Looked at closing this Friday’s -p160 and -p162.5 for 90-95% profit and opening new short put positions for next week but the premiums are not great. I’d rather wait for a drop.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

A tool I like to use is fib channel. You can see that major-intermediate highs/lows fell very close to levels on these channels. Circled are the closing price on the last day before P&D of each quarter. For 6/30, I'm looking at 158 or 186 as the closing price.

View attachment 938597

I was looking for a similar fib channel indicator in TradingView and couldn’t find one that looks like yours. What’s the name of the one you are using?

Decided to enter some cc for next Friday. 190 strike at .65. Kind of hoping these need to be rolled!

Which gives me the following position:Position in profit. I just need to buy a June call to keep margin low. Probably I will pick the 210 call. But I have till Friday to make up my mind.

1 Call June 170

-2 Call June 185

1 Call may 200

-2 Call may 220

1 Call may 240

Profit/loss:

+145

-253

+20

Investment USD 88.

Profit is gaining. Slow pace of course but that's inherent to the position. Risk is low. But for me the profit counts.

MACD, RSI and divergences andThanks. Do you have a favorite tool to gauge momentum?

Call/put IVs (not stock IV)

are my main momentum tools.

I was looking for a similar fib channel indicator in TradingView and couldn’t find one that looks like yours. What’s the name of the one you are using?

MACD, RSI and divergences and

Call/put IVs (not stock IV)

are my main momentum tools.

View attachment 938647

Thank you.

Forgive me if this question has been asked before, I couldn’t find it via search:

If someone has, say, 8,000 TSLA shares with half CB around $215 and the second half around $358, and can sell covered calls against them while waiting for recovery.

What is the responsible ratio to put on the line when selling CCs? I know it’s subjective to each case, I’m just wondering if there’s a broader rule of thumb ppl follow.

For example, is selling as many contracts as allowed (say 80 in this case) for a strike 10-15% OTM ($187.50-$195) for expiration next Friday 5/26 considered suicidal or is common practice if managed carefully (i.e., cut quickly if SP breaks through certain resistance, or position passes a certain loss like say $2,500, etc).

I’d appreciate if you can share any rules you follow for yourself. I’m sure it will be helpful to others as well.

I am trying to be prudent and don’t want to blow up my account due to chasing gains (and greed/impatience) and I still have a lot to learn.

If someone has, say, 8,000 TSLA shares with half CB around $215 and the second half around $358, and can sell covered calls against them while waiting for recovery.

What is the responsible ratio to put on the line when selling CCs? I know it’s subjective to each case, I’m just wondering if there’s a broader rule of thumb ppl follow.

For example, is selling as many contracts as allowed (say 80 in this case) for a strike 10-15% OTM ($187.50-$195) for expiration next Friday 5/26 considered suicidal or is common practice if managed carefully (i.e., cut quickly if SP breaks through certain resistance, or position passes a certain loss like say $2,500, etc).

I’d appreciate if you can share any rules you follow for yourself. I’m sure it will be helpful to others as well.

I am trying to be prudent and don’t want to blow up my account due to chasing gains (and greed/impatience) and I still have a lot to learn.

Forgive me if this question has been asked before, I couldn’t find it via search:

If someone has, say, 8,000 TSLA shares with half CB around $215 and the second half around $358, and can sell covered calls against them while waiting for recovery.

What is the responsible ratio to put on the line when selling CCs? I know it’s subjective to each case, I’m just wondering if there’s a broader rule of thumb ppl follow.

For example, is selling as many contracts as allowed (say 80 in this case) for a strike 10-15% OTM ($187.50-$195) for expiration next Friday 5/26 considered suicidal or is common practice if managed carefully (i.e., cut quickly if SP breaks through certain resistance, or position passes a certain loss like say $2,500, etc).

I’d appreciate if you can share any rules you follow for yourself. I’m sure it will be helpful to others as well.

I am trying to be prudent and don’t want to blow up my account due to chasing gains (and greed/impatience) and I still have a lot to learn.

My only rule of thumb is not to sell calls or puts that I’m not okay with having exercised/assigned. You just never know with this stock.

Do you want to sell those at $215 for breakeven or did you intend to hold long-term?

My only rule of thumb is not to sell calls or puts that I’m not okay with having exercised/assigned. You just never know with this stock.

Do you want to sell those at $215 for breakeven or did you intend to hold long-term?

The ones at $358 are for long term. The rest for trading.

An important idea back when I started the thread is that idea of selling csp at a strike you'd like to buy shares at, and sell cc at a strike you would like to sell shares at. I've drifted away from that idea and its become more of a back stop to the trades I make, but its still an important idea to keep in mind.The ones at $358 are for long term. The rest for trading.

In your instance if you'd be ok with parting with 1000 of those shares at $200, then sell 10 CC at a 200 strike. Knowing full well that if you were a bit in the money but not a lot, then you could easily decide to roll the cc rather than sell the shares off. You don't need to decide in advance what you will do in that situation, but you also don't want to be surprised by it.

The real thing to be ready for, even if it only arises 1-2 times every 1-3 years, is you sell those $200 strike cc and the shares rocket to $250. Are you really ready to trade/sell those shares? That was the plan at open - are you still ok with following that plan, as taking assignment is the easiest resolution to being $50 ITM.

It's one way to get at risk management and size of positions.

The ones at $358 are for long term. The rest for trading.

195 isn’t that far from 215, I would think you could roll yourself up there eventually even if you do get steamrolled by a sudden rally. Selling against only 25-50% of your position would leave more flexibility to increase contracts and move the strike up, if necessary.

I’ve posted this before (if you want more detail, please search), but I’m taking a ladder approach and doing CC only, more or less 1/6 of shares in each group:Forgive me if this question has been asked before, I couldn’t find it via search:

If someone has, say, 8,000 TSLA shares with half CB around $215 and the second half around $358, and can sell covered calls against them while waiting for recovery.

What is the responsible ratio to put on the line when selling CCs? I know it’s subjective to each case, I’m just wondering if there’s a broader rule of thumb ppl follow.

For example, is selling as many contracts as allowed (say 80 in this case) for a strike 10-15% OTM ($187.50-$195) for expiration next Friday 5/26 considered suicidal or is common practice if managed carefully (i.e., cut quickly if SP breaks through certain resistance, or position passes a certain loss like say $2,500, etc).

I’d appreciate if you can share any rules you follow for yourself. I’m sure it will be helpful to others as well.

I am trying to be prudent and don’t want to blow up my account due to chasing gains (and greed/impatience) and I still have a lot to learn.

- $5-$10 OTM split evenly for 7 and 14 DTE, and rolling 2 weeks out as needed

- 10%-15% OTM 6-8 DTE

- $50 OTM 30 DTE

195 isn’t that far from 215, I would think you could roll yourself up there eventually even if you do get steamrolled by a sudden rally. Selling against only 25-50% of your position would leave more flexibility to increase contracts and move the strike up, if necessary.

This sounds like good advice. I’ll reduce my exposure.

Last edited:

I’ve posted this before (if you want more detail, please search), but I’m taking a ladder approach and doing CC only, more or less 1/6 of shares in each group:

It gets a little nervy with strikes below cost, but leaving half of shares uncovered allows for rescue scenarios. Important to not chase premiums by relaxing parameters in these days of low IV and premiums.

- $5-$10 OTM split evenly for 7 and 14 DTE, and rolling 2 weeks out as needed

- 10%-15% OTM 6-8 DTE

- $50 OTM 30 DTE

Thanks, this approach seems to add some fun and extra income while not being too risky.

So unless one is ready to have the shares called away at the chosen strike, to not write calls on one’s whole lot. Always leave some open.

TLSA chewed through the sell wall at 175 in PM this morning. Starting to wonder if the -C187.50, -C190, -C192.50 for next week 5/26 are actually safe.

When TSLA runs no one should stand in front of it regardless of what TA or EW says. I think @dl003 said something to that effect just recently as well when the Twitter CEO news dropped.

Anyone closing/rolling or just holding through?

Are there more signs needed, like breech of $176, $180, $185? But by then the position may be too red to make the roll worth it/doable, maybe close now with smaller loss?

When TSLA runs no one should stand in front of it regardless of what TA or EW says. I think @dl003 said something to that effect just recently as well when the Twitter CEO news dropped.

Anyone closing/rolling or just holding through?

Are there more signs needed, like breech of $176, $180, $185? But by then the position may be too red to make the roll worth it/doable, maybe close now with smaller loss?

Last edited:

Will roll 19May$180 CC —> 2Jun$185 if SP hits $178 today or tomorrow; seems to be moving slowly and will probably stop <$180, but roll credit isn’t too bad and has been rising with SP in recent days. Get the feeling that one of these days we will have a spurt that requires a rescue plan, but these near-OTM’s have been paying nicely the last few months (80% of CC income YTD).TLSA chewed through the sell wall at 175 in PM this morning. Starting to wonder if the -C187.50, -C190, -C192.50 for next week 5/26 are actually safe.

When TSLA runs no one should stand in front of it regardless of what TA or EW says. I think @dl003 said something to that effect just recently as well when the Twitter CEO news dropped.

Anyone closing/rolling or just holding through?

Are there more signs needed, like breech of $176, $180, $185? But by then the position may be too red to make the roll worth it/doable, maybe close now with smaller loss?

intelligator

Active Member

Wondering the same... I have a small mess with sold call spreads at -c177.5 and -c180 , $5 wide that I will close if the uptrend continues.

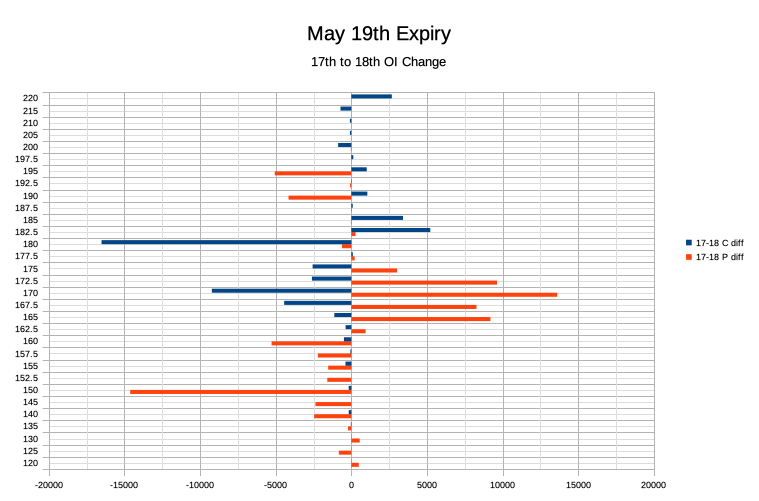

OI pulled back at C180, P150, a sprinkling of -/+ in between , P170 added 13.5k, slightly less increase up/down a few put strikes. P160 <-> C180 are the tallest walls.

OI pulled back at C180, P150, a sprinkling of -/+ in between , P170 added 13.5k, slightly less increase up/down a few put strikes. P160 <-> C180 are the tallest walls.

Hopefully by now you can see that, actually, nothing is ever safe. Up or down, TSLA can be a runner.TLSA chewed through the sell wall at 175 in PM this morning. Starting to wonder if the -C187.50, -C190, -C192.50 for next week 5/26 are actually safe.

When TSLA runs no one should stand in front of it regardless of what TA or EW says. I think @dl003 said something to that effect just recently as well.

Anyone closing/rolling or just holding through?

Are there more signs needed, like breech of $176, $180, $185? But by then the position may be too red to make the roll worth it/doable, maybe close now with smaller loss?

The idea behind this is, that at times TSLA is more than 50% of the entire options market. That is a stat that is hard to wrap the mind around.

Most of the time, we are range bound and money can be made close in, sometimes we are going up and money can be made with selling puts, or heading down and money can be made selling calls.

However, the hectic part is the steam roller of Gamma. That is with TSLA being literally 50% (or more at times) of the entire options market, there are huge gamma bursts up or down that run through positions.

That is why most of the old timers (lol, hard to say on a 3 year old thread) will preach time and time again to stay safe, have a back up plan and be ready to lose, roll or get assigned.

You will get scarred, beaten and punched, but you can also make some real cash.

For this past 8-9 months (I had a rough early 2022 with some ITM Puts at a high basis) I have been staying smaller and trading in and out and making good returns. But it is not for the passive options trader. I do not have positions open unless I can be near the terminal and make a move if they go the other way when I don't have stop losses set.

Make no mistake, you will lose money doing this, you might lose shares too. Just limit your downside by always having a plan.

One of the most important parts - IMO - is not to get too overly concerned with another persons outlook or trading view / setup.

This is because everyone has different goals, and a lot have different strategies for what they are trying to accomplish.

This could be vastly different from your own strategy.

And they could be a little wrong, or a lot wrong. Hopefully the benefit is that by talking about the positions and most importantly the reasoning behind getting into the positions is that we can learn more from each other like a hive mind.

Thinking about your position and amount of shares is one thing, but we are not offering advice.

If I was you, and I'm not, I would approach your situation much differently than another providing a colorful response.

Even after losing some real cash last year, I am still very aggressive, but I still have a sizable position to play with fortunately and don't really need the money if it were to truly burn to the ground since I still have other income streams. This would let me provide more aggressive advice than an @adiggs who is retired and uses the money gained to donate to charity for the most part.

Capital preservation and modest returns are the game there.

So you can see that there is too much nuance to be accurate with "what would you do?" posts -

Other than to say - don't bet the farm, and have an exit strategy.

Personally this morning I am thinking about selling some aggressive Calls for next week (didn't sell the $185's yesterday) that are ATM and using those proceeds to get some more leaps and keeping the spare cash for Put writing.

I still think that this summer is going to be a rough one for the Macro environment and I want to be able to Wheel more contracts than I am currently writing with my strategy.

I want to be converting shares to leaps through the summer to capture upside going into 2024. I am also writing 45 day out Calls on those $5 above strike - they are all December 2025 - $200's

Hopefully by now you can see that, actually, nothing is ever safe. Up or down, TSLA can be a runner.

The idea behind this is, that at times TSLA is more than 50% of the entire options market. That is a stat that is hard to wrap the mind around.

Most of the time, we are range bound and money can be made close in, sometimes we are going up and money can be made with selling puts, or heading down and money can be made selling calls.

However, the hectic part is the steam roller of Gamma. That is with TSLA being literally 50% (or more at times) of the entire options market, there are huge gamma bursts up or down that run through positions.

That is why most of the old timers (lol, hard to say on a 3 year old thread) will preach time and time again to stay safe, have a back up plan and be ready to lose, roll or get assigned.

You will get scarred, beaten and punched, but you can also make some real cash.

For this past 8-9 months (I had a rough early 2022 with some ITM Puts at a high basis) I have been staying smaller and trading in and out and making good returns. But it is not for the passive options trader. I do not have positions open unless I can be near the terminal and make a move if they go the other way when I don't have stop losses set.

Make no mistake, you will lose money doing this, you might lose shares too. Just limit your downside by always having a plan.

One of the most important parts - IMO - is not to get too overly concerned with another persons outlook or trading view / setup.

This is because everyone has different goals, and a lot have different strategies for what they are trying to accomplish.

This could be vastly different from your own strategy.

And they could be a little wrong, or a lot wrong. Hopefully the benefit is that by talking about the positions and most importantly the reasoning behind getting into the positions is that we can learn more from each other like a hive mind.

Thinking about your position and amount of shares is one thing, but we are not offering advice.

If I was you, and I'm not, I would approach your situation much differently than another providing a colorful response.

Even after losing some real cash last year, I am still very aggressive, but I still have a sizable position to play with fortunately and don't really need the money if it were to truly burn to the ground since I still have other income streams. This would let me provide more aggressive advice than an @adiggs who is retired and uses the money gained to donate to charity for the most part.

Capital preservation and modest returns are the game there.

So you can see that there is too much nuance to be accurate with "what would you do?" posts -

Other than to say - don't bet the farm, and have an exit strategy.

Personally this morning I am thinking about selling some aggressive Calls for next week (didn't sell the $185's yesterday) that are ATM and using those proceeds to get some more leaps and keeping the spare cash for Put writing.

I still think that this summer is going to be a rough one for the Macro environment and I want to be able to Wheel more contracts than I am currently writing with my strategy.

I want to be converting shares to leaps through the summer to capture upside going into 2024. I am also writing 45 day out Calls on those $5 above strike - they are all December 2025 - $200's

Good advice, thanks!

One thing I'm also learning is not to let previous missed opportunities or losses to skew risk appetite to make a riskier next trade.

I think I fell for that after BTC -P167.50 5/19 for a -7.9k loss. It was a trade I put on at around $173 when TSLA raced after Twitter CEO news and so many were sure the train will chug on and not look back ("Roll all covered calls up and out!" "Get out of the way of TSLA!"). But it suddenly reversed back to $167 and erased the run and I didn't stop-out early enough because of hopium that it'll recover (which it did but the AGM and Tesla CEO rumors was a reason for me to go flat so I don't end up holding margin if the puts were assigned to me during a deep retracement to 150-140). So I measured what I want to gain with the next risk I take on against making up the loss amount, which can skew the brain. They need to be disparate transactions.

Bit by bit it all falls into place.

For now I think I'll go flat (minimal loss) and wait for TSLA to show some direction through Monday and I'll revisit next week. There's a thousand tomorrows to trade.

PS Peace of mind and stomach-acid cost is also important to factor in. Not worth putting on a trade if it causes a lot of anxiety.

Last edited:

Last edited:

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K