I'm guessing now that AI money is moving into appl finally, tsla will soon follow.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

dc_h

Active Member

In my IRA I have been selling more in waves, I have 2 weeks out, where I think we're safe, a month out, where I can roll and 2 and 3 months out where I'm ok being assigned. I'm listening here on ranges for the next few weeks and at this level, I'll be backing off on short term CC's. Very little upside and the downside, to Yoona's point is significant. If Tesla Energy (battery) sales double, the stock could have a big run, if the Model 2 starts rolling out of Texas ahead of schedule or some other announcement, the stock could have a big run. I'm bearish overall, but not a reason to risk all my upside on owned shares.Yoona , I have a funny siuation . i have 5000 shares in my IRA account, now i cannt do any CC because of the law pemiums and if i sell at low target price , they may get assighned. In my taxa ble account i have 1500 ahres with unit cost of $76.00. Here my problem is CC gives less premiums. If the target price is low shares may get assigned and will create huge capital gains. Thus i do only a few CC. How can i handle the situation. Thanks.last year i averaged about $20,000.this year very bad and february is a loss too.

dc_h

Active Member

and that's ok. be the house.Tesla forum and all the comments this morning was about NVDA

Mid-day update

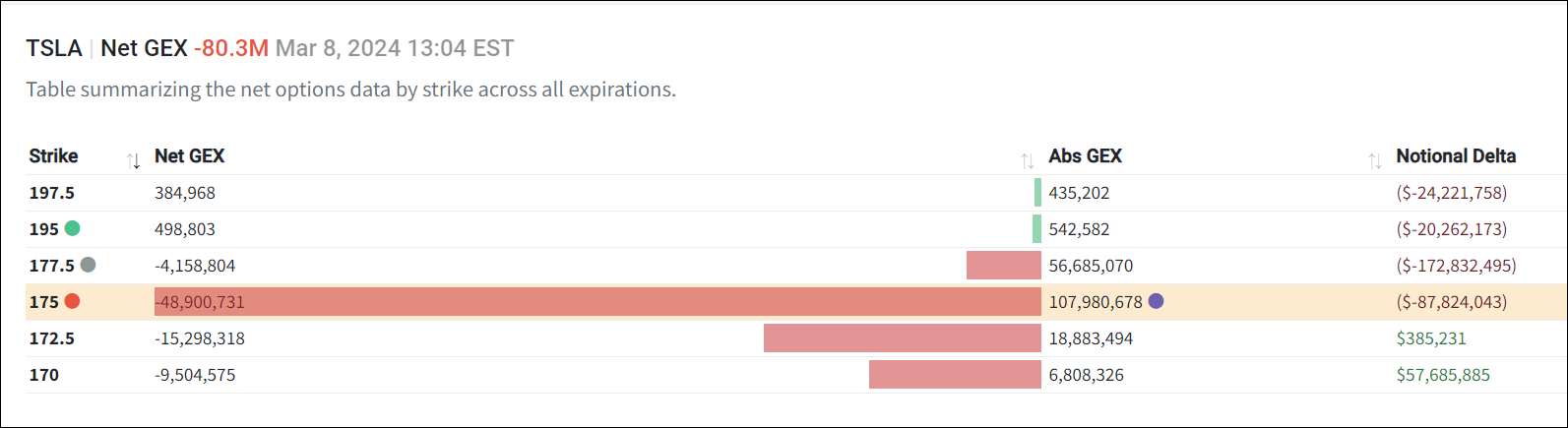

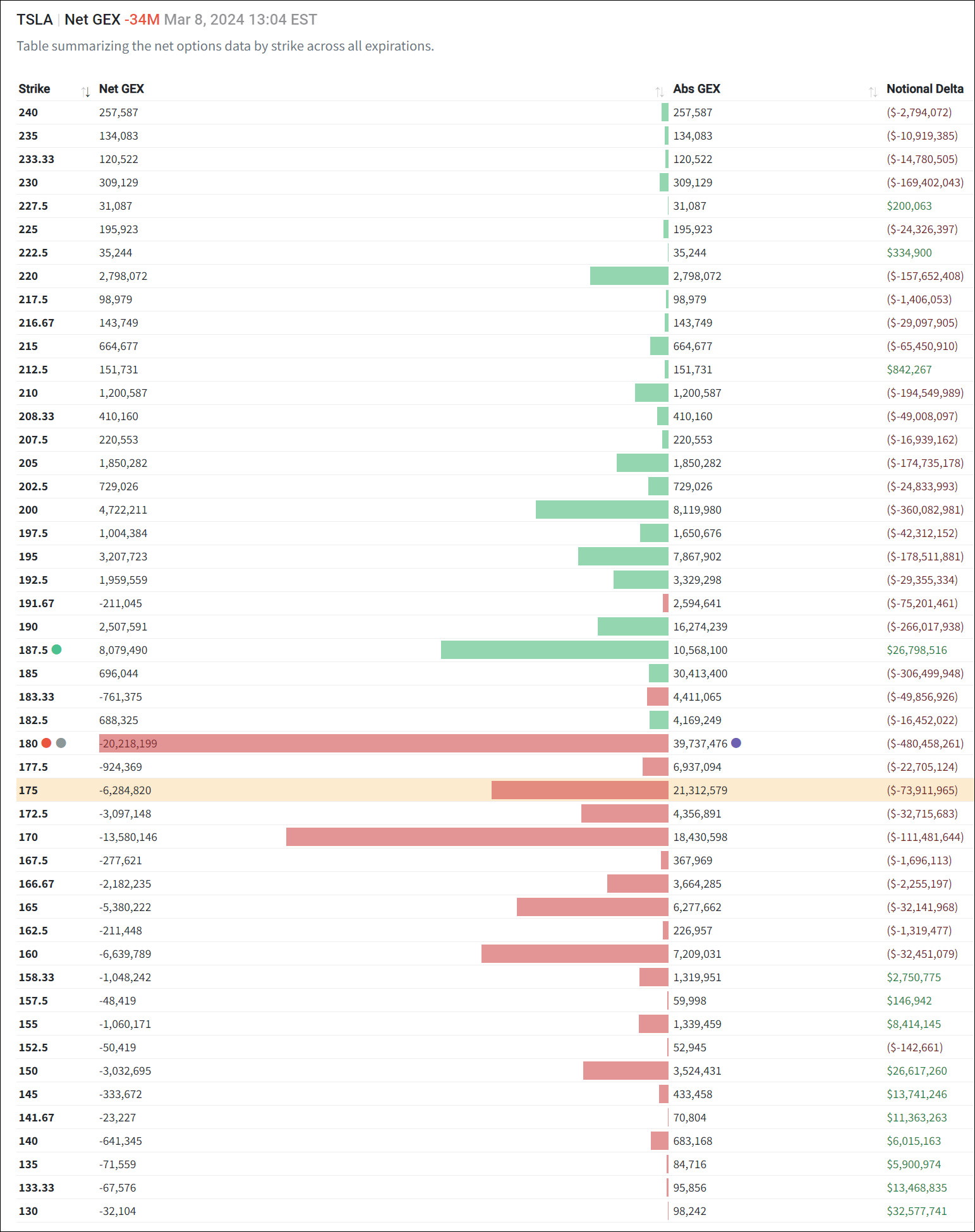

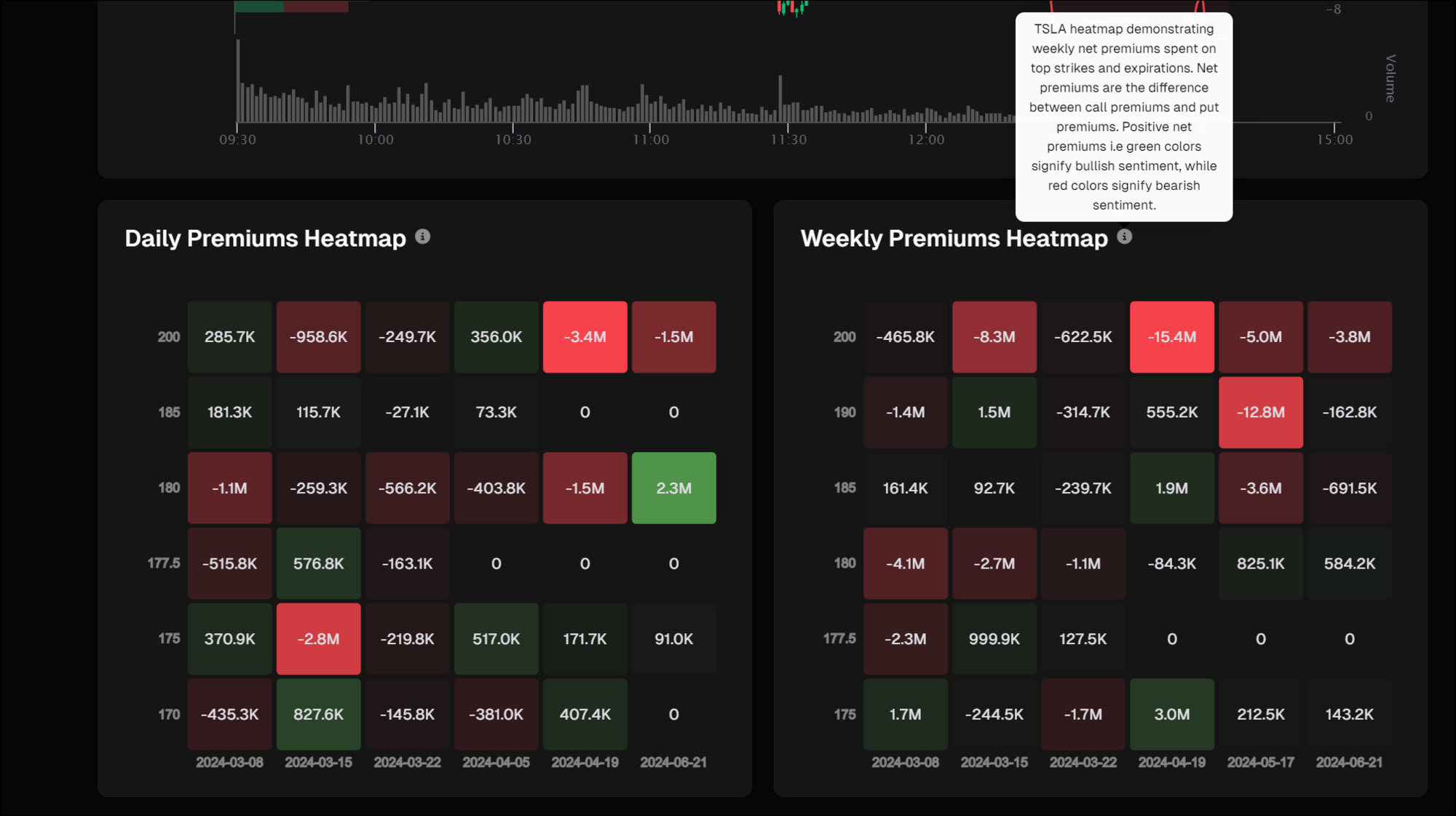

Today $2.93M have been spent on puts and $-4.53M have been spent on calls.

3/8 - Only puts left (turns $175 into support so MM don't have to pay out if it goes lower?)

3/15 - Turned put skewed

SpotGEX:

+C175 @ 3/15/2024 is the most dominant contract today.

The contract has received $6.11M in premiums todayToday $2.93M have been spent on puts and $-4.53M have been spent on calls.

3/8 - Only puts left (turns $175 into support so MM don't have to pay out if it goes lower?)

3/15 - Turned put skewed

SpotGEX:

Last edited:

Got caught out a bit on NVDA, but they are April 5 short puts so there is time for recovery. Added to the position to DCA into something I feel is less risky.

I guess we are getting into the election funk now. Interest rates need to drop soon if the Fed wants to limit damage.

I guess we are getting into the election funk now. Interest rates need to drop soon if the Fed wants to limit damage.

dc_h

Active Member

I hope it gets back to 900, but I hope you avoid that big a risk in the future. That is crazy risky without a lot of upside. I'm putting in an order for a share. now.What just tanked the entire market?

dc_h

Active Member

Was that a Gary Black catalyst?True?

View attachment 1025801

Tesla starts shipping $3,000 Cybertruck tent, looks nothing like what was unveiled

Tesla starts shipping $3,000 Cybertruck tent, looks nothing like what was unveiled

Tesla has started shipping its ‘Basecamp’, a $3,000 tent designed for the back of the Cybertruck. It’s a bit of...electrek.co

thenewguy1979

"The" Dog

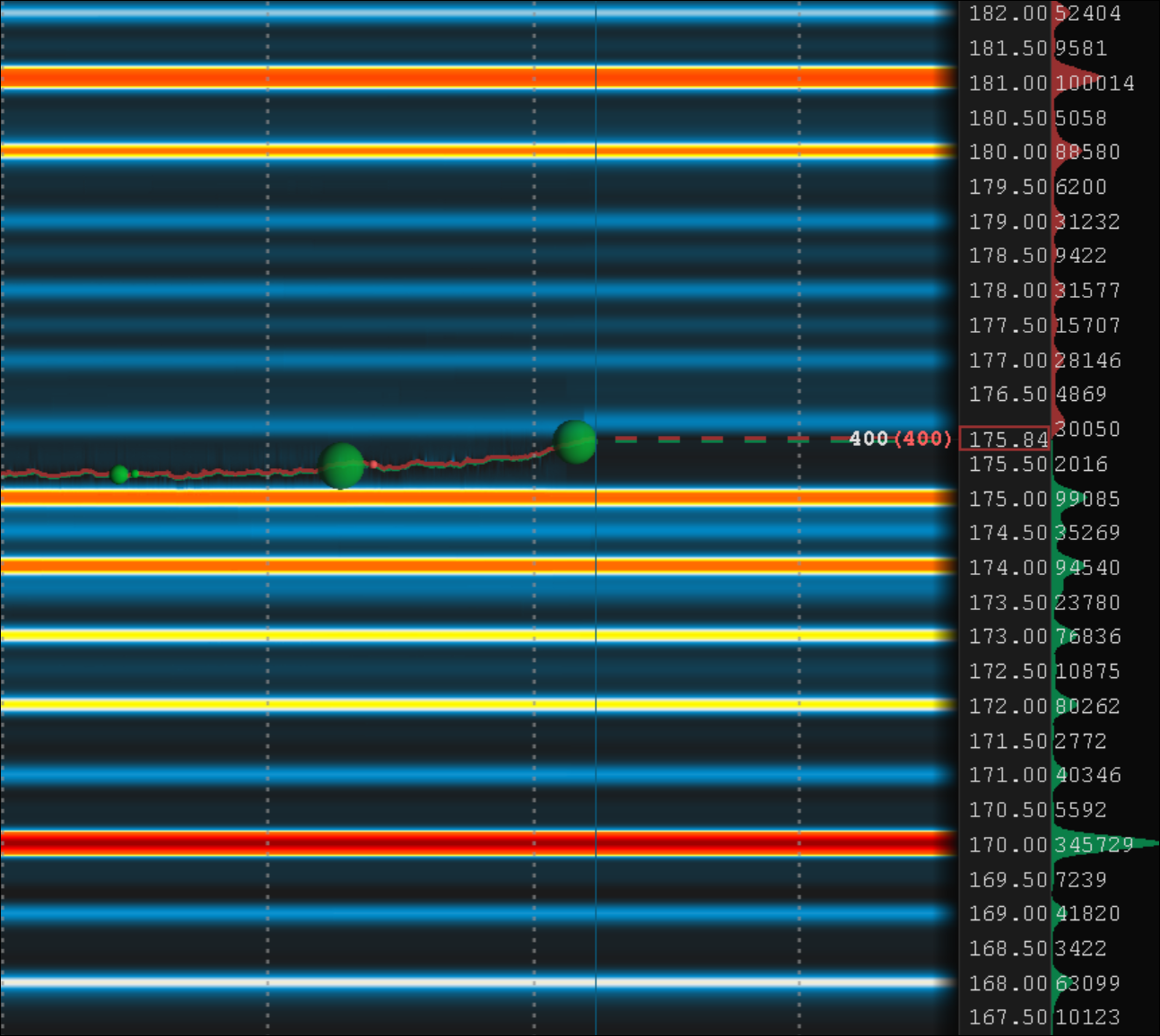

Would you take 175 if that the closing price for today? Or wait for 172 next week?Gimme 172 and I'll be bullish.

thenewguy1979

"The" Dog

I'm just scared looking at how close they were and the sheered numbers of contracts.I hope it gets back to 900, but I hope you avoid that big a risk in the future. That is crazy risky without a lot of upside. I'm putting in an order for a share. now.

Hope today pullback can alleviates some of those Contracts.

Pissed my pant for loosing couples hundreds this week.

Even Yoona with her FOTM BPS (100 wide) are feeling nervous with today dump.......

Good luck guys and please don't bet the house.

Maybe we get MMD on MondayWould you take 175 if that the closing price for today? Or wait for 172 next week?

Closed out some more call spreads. These started life as put spreads and were fairly far ITM, got flip rolled into 195/225 call spreads for 3/22 expiration. Down to $3 or so, from probably $20 - I think we've got more down than up from here, but getting out of that position makes me happy. More of these still to repair - 165/195s.I'm just scared looking at how close they were and the sheered numbers of contracts.

Hope today pullback can alleviates some of those Contracts.

Pissed my pant for loosing couples hundreds this week.

Even Yoona with her FOTM BPS (100 wide) are feeling nervous with today dump.......

Good luck guys and please don't bet the house.

Same-same with 180/210s expiring next week, these gone for 2.75 or so.

Leaves me with 165/195s for next week and 190/220s out in May.

Also closed the -200c opened yesterday for about 50%. Way more trading than I normally like to do, but while I still see lots of reason for downside, I'm also being extra special cautious about these spreads. All of them were at a 2/3rds buyout at one point, so having a 5-10% ending for them makes me ecstatic. I've had positions like these before where I keep holding on looking for that little bit more, and had them go back to being a disaster.

tivoboy

Active Member

The current Mkt tends to run up a bit into CPI/PPI and retail sales.. but that leaves ONLY Monday. Also, Friday is OPEX quarterly expiration and QUAD witching. That tends to lead to a lot more vol than normal. Lots of repositioning will occur.

Following week is FOMC Mar rate decision (most likely no change)

NVDA: being very long and short calls, I’ll take this pull back - but damb a $200B move in a DAY is pretty spectacular.

Following week is FOMC Mar rate decision (most likely no change)

NVDA: being very long and short calls, I’ll take this pull back - but damb a $200B move in a DAY is pretty spectacular.

Last edited:

thenewguy1979

"The" Dog

I asked ChatGPT but no answer. Figured I ask the one and only TivoBoy.The current Mkt tends to run up a bit into CPI/PPI and retail sales.. but that leaves ONLY Monday. Also, Friday is OPEX quarterly expiration and QUAD witching. That tends to lead to a lot more vol than normal. Lots of repositioning will occur.

Following week is FOMC Mar rate decision (most likely no change)

NVDA: being very long and short calls, I’ll take this pull back - but damb a 200B move in a DAY is pretty spectacular.

What % will NDVA hit 1000 next week?

StarFoxisDown!

Well-Known Member

Trying to decide how I want to play a drop into the 150-160's over the next few weeks. I know some think TSLA has bottomed, I think we still have another leg down, with the combination of weak Q1 P/D numbers and a macro pullback over Fed's not lowering rates this month. As @tivoboy just pointed out, CPI/PPI comes out next week and really only a very cold inflation number would make me change my mind at this point in a pretty decent macro pullback incoming.

I have a decent amount of cash set aside that is being set aside to exercise some DITM LEAPS I bought way back in Q1 of 2023 and I've since rolled them into June 2026. I don't want to use a majority of my cash since I like to keep a buffer. I think what I'll likely do if we do go down into the 150's and especially if we fill that gap at 146 intraday, is sell cash secured Puts at a 120 strike price for end of this year and use the proceeds along with a little bit cash set aside to buy some OTM June 2026 LEAPS (but not far OTM, just like $200 strike).

If the stock keeps falling through 146, well I don't mind buying the stock at 120/share and it'll take less cash to buy X number of shares than at 146/share. Just a reminder of my situation, I'm expecting a pretty decent large cash infusion sometime in the next 1-2 years so I'm focused more on ATM or DITM LEAPS than buying outright shares at the moment to accumulate more shares in the future.

I have a decent amount of cash set aside that is being set aside to exercise some DITM LEAPS I bought way back in Q1 of 2023 and I've since rolled them into June 2026. I don't want to use a majority of my cash since I like to keep a buffer. I think what I'll likely do if we do go down into the 150's and especially if we fill that gap at 146 intraday, is sell cash secured Puts at a 120 strike price for end of this year and use the proceeds along with a little bit cash set aside to buy some OTM June 2026 LEAPS (but not far OTM, just like $200 strike).

If the stock keeps falling through 146, well I don't mind buying the stock at 120/share and it'll take less cash to buy X number of shares than at 146/share. Just a reminder of my situation, I'm expecting a pretty decent large cash infusion sometime in the next 1-2 years so I'm focused more on ATM or DITM LEAPS than buying outright shares at the moment to accumulate more shares in the future.

Last edited:

I can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

intelligator

Active Member

Be careful, especially if you are thinking to open a 6DTE NVDA position !I asked ChatGPT but no answer. Figured I ask the one and only TivoBoy.

What % will NDVA hit 1000 next week?

StarFoxisDown!

Well-Known Member

I've been following Nvidia all morning to keep an eye on your situation. Sorry man, Nvidia's trading activity today has been brutal for your positioning. Hang in thereI can't believe I bit the spread bug again and lost.

How on Earth does NVDA go from 970 earlier today after going up 5%, to dropping 10% to be down 5% on the day?!?

I had promised myself I would never let spreads go into the money and roll them week to week. But the reversal happened so fast I was caught flat footed. Looks like I will have a $25 loss X 300.

This will cost me 4,300 shares of TSLA.

The worst part is having to look my wife in the eye and tell her.

That's it. I am never doing spreads again. Just CSP and CCs. I don't know how much I need to lose to learn my lesson. You guys are just smarter and/or more disciplined than I am.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K