what is "quite" right in your dictionary? Seems to me like unless someone has a 100% track record, then they're never good enough for you. Fortunately, you don't have to be 100% right in trading to make money. In fact, if you're right about 60% of the time and have stellar risk management, you can make a comfortable living out of it.

On January 9th, I said

On January 11th, we got rejected at 126 and dropped 8.4% to 115.6 over the next 2 days. On the 11th, I said

On January 18th, we got rejected at 136.65 and dropped 8.8% to 124.31 the next day.

On January 26th, I said

On January 27th, we got rejected at 181 and dropped 9.77% to 163 the next day.

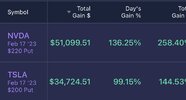

View attachment 906134

Do you have any idea how much money can be made on a 8-10% drop on TSLA, levels given at least a week in advance? A boat load. Sure, I've been wrong, too, a lot actually, but if you followed my levels and warnings, you'd have made a lot of money on a net-net basis. That's what trading is. I have nothing but respect for you, but to be honest you're not acting much differently from TSLAQ who laughed at us for following our thesis. It seems that, to you, it's your way or the highway. You seem to happily skip over instances when someone is right to go straight to sneer at them when they're wrong.