intelligator

Active Member

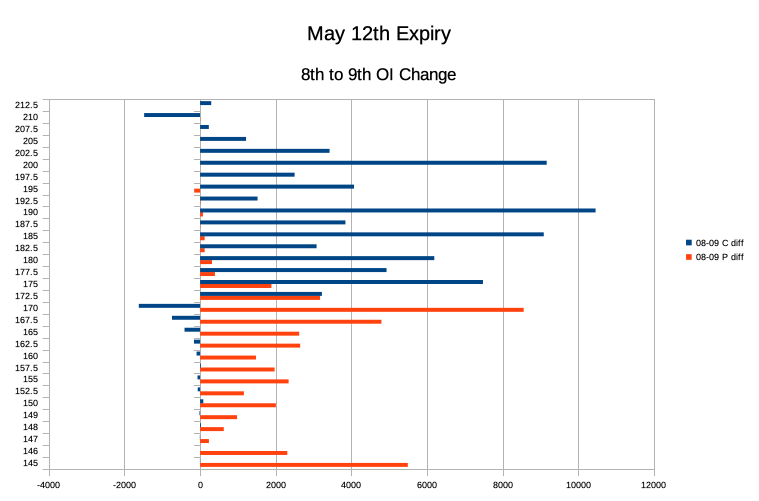

Call open interest increased most strikes above 172.5 inclusive, Put interest increased at same 172.5, more so at 170 followed by 167.5 and 165.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I was just comparing this to the max pain chart as well.Call open interest increased most strikes above 172.5 inclusive, Put interest increased at same 172.5, more so at 170 followed by 167.5 and 165.

View attachment 936097

Call open interest increased most strikes above 172.5 inclusive, Put interest increased at same 172.5, more so at 170 followed by 167.5 and 165.

View attachment 936097

Market Makers don't manipulate the market. That's just a conspiracy theory. They are fully delta hedged and don't care how the market moves.Does this imply the MMs would aim for/prefer a close this Friday just below $170?

Market Makers don't manipulate the market. That's just a conspiracy theory.

Yes, it's a popular conspiracy theory. Doesn't make it true. Just see last week...I’m not smart enough to know either way. PoppaFox seems to believe it’s true, though sometimes the market gets away.

Let’s use the word prefer, would they prefer a close just below $170 this Friday based on the positioning noted above?

Also, if it’s not the MM’s tools, how does the SP drift to the precise close—sometimes to the penny—that benefit MM’s? I’m not intending to start a debate about manipulation or not, just genuinely curious.

Understood - just remarking on the movement between the way it is posted with your graph and the max pain chart@UltradoomY I pickup the data from max pain, the morning of. @Jim Holder , *my understanding* is that MM provide liquidity, they buy when everyone wants to sell, sell when everyone wants to buy. Depending on their position and need to hedge, rebalance, they may drive the bid/ask spread of options and underlying as well.

Added another 30x 5/12 -C$185 for $0.35 at the $172.45 push.

I have buy orders set for my 30x -c$180s at 50% profits (would be at .35 per share) - we’ll see if those trigger today. I still feel pretty good about them expiring OTM, but would prefer closing them early.

I sold $182.5 at open at $0.98. My thinking is that we are range bound from $200 to $160 at least until ER so I have some time to figure things out if the trade goes wrong. I am also ok with going cash at this point because of the possibility of a recession... I might regret it lol but that's my thinking right now.

STO 30x 5/19 -p162.50 @$3.1

Still holding those 90x 5/12 -c150's, have decided to let them run, who knows, maybe CPI crashes the markets tomorrow, or maybe TSLA goes to the moon... we will see

In for 152.50/145 put spreads on 5/19 (.60).

I see MP is 170 for 5/19, but there's quite some calls 160 and above, although they're mostly neutralised by puts... who knows what will happen, sometimes it plays out sometimes it doesn'tFYI lots of chatter for a while that 5/19 will be deep lows based on option positioning and other factors. Are you seeing that too or you’re confident in TSLA not being below $162.50 by 5/19 (or plan to BTC on push)?

I see MP is 170 for 5/19, but there's quite some calls 160 and above, although they're mostly neutralised by puts... who knows what will happen, sometimes it plays out sometimes it doesn't

I've almost got +$1 on a roll of the 90x -c150's to next week, would likely take that if it was offered (I have no roll function, so need to monitor manually and do the necessary buy/sell separately)

I'm still wary of the 146 gap...