So now that we’re at $218 it’s apparent in hindsight I should have respected the original $228 SL level. Oh well. I already missed cutting my longs on the drop from $265-$228, what’s another $10  .

.

TSLA closing the week below $223 isn’t helpful, allowing for low $180's area to come in 3-5 weeks, especially if the rest of equities correct during this time.

I wonder if we’ll first get a bounce to $230-240 and only then head further down to hit $180. All timed to head into ER and fall after.

The next level to watch this week may be $216 for a light support to round back up. Absent that may have to look out below.

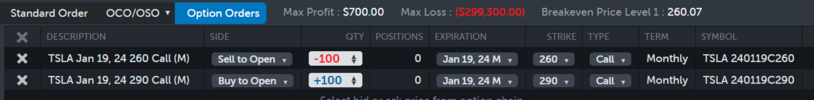

I’m still positioned more bullish than bearish (more -P and +C LEAPs than short calls) in case this is the local bottom, but will play a further drop more assertively if we get one.

Time for me to learn newer moves than I’m used to in chop weeks and not be so timid to short my own longs on these drops.

TSLA closing the week below $223 isn’t helpful, allowing for low $180's area to come in 3-5 weeks, especially if the rest of equities correct during this time.

I wonder if we’ll first get a bounce to $230-240 and only then head further down to hit $180. All timed to head into ER and fall after.

The next level to watch this week may be $216 for a light support to round back up. Absent that may have to look out below.

I’m still positioned more bullish than bearish (more -P and +C LEAPs than short calls) in case this is the local bottom, but will play a further drop more assertively if we get one.

Time for me to learn newer moves than I’m used to in chop weeks and not be so timid to short my own longs on these drops.

Last edited: