Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

not-adviceLooking for some opinions about the following.

I now have a June 25 260 -p which I could roll higher and use the generated cash to roll 07/28 225 CC to 245 or 250 (same expiry month).

Why? Because my main goal with that contract is generate weekly (or monthly) income and at the current SP rolling 225 CC monthly is starting to not getting worth it anymore. When theta is about out of the 245 or 250 CC, I would then roll a month to the same strike, which will be about my monthly goal (600 - 800)/contract.

Then there's the big question: what if the SP tanks?

Say we get back to 250, that would be the time to roll back the CC contract to 225 to generate cash to lower the sold put to 260 again (best case).

If that's the case, rolling the 225 CC one month would generate about my monthly goal as well.

Is this making sense? Other option is to let the CC contract expire and sell puts from that point, BUT I don't want to commit (a lot of) extra cash selling puts...

Near term SP action: I think earnings may disappoint. Margins bottomed in Q2, so I really don't know the additional amount of sold cars will compensate for that. With that in the back of my mind, it could be a good thing to just sit and wait (there's still extrinsic in the 225 CC). But as we all know sitting on our hands is so difficult

One of my best methods for getting into trouble is rolling a winning position closer to the strike (same expiration). I think the reason is that on a roll, a given position is being opened and closed, and what's good for one is necessarily bad for the other.

E.g. roll a 250 put to 260 on the same expiration. In that case, while its a good time to close the 250 it is also a bad time to open a 260. Or vice versa, but we never use a local dip for these kinds of rolls - always a local peak. Worse - the good side is relatively small, and the bad side is relatively large.

Most of the time it works out - just that a non-trivial amount of time it works badly, frequently in such a way that no roll would have expired worthless.

As a result, my own personal rule, is that I never roll an OTM / winning position closer to the money in an effort to squeeze out a bit more gain. The winnigng rate and value isn't high enough over many trades to justify the incremental risk and size of loss, at least for me.

not-advice

One of my best methods for getting into trouble is rolling a winning position closer to the strike (same expiration). I think the reason is that on a roll, a given position is being opened and closed, and what's good for one is necessarily bad for the other.

E.g. roll a 250 put to 260 on the same expiration. In that case, while its a good time to close the 250 it is also a bad time to open a 260. Or vice versa, but we never use a local dip for these kinds of rolls - always a local peak. Worse - the good side is relatively small, and the bad side is relatively large.

Most of the time it works out - just that a non-trivial amount of time it works badly, frequently in such a way that no roll would have expired worthless.

As a result, my own personal rule, is that I never roll an OTM / winning position closer to the money in an effort to squeeze out a bit more gain. The winnigng rate and value isn't high enough over many trades to justify the incremental risk and size of loss, at least for me.

Ohh! I learned this lesson as well! But I found a variation that I think you might find useful. If you have multiples of that position, then "concentrate" the roll. Then if it reverses, you can still split it back out.

e.g (made up numbers to illustrate):

started off with: 4x -260p (opened at $1/shr, but is now at $0.20/shr)

BTC 4x -260p and STO 2x -270p for a slight credit.

If the SP continues rising, then you can concentrate it again.

If the SP stagnates, then it might still expire worthless.

If the SP reverses, split it back out (but wait until you think it's near a bottom to maximize the split):

BTC 2x -270p and STO 4x -265p (or something like that, but will never be as low as what you started with) for a slight credit. If it's still ITM by expiration date, then it should be significantly closer than the -270p would've been and thus your rolling options are better.

I do this with puts primarily, since when I did this in Jan, all my splits kept getting pulled ITM and are now all in LEAP territory (but I didn't lose a single share!). Also, I ONLY do this if the SP looks like it's still in an uptrend.

OK, I've been busy today:

BTO 30x Jan 24 +p250 @24.25

STO 30x 7/14 -p280 @9.1

BTC 30x 7/7 -p260 @0.2 net +7.4 (this was more risk mitigation than anything else)

BTC 4x 7/21 -c200 @81

BTC 30x 7/21 -c200 @81.4 -> STO 26x 10/20 -c200 @89.5

STO 8x 7/7 -c280 @5.1

Roughly break-even, except for the +p250's, of course, but they backstop the weekly short puts

Net result, 8x -c200 closed out and replaced with weekly -cATM, which may, or may not, expire, but easy to roll from here

So in play for this week:

8x -c280 - will roll if necessary

30x -c260 - will let exercise for CSP's -> the idea is to then write aggressive 50x -pATM, allow 30x to assign, then sell 30x calls again with straddled puts (the +p250's providing a base)

It's a bit complicated, I know, but quite challenging and fun!

BTO 30x Jan 24 +p250 @24.25

STO 30x 7/14 -p280 @9.1

BTC 30x 7/7 -p260 @0.2 net +7.4 (this was more risk mitigation than anything else)

BTC 4x 7/21 -c200 @81

BTC 30x 7/21 -c200 @81.4 -> STO 26x 10/20 -c200 @89.5

STO 8x 7/7 -c280 @5.1

Roughly break-even, except for the +p250's, of course, but they backstop the weekly short puts

Net result, 8x -c200 closed out and replaced with weekly -cATM, which may, or may not, expire, but easy to roll from here

So in play for this week:

8x -c280 - will roll if necessary

30x -c260 - will let exercise for CSP's -> the idea is to then write aggressive 50x -pATM, allow 30x to assign, then sell 30x calls again with straddled puts (the +p250's providing a base)

It's a bit complicated, I know, but quite challenging and fun!

R

ReddyLeaf

Guest

OK, I've been busy today:

BTO 30x Jan 24 +p250 @24.25

STO 30x 7/14 -p280 @9.1

BTC 30x 7/7 -p260 @0.2 net +7.4 (this was more risk mitigation than anything else)

BTC 4x 7/21 -c200 @81

BTC 30x 7/21 -c200 @81.4 -> STO 26x 10/20 -c200 @89.5

STO 8x 7/7 -c280 @5.1

Roughly break-even, except for the +p250's, of course, but they backstop the weekly short puts

Net result, 8x -c200 closed out and replaced with weekly -cATM, which may, or may not, expire, but easy to roll from here

So in play for this week:

8x -c280 - will roll if necessary

30x -c260 - will let exercise for CSP's -> the idea is to then write aggressive 50x -pATM, allow 30x to assign, then sell 30x calls again with straddled puts (the +p250's providing a base)

It's a bit complicated, I know, but quite challenging and fun!

And here I thought those 4050x Dec 350p/c might be yours

Even so, decided to add a few ICs, some near ATM (probably degenerate gambling) and some far. Will probably close the near ones tomorrow, maybe everything since they were all green at the close. Tried to leg into them at the open when the IV was higher, putting in 10% higher priced orders on both BPS and BCS sides. Unfortunately, once again the broker messed up the pairing, so I don’t really believe all of the credits. $280 was really sticky today until near the close. Sure seems like the whales are fighting.

1x IC: +p255/-p280/-c285/+c310 $9.09 cr

1x IC: +p255/-p265/-c300/+c310 $1.03 cr

1x IC: +p270/-p275/-c300/+c310 $0.44 cr

9x IC: +p255/-p265/-c300/+c310 $0.95 cr

9x IC: +p270/-p280/-c300/+c310 $4.22 cr

4x IC: +p272/-p277/-c282/+c287 $3.30 cr

juanmedina

Active Member

^

Those post are really helpful @Max Plaid .

Right now I have these positions:

2x 210cc 7/14

15x 215cc 7/14

20x 220cc 7/14

5x 225cc 7/14

Which options do you guys try to save first, the lower strike ones or the higher strike priced ones?

I have some money for a few puts to try to save some of the calls and I like the idea of closing the call and start selling ATM right away to generate some decent cash.

Those post are really helpful @Max Plaid .

Right now I have these positions:

2x 210cc 7/14

15x 215cc 7/14

20x 220cc 7/14

5x 225cc 7/14

Which options do you guys try to save first, the lower strike ones or the higher strike priced ones?

I have some money for a few puts to try to save some of the calls and I like the idea of closing the call and start selling ATM right away to generate some decent cash.

R

ReddyLeaf

Guest

Ouch, those have no time value left and rolling can’t get much credit or strike improvement unless you go out to 2025. Personally, if you’re cash or margin constrained, I would let the 2x -c210s expire, roll the rest a week, and then try to buyback and/or roll up strikes with cash from the -c210 exercise. If earnings come in high, you’ll likely lose the shares anyway. Definitely tough choices. I rolled nearly everything out to 2025 and have focused on selling ICs at about 4%-8% return per week. I still haven’t bought back any CCs yet, because I jut don’t feel like I have enough free cash for that yet. Good luck^

Those post are really helpful @Max Plaid .

Right now I have these positions:

2x 210cc 7/14

15x 215cc 7/14

20x 220cc 7/14

5x 225cc 7/14

Which options do you guys try to save first, the lower strike ones or the higher strike priced ones?

I have some money for a few puts to try to save some of the calls and I like the idea of closing the call and start selling ATM right away to generate some decent cash.

tivoboy

Active Member

Might I ask what software you use to track, monitor and quantify this all in real time? Asking for a friend.OK, I've been busy today:

BTO 30x Jan 24 +p250 @24.25

STO 30x 7/14 -p280 @9.1

BTC 30x 7/7 -p260 @0.2 net +7.4 (this was more risk mitigation than anything else)

BTC 4x 7/21 -c200 @81

BTC 30x 7/21 -c200 @81.4 -> STO 26x 10/20 -c200 @89.5

STO 8x 7/7 -c280 @5.1

Roughly break-even, except for the +p250's, of course, but they backstop the weekly short puts

Net result, 8x -c200 closed out and replaced with weekly -cATM, which may, or may not, expire, but easy to roll from here

So in play for this week:

8x -c280 - will roll if necessary

30x -c260 - will let exercise for CSP's -> the idea is to then write aggressive 50x -pATM, allow 30x to assign, then sell 30x calls again with straddled puts (the +p250's providing a base)

It's a bit complicated, I know, but quite challenging and fun!

R

ReddyLeaf

Guest

I do a little of everything, which doesn’t always work. Today, I sold ICs all at once, about $1 cr on $10 spread, as well as selling each side individually. Premiums are higher near the open, and I got $0.95-$1.00 on 255/265/300/310, so if the SP stays above 265 and below 300, it yields nearly 10%. I’m trying to NOT trade until Wednesday AM, plus close out all my other spreads (ones that went ITM and I had to roll out 2-3 weeks). BPS and -CCs can pair well together, just roll out the losing side to gain more time premium. However, the BCS side prices move together with the CCs and can get you into trouble quickly. I try to stay above a call wall, only trade 1-2 DTE, and bias the IC center to the BPS side (example: SP=280, then trade 260/270 BPS, but 300/310 BCS). Also, I’m not betting all my cash on the spreads, just enough to generate a nice income. I’m not trying to get into the $100k/wk club. If I can buy back even one LEAP CC at $80 each week, then I’ll consider it a success. Right now, I have:Interesting approach. Trying to get a similar income from less cash using a more aggressive trading strategy. I got burn with BCS but with BPS I did well. I am back at the office so I don't have time to keep and eye on IC's like I used to. 4%-8% return a week is insane. Are you still doing 3 day IC's? are you opening both legs at the same time? I think I will roll some contracts before ER because I thought P&D was going suck and we know what happened. What is the strike on your 2025 options?

Oct2023 -c300s, March2024 -c270s, June2024 -c290s, -c300s, Jan2025 -c200s, -c260s, and June2025 -c225s, all rolled into for credit in order to save an earlier trade that went ITM on the rocketing SP. So lots of work to do. I’m not in a great hurry to close the CCs because any number of events could negatively affect the SP (war, recession, elections, cage fights, key man risk, poor profitability, tornados/hurricanes, resource limitations, bear raids, actual competition

Last edited by a moderator:

I decided to act on the relatively good recovery in the 175/150 put spread from late last year / early this year that I had rolled out to Jan '25 to buy time. Really thrilled (/sarcasm) with that position when the share price was near 100. At its worse it was worth about $20 (call it a 75% loss of capital at risk). Since I sold it for maybe $2, buying it out for 80% was never thrilling.

Closed for 5.70 today - about 22% net loss? That's totally manageable. Also not a thrilling result, but this is a manageable loss, and frees up the cash backing the position for the next 18 months. That's a year and a half of access to the remaining capital that I've regained.

Also closed 135/115 put spreads that have a similar story. The position was created later in the dip (I was buying the dip aggressively, all the way down). These also got rolled way out in time when suddenly the 135 put strike was looking expensive instead of cheap. I decided to roll all of these WAY out in time rather than trying to guess when the recovery would come.

One thing I've learned here is that when the circumstances are right, such as this one, a really long roll out in time can work well for recovering from one of these. As a counterpoint - I had something like 333/300 put spreads that went bad on me back when shares hit ATH. If I'd have rolled them for 2 years, then they'd still be badly ITM and still badly positioned for recovery.

So the lesson has something to do with relative share price. I felt really comfortable with the long roll this time around, as the spread strikes were so low relative to ATH, and the share price was so low relative to ATH. I didn't know if it would be 6 months or 18 months, but I figured today would come. I decided today that 6 months is fast enough, and the share price has gone far enough / fast enough, that its time to take the "win".

Closed for 5.70 today - about 22% net loss? That's totally manageable. Also not a thrilling result, but this is a manageable loss, and frees up the cash backing the position for the next 18 months. That's a year and a half of access to the remaining capital that I've regained.

Also closed 135/115 put spreads that have a similar story. The position was created later in the dip (I was buying the dip aggressively, all the way down). These also got rolled way out in time when suddenly the 135 put strike was looking expensive instead of cheap. I decided to roll all of these WAY out in time rather than trying to guess when the recovery would come.

One thing I've learned here is that when the circumstances are right, such as this one, a really long roll out in time can work well for recovering from one of these. As a counterpoint - I had something like 333/300 put spreads that went bad on me back when shares hit ATH. If I'd have rolled them for 2 years, then they'd still be badly ITM and still badly positioned for recovery.

So the lesson has something to do with relative share price. I felt really comfortable with the long roll this time around, as the spread strikes were so low relative to ATH, and the share price was so low relative to ATH. I didn't know if it would be 6 months or 18 months, but I figured today would come. I decided today that 6 months is fast enough, and the share price has gone far enough / fast enough, that its time to take the "win".

Interesting. I'm debating the same on Jan 2024 +175/-200 BPS (that I had rolled out a year). I have the margin to handle the SP going back down to 100. I asked myself - would I open this BPS now for what it would cost me to close it? Yes. Yes, I would, so I'm not closing it early for a debit. If it goes back ITM, I will roll it out another year.I decided to act on the relatively good recovery in the 175/150 put spread from late last year / early this year that I had rolled out to Jan '25 to buy time. Really thrilled (/sarcasm) with that position when the share price was near 100. At its worse it was worth about $20 (call it a 75% loss of capital at risk). Since I sold it for maybe $2, buying it out for 80% was never thrilling.

Closed for 5.70 today - about 22% net loss? That's totally manageable. Also not a thrilling result, but this is a manageable loss, and frees up the cash backing the position for the next 18 months. That's a year and a half of access to the remaining capital that I've regained.

Also closed 135/115 put spreads that have a similar story. The position was created later in the dip (I was buying the dip aggressively, all the way down). These also got rolled way out in time when suddenly the 135 put strike was looking expensive instead of cheap. I decided to roll all of these WAY out in time rather than trying to guess when the recovery would come.

One thing I've learned here is that when the circumstances are right, such as this one, a really long roll out in time can work well for recovering from one of these. As a counterpoint - I had something like 333/300 put spreads that went bad on me back when shares hit ATH. If I'd have rolled them for 2 years, then they'd still be badly ITM and still badly positioned for recovery.

So the lesson has something to do with relative share price. I felt really comfortable with the long roll this time around, as the spread strikes were so low relative to ATH, and the share price was so low relative to ATH. I didn't know if it would be 6 months or 18 months, but I figured today would come. I decided today that 6 months is fast enough, and the share price has gone far enough / fast enough, that its time to take the "win".

In my own case I had about 1/2 the value of the primary account backing this position. The committed cash was a big part of the decision to proceed with the early close.Interesting. I'm debating the same on Jan 2024 +175/-200 BPS (that I had rolled out a year). I have the margin to handle the SP going back down to 100. I asked myself - would I open this BPS now for what it would cost me to close it? Yes. Yes, I would, so I'm not closing it early for a debit. If it goes back ITM, I will roll it out another year.

But its an interesting question - would I open a new -175/+150 for $6 today? No I wouldn't. But the 200/175... for an 18 month commitment I agree with the idea that's a position that is very likely to be very profitable. But I think I'd want at least $12 (roughly 50% of capital at risk. 25% of capital at risk doesn't look like enough to me, not for 18 months).

That position probably gets close to the same value if its 6 months as 18 months, and that sounds a lot more appealing. This is one of the things about spreads that is just so very, very different.

Of course the big difference here is that I had an extra year on my position to go. When I did the original roll, I wasn't sufficiently confident that the recovery would happen this year. I am not surprised that it has, and back then I wouldn't have been surprised that it's worked out as it has. But I also had no trouble imagine still being fully ITM on Jan '24 and then needing to do another roll - that sounded a lot like throwing more cash in the fire in an attempt to snuff it out

And now way too much talk of nuclear stuff. I'm sure the market is going to love that.

I guess you'd prefer to close them all out if possible rather than let any exercise, and I guess it's against shares so you're not time-constrained, and don't need weekly income...?^

Those post are really helpful @Max Plaid .

Right now I have these positions:

2x 210cc 7/14

15x 215cc 7/14

20x 220cc 7/14

5x 225cc 7/14

Which options do you guys try to save first, the lower strike ones or the higher strike priced ones?

I have some money for a few puts to try to save some of the calls and I like the idea of closing the call and start selling ATM right away to generate some decent cash.

This is what I would do, but of course my situation isn't yours, I have a desire to keep my gains/losses frames in the current financial year, so I'm trying hard to fix everything before end of the year -> basically keep my profits commensurate to previous years so as not to rock the boat with the tax authorities -> too much taxes and next year they'll expect the same, too low and they might get upset

And is this the best approach? Don't know, maybe for you rolling the lot to 2025 is better, maybe just letting the lot exercise and selling puts works better over time, I don't know... my approach fixes the situation gradually, which is great if the SP stays flattish or drops, but won't work so well if the SP keeps rising - then in December I'll have to sell some of the LEAPS to allow a roll of the rest into next year. Will cross that bridge as and when

Very roughly, an roll to October gives roughly +$10, +$11, +$12 premium for the 215, 220, 225's - that's roughly +370 in premium to play with, so you could close out the 2x -c210 for 73 leaving 220 to play with, which could be used to buy-back 3x -c215, leaving you with:

12x 215cc 10/20

20x 220cc 10/20

5x 225cc 10/20

This also frees-up 5x contracts for weekly writes - now whether you want to do that and risk the SP rising more is your choice, but imagine you were OK to let shares go at these higher prices and you had the capital to sell some puts, then a weekly -ATM straddle typically nets +17 for the moment, so you could sell 5x and buy-back one call every week

Risk is that the SP dumps and you get left holding shares bought at these "high prices", only you can judge if that's acceptable for your situation - that's why I bought the protective January puts, just to give me the freedom to write aggressive weekly -pATM

Attachments

Nothing really, I use Options profit calculator to determine my limit prices to set orders and I bought a yearly subscription to OptionStrat | Options Profit Calculator, Optimizer, & Options Flow but tbh I didn't really use it that much yetMight I ask what software you use to track, monitor and quantify this all in real time? Asking for a friend.

I have a WeBull subscription for real-time options prices, I basically look at the Ask/Bid and work it out in my head

For profit/loss tracking I use Excel screen-data fro broker copy-pasted, my broker has no facility for this, and I neither have a roll function, everything is done with simple buy/sell orders

SebastienBonny

Member

Thank you for this.not-advice

One of my best methods for getting into trouble is rolling a winning position closer to the strike (same expiration). I think the reason is that on a roll, a given position is being opened and closed, and what's good for one is necessarily bad for the other.

E.g. roll a 250 put to 260 on the same expiration. In that case, while its a good time to close the 250 it is also a bad time to open a 260. Or vice versa, but we never use a local dip for these kinds of rolls - always a local peak. Worse - the good side is relatively small, and the bad side is relatively large.

Most of the time it works out - just that a non-trivial amount of time it works badly, frequently in such a way that no roll would have expired worthless.

As a result, my own personal rule, is that I never roll an OTM / winning position closer to the money in an effort to squeeze out a bit more gain. The winnigng rate and value isn't high enough over many trades to justify the incremental risk and size of loss, at least for me.

I will just let it run a bit until there's only a bit of extrinsic left and see what's possible at that time.

I'll probably let those 100 shares go if the SP stays like this or higher and start selling puts.

That will need some more cash commitment, but will manage it down if needed.

juanmedina

Active Member

I guess you'd prefer to close them all out if possible rather than let any exercise, and I guess it's against shares so you're not time-constrained, and don't need weekly income...?

This is what I would do, but of course my situation isn't yours, I have a desire to keep my gains/losses frames in the current financial year, so I'm trying hard to fix everything before end of the year -> basically keep my profits commensurate to previous years so as not to rock the boat with the tax authorities -> too much taxes and next year they'll expect the same, too low and they might get upset

And is this the best approach? Don't know, maybe for you rolling the lot to 2025 is better, maybe just letting the lot exercise and selling puts works better over time, I don't know... my approach fixes the situation gradually, which is great if the SP stays flattish or drops, but won't work so well if the SP keeps rising - then in December I'll have to sell some of the LEAPS to allow a roll of the rest into next year. Will cross that bridge as and when

Very roughly, an roll to October gives roughly +$10, +$11, +$12 premium for the 215, 220, 225's - that's roughly +370 in premium to play with, so you could close out the 2x -c210 for 73 leaving 220 to play with, which could be used to buy-back 3x -c215, leaving you with:

12x 215cc 10/20

20x 220cc 10/20

5x 225cc 10/20

This also frees-up 5x contracts for weekly writes - now whether you want to do that and risk the SP rising more is your choice, but imagine you were OK to let shares go at these higher prices and you had the capital to sell some puts, then a weekly -ATM straddle typically nets +17 for the moment, so you could sell 5x and buy-back one call every week

Risk is that the SP dumps and you get left holding shares bought at these "high prices", only you can judge if that's acceptable for your situation - that's why I bought the protective January puts, just to give me the freedom to write aggressive weekly -pATM

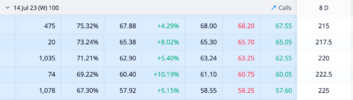

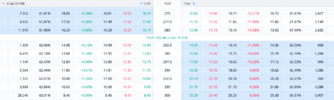

View attachment 953653

View attachment 953651

View attachment 953656

Thanks for the post. These shares are spread out between different account most in retirement accounts so I shouldn't have to deal with taxes and I had losses last year that should cover gains for this year in our after-tax account. I will be ok with letting the contracts exercise and start collecting some decent premium but like you say the stock may tank and I will end up with less shares. The 84% move from April 26 to now was a killer. Another option is to divest into something else.

intelligator

Active Member

Put Call Ratio is jut over 1, although SP slipped, still seeing 277.5-282.5 being reasonable end of week range.

EDIT: To be safe and avoid having to roll forward for ER, I'm going to close out 7/7 -C285 for 65% , sit the sideline and reset once ER sentiment direction is set.

EDIT: To be safe and avoid having to roll forward for ER, I'm going to close out 7/7 -C285 for 65% , sit the sideline and reset once ER sentiment direction is set.

Last edited:

SpeedyEddy

Active Member

For the first time this year I am happy to have held on to all of my -C 's, rolling them and hoping for/counting on a sudden (more macro) drop so keeping them close to expiration, even DITM. That looked better to me than far from expiration because rebounds can be even more sudden, so you loose later on (delta). I am confused about what is happening right now, but hope it will make up a bit for the big mistakes I made this year, waiting too long to buy back in after my early holidays. Scooped up some Palantir at a discount.

Besides some news about retail bringing money out of AI into EV, I can not find a reason, but algo's for sure at work.

Only thing that is indecisive is volume, but VIX bumping up and maybe later on Fear/Greed dropping maybe tells a story: Belief of recession incoming..

Besides some news about retail bringing money out of AI into EV, I can not find a reason, but algo's for sure at work.

Only thing that is indecisive is volume, but VIX bumping up and maybe later on Fear/Greed dropping maybe tells a story: Belief of recession incoming..

SpeedyEddy

Active Member

Oh, ADP data, showing strong labor.. rate-hikes incoming? Sigh..

BTC 30x 7/21 -c200 -> STO 26x 10/20 -c200 + 4x 7/7 -c280 = 4x -c200 less, 107x remaining (39x 7/32 & 68x 10/20)

Will roll the 39x 7/21 -c200 to 35x 10/20 -c200, that gives the possibility to write 16x -cATM weeklies, although I’m also looking to sell the 15x Jan 24 +c233’s at some point too, which are currently being used to cover calls

46x Dec -c300’s also, too early to say what I’m do with these

Will roll the 39x 7/21 -c200 to 35x 10/20 -c200, that gives the possibility to write 16x -cATM weeklies, although I’m also looking to sell the 15x Jan 24 +c233’s at some point too, which are currently being used to cover calls

46x Dec -c300’s also, too early to say what I’m do with these

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K