Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

if the market is irrational, should I be more irrational ahead of them? That is the question.

Just because others are going postal there's no need to go Hamlet!

Panic in the streets, entertaining.

I don't think it is panic.

People were looking forward to the blog post.

When that got delayed, they decided to take their money off the table for until it is done.

MitchJi

Trying to learn kindness, patience & forgiveness

Questions for institutional investors? Turned down by every investor?There's a reason TSLA is falling... While everyone here (for the most part) knows for a FACT TSLA is worth $260/share+, and can see the value in what Elon is trying to accomplish, the street is extremely skeptical. TSLA has a very high debt ratio, and now they're going to aquire SCTY (which has even more debt)... This raises significant questions for both instational investors and the professionals on the street. For one, how will TSLA finance this if they've already been turned down by every investor? Another public sock offering, and in turn more debt... TSLA will (unfortunately) keep drifting lower until we get some good news. But for the long term price to be maintained, as previously mentioned, we absolutely need Model 3s to start rolling off the production line in late 2017!

The M3 might not start shipping until sometime in 2018.

What in the world makes you believe that?We may soon see downgrade by major institutions, like GS or MS. Then see you at 180

brian45011

Active Member

Interesting info! Where did you get that from? Edit : just to clarify, my question was about how we know he borrowed for the full amount. The source that he invested in the bonds is of course well known.

The proxies in April show Elon had pledged 4 million of his SCTY shares and 9.4 million of his TSLA shares.

The S-4 shows those have increased to 6.7 million and 11.6 million, respectively.

The proxy in May did not disclose pledged shares but stated his borrowings from MSSB increased by $36.5 million to $299 million, and he owed $187 million to a new, unidentified creditor, but he had repaid all borrowings to GS Bank.

I would expect that after the upcoming long holiday weekend, mention of the SpaceX “anomaly”, Tesla “cash burn” and SolarCity concerns will have receded from their recent contemporaneous appearances in the media. That would likely halt the fear inspired pressure that has recently been depressing the Tesla share price and allow for a significant rally.

Most of us know this, but it's great to see an article shining light on this subject.

Clean Energy Jobs Are Exploding in America. Why Don’t Mainstream Reporters Know?

Clean Energy Jobs Are Exploding in America. Why Don’t Mainstream Reporters Know?

Last edited:

In my opinion all this downward trajectory is a result of the SolarCity proposal. Paying $2.6 billion for a loss-making company that is $3.4 billion in debt is a bridge too far for much of the market... no matter the benefits.

rallykeeper

Member

Not sure about your analysis, but your conclusion is basically right (depending).

A couple quick conclusions relevant to our prior short squeeze theories and any SCTY/TSLA arbitrage strategies (I'm rounding for ease).

- Only 44 million non-Elon shares need to be cast to achieve quorum; if that's all that's cast, merger passes with just 23 million yes votes.

- Institutions hold about 100 million shares. If they are the entire lending base of the shorts, they still hold about 74 million unlent shares.

- If institutions vote all their unlent shares (and all other shares are voted no), merger passes if 60 million institutional shares are voted yes. Required institutional vote goes down one-for-one with every yes retail vote and every retail non-vote. (fwiw, I'm a yes vote so I know it's going down a little. .)

.)

If you are an institution in favor of the merger (or opposed), it would be in your interest to recall your shares because your vote may prove critical -- particularly if you believe that there may be more than 14 million institutional no votes). That being said, if none of the shares are successfully recalled, the merger can still pass with a supermajority of unlent institutional shares.

- Musk is voting his 21 million SCTY shares in in favor of the merger. He has to under the terms of the SCTY/Musk Voting Agreement.

- That means that SCTY quorum will be reached if only ~30 million more shares vote at all in the meeting.

- SCTY merger is approved if a majority of those ~30 million (i.e., 15+ million) vote in favor.

- If more shares are voted than those 30 million, then the required vote increases accordingly.

A couple quick conclusions relevant to our prior short squeeze theories and any SCTY/TSLA arbitrage strategies (I'm rounding for ease).

- Only 44 million non-Elon shares need to be cast to achieve quorum; if that's all that's cast, merger passes with just 23 million yes votes.

- Institutions hold about 100 million shares. If they are the entire lending base of the shorts, they still hold about 74 million unlent shares.

- If institutions vote all their unlent shares (and all other shares are voted no), merger passes if 60 million institutional shares are voted yes. Required institutional vote goes down one-for-one with every yes retail vote and every retail non-vote. (fwiw, I'm a yes vote so I know it's going down a little.

If you are an institution in favor of the merger (or opposed), it would be in your interest to recall your shares because your vote may prove critical -- particularly if you believe that there may be more than 14 million institutional no votes). That being said, if none of the shares are successfully recalled, the merger can still pass with a supermajority of unlent institutional shares.

That might be worth checking SCTY's forms. If he is voting his roughly 20M SCTY shares, then if my math is right there's about 60M float, 20M short, and Musk's shares would be guaranteed to vote for the merger so they'd only need about 11M more yes votes.

TSLA_Hopeful

Member

In my opinion all this downward trajectory is a result of the SolarCity proposal. Paying $2.6 billion for a loss-making company that is $3.4 billion in debt is a bridge too far for much of the market... no matter the benefits.

I've been a long for years but it is absolutely ridiculous to pay that much. Let's think of the other alternatives:

1) Buy another solar company (Vivint trades far lower than SCTY)

2) Let it go bankrupt and buy it from bankruptcy (Much cheaper and you get rid of ALL debt)

3) Sign a partnership with SCTY

Elon Musk is clearly using Tesla to bail out Solar City, as ANY of those alternatives would be better for Tesla and still allow Solarcity to enjoy the synergistic benefits.

you may need to be circumspect with commentz. at least one of the above, sems to monitor these pagez. (apoligiez az my keybord sometimez goes crazzy) i have seen the montanna gy tell me to 'stop zlandering', seen the phraze elsewhere on ZA of 'actionable zlander'Some are mad for genuine reasons, those whose jobs are in jeopardy in the ICE, dealership, or oil&gas industries. Many are paid full time bloggers especially on Seeking Alpha, thanks to the generous contributions from the likes of Koch brothers. For example, the sewer septic guy from Montana, the Illogical Thoughts guy, Wonton Walnut guy, the crap Marley lady, etc.,.

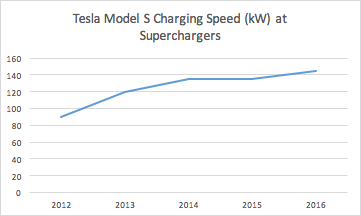

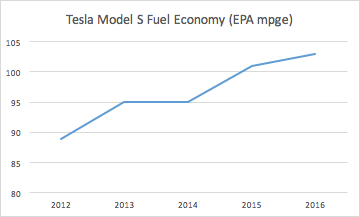

I made some charts of Tesla's progress since the launch of the Model S for a seeking alpha article (which got rejected) but don't want all the effort wasted so I'll share here:

It would be interesting to see the article anyway somehow as I pretty much only read Randy C's articles there due to heat and light and no dislike button(s).

perhaps if you had titled your article "tesla killer something something and thrown in some specious verbage and then said 'unless the following......(and guaranteed 1,000+ clicks for the advertisers)

Last edited:

I wonder why he needs to borrow. From what I understand, he lives relatively modestly, so personal expenses couldn't be the reason.The proxies in April show Elon had pledged 4 million of his SCTY shares and 9.4 million of his TSLA shares.

The S-4 shows those have increased to 6.7 million and 11.6 million, respectively.

The proxy in May did not disclose pledged shares but stated his borrowings from MSSB increased by $36.5 million to $299 million, and he owed $187 million to a new, unidentified creditor, but he had repaid all borrowings to GS Bank.

Musk is voting his 21 million SCTY shares in in favor of the merger. He has to under the terms of the SCTY/Musk Voting Agreement.

Thank you for that, rallykeeper. I did not notice that. Here is the relevant section of the S-4.

From the draft Tesla S-4 said:On July 31, 2016, concurrently with the execution of the Merger Agreement, SolarCity entered into a voting and support agreement (the “Voting Agreement”) with Mr. Elon Musk, solely in his capacity as a holder of SolarCity Common Stock and not in any other capacity, and the Elon Musk Revocable Trust dated July 22, 2003 (collectively, the “EM Stockholders”), pursuant to which, among other things:

• the EM Stockholders agreed that they will vote their shares of SolarCity Common Stock in favor of the adoption and approval of the Merger Agreement and the transactions contemplated by the Merger Agreement, unless the SolarCity Board withdraws its recommendation with respect to the Merger Agreement and the Merger in accordance with the terms of the Merger Agreement; and

• in the event that SolarCity terminates the Merger Agreement in order to enter into a binding agreement with respect to an alternative proposal for the acquisition of SolarCity in accordance with the terms of the Merger Agreement, the EM Stockholders agreed that they would vote their shares of SolarCity Common Stock in favor of, or tender their shares of SolarCity Common Stock with respect to, that alternative proposal, as applicable, in the same proportion as all other shares of SolarCity Common Stock are voted in favor of, or tendered with respect to, that alternative proposal.

In addition, the EM Stockholders agreed that in the event they transfer shares of SolarCity Common Stock (other than by way of charitable gifts or donations) and do not retain voting power over such shares but either (i) remain a beneficial owner of such shares or (ii) retain the economic benefits of such shares, the transferee must agree in writing to the terms of the Voting Agreement by executing and delivering a joinder agreement.

The Voting Agreement automatically terminates upon the earliest of: (i) with respect to the EM Stockholders’ obligations in respect of the Merger Agreement and the Merger, (A) the effective time of the Merger, (B) the termination of the Merger Agreement in accordance with its terms and (C) the written agreement of the EM Stockholders and SolarCity to terminate the Voting Agreement; and (ii) with respect to the EM Stockholders’ obligations in respect of an alternative proposal for the acquisition of SolarCity, (A) the effective time of any Merger or other transaction of SolarCity provided for in the binding agreement that provides for that alternative proposal, or (B) the termination of the binding agreement that provides for that alternative proposal in accordance with its terms.

The foregoing description of the Voting Agreement is qualified in its entirety by the full text of the Voting Agreement, which is attached to this joint proxy statement/prospectus as Annex B and is incorporated by reference into this joint proxy statement/prospectus.

I like Papa and most everybody on here. I respect their views and their contribution is leagues above mine. But yes, the infatuation with short sellers is over the top. Lets hold Musk and company accountable, not short sellers.

In previous months we've seen TSLA weather some pretty significant negative news, such as the 2Q ER. TSLA somehow managed to climb after the 2Q ER, presumably on the guidance that Model 3 and gigafactory are on time and because the 2nd half of 2016 holds the potential to turn out 50,000 Model S and X vehicles. Those positives are balanced by concerns about the negative effect of the proposed SCTY merger on cash flow and dilution. All of these are important topics to discuss and ponder, and none are swept under the rug by myself, nor do I claim that short-selling is the sole cause. That would be silly.

My point in discussing the unexpected arrival of great quantities of new shares to short is that it broke the balance. Tesla is a stock that makes large moves up and down. When it is moving up, shorts are buying in to cover, and when it is dropping, shorts are selling to increase their positions (provided new shares to short are available). We end up with a situation that once a movement starts in one direction, up or down, it tends to continue running in this direction until it hits some type of barrier. In most stocks, the barrier is the generally-accepted value of the stock, defined by PE ratio and other numbers, but such clear value guidance is lacking in a growth stock such as TSLA. Just as one of the barriers that prevented a slide of TSLA SP downward was in jeopardy of being breached (the 220 support level), another barrier was removed (when large quantities of new shares to short arrived). This removal of two barriers simultaneously allowed the negative news of the week to have an exaggerated effect upon the movement of the stock.

In the future I will be more inclusive in my posts to mention the underlying positive or negative news that may be pulling TSLA up or down, but the discussion of short-selling needs to be covered as well, because the 20 point loss you see before you is the result of some negative news that would not normally have resulted in such a big loss. Once the large quantities of new shares to short arrived, the breaching of the 220 support level was all but assured, and the availability of these new shares to short greatly magnified the drop we saw. Careful investors need to understand not just the positive and negative news, but also the underlying dynamics that either mute the response to the news or exaggerate it.

3Victoria

Active Member

I do not see why there is this sudden nashing of the teeth. Nothing has changed in the SC deal. The debts seem to be ovet emphasized, but not the ongoing income from the installs. Certainly there has been more stirring of the pot lately. I await Tuesday's developments.

MitchJi

Trying to learn kindness, patience & forgiveness

Qouted from the Elon Musk biography written by Ashlee Vance:

Expecting something different is somewhere between daft and batshit crazy.

If you freak out every time Elon does something that has long-term potential but hurts the SP in the short-term (accelerated M3 ramp, SCTY acquisition etc.), you are invested, or trading in the wrong company. That's the case for investing in Tesla.“The Supercharger stations, as Tesla called them, represented a huge investment for the strapped company. An argument could easily be made that spending money on this sort of thing at such a precarious moment in the Model S and Tesla’s history was somewhere between daft and batshit crazy. Surely Musk did not have the gall try to revamp the very idea of the automobile and build an energy network at the same time with a budget equivalent to what Ford and Exxon Mobil spent on their annual holiday parties. But that was the exact plan.”

Expecting something different is somewhere between daft and batshit crazy.

aznt1217

Active Member

I've been a long for years but it is absolutely ridiculous to pay that much. Let's think of the other alternatives:

1) Buy another solar company (Vivint trades far lower than SCTY)

2) Let it go bankrupt and buy it from bankruptcy (Much cheaper and you get rid of ALL debt)

3) Sign a partnership with SCTY

Elon Musk is clearly using Tesla to bail out Solar City, as ANY of those alternatives would be better for Tesla and still allow Solarcity to enjoy the synergistic benefits.

The PV of the contracts that SCTY has with customers is the price of the buyout alone. I am a broken record but this is all going to come together quite nicely.

1. Top most (if not most) efficient Panel on the market right now

2. Vivint doesn't have Silevo's tech nor does it have the factory to build the panels. Vivint is a mere installer. They do not own the entire process

3. It's a cost effective move as the Gigafactory will need to be outfitted with panels. Why buy them, if you can make them "yourself" in your own Gigafactory on the East Coast (this last point, I want whoever is reading to think about hard).

4. By combining you cut your costs (largest thing killing SCTY is sales operations & conversion costs). Instead, consolidate the man-power (for sales and sales conversion) and also get more incremental sales by selling the Tesla eco-system.

5. Consolidating and bringing in more foot traffic of households with higher disposable income.

I hate how people are branding this as a "bail-out" strictly based on current cash position without looking at assets and what the cash is being used for.

stealthology

Member

FWIW: hearing a trader colleague say he had a seller that wanted to leave early for the long weekend, and was way more aggressive than he would have been. He thinks we'll rally back up a bit today.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 2

- Views

- 1K

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K