its not a good news, but is it a surprise? Has TSLA been trading in this range for a month under the premise of this credit NOT going away in 2024? Me think big money already knew it would.Can you also chart GM and EPS esp. growth rate ...

3 losing tax credit next year isn't good news.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Knightshade

Well-Known Member

its not a good news, but is it a surprise? Has TSLA been trading in this range for a month under the premise of this credit NOT going away in 2024? Me think big money already knew it would.

AFAIK the thinking was it'd drop to $3750 for those models, with the offset of it being POS and essentially refundable as of Jan 1... not that it'd drop to $0.

From all I've seen a FED pivot signals economic weakness which usually causes a correction. This covid market hasn't exactly acted like a rational market though so...Fed pivoted

According to CGS it’s time to buy stock once again when fed pivot, everything but TSLA is at ATH.

I really don’t know what to do

juanmedina

Active Member

I would buy more Tesla if they raised prices by a decent amount other than that I am not felling confident about a run to AH any time soon.

Who knows if history will repeat itself we live in some weird times:

If the stock market crashes I hope we can time some put buying right.

Who knows if history will repeat itself we live in some weird times:

If the stock market crashes I hope we can time some put buying right.

I stick to my strategy from here: offload my expensive LEAPS... hold 100x +p & +c at any point in time, sell weeklies against those until cash target hit, then flip to accumulating shares on a weekly basis with an aggressive 10x -pATM write (in addition to the 100x -p and -c "safe" shorts), funded by the short premiumsFed pivoted

According to CGS it’s time to buy stock once again when fed pivot, everything but TSLA is at ATH.

I really don’t know what to do

I'm sure TSLA will play out well over time, but I can see the next 12 - 18 months trading in the 200-channel

StarFoxisDown!

Well-Known Member

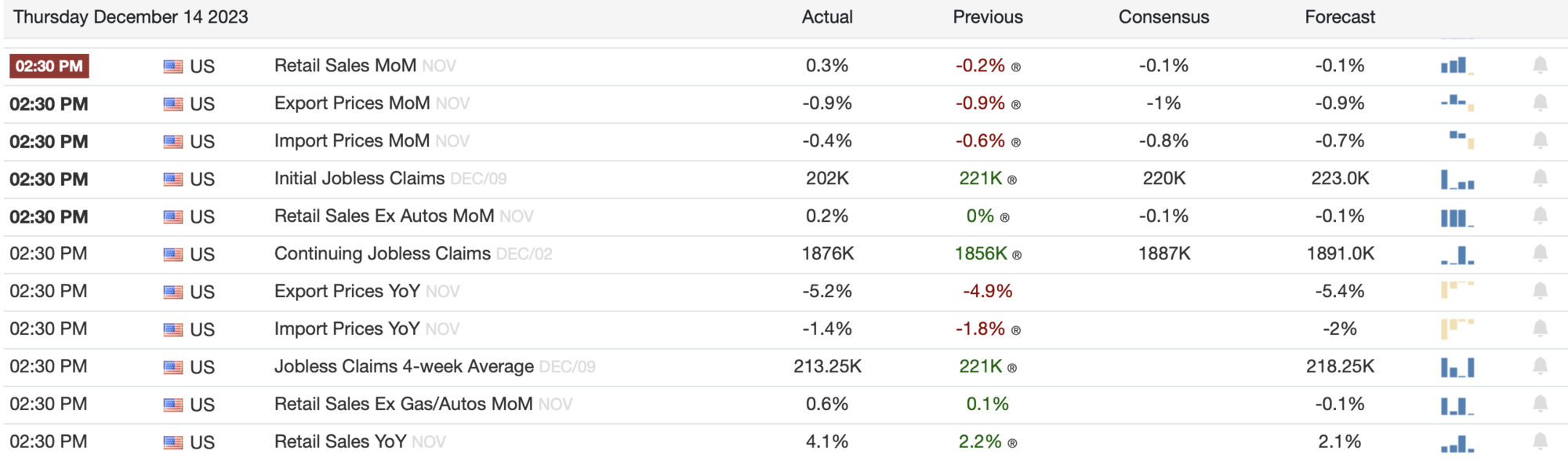

That’s because historically a FED pivot means an assured recession is closely following. There’s at least a 50% chance that the Fed has in fact just actually orchestrated a soft landing which would be a Goldilocks scenario for the market including a scenario where real wage growth will exceed actual inflation for the next couple of years. The economy and stock market could be entering a roaring 20’s environment soon.I would buy more Tesla if they raised prices by a decent amount other than that I am not felling confident about a run to AH any time soon.

Who knows if history will repeat itself we live in some weird times:

If the stock market crashes I hope we can time some put buying right.

Of course there will be rug pulls here and there in the market but I think anyone expecting a historical repeat of other times the Fed has pivoted and cut rates will be sorely disappointed when there is no “crash” come Q1 or Q2

Indeed, the FED raise rates to bring the economy to its knees, except this time it has indeed been different... Obviously so, because the root-cause of the inflation in the first place was the FED themselves and the pandemic, it wasn't the economy overheatingFrom all I've seen a FED pivot signals economic weakness which usually causes a correction. This covid market hasn't exactly acted like a rational market though so...

So no post-pivot crash IMO

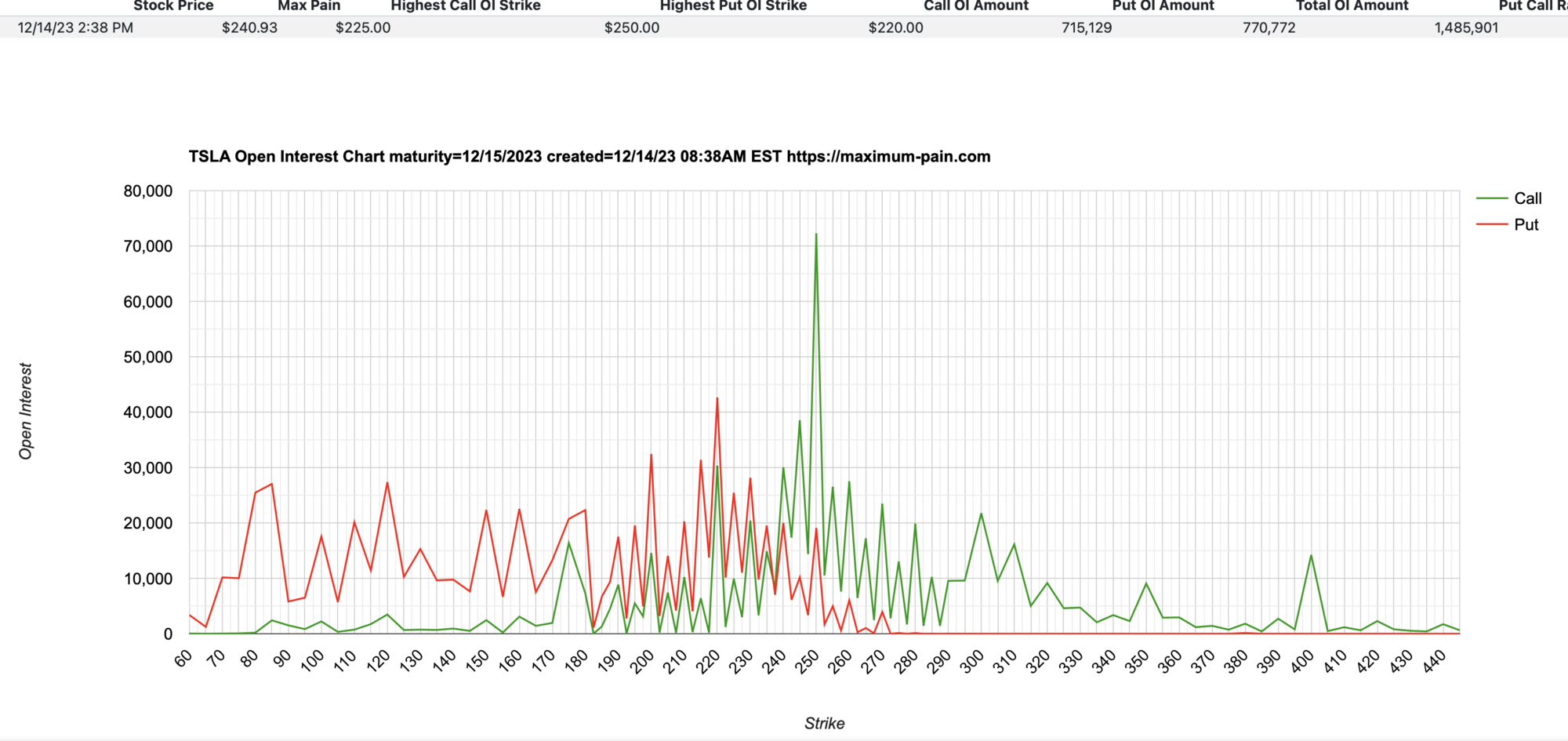

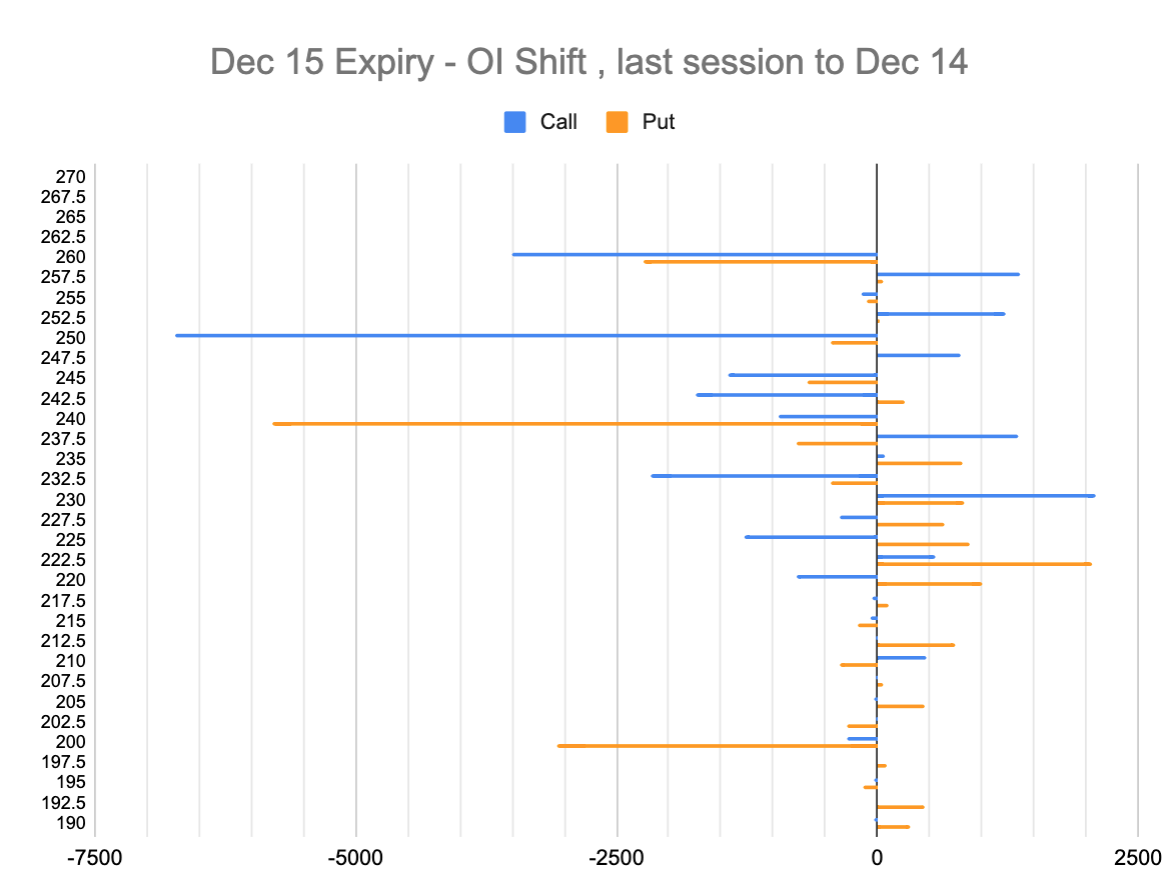

Max P dropped to $225, perusing the chart though I would say ~237.50 looks like the likely Friday close

Fed pivoted

According to CGS it’s time to buy stock once again when fed pivot, everything but TSLA is at ATH.

I really don’t know what to do

Sasha, has been saying inflation coming down for over 6 mths, and each time he was showing data on it.

he also bring's up a point I have been thinking about - next year is an election year ... incumbents want a great economy, everyones 401K taking off etc etc.

(personally, I think the MMs will twist the same data atleast once for a recession like scenario to make more money - trying to read the tea leaves and time this gonna be hard.

On Oct 31st, I bought VWUSX in one of my 401K's I cannot choose stocks and thats up ~19% already ...,up more than tesla, now need to think about when to go back to cash on this one.. wanted to buy bond funds, but not much options and I really don't understand bonds no matter how I try ..

... but then trend is gonna be our friend)

Last edited:

intelligator

Active Member

Tuesday's add to p240 came off the table, more c250 came off as well. I have -c247.5 for tomorrow , will watch closely , roll if we get some lift.

EDIT: Considering roll 12/15 247.5 to 1/12 -C265, would be the .75 that I aim for weekly. Anyone feel we'd blow past that by then? Same expirey -C260 delta is .34, closer to what I'd buy back 12/15 and above the -C265 of .29 delta, would be closer to 1.1 weekly but also closer to the money.

EDIT: Considering roll 12/15 247.5 to 1/12 -C265, would be the .75 that I aim for weekly. Anyone feel we'd blow past that by then? Same expirey -C260 delta is .34, closer to what I'd buy back 12/15 and above the -C265 of .29 delta, would be closer to 1.1 weekly but also closer to the money.

Last edited:

They are pivoting with inflation still running at 4 percent with signs that it might even spike a little the next few months.

They are pivoting with a still hot labor market.

Seems they are trying harder than usual. Ofc, election year matters a lot….

I admit that I was certain they would simply stick to the ‘higher for longer’ script. I paid for that certainty lol.

In the past the Fed did not seem happy until real signs of distress in economy, and then they would respond with emergency rate cuts and the such. This does not seem to be the case here.

Implied but never stated by this Fed: that they will tolerate inflation in the 3 percent range for a while rather than cause recession.

250 today? Rejected twice at 246 I believe.

They are pivoting with a still hot labor market.

Seems they are trying harder than usual. Ofc, election year matters a lot….

I admit that I was certain they would simply stick to the ‘higher for longer’ script. I paid for that certainty lol.

In the past the Fed did not seem happy until real signs of distress in economy, and then they would respond with emergency rate cuts and the such. This does not seem to be the case here.

Implied but never stated by this Fed: that they will tolerate inflation in the 3 percent range for a while rather than cause recession.

250 today? Rejected twice at 246 I believe.

Getting a little OT, but having elevated but reasonable inflation is the easiest way to reduce US federal debt in real terms. Debt isn't technically in the FED's area of responsibility but that doesn't mean all that much.They are pivoting with inflation still running at 4 percent with signs that it might even spike a little the next few months.

They are pivoting with a still hot labor market.

Seems they are trying harder than usual. Ofc, election year matters a lot….

I admit that I was certain they would simply stick to the ‘higher for longer’ script. I paid for that certainty lol.

In the past the Fed did not seem happy until real signs of distress in economy, and then they would respond with emergency rate cuts and the such. This does not seem to be the case here.

Implied but never stated by this Fed: that they will tolerate inflation in the 3 percent range for a while rather than cause recession.

SpeedyEddy

Active Member

don't ask why they are gonna pivot in election time. We now are going parabolic (and will crash for sure, but we will now when Tesla falls 5 % on a day)

For now, you can really enjoy the ride (no advice, just a thought), don't bet against the trend. How many signals more do you want to have to believe the bottom is behind us for at least a few weeks. I discovered a trend (MA4x), @dl003 told you something, @Jim Holder added a trend on the log scale yesterday).

I lost yesterday. But if I win today, tomorrow, next week, next three weeks, I will laugh about it.

For now, you can really enjoy the ride (no advice, just a thought), don't bet against the trend. How many signals more do you want to have to believe the bottom is behind us for at least a few weeks. I discovered a trend (MA4x), @dl003 told you something, @Jim Holder added a trend on the log scale yesterday).

I lost yesterday. But if I win today, tomorrow, next week, next three weeks, I will laugh about it.

Last edited:

So, from here-on, I guess the markets will start taking higher employment and retail spending as a positive? Nulbers like this last month would have crashed equities

SpeedyEddy

Active Member

BTW my other stocks are doing well also, especially SOFI (+22% since yesterday morning) what triggered a shortsqueeze for sure, now gamma squeezing. PLTR check Tomra check Only NVO is lagging, so I reduced the position.

on topic:

new:

-TSLA NASDAQ.NMS Dec29'23 247.5 PUT.

-TSLA NASDAQ.NMS Mar15'24 241.67 PUT

+TSLA NASDAQ.NMS Mar15'24 245 CALL

more now of this one - TSLA NASDAQ.NMS Jan16'26 250 PUT

and more of this one + TSLA NASDAQ.NMS Jan16'26 510 CALL

some oldies:

long

TSLA NASDAQ.NMS Mar15'24 290 CALL

TSLA NASDAQ.NMS Dec29'23 280 CALL

TSLA NASDAQ.NMS Dec22'23 300 CALL

plus some worthless puts

on topic:

new:

-TSLA NASDAQ.NMS Dec29'23 247.5 PUT.

-TSLA NASDAQ.NMS Mar15'24 241.67 PUT

+TSLA NASDAQ.NMS Mar15'24 245 CALL

more now of this one - TSLA NASDAQ.NMS Jan16'26 250 PUT

and more of this one + TSLA NASDAQ.NMS Jan16'26 510 CALL

some oldies:

long

TSLA NASDAQ.NMS Mar15'24 290 CALL

TSLA NASDAQ.NMS Dec29'23 280 CALL

TSLA NASDAQ.NMS Dec22'23 300 CALL

plus some worthless puts

Last edited:

Just sold 250calls on all my TSLA for Friday.

Last edited:

SpeedyEddy

Active Member

$250 will be a bit difficult to take, but signs of a squeeze are getting stronger now (50% of average daily volume in 1 hour, going up)

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K