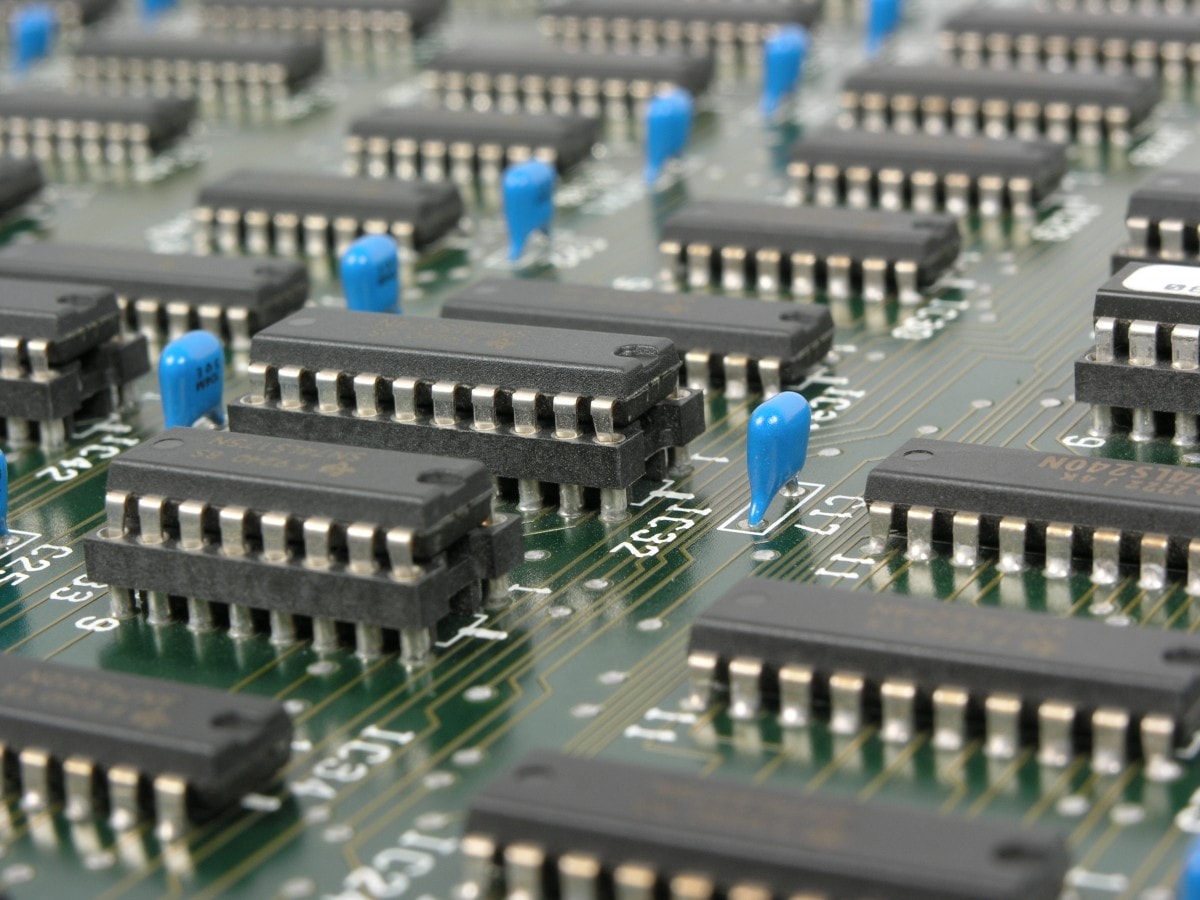

Most of those sitting on the sidelines are well aware that the market is being affected by a shortage of microchips, the research showed.

www.autonews.com

Most of those sitting on the sidelines are well aware that the market is being affected by a shortage of microchips, the research showed.

More would-be vehicle buyers are exiting the market, according to research posted Wednesday by Cox Automotive and Kelley Blue Book.

Most of those sitting on the sidelines, at least temporarily, are well aware that the market — which is short on inventory and high on pricing — is being affected by a shortage of microchips.

The August survey found that 48 percent of consumers were choosing to postpone a purchase, up from 37 percent in April.

Of those consumers who said they were stepping back from the market in August, 80 percent said they planned to be sidelined for between three and 12 months. In April, that figure was at 60 percent.

A shortage of microchips has constrained production of new vehicles, which in turn has led to increased demand and higher prices for used ones.

In the August survey, three-quarters of in-market shoppers said they would be willing to travel outside their local area to buy a vehicle. Most of those shoppers said they would be willing to drive 50 to 200 miles, but fewer than 20 percent said they'd go more than 200 miles. That question was not included in the April survey.

Also in the August research, 35 percent said they would shift from an imported brand to a domestic one, compared with 28 percent in the April survey; 32 percent said they'd switch brands in general, down slightly from 33 percent; and 31 percent said they would change which vehicle category they're shopping for, such as an SUV, crossover, minivan, compact car and so on. That compares with 19 percent in April.

Thirty-eight percent of shoppers in August said they would switch from a new vehicle to a used one, but only 18 percent said they'd go the opposite route. In April, 23 percent said they would go from new to used, while 16 percent said they would switch their search from used to new.

A little more than a third of shoppers in August said they would pay above the sticker price for new vehicles, compared with 42 percent in April.

More than half of shoppers in August were aware of the cause of the microchip shortage, compared with 46 percent in April. And nearly three-quarters said they were familiar with the effect it has had on the automotive market. In April, that figure was 53 percent.

"With a large portion of the in-market population now saying they plan to delay their purchase given the current market conditions, it will be interesting to see how that could impact the ongoing delicate balance of supply, demand and pricing across the industry," Vanessa Ton, senior industry intelligence manager for Kelley Blue Book, said in Wednesday's report.

www.autoevolution.com

www.autoevolution.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OPQIME5DZJLUXIALRWYKJOKTJE.jpg)