Normally I'm using OptionStrat and looking at the contract value over time and SP range, but now I see you can show the Theta (borrow right, click "More...", then you see the greeks, I'm assuming here the Theta below 1 is the danger zone, also Delta close to 100% is an indication, I think...@Max Plaid what's your method for estimating extrinsic value on an option at x price. For example, I have 15x -P280 1/2025 that shows $3.46 extrinsic @ SP $187.50. I'm looking to learn how to model what the extrinsic will be at slices below, say $270, $260, $250, etc. to estimate when extrinsic falls to $0.00 and danger of early assignment looms.

TIA

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

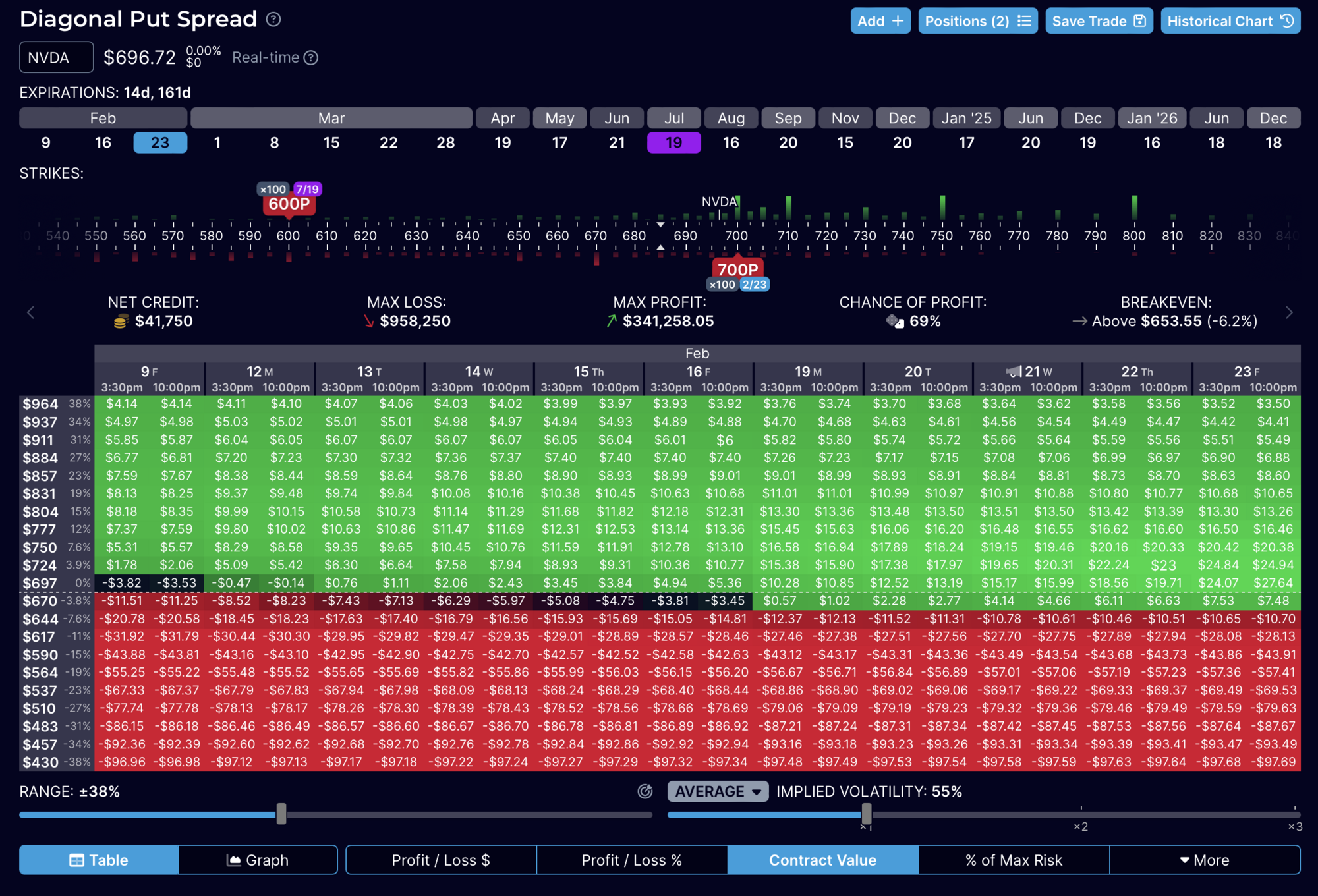

So looking at NVDA, July +p400 @3.25 / Feb 23rd -p600 @$5you know, i eat corrections for breakfast

View attachment 1016685

nvda is starting to lose momentum; IV is a bit dropping and call volume fell over 4 days, hinting tiredness to the upside

SPY daily/weekly are overdue for pullbacks; only 256 stocks are up and the rest are red for the year (tsla is #1 loser)

of the green 256, 40% of gains are from only 4 stocks and the other 252 stocks are not participating as much so beneath the surface, the stock market is not as strong as it seems

NASDAQ 60 min/daily are also overdue for pullbacks

I see a lot of scope for trading those, can even go ratio and a bit wider 200x +p400 / 100x Feb -p620, need to play with OptionStrat on this, but I see potential to get a pile of free puts here to trade against for 6 months...

Looks very interesting, this is just the outcome by Feb 23rd, obviously if it drops close to the short strike then there's work to be done, but with 5 months to roll and 2x the number of long puts should be quite easy to sort out

This obviously plays on the high IV of the earnings giving a far better premium for the short side compared to the long

SebastienBonny

Member

Yes, no problem trading other stocks of course, but I'd like this thread to concentrate on TSLA only.What's the point in this thread - Selling Other Stocks Options - Be the House ?

OK, have been looking and playing with some NVDA ideas, so what's the real risk of 7/19 +p600:2/23 -p700?

Obviously as a stand-alone trade it's clear, but it's more complicated than that as even if the stock drops, there're roughly 25x opportunities to weekly roll down the short side below the long and then profit from the trade

Any way to model this over time?? Obviously if the SP drops then you roll the short side down to 600, then it's covered with zero margin until July, you could just write weekly -p600 and take the Theta, if it really dropped through the floor then then a risk of early assignment might come up

The gambit is that the short side stays OTM on 23rd Feb, which lands you with 100x July +p600's and 25x weeklies to write 100x -p600's at zero risk

Obviously as a stand-alone trade it's clear, but it's more complicated than that as even if the stock drops, there're roughly 25x opportunities to weekly roll down the short side below the long and then profit from the trade

Any way to model this over time?? Obviously if the SP drops then you roll the short side down to 600, then it's covered with zero margin until July, you could just write weekly -p600 and take the Theta, if it really dropped through the floor then then a risk of early assignment might come up

The gambit is that the short side stays OTM on 23rd Feb, which lands you with 100x July +p600's and 25x weeklies to write 100x -p600's at zero risk

You mean 170/160/150? As you move down on strikes, extrinsic increases so thats not a problem. the problem is when the stock drops, extrinsic drops so I wonder why you say 270/260/250.

1. When you short DITM puts, make sure it has a lot of open interests to decrease the odd of getting assigned early.

2. What is the risk of getting early assignment? Nothing major. There is a slight inconvenience from your cash disappearing and you stop earning interest on them or start paying interest if margin was used. There is no extra margin pressure or tax concern.

3. Add up the current stock price and the put premium. Subtract the strike price from that sum. The result will be the extrinsic.

4. If you wonder what the extrinsic will look like if the stock drops $20, look at a strike $20 higher and calculate its extrinsic. If you wonder what a 280p will look like if the stock drops from 190 to 170, look at a 300P.

I meant estimating extrinsic for SP 170/160/150. Thanks for the helpful write up!

Re #2, what is the best move if 15x DITM -P280 1/2025 with a $94.50 premium (net $185.50) gets assigned when SP $170 or $160 (upside down $15 or $25; $22.5k-$37.5k)?

Last edited:

4. If you wonder what the extrinsic will look like if the stock drops $20, look at a strike $20 higher and calculate its extrinsic. If you wonder what a 280p will look like if the stock drops from 190 to 170, look at a 300P.

Re #4, below is what the chain shows currently, can the -P280 really suffer a $40+ drop from here (SP $150) and still have extrinsic @$1.40? Seems off since the chain was showing around $2.05 extrinsic at SP $180 last week in realtime, which is just a $10 drop from here.

Matches what the GEX team at QTA is saying:

Next week:

- Choppy PA expected between $185-$190.

- A break and hold over $195 means $200 is very possible.

- Above $200 and forget about shorting unless it's back below $200.

- If below $180 be careful unless price reclaims $180.

- Look to additional confluences with VWAP and other levels.

A few things:I meant estimating extrinsic for SP 170/160/150. Thanks for the helpful write up!

Re #2, what is the best move if 15x DITM -P280 1/2025 with a $94.50 premium (net $185.50) gets assigned when SP $170 or $160 (upside down $15 or $25; $22.5k-$37.5k)?

a. Sell 100s and then reopen a short leap put with some extrinsic left, hoping this one can stay open long enough for the SP to recover. Do this in 100s increment to make sure you get a favorable fill on the puts (maximizing extrinsic).

b. Instead of trying to get back into a short put position, treat it as a BW (which it is). Keep 100s and then sell a leap CC against it. The extrinsic on the CC will be much more than the one on the same strike put because of the high interest rate environment we're in. See if this difference can make up for the amount of interest you're having to bear by holding the shares instead of the puts. For example, a 280 BW is going to have a $12 extrinsic while a short put only $4. $8 divided by $280 / 11 months x 12 months = 3.1%, less than the current rate on cash. Worth to note that a BW is going to have slightly higher delta and higher theta than a short put so it's favorable if the SP keeps basing here for a while longer but less appealing if the SP reverses hard from here.

c. Start selling weekly CCs instead of a single leap cc against those 100s. The weekly premiums when added up can go higher than 3.1% and are more flexible against sudden reversal in price, assuming you're not getting caught in a rip.

d. Do (a), but weekly lower strike puts instead of leap puts, collecting more weekly extrinsic.

The goal here, if you still want to hold on to this long position, is to try to collect premiums to pay for the interest given up in the exchange of cash for shares, or simply reverse that exchange.

Last edited:

It makes total sense. It's what is shown on my end as well. Extrinsic is better isolated from drops if the exp is that far out. However, keep in mind the spread on those. These 2025 puts have a $1.5 spread so the actual extrinsic you will receive, if projected in the $1-$3 range, can swing around quite a bit depending on the price of the fill. In this sense, a BW is less of a headache since the spread on the same strike call is much smaller.Re #4, below is what the chain shows currently, can the -P280 really suffer a $40+ drop from here (SP $150) and still have extrinsic @$1.40? Seems off since the chain was showing around $2.05 extrinsic at SP $180 last week in realtime, which is just a $10 drop from here.

View attachment 1016833

Last edited:

I tried your trick of buying cheaper Puts farther out, and selling closer to the money Puts weekly. I had +200P for March 15. Before the drop I had sold -210P for after earnings when we still above 240. The ER drop caused the -210P to be so far ITM, that even with 6 weeks left I could no longer roll it under the +200P, and they were only $10 apart at that point. I can't imagine starting $100 apart....OK, have been looking and playing with some NVDA ideas, so what's the real risk of 7/19 +p600:2/23 -p700?

Obviously as a stand-alone trade it's clear, but it's more complicated than that as even if the stock drops, there're roughly 25x opportunities to weekly roll down the short side below the long and then profit from the trade

Any way to model this over time?? Obviously if the SP drops then you roll the short side down to 600, then it's covered with zero margin until July, you could just write weekly -p600 and take the Theta, if it really dropped through the floor then then a risk of early assignment might come up

The gambit is that the short side stays OTM on 23rd Feb, which lands you with 100x July +p600's and 25x weeklies to write 100x -p600's at zero risk

View attachment 1016828

Those puts getting assigned at 170 or 160 will be a gift. as there will easily be $1-$2 of extrinsic left on those at that moment, meaning the buyer will have given that up and you can get it for free by selling the shares and reopening these short puts.I meant estimating extrinsic for SP 170/160/150. Thanks for the helpful write up!

Re #2, what is the best move if 15x DITM -P280 1/2025 with a $94.50 premium (net $185.50) gets assigned when SP $170 or $160 (upside down $15 or $25; $22.5k-$37.5k)?

By this token, look at the extrinsic left on those puts. When it starts shrinking to near $0, the risk of early assignment goes up as there are no incentives for the buyer to hold on to those any longer. It can certainly happen above $0.5 so it's not an exact science, what's going on on their balance sheet that prompts them to exercise the puts, which is why pick a high OI strike. 1 out of 5000 chance is a lot better than 1 out of 500.

Last ER I didn't play. This ER will see what the play is going to be at last minute but it's going to be a pure gamble.Same NVDA play like last time? Butterfly on Call side and Calender Spread on Puts Side?

Yeah, I don't think 6 weeks is enough time, but I'm going to try a handful of the July +p600 / Feb 23rd -p700 to see how it goes - again here the exceptional IV for the earning's week is what's making it interesting...I tried your trick of buying cheaper Puts farther out, and selling closer to the money Puts weekly. I had +200P for March 15. Before the drop I had sold -210P for after earnings when we still above 240. The ER drop caused the -210P to be so far ITM, that even with 6 weeks left I could no longer roll it under the +200P, and they were only $10 apart at that point. I can't imagine starting $100 apart....

Last edited:

thenewguy1979

"The" Dog

Is Winter is coming soon? ATH bubble bursting...SPY QQQ now into next 2 weeks?Last ER I didn't play. This ER will see what the play is going to be at last minute but it's going to be a pure gamble.

thenewguy1979

"The" Dog

Tesla seem back to the old usual games - early morning pump then dump...been like this for days.

Should work well for scalping right Jim?

Should work well for scalping right Jim?

Opened NVDA IC

+570/-600P. -820/+850C

Probability calculator says less than 1% chance of being ITM.

Premium 0.43

SebastienBonny

Member

thenewguy1979

"The" Dog

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K