Agreed, you get the most up to date information the closer you get to the final day of the quarter. He has probably been more accurate, each quarter, than any analyst covering Tesla.He only posts updates during the quarter because he wants interaction and likes and views. Otherwise it would be in his best interest to just wait until the last day of the quarter.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

EPS update incoming in three, two, one

EPS update incoming in three, two, one

We go one from RBC that lowered PT from $301 to $300(!)

Not making this up.

Troy’s been parading salty Tesla news the past few months. Here’s tonight’s gem:

I should send him a thank-you note for doing his part to help my short calls positions every other week

I should send him a thank-you note for doing his part to help my short calls positions every other week

juanmedina

Active Member

Troy’s been parading salty Tesla news the past few months. Here’s tonight’s gem:

I should send him a thank-you note for doing his part to help my short calls positions every other week

BYD is going to sell more BEV's than Tesla very soon. I am not sure what it would do to the stock but we will see it all over the news. BYD has more factories and cheaper models that they sell in a more EV friendly market.

thenewguy1979

"The" Dog

If Troy wont do it - Elon will step in. Lost count of how many times Elon help those with short callTroy’s been parading salty Tesla news the past few months. Here’s tonight’s gem:

I should send him a thank-you note for doing his part to help my short calls positions every other week

chillerjt

Member

18.3k weekly China numbers from Twitter. Very strong.

Portfolio is 43% up YTD, but I'll admit that if I had just HODL'd the year - as I entered 2023 with a substrantial TSLA position - then it would be closer to 85%, so it goes!Does anyone else keep detailed metrics?

As of now, I had a 16.2% ROI on the money invested selling puts and covered calls. Of that, 12% came from puts, and 4% from CC. How did everyone else do for the year? Not terrible, but not great.

But TBH I was so over exposed on shares and beaten-up on the emotional roller-coaster with the drop from >300 to ~100 that moving to cash was a great relief

Looking now to rebuild that position, but without eating into the cash pile...

Last edited:

I am thinking of starting to sell weekly covered calls on my position. Curious how you go about choosing which strike to sell. Thanks for your insights.I should send him a thank-you note for doing his part to help my short calls positions every other week

intelligator

Active Member

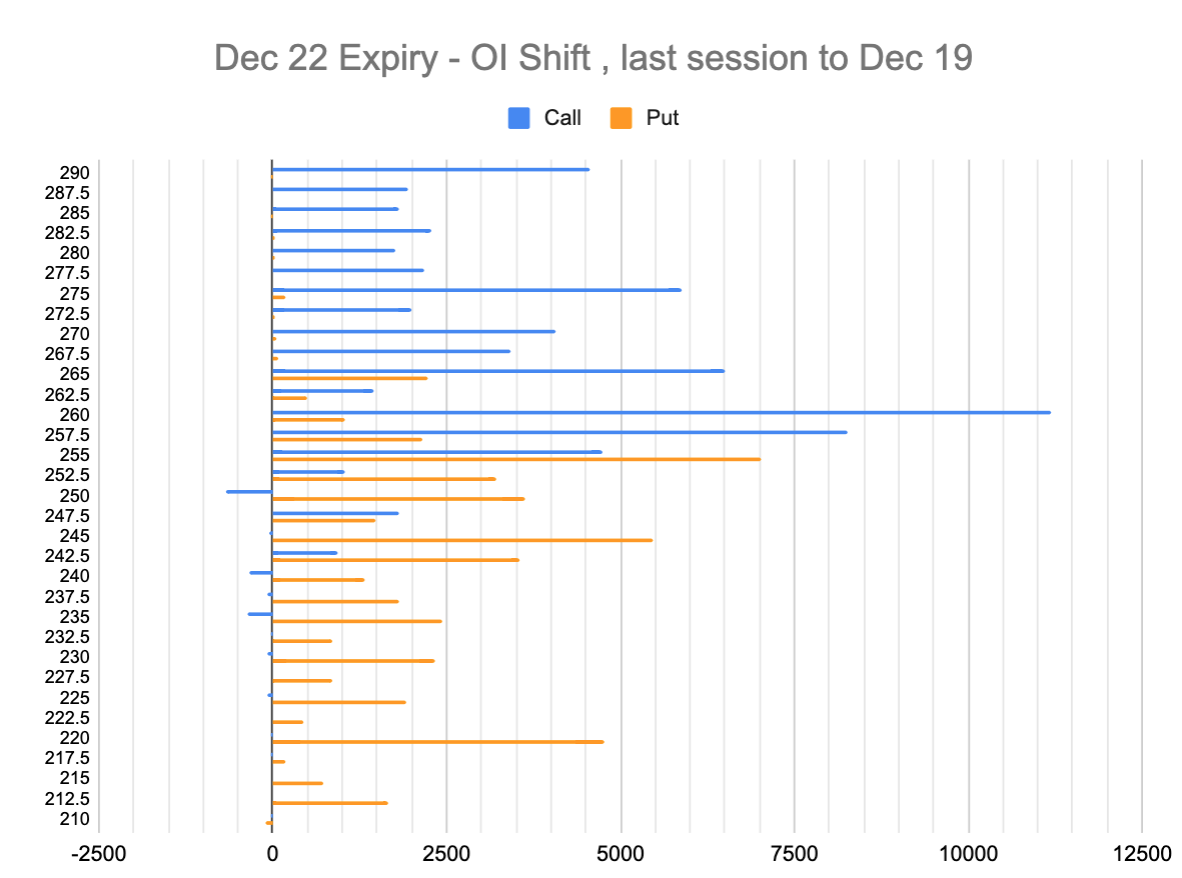

Take a peek at OI shift ... c260 , c257.5 , p255 , c265 each picked up interest. Tallest call wall at 262.5, nearest tall put wall at 240, put call ratio 1.01 is about even. 255 seems to be the middle ground in terms of shift, maybe we hang around there the day? I'm out this session due to a morning through early afternoon commitment. Yesterday I didn't roll the -c257.5 to February 260/265. My thoughts are that if these have a chance to expire this week, that'd be ideal. Should we continue to climb I'd still have a shot to set and forget, deal with them then. Let's see what we get !

jeewee3000

Active Member

Your study begins here, young padawan.I am thinking of starting to sell weekly covered calls on my position. Curious how you go about choosing which strike to sell. Thanks for your insights.

I also usually wait until Thu/Fri if odds of expiry or a really low close-out look good, as this week, but yesterday’s net credit on rolling to Feb was so good, I decided to lock it in. Sometimes waiting to save on the btc cost can leave you with a reduced sto premium, if the SP or IV fluctuates down.Take a peek at OI shift ... c260 , c257.5 , p255 , c265 each picked up interest. Tallest call wall at 262.5, nearest tall put wall at 240, put call ratio 1.01 is about even. 255 seems to be the middle ground in terms of shift, maybe we hang around there the day? I'm out this session due to a morning through early afternoon commitment. Yesterday I didn't roll the -c257.5 to February 260/265. My thoughts are that if these have a chance to expire this week, that'd be ideal. Should we continue to climb I'd still have a shot to set and forget, deal with them then. Let's see what we get !

View attachment 1000990

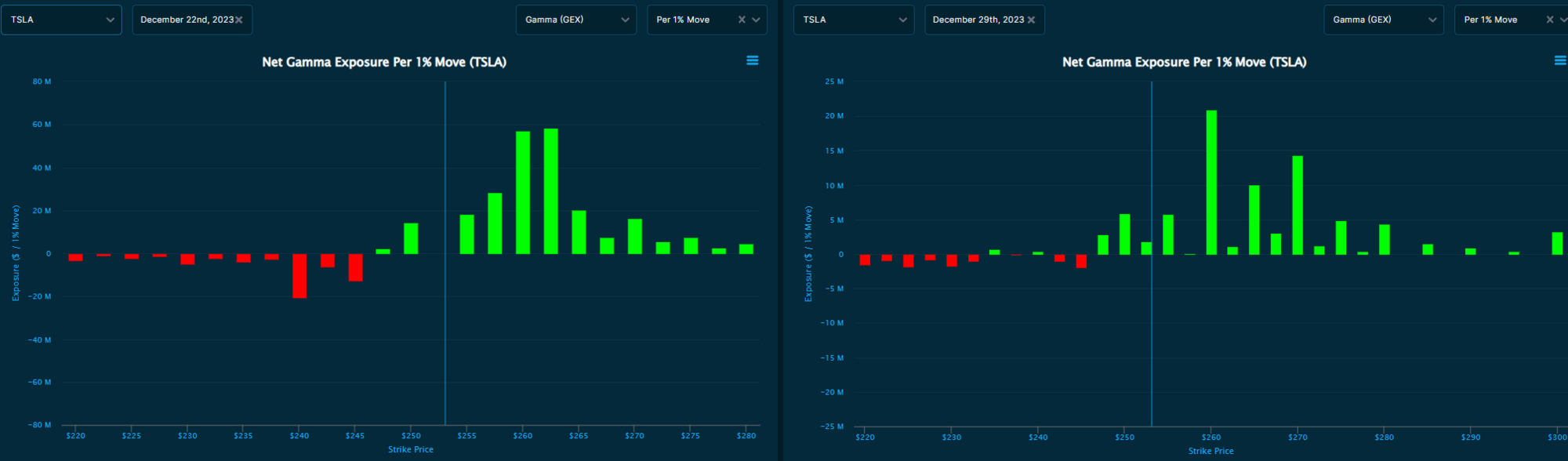

12/22 3DTE 68% Probability of Market Maker Move = 242.14-262.02 based on last night's options premiums @ 51.99% IV. Tighter guess = 247.84-256.32. Max Pain 247.50.

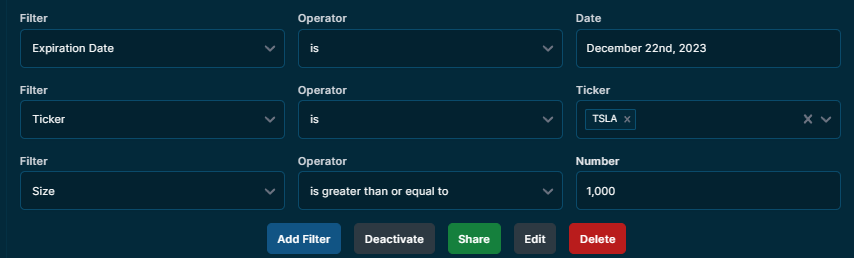

weird slow day yesterday for big players... only 15 trades opened size >=1000, never seen it that low

weird slow day yesterday for big players... only 15 trades opened size >=1000, never seen it that low

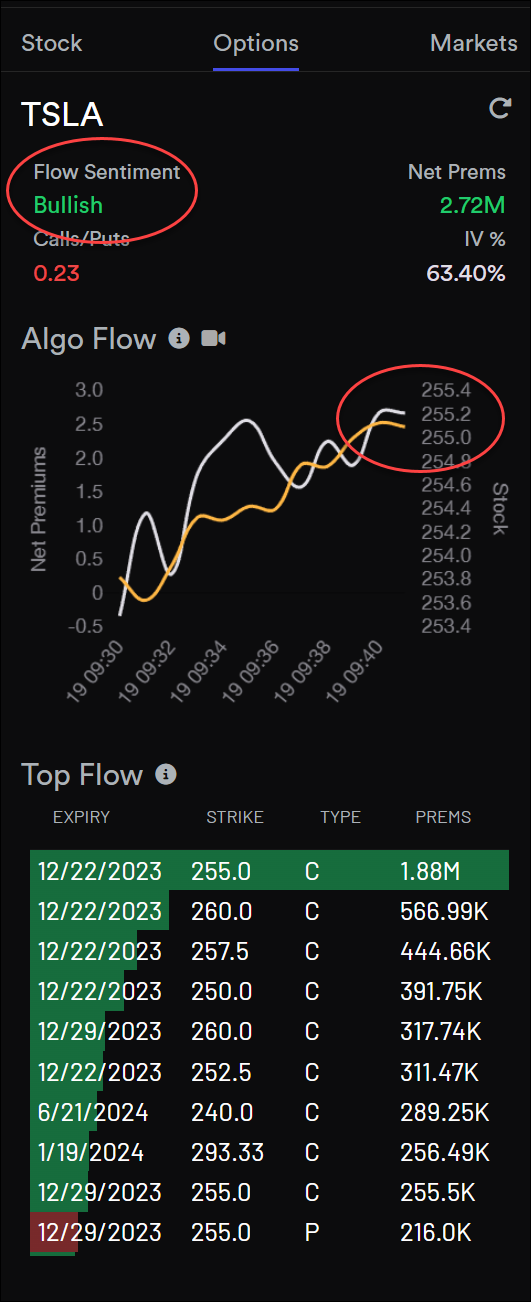

Yellow line is algo where price can gravitate to currently:

STO -C265 12/22 @$1.50

STO -C270 12/22 @0.76

(3rd round trip)

STO -C270 12/22 @0.76

(3rd round trip)

Big question is are you ok losing your shares at current prices, or are you a long term holder that is wanting a little extra money?I am thinking of starting to sell weekly covered calls on my position. Curious how you go about choosing which strike to sell. Thanks for your insights.

The only way to really lose money on CCs is to sell for a certain strike, regret it, and they buy back a losing position instead of rolling or letting the shares go.

If you are a long term holder, I would not sell for more than 0.2 premium, and try to wait for a green candle. 0.1 premium is even safer. If those go ITM, they shouldn't do it too badly, so you will have a pretty good bailout to Jan 2025 that raises the strike a lot and still gives you some income. Other option is just sell 400 or 450 strike CCs now for Jan 2025. If the SP is 500, you will still be able to roll them up and out another year (without income) to 500+.

OK, so I need to let this week play out (50x -p240, 100x -c240, 100x -c260), but after that I'm eyeing Jan 26th 270 strike, specifically 1:10 ratio straddles, i.e. 1x -p270 + 10x -c270

So given that I'm happy to let LEAPs go at 270 strike in case of >270, I see little risk and if SP is <270 at that moment, I can let the puts assign for a net share cost of around $45

So given that I'm happy to let LEAPs go at 270 strike in case of >270, I see little risk and if SP is <270 at that moment, I can let the puts assign for a net share cost of around $45

Last edited:

TSLA has more than doubled this year. That means a lot of people have a lot of profits. I wonder how much institutional selling there will be before the end of the year to lock in gains? That could limit the SP going forward until we start 2024.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K