Picked up a few shares at $182.85 on the news release. Bounced back fairly quickly. Seems like any news on Tesla creates a knee jerk reaction, but then other people like myself fill in the gaps of the quick sellers. Should make a stronger Q3 if this action continues.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short-Term TSLA Price Movements - 2013

- Thread starter Robert.Boston

- Start date

- Status

- Not open for further replies.

Gtoffo

Member

I got this alert on Fidelity

DOW JONES & COMPANY,

INC. 10:56 AM ET 10/16/2013

10:56 EDT - From the "Is this allowed?" department, S&P

Capital IQ starts coverage of market darling Tesla (TSLA) at sell and sets a

$150 price target while issuing well-below-consensus profit

guidance for both this year and next. "We believe a premium-to-peer valuation is

warranted given its unique business model and technological leadership." TSLA is

trading at just below 100 times the firm's 2014 EPS view. But S&P Capital IQ

thinks "there is execution risk for Tesla as well as opportunity. We expect

these volatile shares to impacted by news flow and investor-sentiment shifts."

As the broader market bounces, TSLA falls 0.4% to $183.23;

they've more than quintupled this year.

took this dip opportunity to accumulate some more.

That is just totally insane. I also bought some ultra short term Bull call spread options expiring friday just in case something interesting happens.

sleepyhead

Active Member

I got this alert on Fidelity

DOW JONES & COMPANY,

INC. 10:56 AM ET 10/16/2013

10:56 EDT - From the "Is this allowed?" department, S&P

Capital IQ starts coverage of market darling Tesla (TSLA) at sell and sets a

$150 price target while issuing well-below-consensus profit

guidance for both this year and next. "We believe a premium-to-peer valuation is

warranted given its unique business model and technological leadership." TSLA is

trading at just below 100 times the firm's 2014 EPS view. But S&P Capital IQ

thinks "there is execution risk for Tesla as well as opportunity. We expect

these volatile shares to impacted by news flow and investor-sentiment shifts."

As the broader market bounces, TSLA falls 0.4% to $183.23;

they've more than quintupled this year.

took this dip opportunity to accumulate some more.

I literally stopped reading after:

"while issuing well-below-consensus profit guidance for both this year and next"

TSLA will crush consensus guidance, that much I am certain. Q3 for sure, but I haven't looked what consensus is beyond Q3.

I still can't believe that "professional" analysts are so wrong about the company. I mean all of the needed information is out there and public, all you have to do is research it (isn't this what a professional research firm is supposed to do?).

Easy money still to be made in TSLA. Very easy money. I can't believe how easy this is, it is almost mind-boggling. Only a force majeure event can stop TSLA in the short run.

Mario Kadastik

Active Member

Well when the sudden dip happened I bought weekly 190-s. Already cashed some out for ca 30% profit

- - - Updated - - -

Like US politicians being idiots and crashing the whole market?

But I guess the whole shutdown if it gets resolved in the next few days (likely) will be the GS like dip for Q3 So if people didn't load up, tough luck...

So if people didn't load up, tough luck...

- - - Updated - - -

Easy money still to be made in TSLA. Very easy money. I can't believe how easy this is, it is almost mind-boggling. Only a force majeure event can stop TSLA in the short run.

Like US politicians being idiots and crashing the whole market?

But I guess the whole shutdown if it gets resolved in the next few days (likely) will be the GS like dip for Q3

Norbert

TSLA will win

I literally stopped reading after:

"while issuing well-below-consensus profit guidance for both this year and next"

TSLA will crush consensus guidance, that much I am certain. Q3 for sure, but I haven't looked what consensus is beyond Q3.

I still can't believe that "professional" analysts are so wrong about the company. I mean all of the needed information is out there and public, all you have to do is research it (isn't this what a professional research firm is supposed to do?).

Easy money still to be made in TSLA. Very easy money. I can't believe how easy this is, it is almost mind-boggling. Only a force majeure event can stop TSLA in the short run.

It sounds a bit like they are just making that up...

Jeepinjake

Member

Hi all. I've been lurking this thread for several months. My first TSLA purchase was at 27, and since then I've made a small fortune. I made my first option purchase last week when we were in the 160s. Only 25 years old, from Austin, TX, just wanted to introduce myself, share some opinions, but mostly learn!

sub

Active Member

Covered Call Strategy...

(I've seen a few post here on covered calls - but not go thru all 1065 pages of this thread)

Anyone regularly selling covered calls?

I've been doing it for a few months now and am very happy with how it is going..

Highlight of my strategy...

I am in the stock for the long run. (years... do not need the funds for years....)

I am basically selling 30-45 days out (that is when premium decay is the greatest... going furthur out you have very little premium decay added)

Selling Delta 20' ish (Basically market makers are saying you have a 20% chance of expiring ITM, 80% chance of expiring worthless)

So far all have expired OTM

If I do get called on any - I would have made great gains on the stock itself during those 30-45 days...

And would most likely be able to buy those all back on a pullback at a cheaper price.

(Doing this also with Facebook - had sold a 50.00 strike... got called at 50.01 (??? yes really) bought them back at 47.32)

If (Big If) the stock drops enough I will buy them back and re-sell

I am trading in a Sept Ira account - no short term gains issue

Example - Yesterday I sold Nov 16 215 calls for $ 6.95 (Hey if it goes to 215 within the next 4 weeks - I am a very happy camper)

Rinse and repeat.

Any feedback appreciated.....

PS Edit: I like selling when TSLA has a strong pop in price, IV gets jacked up and I get a great price on the call

I've been looking at different ways of doing this without getting caught out on a big run up. I almost got caught when DB released their upgrade, I was in the red big time but the fire saved me and I was able to buy them back at a small profit. One thing you could do to avoid missing a big run up is buy replacement shares at the strike if there is a big run up, I've considered using my margin for this. However, I've been uncomfortable with the downside risk so i'm trying to workout ways that I can hedge if this happens and limit downside and lose some upside if necessary.

Jeepinjake

Member

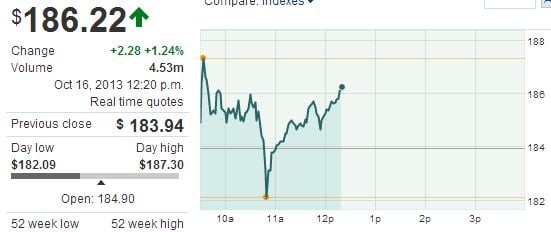

I'm not one for speculation, but I do like seeking understanding.

What could have a quick drop like this ? I watch the stock for hours a day, and that was unusual. The market didn't have any such hiccup...

? I watch the stock for hours a day, and that was unusual. The market didn't have any such hiccup...

Was it algos knee jerking to this:?? Timing looks the same

DOW JONES & COMPANY,

INC. 10:56 AM ET 10/16/2013

10:56 EDT - From the "Is this allowed?" department, S&P

Capital IQ starts coverage of market darling Tesla (TSLA) at sell and sets a

$150 price target while issuing well-below-consensus profit

guidance for both this year and next. "We believe a premium-to-peer valuation is

warranted given its unique business model and technological leadership." TSLA is

trading at just below 100 times the firm's 2014 EPS view. But S&P Capital IQ

thinks "there is execution risk for Tesla as well as opportunity. We expect

these volatile shares to impacted by news flow and investor-sentiment shifts."

As the broader market bounces, TSLA falls 0.4% to $183.23;

they've more than quintupled this year.

What could have a quick drop like this

Was it algos knee jerking to this:?? Timing looks the same

DOW JONES & COMPANY,

INC. 10:56 AM ET 10/16/2013

10:56 EDT - From the "Is this allowed?" department, S&P

Capital IQ starts coverage of market darling Tesla (TSLA) at sell and sets a

$150 price target while issuing well-below-consensus profit

guidance for both this year and next. "We believe a premium-to-peer valuation is

warranted given its unique business model and technological leadership." TSLA is

trading at just below 100 times the firm's 2014 EPS view. But S&P Capital IQ

thinks "there is execution risk for Tesla as well as opportunity. We expect

these volatile shares to impacted by news flow and investor-sentiment shifts."

As the broader market bounces, TSLA falls 0.4% to $183.23;

they've more than quintupled this year.

Norbert

TSLA will win

I'm not one for speculation, but I do like seeking understanding.

What could have a quick drop like this? I watch the stock for hours a day, and that was unusual. The market didn't have any such hiccup...

View attachment 33204

Was it algos knee jerking to this:?? Timing looks the same

If it had anything to do with that (and it could well have), then it shows that there is (still) quite some uncertainty about the numbers we'll get in the Q3 results. Which I'd think indicates additional potential upside.

Clemsons2k

Member

I'm not one for speculation, but I do like seeking understanding.

What could have a quick drop like this? I watch the stock for hours a day, and that was unusual. The market didn't have any such hiccup...

View attachment 33204

Was it algos knee jerking to this:?? Timing looks the same

DOW JONES & COMPANY,

INC. 10:56 AM ET 10/16/2013

10:56 EDT - From the "Is this allowed?" department, S&P

Capital IQ starts coverage of market darling Tesla (TSLA) at sell and sets a

$150 price target while issuing well-below-consensus profit

guidance for both this year and next. "We believe a premium-to-peer valuation is

warranted given its unique business model and technological leadership." TSLA is

trading at just below 100 times the firm's 2014 EPS view. But S&P Capital IQ

thinks "there is execution risk for Tesla as well as opportunity. We expect

these volatile shares to impacted by news flow and investor-sentiment shifts."

As the broader market bounces, TSLA falls 0.4% to $183.23;

they've more than quintupled this year.

Yep thats exactly what caused it. If you read the last page it will detail some discussion about it

Gtoffo

Member

Norbert

TSLA will win

The S&P fool is on CNBC right now "justifying" his Sell recommendation......

I was just wondering what caused the next jerk down a few seconds ago.

Mario Kadastik

Active Member

Well the rhetoric from reuters feed is that everyone is patting their backs for actually making it work and that it's now done deal to open the government, then if that's the case then why is TSLA dropping? And on volume...

Gtoffo

Member

I was just wondering what caused the next jerk down a few seconds ago.

There we go. Back in the red.

P.S. I would like to point out how clueless the guy sounded during his interview. He clearly didn't add anything new to the bear perspective but just rehashed the usual "the valuation is crazy". The panel also brought up Damodaran's analysis from a few months back saying that almost everybody believes that the stock is overvalued. No word about earnings (I would have liked to hear why this guy thinks TSLA will underreport :-D... would have been a great laugh).

Last edited:

Well the rhetoric from reuters feed is that everyone is patting their backs for actually making it work and that it's now done deal to open the government, then if that's the case then why is TSLA dropping? And on volume...

Automated trades (algos) reacting to the idiotic analyst "downgrade" and subsequent CNBC discussion of this downgrade. View this as a pre-earnings gift, as Sleepy said. It's easy money.

Mario Kadastik

Active Member

Seriously, the whole news media is reporting a deal and TSLA is getting high volume red candles  it's a great buying opportunity as I think later today or tomorrow the market will go up with the final deal getting signed, but why the selling right now

it's a great buying opportunity as I think later today or tomorrow the market will go up with the final deal getting signed, but why the selling right now  And it has absolutely no correlation to generic Nasdaq

And it has absolutely no correlation to generic Nasdaq

Norbert

TSLA will win

Tesla: Look What the Bear Dragged In - Stocks To Watch - Barrons.com

According to FactSet, of the 13 analysts covering the stock, six rate the stock Outperform or Buy, six rate it Hold and just one rates it Sell. That lone analyst now has some company.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 221

- Locked

- Replies

- 0

- Views

- 3K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 21

- Views

- 6K