigned seems to vary with share price for me.

EVNow

Well-Known Member

Experience.Am I missing something?

Xepa777

Banned

If you follow a stock as obsessively as we do then tesla is actually safer than an etf with a bunch of trash stocks in it. Etf also has fees while tesla gives us dividends via selling options.One thing I'm thinking about. If some of you went from 100s of thousands of dollars to a couple of million. Why didn't you guys put some in a "safe" world-wide ETF and just enjoy dividends for that part of your portfolio?

It's not like that at the moment, but I plan balancing my portfolio near 25% TSLA, 25% World-wide ETF and 50% cash (for options or opportunities).

Tesla has basically an assured pathway to returning over 5% cagr even from its all time high number over a ten year time horizon. What the company is doing now will be legendary for HBS case studies around engineering moats, vertical integration, and team management. Elon could die of a heart attack and china can seize all of teslas assets there and the company would still be at an all time high share price in 2030 based off everything we know.

The IRA is basically gonna get rescinded by 2027 because it’s more or less the tesla enrichment act.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K