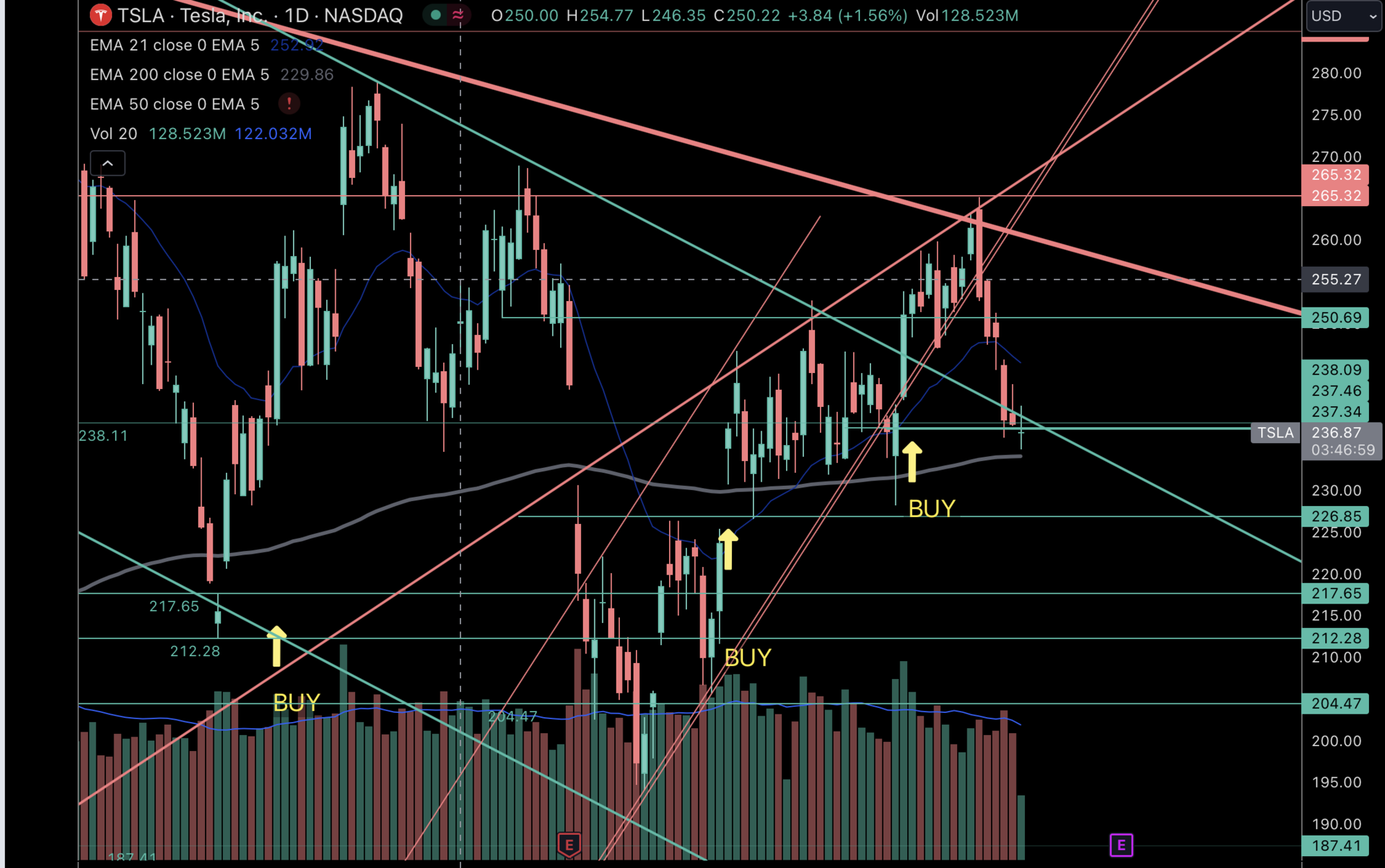

History repeated.I entered +250/-245P and -300C for 1/19.

Looking at history, TSLA often runs up in the last days leading up to P&D. However, the starting point of the run up can be a telling sign of what to come between P&D and ER.

If TSLA ran up near the very top, then the stock would go up after P&D

If TSLA ran up near the bottom, then the stock would also go up

If TSLA ran up near the top of a big dead cat, then the stock would drop after P&D

NTA.

View attachment 1003435

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

So far a boring day today.

Not for me ;-)

Scalped $5k so far from the pop and fade.

We are getting to the bottom of the range that we have been in since mid-November. 5 and possibly 6 daily red candles in a row. I'm going to wait for a bounce to sell CCs for next week.

Trades pleaseNot for me ;-)

Scalped $5k so far from the pop and fade.

cheeksaboss

New Member

Is this think or swim analysis chart or Bloomberg?

john tanglewoo

2012 Roadster Owner

Yup, def jinxed it, sorry folksFinally out of these, timed the low of the day (so far, prob just jinxed)

thenewguy1979

"The" Dog

Jim - curious why just 1 year out? Does it provide a better balance of risk to reward ratio when scalping.....

It great to see the differing strategies in plays (Yoona, Max, and Yourself).

I’m experimenting with the effects of IV on gains per % price move on different expirations. Also if one set goes against me I have *plenty* time to wait it out or fix it ;- )Jim - curious why just 1 year out? Does it provide a better balance of risk to reward ratio when scalping.....

It great to see the differing strategies in plays (Yoona, Max, and Yourself).

During the 2nd half of 2023 I had 60x -C500 for 1/2025 and it gained $125k when we fell to the low $200’s-$190’s (closed it out then with gains from selling -P290 9/24 and closed that at recent $265 touch for nice gains too), so they can also give a home run too a couple times a year if laddered in at the right time (apex/trough).

Just dabbling and having some fun while letting my longs pickle.

I would say because if you trade weeklies and it goes against you then you're toast, if you trade one year out and it goes belly-up, then just wait a few weeks and will probably recoverJim - curious why just 1 year out? Does it provide a better balance of risk to reward ratio when scalping.....

It great to see the differing strategies in plays (Yoona, Max, and Yourself).

I've done it quite a bit the previous year - sell calls 6 months out, wait until the inevitable drop, then buy them back, resell 'em when it pops again

But you do miss the dopamine hit of the weeklies - which I suspect a few of us are addicted to, I know, I am!

On that note, this is the first week since I can remember where I have no expiries today, it's very weird. Still watching the ticker for sport and trying to buy some June 2026 +p270's for a decent price...

Also note that EV stocks getting beaten-up across the board, TSLA holding up way better than the rest

Edit: adapted for typos, comprehension, bad grammar, etc... I am actually native English speaker, not that you'd know it half the time

Last edited:

Trying to buy some June 2026 -p270's for a decent price...

Do you mean sell -P270 or buy +P270?

These way-out positions only really work if you don't write against them, which is my eternal undoing, of courseI’m experimenting with the effects of IV on gains per % price move on different expirations. Also if one set goes against me I have *plenty* time to wait it out or fix it ;- )

During the 2nd half of 2023 I had 60x -C500 for 1/2025 and it gained $125k when we fell to the low $200’s-$190’s (closed it out then with gains from selling -P290 9/24 and closed that at recent $265 touch for nice gains too), so they can also give a home run too a couple times a year if laddered in at the right time (apex/trough).

Just dabbling and having some fun while letting my longs pickle.

One very successful year I did an analysis of all my trades, the short calls and puts bioth netted to about zero, all the gains, and they were substantial, came from buying LEAPS low, selling high, then waiting. Back then I didn't write against calls, just shares

Closed the -230p/+200p put spread expiring today - about 85% gain. I'm confident that we won't be under 230 at end of day, and I prefer having the position resolved rather than trying to get that last $3-4 per contract.

I'm also trying something out that I haven't done before - I've proceeded with buying the 200 strike long puts (.08) for next week that I'll pair up with short puts on Monday to make put spreads. I went ahead and bought them today though with the thinking that the intent is to turn these into put spreads, but if I wake up Monday morning to a significant drop in the share price, then I can either proceed with the put spreads as planned, or just take the profit from the long puts.

It's sort of a "free" option on a significant drop first thing on Monday morning. My larger thinking is that I won't need very many of these to work out to make this profitable, and potentially significantly profitable.

I'm also trying something out that I haven't done before - I've proceeded with buying the 200 strike long puts (.08) for next week that I'll pair up with short puts on Monday to make put spreads. I went ahead and bought them today though with the thinking that the intent is to turn these into put spreads, but if I wake up Monday morning to a significant drop in the share price, then I can either proceed with the put spreads as planned, or just take the profit from the long puts.

It's sort of a "free" option on a significant drop first thing on Monday morning. My larger thinking is that I won't need very many of these to work out to make this profitable, and potentially significantly profitable.

These way-out positions only really work if you don't write against them, which is my eternal undoing, of course

One very successful year I did an analysis of all my trades, the short calls and puts bioth netted to about zero, all the gains, and they were substantial, came from buying LEAPS low, selling high, then waiting. Back then I didn't write against calls, just shares

True. For me my positions are always written against my shares, I don’t write calls against calls.

In 2023 I flipped a -$440k loss to +$420k gain by selling simple premium, with just a little help from +C LEAPS (and a nice dose of beginner’s luck).

One day I hope to be able to keep as many plates in the air as you do so well! Meanwhile baby steps for me.

Doh! Buy +p270's I meant... as I want to roll my Dec 2025 -p270's to Jun 2026 I decided to do it in batches of 10x, there's no real rushDo you mean sell -P270 or buy +P270?

First buy the new ones, then sell some 10x weeklies $5, either I win the $5 premium, or the SP moves down and I can sell off the 2025's at a higher price

At least that's the plan

thenewguy1979

"The" Dog

The only thing I've been flipping sucessfully was burgers..........need to go on a diet.True. For me my positions are always written against my shares, I don’t write calls against calls.

In 2023 I flipped a -$440k loss to +$420k gain by selling simple premium, with just a little help from +C LEAPS (and a nice dose of beginner’s luck).

One day I hope to be able to keep as many plates in the air as you do so well! Meanwhile baby steps for me.

Wow, those are cheap and I almost jumped in to buy some, but SP would need to open below $228 on Monday morning for profits, but definitely a good idea for spread writing - my problem is that the broker fees to open them is wzy too muxh, if I bought 100x @8c, I'll pay $250 in fees, then another $250 if I wanted to sell themClosed the -230p/+200p put spread expiring today - about 85% gain. I'm confident that we won't be under 230 at end of day, and I prefer having the position resolved rather than trying to get that last $3-4 per contract.

I'm also trying something out that I haven't done before - I've proceeded with buying the 200 strike long puts (.08) for next week that I'll pair up with short puts on Monday to make put spreads. I went ahead and bought them today though with the thinking that the intent is to turn these into put spreads, but if I wake up Monday morning to a significant drop in the share price, then I can either proceed with the put spreads as planned, or just take the profit from the long puts.

It's sort of a "free" option on a significant drop first thing on Monday morning. My larger thinking is that I won't need very many of these to work out to make this profitable, and potentially significantly profitable.

Last edited:

alrighty, shutdown time

the #1 lesson i learned last year is this: don't bet everything, even if you think you're right; keep it simple and small so you have room to escape bad days.

the market will ALWAYS ALWAYS turn against you (CPI, FOMC, FUD, JOLTs, sector rotation, macros, etc) so you need your full account size to escape a loss (flip-split, split-roll, etc).

that's the advice i would give to my younger self if i can go back in time.

from 3 years ago... bookmark it and read it until you get it: (but best to click on the bxr140 link so you see the whole context)

the #1 lesson i learned last year is this: don't bet everything, even if you think you're right; keep it simple and small so you have room to escape bad days.

the market will ALWAYS ALWAYS turn against you (CPI, FOMC, FUD, JOLTs, sector rotation, macros, etc) so you need your full account size to escape a loss (flip-split, split-roll, etc).

that's the advice i would give to my younger self if i can go back in time.

from 3 years ago... bookmark it and read it until you get it: (but best to click on the bxr140 link so you see the whole context)

So fundamentally, I never exit a -C/-P at a loss. That's my #1 rule. (My other #1, as noted above, is "don't ever roll for debit"). I'll simply keep rolling until I exit through expiring worthless (or at least getting close to worthless and then closing out)--even if it takes weeks or months--by slowing burning down the negative value through progressively more favorable strikes. I certainly wouldn't suggest that's the most profitable approach as it can tie up capital that could otherwise be earning profit, but it keeps me in check on the selling side. Selling options is almost inherently a long term losing game if you don't apply some strict rules for selective entry/exit (to be fair, that's all trading, but especially with selling options), and so "never close for a loss" is my approach to never getting too deep and, ultimately, never losing.

Next, if you're trading in a Fidelity IRA (and probably many other IRA platforms?) you're pretty limited in rolling. You can't do splits and flips like you can with a regular Level 4 account. Much to my chagrin you can't even sell a call against existing shares to back into a covered call position in a Fidelity IRA (To be fair, I haven't confirmed with Fidelity whether or not that's user error on my part...).

But to answer your question, generally when it comes to selling options and especially selling naked/cash covered, you're should be doing so at a strike where your analysis says the price won't go. So for instance on a put, if your original strike was (as it should be...) below a technical support price/zone and the price blew out the bottom of that support and now you're ITM, you'd want to identify the next area of support (using whatever method works for you) for your roll-to strike price. If that next area is pretty close and especially if its strong and especially if the stock is in general strong both technically a fundamentally, you can take your chances by just rolling outa week in expiration and down in strike or however far you can go on credit, based on the logic that your analysis suggests there could be a fairly quick reversal in underlying back into your favor. But...if the signs aren't as positive, you'd want to roll farther down and, preferably, not really farther out (you want to get out of this, after all).

So if things look really shitty you could just flip the -P into a -C. This one's a pretty agressive move and I definitely wouldn't recommend it as a go-to as it explicitly means you're getting yourself out of an ITM -P and into an ITM -C, but its also the most basic: All you're doing is buying to close the -P and selling to open an equivalent value -C, again at a strike that makes sense, and again, for credit. This is mostly useful in a major tanking scenario where the whole market is going south, but can be used around earnings too if it looks like a post-earnings dump is going to keep swirling.

Just to be clear, when I say always roll for credit, I'm talking cents on the contracts (or dollars on the position). I usually try not to go below $10 just so I know any fees and commission will be covered, but at some point the credit your taking could be used for a more favorable strike/expiration. Depending on the option B/A spread, I'm usually collecting maybe tens of dollars on the position.

The other thing you can do is a split--all this means is you buy your -P to close (or -C, or spread, or whatever--none of these strategies are just about puts) and sell multiple -P's to open, 'splitting' the value of the original -P over that number of -P's for the specific purpose of having a lower strike--ostensibly one below a strong support--and, if possible, a closer expiration. This can be a bit of a rabbit hole too so you really need to be careful about it. It ties up more capital/margin and increases your downside risk. But, in moderation and in the right scenario it can be a reasonably safe and fast way to get out of a red position.

As previously noted, my go-to is a combination of the two--a split-flip. I use it all the time to pull out of ITM covered calls when I don't just want to close the position (RSUs especially), but I'll also do it with diagonals (which are sort of the all-option version of a covered call) and vertical spreads, though rarely do I go long on a vertical spread... Anyway, in that scenario I BTC my ITM -C and STO a -C with a higher strike, and then also STO a -P (and as previously noted, usually a credit spread over a naked -P), and occasionally--especially for WAY ITM -C's--multiple -P's. This works no problem in a standard four-leg orders as it ends up looking like:

BTC ITM -C

STO less ITM -C

STO OTM -P

BTO farther OTM +P

The reason I like this strategy is that it splits the current value of the ITM -C across more contracts, giving me a more favorable -C (which is the primary thing I'm trying to get out of). It also flips some of the red value to the other side of the equation, so price movement in the unfavorable direction isn't all bad--if price keeps going up on underlying those -P's are going to lose value quickly, if price moves down that makes my ITM -C less ITM, and, assuming I was smart with where I chose my -P strike, they'll still expire worthless. Bear in mind that split-flip example was solving for an ITM -C, but you can imagine it working for an ITM -P too.

Somewhat related, I'll often sell ATM or even ITM CCs during earnings week to capture the mega high Vega. For instance, on Monday two weeks ago I sold a just-ITM ROKU weekly where the time value was (I think) something like 7% of my capital on the trade. So that meant that if earnings hit I'd make 7% on my capital in 5 (or less) trading days, and if earnings tanked I'd have something like 8% (or maybe more?) downside protection. Earnings ended up pretty shitty, but I still ended up with something like $100 profit.

Yeah its good to understand that, especially in context of The Wheel, a -P is NOT the inverse of a covered call, so you absolutely shouldn't be using the same logic on choosing strike prices and expirations. The inverse of a CC is if you shorted 100 shares and then sold a -P.

Insert same soapbox as upthread about ∆ having little to do with selling options, but again I appreciate that you're using ∆ to try and find some way to normalize risk. I just can't stress enough for folks that maybe don't fully understand that nuance that selling options to realize ∆ is a terrible way to try and make money.

Since it sounds like you're using Fidelity, look into the "Probability Calculator" and "Profit/Loss Calculator" in the options tab. In slightly different ways both of them provide a much more accurate normalization you're looking for, in a way that incorporates the whole picture of the contract and not the very small piece of the pie that's ∆. Picking a -C/-P based on ∆ is like picking a Tesla over XYZ car because you like the frunk. Yeah, no question its cool to have a trunk. But if the reason you pick a Tesla is because of the frunk....

Otherwise, monthly CCs really aren't a bad way to go. You get more Vega on the monthlies than the weeklies which is nice for profit, less maintenance than a weekly so that's always great, more room to run (you'd have a farther OTM strike with a monthly than a weekly), and more time to pull out of an ITM scenario if you're feeling YOLOey. And most importantly with a CC vs a naked/cash covered put, its really no big deal if you go ITM on a covered call. Being ITM basically just gives you downside protection until you can roll out of it. Obviously you get no income during that time, but each roll that moves the strike up you sort of 'unlock' more profit.

Yeah, its super sketchy to open a -C/-P position without an exit at some price target that makes sense. Basically, if you're actually letting an option expire worthless, odds are you're doing it wrong. A common value to close is $5, and some (many?) brokerages will actually waive fees when you're closing a contract that low since they don't want to deal with the hassle of potential assignment. And seriously, if you're at $5 contract value--especially if its not later in the day on Friday, its kind of insane to not close out.

But...IMHO a smarter, less agressive price target is the way to go--say, closing out when contract value is 25% of what you sold it for. A potentially more practical method to implement this is to roll the value that's left to your next preferred expiration (next week, next month, whatever). WIth pretty much any OTM contract, and especially weeklies, its a better deal to roll before close on Friday and sometimes even Thursday, unless you're sufficiently OTM on that contract and have the capital/margin to open up a new position. Depending on how close to zero your current contract value goes, its very plausible that you can find a suitable contract for next week that has better theta.

So the rub with selling options is that one can easily fall into the too-good-to-be-true trap. Its easy for a trader to be a little lax on finding proper entry and exit points based on the perceived logic of "I don't have to be right, I just have to be not wrong". Unfortunately, that approach significantly increases the already unfavorable odds that one cycle will wipe out (or more) the profit collected from many previous cycles. Make no mistake, selling options still requires diligence with an entry, exit, and stop.

For a case study on the unfavorable odds, had one sold a 1450 weekly put on Friday close they would have collected a little less than ~$1k in time value--that would be for a contract that's ~$200 OTM and has a ~10% chance of being ITM. Assuming that's average collection (it won't be, but first order, that's not a problem with the case study), over 9 cycles one makes $9k on $145k worth of capital. First blush, 6% in two months ain't so bad, right?. The issue is that on the 10th cycle that's statistically ITM, the underlying drops $200, and at that point you're just hoping you found the bottom of a pretty major drawdown. If the underlying goes down more than $10 from there (equivalent to the $1k you collected on the current contract), you're eating into the past two months of profits. If the underlying goes another $100--equivalent to the $9k you collected previously plus the $1k from the current contract--your last 2 months are a wash. If it goes farther, you're progressively more and more in the hole. And of course if that statistical ITM happens sooner in the two months, it all gets more red.

Similarly, a more agressive case using 1550 would have collected ~$2.1k on a ~25% probability ITM. Assuming 3 good weeks you're at ~$6.3k profit, but now the fourth week only needs a dip of $100 in underlying to go ITM, and a ~$184 drop in underlying to wash out the ~month's work.

The same math applies at any underlying price and any expiration timeframe, and the same math applies if you're allowing yourself to be put shares (and thus you're starting in the red). Its a tight line to walk to maintain profit with that kind of strategy, and the odds of staying on the right side of the line are SIGNIFICANTLY improved by having things like proper entry, exit, and stop targets.

Countering those case studies--and obviously a different strategy completely--for a comparison in profit, remember my "looks like we might see it drop down to high 1300's" from upthread? Had one bought an ATM call on the first drop down and back through $1400 on 7/24 (I'm using November for expiry as its a good rule of thumb to never buy calls/puts closer than ~3 months expiration), one would have laid out ~$25k in capital and would be sitting at ~$13-14k profit. In three weeks. (To be clear, that was before I made the statement). Had that same call been purchased the second time price dropped down and back out of the high 1300's, confirming that support, (that would have been on 8/10, so after I made the statement), one would have even more profit.

As it stands I bought calls a little too aggressively on that price target, risking a bigger drawdown in an attempt to beat the flag breakout. I bought near close of 7/31, which was around $1430 underlying--and I bought $1600 (Nov) calls to reduce my ∆ exposure a bit, so I'm "only" sitting at $9.4k/contract profit right now. Futures are looking good right now and while Asia-Pac is split, Shanghai is up like 2.3% (to be fair, TSLA seems to deviate from the market more than other stocks...but TSLA is increasingly heavy in China so seeing DJSH up can't be bad news), so there's a good chance I'll open to a nice jump in profit.

The point is that the level of effort is basically equivalent in the two strategies (I'm actively charting TSLA either way), the position I took basically waited for [what I deemed] a quality entry point, whereas the -P strategy relies on quantity over quantity to return results. And, since any kind of trading or investing is all about making money, it does seem to make sense to focus on quality of unbounded profit positions over quantity of bounded and limited profit positions...

This looks like pure manipulation to me...

And of course being AAPL, when it dumps, it brings everything down with it, how convenient 2 hours before OPEX close on a Friday!

NYFT...

And of course being AAPL, when it dumps, it brings everything down with it, how convenient 2 hours before OPEX close on a Friday!

NYFT...

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K