Just my stream of thoughts:

I've noticed a different kind of divergence: stock price & IV. This Monday we traded and closed higher than last Friday but somehow call IVs were lower, especially considering Monday tends to kick off the week with higher IVs. This may mean that bullish bets via options are drying up. The stock may still make another high to finish the ending diagonal pattern, but this divergence, in my opinion, affirms that should mark the top of wave 1.

My way of hedging against unexpected news, ie Hertz 2.0:

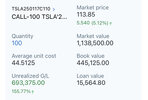

If you are stuck with ITM CCs, consider this strategy:

View attachment 904391

What we're looking at is a 200/210/220 call butterfly paired with a 160 short put. It can give you protection against a "melt-up" scenario in which macro news becomes rosy for the next month or 2. If TSLA close next week around 210, you'll profit $10 per contract. To pay for this, sell a 160 put. Should be ok according to my TA. If TSLA drops, your ITM CCs will get rescued. Win-win for little risks.

At this stage, one should be more afraid of "melt-ups" than some insane spike. Internals show that bullish bets are drying up so any spike should trigger massive profit taking. Melt-ups, on the other hand, are much more annoying to deal with. Now, if BRK files its 13D saying that it bought TSLA, buckle up. Nothing can protect you from something like that, but we do what we can with the tools we have.