Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

CPI Thursday morning ... must be good expectations ....FlowAlgo still showing more Call buying than Put buying for both TSLA and overall market.

On the contrary, premium shows that call flow is still negative today, to me at least. Today's candle does not confirm low was in yesterday. Need a gap up or else we might go lower still. Closed my -235P's for a 50% gain.FlowAlgo still showing more Call buying than Put buying for both TSLA and overall market.

intelligator

Active Member

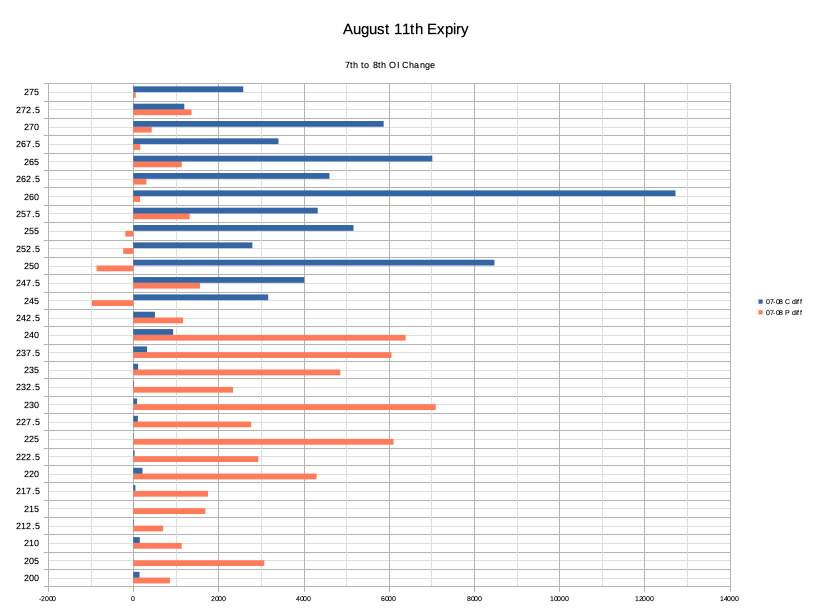

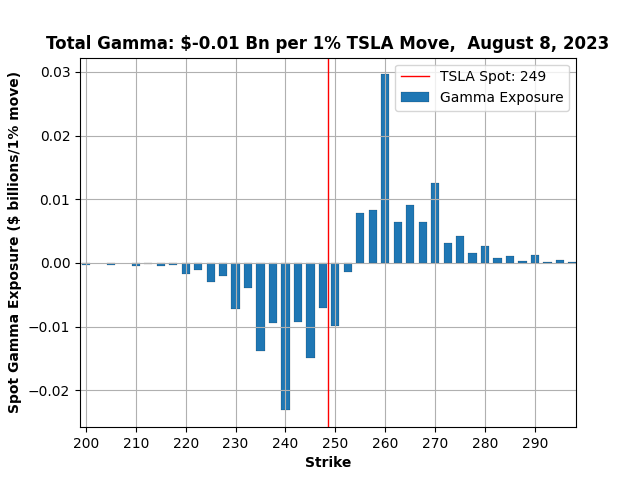

Gamma flip is 249... right where we sit. That and OI volumes split at 242.5 (wasn't able to put this out earlier) and 240 being the attractor (using today's opening options pricing) on the put side, kind of feeling good that I didn't have free time at the MMD to sell -p235 for this week. If CPI is lousy, Wednesday can just as easily be a red day. Careful.

EDIT: Thanks for that CPI date note, @BornToFly , much appreciated.

EDIT: Thanks for that CPI date note, @BornToFly , much appreciated.

Last edited:

CPI is Thursday. I think tomorrow will be green to buy the rumor since today was pretty red, but we will see. If word on the street is a bad number, tomorrow could be red too. I debated closing some 240 and 235 Puts for Friday, but have held for now. I might close them tomorrow depending on price action.Gamma flip is 249... right where we sit. That and OI volumes split at 242.5 (wasn't able to put this out earlier) and 240 being the attractor (using today's opening options pricing) on the put side, kind of feeling good that I didn't have free time at the MMD to sell -p235 for this week. If CPI is lousy, Wednesday can just as easily be a red day. Careful.

View attachment 963279 View attachment 963280

So the biggest problem right now is that the QQQ is also not far from falling below the 50 day MA. If it losses the 50, we are probably looking at a prolonged downtrend again. TSLA is in no position to buck a trend. So we need to be prepared for a slide back to 230 or lower very soon if the market doesn't react well to the CPI Thursday morning.

tivoboy

Active Member

Everyone should be looking at 150-200 days on their positions for a target..not saying everything will get there but we’ve had a long period of consolidation in the past quarter which has inflated 50’s and IMO those targets are closer than regaining or breaking 50’sSo the biggest problem right now is that the QQQ is also not far from falling below the 50 day MA. If it losses the 50, we are probably looking at a prolonged downtrend again. TSLA is in no position to buck a trend. So we need to be prepared for a slide back to 230 or lower very soon if the market doesn't react well to the CPI Thursday morning.

could be closer to a 50% retracement, will depend on the equity and how how above the 50 they managed to get.

If CPI is bad tomorrow, where does everyone see the SP on Friday close? 240? 235? 230?

235 is a little more than 6% drop. I think that could happen. Might just close my 235 Puts this morning and leave potential profits on the table.

235 is a little more than 6% drop. I think that could happen. Might just close my 235 Puts this morning and leave potential profits on the table.

tivoboy

Active Member

I would close the puts..;-0If CPI is bad tomorrow, where does everyone see the SP on Friday close? 240? 235? 230?

235 is a little more than 6% drop. I think that could happen. Might just close my 235 Puts this morning and leave potential profits on the table.

What makes you think CPI will be bad? Recent trend is that CPI has been coming in colder than both forecast and consensus, Truflation indicates this should be the same this time tooIf CPI is bad tomorrow, where does everyone see the SP on Friday close? 240? 235? 230?

235 is a little more than 6% drop. I think that could happen. Might just close my 235 Puts this morning and leave potential profits on the table.

I know people have been saying that gas prices have increased, but one of the biggest influences on core inflation is shelter, which is a very lagging indicator and should normally be dropping now

We'll see, I guess... if anyone's worried about it, close out all positions before close today and re-open tomorrow...

tivoboy

Active Member

I said pretty much the same thing above, but Truflation - which I like, was about ready to break sub 2% a month ago, and here we are. so, as I said above I think our number might be either just a tad hotter than expected, OR FLAT - which in and of itself will be perceived negatively.What makes you think CPI will be bad? Recent trend is that CPI has been coming in colder than both forecast and consensus, Truflation indicates this should be the same this time too

I know people have been saying that gas prices have increased, but one of the biggest influences on core inflation is shelter, which is a very lagging indicator and should normally be dropping now

We'll see, I guess... if anyone's worried about it, close out all positions before close today and re-open tomorrow...

View attachment 963473

Isn’t this fun.

Last edited:

tivoboy

Active Member

Spotting trends is a key part of investing well..Lately, every time we are green in pre-market we go red. I need to go back to selling shares in pre-market and buying them back later with a stop loss….

And, PATIENCE is not INACTION!

Recent trend has been TSLA red, regardless of pre-marketSpotting trends is a key part of investing well..

And, PATIENCE is not INACTION!

Question: any idea when 2026 options become available?

September they open up for January 2026 - cheers!Recent trend has been TSLA red, regardless of pre-market

Question: any idea when 2026 options become available?

tivoboy

Active Member

Max is usually three years but tesla seems to have closer to 30 months. so I would expect to see Jan 2026 pretty soon. They might be out there somewhere though.Recent trend has been TSLA red, regardless of pre-market

Question: any idea when 2026 options become available?

bkp_duke

Well-Known Member

Lately, every time we are green in pre-market we go red. I need to go back to selling shares in pre-market and buying them back later with a stop loss….

My bad. Bought some shares for the kids accounts. I'm done now till next month.

juanmedina

Active Member

Gosh, I don't know what to do about my $220 and $215 covered calls. Roll to Jan 300 for $10 or 9. Roll to $245 next week for $17, close them right now for $24 and start generating income or be patient and wait until I can close them for cheaper. 2/3 of my shares are already on Jan 300's so I cannot really generate much income to help with the debit transaction. any non advise?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K