Slight correction: I expect TSLA to have problems breaking out of 209 for a while without price hikes. Even if it outright drops from 196.5, your ATM puts would still give you an extra $4 from that initial time value.Got it, thanks. So in effect you're saying TSLA is expected to be range-bound ($190-$210) for a while (3-4 weeks?) and therefore trade delta to harvest theta while it does so.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Got assigned on 10 x -p320 yesterday

Now having 1000 TSLA shares which 140k is on margin in my US account

I have 450k invested in CASH.TO so no margin call.

What would you guys do

1) keep those shares for ever

2) sell them and sell 30% DITM puts 2 years out for them to act as shares but benefiting of theta decay and avoiding to pay interests on the shares

3) sell them and buy ATM LEAPS 2 years out

4) liquidate all my portfolio and go work more

Now having 1000 TSLA shares which 140k is on margin in my US account

I have 450k invested in CASH.TO so no margin call.

What would you guys do

1) keep those shares for ever

2) sell them and sell 30% DITM puts 2 years out for them to act as shares but benefiting of theta decay and avoiding to pay interests on the shares

3) sell them and buy ATM LEAPS 2 years out

4) liquidate all my portfolio and go work more

190 CCs for Feb 9, 2024 are probably safe. NFA and have been wrong before. FWIW, I sold 200x 187.5 CCs. If I’m wrong and these 20k of my shares are called away, I won’t be sad about it. So, I guess ultimately the answer is how you’ll feel if your shares backing your CCs are called away.Well, guess I'm rolling my 190CCs for Friday....

Rolled to 200 strike next week on the opening dip to 186.5 by giving back .4 of the initial .9 premium.Well, guess I'm rolling my 190CCs for Friday....

Have 140X CCs still free to write for this Friday on a rebound....

Edit: "Doh!!!" (as the SP keeps dropping)

Why not roll the cc if they’re ITM Fri afternoon?190 CCs for Feb 9, 2024 are probably safe. NFA and have been wrong before. FWIW, I sold 200x 187.5 CCs. If I’m wrong and these 20k of my shares are called away, I won’t be sad about it. So, I guess ultimately the answer is how you’ll feel if your shares backing your CCs are called away.

Well with Ford's blowout earnings that will be all over MSM including Cramer maybe folks will sell TSLA & rotate in to Ford.I wonder if there is any chance we pass through $178 tomorrow before we start to head out of the < $200 area.

I still have these last few shares I want to buy.

never fails !!Rolled to 200 strike next week on the opening dip to 186.5 by giving back .4 of the initial .9 premium.

Have 140X CCs still free to write for this Friday on a rebound....

Edit: "Doh!!!" (as the SP keeps dropping)

But Ford is up nicely with virtually no Free Cash Flow for the quarter and nearly Negative 100% margins on its EVs. Why would the only company with Positive 17% margins on EVs NOT go down...? /s

Ford's earnings were a dumpster fire of smoke and mirrors.Well with Ford's blowout earnings that will be all over MSM including Cramer maybe folks will sell TSLA & rotate in to Ford.

never fails !!

Ford doesn't have a massive valuation like Tesla, you always need to consider thatBut Ford is up nicely with virtually no Free Cash Flow for the quarter and nearly Negative 100% margins on its EVs. Why would the only company with Positive 17% margins on EVs NOT go down...? /s

Looks like a reverse from yesterday, -2.5 to +2.5 becomes +2.5 to -2.5

Two reasons:Why not roll the cc if they’re ITM Fri afternoon?

The first is simply, I am OK selling those shares at the $187.50 strike price...if I wasn't OK doing so, I wouldn't have sold the calls.

The second is the more important reason...it's because I have a fundamentally different perspective on options than most (nearly all?) of those in this thread. It seems the prevalent philosophy here is along the lines of (poorly paraphrased, I'm sure): "If I roll the call I avoid taking the loss, and get to hopefully eventually make good on it." However, I look at rolling as two atomic actions (because in reality it *is* two atomic actions), 1) buying back the sold call (A) at a loss and fully recognizing that loss and 2) selling the new call (B) hoping to make a profit. IMHO, it is fundamentally wrong to look at rolling as "I didn't take the loss on (A) yet, because I just rolled it out." No. Full stop, "No." I took the loss on (A). It was a poor trading decision. If I lose money on (A) and make money on (B), I don't want to blur them together and tell myself that it was all just one transaction that got dragged out over a second (or third or fourth or ...) week (or month or year). I want to be very honest with myself that (A) was a money-losing trade. And if (B) works out to be a profitable trade, I want to be very honest with myself about that, too.

Even worse, by rolling, it's right at the point of having lost money on (A) that I'm making a decision on whether (B) is a good trade or not. Separating them out (by hours, days, etc) gives me time to pause and contemplate *why* I chose (A), what was incorrect about my assumptions (or what happened randomly / unexpectedly). When I've made a decision that did not work out for me, it is the perfect time to think about that. A time to reflect, not a time to instantly make a decision again. Then I can really internalize that (A) was a bad choice and (B) <even if done hours / days later than (A)> was a good choice, instead of mentally blurring them together.

NOTE: Hopefully this is read in the intented "This is just my opinion and I hold no judgement over those who think differently" manner, and does not bother or offend anyone. Different approaches are best for different people. This is just what works for me. YMMV, NFA, etc.

@OrthoSurg - that depends; in the US, it makes all the difference in the world what you should do if this is in a taxed account or Roth IRA?Got assigned on 10 x -p320 yesterday

Now having 1000 TSLA shares which 140k is on margin in my US account

I have 450k invested in CASH.TO so no margin call.

What would you guys do

1) keep those shares for ever

2) sell them and sell 30% DITM puts 2 years out for them to act as shares but benefiting of theta decay and avoiding to pay interests on the shares

3) sell them and buy ATM LEAPS 2 years out

4) liquidate all my portfolio and go work more

MUCH more so if your family has, say, students getting any sort of need-based college aid; friend of mine did great with TSLA a couple years ago in his taxed account; but the extra income caused him to totally lose whatever help he was getting for his 3 college-age kids, the cost to him dwarfing what he made with TSLA.

Then TSLA dropped like a rock depriving him of using his TSLA account to make up the difference.

ADVICE - If you don't understand the tax implications, or are getting any sort of need-based financial aid in yor family, educate yourself about that AND get qualified tax advice.

Last edited:

SpeedyEddy

Active Member

algo pointing to rebound to 189, so After STO --> BTC -C175 (on the way down) now switched to STO -P190. Yeah scalping delta still possible, but you have to be able to act quick on turns

EDIT : AND WATCH SPX (it will be prevented from crossing 5000 too easily /EDIT

EDIT : AND WATCH SPX (it will be prevented from crossing 5000 too easily /EDIT

Third day dealer deltas negative and increasing (bullish for stock price):

Please let the SP know....Third day dealer deltas negative and increasing (bullish for stock price):

Please let the SP know....

We're not at low $170's anymore are we?

it knowsPlease let the SP know....

hardly any puts in spite of MMD

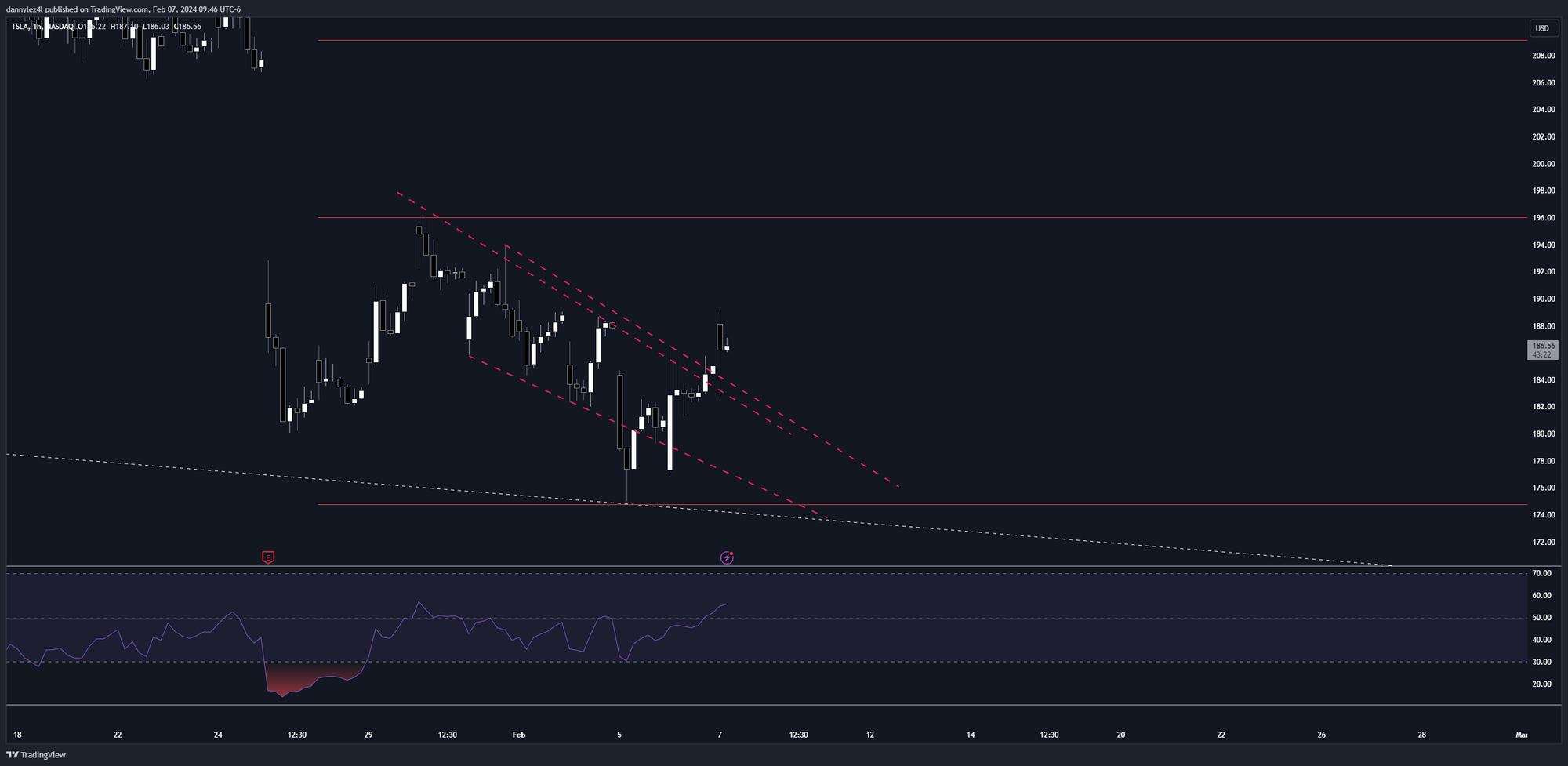

it was a simple retest of the falling wedge. At this stage, gap ups don't hold unless some substantial news causes it, which today none did. Needs time to build up momentum before more impulsive PA can develop. The 1h RSI is 56.8 now. 1st the 15m RSI reaches 70 (196 last week), then it fell some more before a stronger bounce, then the 1H RSI reaches 70 (should happen around 196 this week), then the consolidation begins. At least that's the scenario I'm looking for.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K