Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

September 2021 Order Delivery Dates

- Thread starter scoobybri

- Start date

Correct me if I'm wrong but it's only applicable for those who paid under 55k for their Y. Those with FSD and better than a basic configuration are not qualified.I rate it 50/50 we get something resembling the $8k with a $300k income cap.

pepperoni

Member

The Y should qualify as an SUV, with limit at $80K. We’ll need to see what makes it into the final bill though.Correct me if I'm wrong but it's only applicable for those who paid under 55k for their Y. Those with FSD and better than a basic configuration are not qualified.

Ron J.

MY LR, Blue-Bk, OD 9/30/21 - Delivered 5/26/22

good catch on the date on the version I linked toThe “or later” text you are referencing is a requirement for the manufacturers to label qualified cars with a unique VIN, which could be why Tesla changed its VIN scheme earlier this year. It doesn’t mean that only those cars with the new VIN are qualified for the credit. Otherwise, who would buy the older cars if he newer ones were suddenly $8K cheaper. You need to look at the “effective date” to see when the bill goes into effect, which you’ve done.

By the way, you’re linking to the September version of the bill. The one that was voted on is the November version, which has some important changes such as reduced income limits. Here is that version:

Some interesting provisions of the latest version of the House Bill include:

‘‘(2) BASE AMOUNT.—The amount determined under this paragraph is $4,000.

(3) BATTERY CAPACITY.—In the case of a new qualified plug-in electric drive motor vehicle, the amount determined under this paragraph is $3,500

if— ‘(A) in the case of a vehicle placed in service before January 1, 2027, such vehicle draws propulsion energy from a battery with not less than 40 kilowatt hours of capacity and has a gasoline tank capacity not greater than 2.5 gallons, and

‘(B) in the case of a vehicle placed in service after December 31, 2026, such vehicle draws propulsion energy from a battery with not less than 50 kilowatt hours of capacity and has a gasoline tank capacity not greater than 2.5 gallons."

Those latter provisions effectively mean plug-in hybrid EVs will only qualify for the base $4000 tax credit (not a limitation of Teslas). Further provisions of the bill that are of interest include:

‘‘(4) DOMESTIC ASSEMBLY.—In the case of a new qualified plug-in electric drive motor vehicle which satisfies the domestic assembly qualifications,

the amount determined under this paragraph is $4,500.

(5) DOMESTIC CONTENT.—In the case of a new qualified plug-in electric drive motor vehicle which satisfies domestic content qualifications, the

amount determined under this paragraph is $500.

(c) VEHICLE LIMITATION.—The number of new qualified plug-in electric drive motor vehicles taken in account under subsection (a) shall not exceed 1 per taxpayer per taxable year."

It looks that this version of the bill would allow for a Tesla that qualifies, to receive: $4000 + $4500 = $8500 plus an additional $500 if it satisfies the Domestic Content provision. The Tesla models that qualify for the tax credit are virtually all Model Y's and Model 3's with a price of under $55K. Model S and Model X do not qualify for the tax credit because they exceed the max. vehicle price allowed by the bill.

"THRESHOLD AMOUNT.—For purposes of paragraph (1), the term ‘threshold amount’ means—

(A) $500,000 in the case of a joint return or surviving spouse (half such amount in the case of a married individual filing a separate return),

(B) $375,000 in the case of a head of household, and

(C) $250,000 in any other case."

Last edited:

pepperoni

Member

No, the Domestic Assembly means union, which does not apply to Tesla. The calculation is $4000 + $3500 (battery content) + $500 (domestic battery) = $8000.It looks that this version of the bill would allow for a Tesla that qualifies, to receive: $4000 + $4500 = $8500 plus an additional $500 if it satisfies the Domestic Content provision. The Tesla models that qualify for the tax credit are virtually all Model Y's and Model 3's with a price of under $55K. Model S and Model X do not qualify for the tax credit because they exceed the max. vehicle price allowed by the bill.

Oddmanout

OD 8/28 |MYLR |Black|Black|20"|Tow|FSD|

Congrats!My EDD jumped back to Dec 5-Dec 16. No VIN yet but it looks like September orders are beginning to receive their MYLR!

What vehicle options did you choose, aside from 5 seater?

SpecialDad

Member

All versions of the Model Y qualify as it has been classified as a light SUV and therefore is at the $80k and under. Even with FSD you should qualify.Correct me if I'm wrong but it's only applicable for those who paid under 55k for their Y. Those with FSD and better than a basic configuration are not qualified.

45thParallel

Member

Amazing! I am noticing Tesla is giving deliveries to late September on a sporadic basis out of the blue. I note you declined it. Some lucky guy in your region who wants it now will get it.I just checked my app and i see a VIN is assigned to me today. I am not yet ready to take the car.. hope SA pushes my EDD for next batch atleast for a quarter. Fingers crossed.

45thParallel

Member

I bought the Tesmanian floor mats. I had 2 requirements. I should not have to remove the cargo mat just to open my trunk. Second, I wanted a decent height of the liners, because I live in snow country. The Tesmanian were not the best, but were still much better than others. I also purchased - homelink and 2 Key fobs, quick bandit front number plate holder from Teslarati, a spare tire kit from modern spare, Spigen matt screen protector. My spare tire purchase decision came from reading the frequent complaints of a flat tire in Tesla's reported on the subreddit for model y.Since my car delivery is around the corner, thinking of buying floor mats for my Model Y.

Which ones are the best and what do you recommend? Any Black Friday deals?

No one knows the definition of “SUV” for these purposes. Tesla’s shift in VIN designations seems aimed at pushing the issue, but who knows whether the Model Y will be an SUV for purposes of any tax credit.The Y should qualify as an SUV, with limit at $80K. We’ll need to see what makes it into the final bill though.

What agency qualified it as a light SUV? And what assurances are there that designation apply for purposes of the wording of the tax credit?All versions of the Model Y qualify as it has been classified as a light SUV and therefore is at the $80k and under. Even with FSD you should qualify.

cusetownusa

2022 LR5 MSM/Bl | 19"

I just received my LDCRS mats from Amazon. They have a Black Friday deal. I don’t have my Y yet but they look great. Looks like the maxpiders that I have in my wife’s car.Since my car delivery is around the corner, thinking of buying floor mats for my Model Y.

Which ones are the best and what do you recommend? Any Black Friday deals?

Just received my VIN last night, now waiting on the text to schedule delivery.

Ordered September 16th with original delivery estimate of February. The EDD for the last few weeks has said January 10th - February 7th.

Ordered September 16th with original delivery estimate of February. The EDD for the last few weeks has said January 10th - February 7th.

Satishc

Member

I ordered on 09/30. my EDD for last few weeks is Feb1st - March 1st. I also received my VIN yesterday night.Just received my VIN last night, now waiting on the text to schedule delivery.

Ordered September 16th with original delivery estimate of February. The EDD for the last few weeks has said January 10th - February 7th.

fatheroftwo

Member

I bet you get the delivery sooner than your EDD.I ordered on 09/30. my EDD for last few weeks is Feb1st - March 1st. I also received my VIN yesterday night.

CoasterBrad

Member

Welp my EDD just jumped way up. Ordered 9/22 with an original EDD of March, then was at Jan 17-Feb 14 for a long time, and now is Dec 11-25th. Way sooner than I was planning, and I'm really not looking to take delivery until January. Hopefully it won't be too much hassle to delay a few weeks without getting thrown to the back of the line.

With 5 weeks left to the new year I was wondering about the time-line.

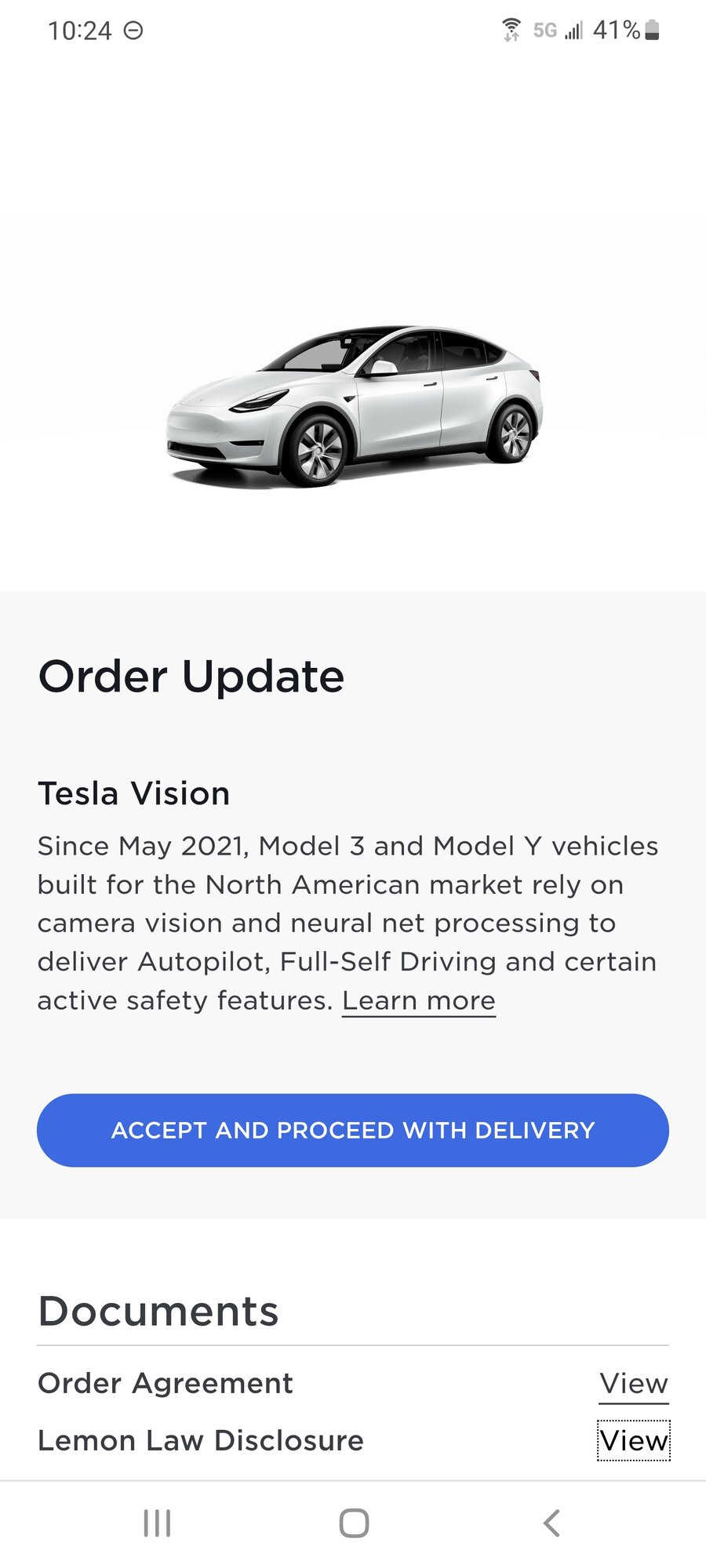

Does anyone know how much time Tesla gives to accept Tesla Vision, upload the insurance papers and schedule the delivery. Would like the car early January. Yes, I got the VIN.

Does anyone know how much time Tesla gives to accept Tesla Vision, upload the insurance papers and schedule the delivery. Would like the car early January. Yes, I got the VIN.

Similar threads

- Replies

- 1

- Views

- 455

- Replies

- 2

- Views

- 1K

- Replies

- 0

- Views

- 205

- Replies

- 6

- Views

- 815