Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

Today was a crazy down up and down ride. Expect tommorow may be as crazy.

Still holding my calls since I missed out on the 247 pump too busy at work today.

Still holding my calls since I missed out on the 247 pump too busy at work today.

At this point, I'd advise against selling options to bet on a direction. Either way it goes from here its going to be explosive. Better to buy spreads or a combo of long spreads + short FOTM on the other side. At least if you are wrong you are not gonna have stomach ulcers

At this point, I'd advise against selling options to bet on a direction. Either way it goes from here its going to be explosive. Better to buy spreads or a combo of long spreads + short FOTM on the other side. At least if you are wrong you are not gonna have stomach ulcers

Good point. Any guidelines for top and bottom strikes/DTE?

Here doggy

12/15 +250c/-265c riding wicked 265 limit

No plan for puts spread yet since trend seem bullish.

Here's a visual for 1 contract, but added a week to give more time:

Knightshade

Well-Known Member

good luck with that.. You can not say I did not warn, but you will profit anyways

FWIW closed these on yesterdays late dip around 60 and 65% profit respectively, seemed good enough to get out of the way of the big spike everyone keeps predicting

thenewguy1979

"The" Dog

I dont know Market is wierd last few days. Either bull or bear trap. But same pattern. Up down up down.

But one thing is Tesla been making higher ground a little bit a day. Let see where we go by end of day. Im wary we all go long call and rug pull before Friday. Market aint letting all those calls being in the money right?

But one thing is Tesla been making higher ground a little bit a day. Let see where we go by end of day. Im wary we all go long call and rug pull before Friday. Market aint letting all those calls being in the money right?

Feels like there is some accumulation going on. Q4 could be back to beat territory and surely some big money is aware of this.I dont know Market is wierd last few days. Either bull or bear trap. But same pattern. Up down up down.

But one thing is Tesla been making higher ground a little bit a day. Let see where we go by end of day. Im wary we all go long call and rug pull before Friday. Market aint letting all those calls being in the money right?

thenewguy1979

"The" Dog

It seem we are spiking up and down everyday. Money could be made during those spike but too dangerous.

The trend does show SP being on an upside. So either long call OTM with longer expiration would be a safer play with addition short put going into earning. DI003 suggestion.

The trend does show SP being on an upside. So either long call OTM with longer expiration would be a safer play with addition short put going into earning. DI003 suggestion.

mickificki

Member

RIVN up 11%, LCID 12%....cmon TSLA do somethin....we gotta be gettin some love soon.

SpeedyEddy

Active Member

I dont know Market is wierd last few days. Either bull or bear trap. But same pattern. Up down up down.

But one thing is Tesla been making higher ground a little bit a day. Let see where we go by end of day. Im wary we all go long call and rug pull before Friday. Market aint letting all those calls being in the money right?

exactly that being the reason not to get tangled in short (only) options. You can get lucky, but it can go wrong.

On the MA4x -convergence: If we stay 240-ish or above, yesterday was the max convergence and we get resolving in a few days. It can still go both ways, so I am still playing both sides, but got out of most profitable +C's today and just bough P232.5 for Friday, so I turned a bit bearish and that is just because of dumb money buying and smart money selling shares.

But as MA4x possibly diverges as from today the start of the big move can only be stretched if SP falls from now on. In the other case today may already be part of that move. I really have no clue yet about the direction of it, downside did not have 25% room last week, but that room it is being created momentarily (last few days: so let's say we end $245 today. -25% is 183.75. That would a pleable outcome, even more than +25% = $306, for reasons found elsewhere above. )Although while typing this we went up, I guess I will hold P232.5 for at least a day.

SpeedyEddy

Active Member

I might add that in case of falling back toward 237 on Friday, the amount of big wicks on the weeklies is maybe becoming a bit too intimidating for investors to keep holding. Gaps below on all major stocks and S&P 500 could become magnetic, $TSLA even overreacting

The purple rising line in my graphs has already been broken once, so it could allow for one more scary one, just below the last one, so Wyckoff will be served as well. Its looks bullish today, but is it really?

The purple rising line in my graphs has already been broken once, so it could allow for one more scary one, just below the last one, so Wyckoff will be served as well. Its looks bullish today, but is it really?

Last edited:

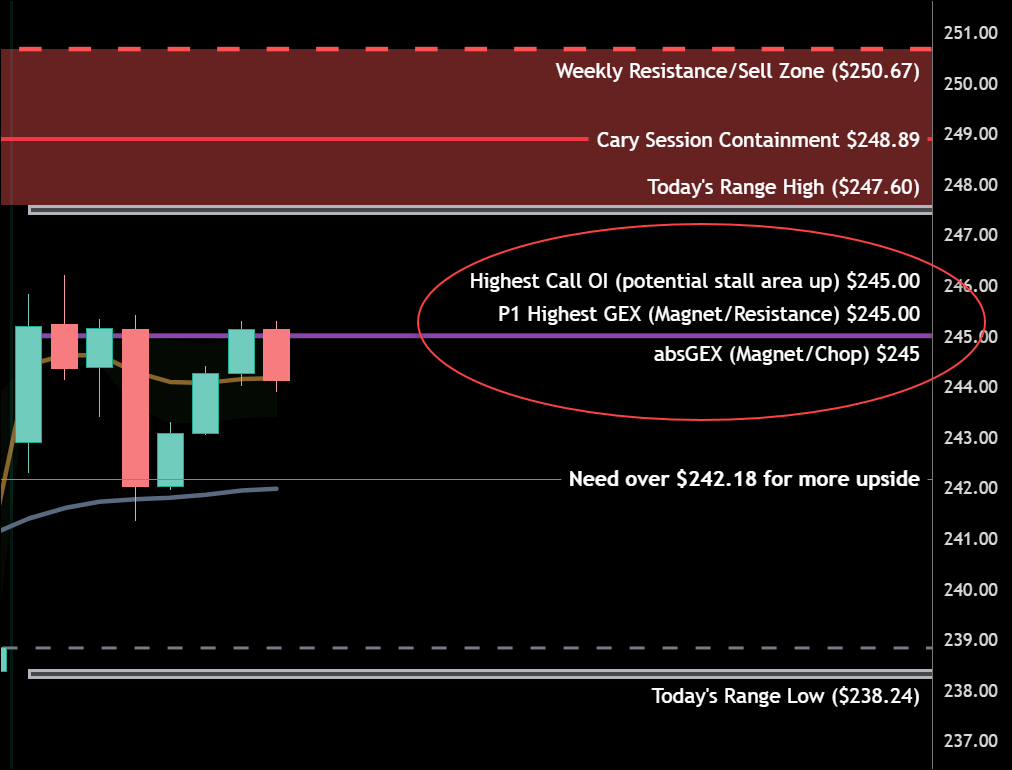

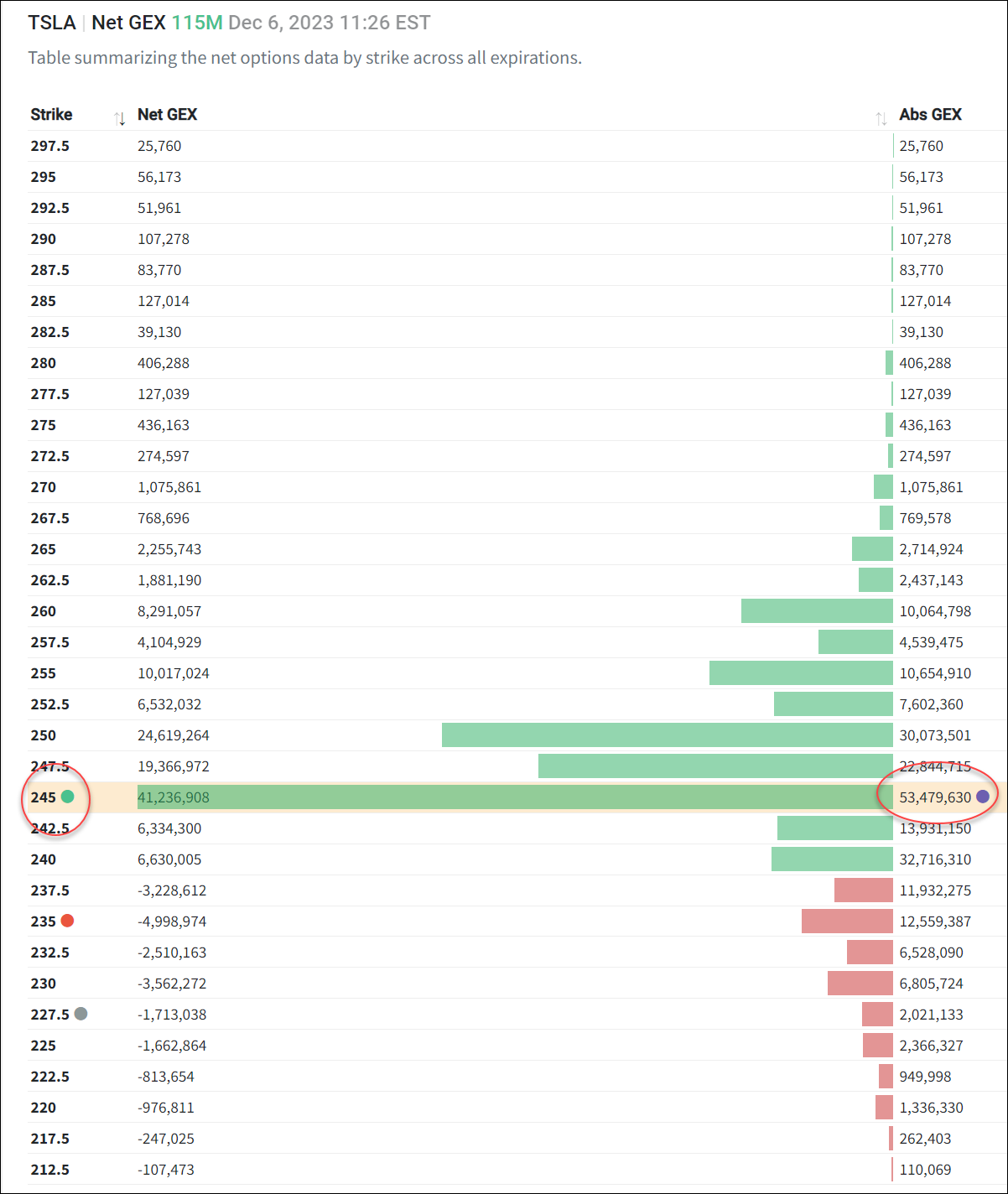

Lots of GEX confluence @ $245 area for 12/8. Usually this means chop +/- $1-2 through Friday.

The wicks imply this is true. We'll find out soon enough though.

The wicks imply this is true. We'll find out soon enough though.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K