Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

FredTMC

Model S VIN #4925

Here's what I got so far.

Analyst PTs:

Baird/ Ben Kallo. 300 to 338 Up

RBC 180 to 252 Up

Deutsche Bank 280 to 290 Up

Goldman Sachs 245 to 250 Up

Morgan Stanley 335 to 335. Unchanged

Analyst PTs:

Baird/ Ben Kallo. 300 to 338 Up

RBC 180 to 252 Up

Deutsche Bank 280 to 290 Up

Goldman Sachs 245 to 250 Up

Morgan Stanley 335 to 335. Unchanged

So you're completely dismissing inevitable capital raise? I see the decline short term profit taking while new accelerated delivery promise has yet to be digested to yield buyers. I would not be surprised if it went all the way to $205 by end of this week.

As I see it a capital raise is indeed inevitable and a quite good thing. If new shares are issued, the incoming cash becomes the shared property of all shareholders. Dilution by itself is essentially neutral and not the negative that many fear. That received cash will be put to work to accelerate production capabilities to meet Model 3 demand. The benefits from hastening and expanding production should far exceed what fixed income investments are paying.

In recent minutes this longtime holder of Tesla shares did something he has never done before. He bought LEAP call options.

So you're completely dismissing inevitable capital raise? I see the decline short term profit taking while ....promise has yet to be digested to yield buyers.

What "yield buyers". Tesla had 350mm of crowd funding in Q1, they paid <1% on their last convertible cap raise, and pay no dividends

Two Tesla Production Chiefs to Leave Ahead of Model 3 Ramp-Up This is starting to make more sense.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

The way Elon talked about the July 1st date as both a date to be taken very seriously, yet a highly improbable date for actual production start makes me think that we as investors must take the 500k run rate exiting 2018 very seriously, yet as something that is highly unlikely to actually occur.

Over promise - under deliver. Yet beat the competition by a wide margin.

Over promise - under deliver. Yet beat the competition by a wide margin.

MitchJi

Trying to learn kindness, patience & forgiveness

I'm considering buying J17 or J18's pretty far OTM. Something like $300-$350's. It seems like a pretty safe bet that sometime between now and either the end of 2016 or the end of 2017 the SP should bounce enough to put those in the green.So short term the big question then becomes: aren't we all picking up pennies in front of a steam roller trying to trade this thing? It's one thing maybe to try to leverage yourself somewhat using a deep ITM LEAPS strategy but for me personally from now on I'm done wasting money trading that could have instead just gone toward steadily increasing my core holdings.

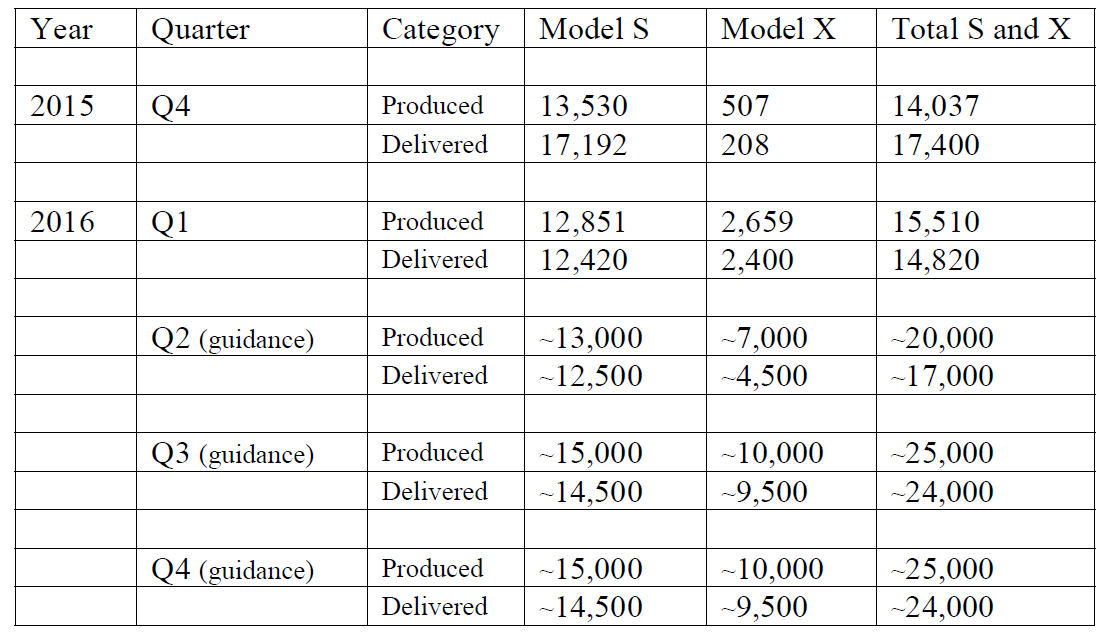

Put together a table summarizing production and delivery numbers from recent delivery notices and earnings letters. The Model S pipeline was cleaned out in Q4. That pipeline is likely being replenished in Q1, Q2, etc.

Looks like the big jump in deliveries will be in Q3, leading to a big jump in revenue and earnings. Earnings will be increased by increasing margins for Model X and will be decreased by increasing CAPEX for model 3. A capital raise may well be done in November, following the release of Q3 deliveries.

Isn't the stock market supposed to be six months ahead of events?

Looks like the big jump in deliveries will be in Q3, leading to a big jump in revenue and earnings. Earnings will be increased by increasing margins for Model X and will be decreased by increasing CAPEX for model 3. A capital raise may well be done in November, following the release of Q3 deliveries.

Isn't the stock market supposed to be six months ahead of events?

Attachments

Julian Cox

Banned

Thanks,

So, the Down-then-up (DTU) scenario is in play today (certainly the 'down' part anyway)

Few analysts have weighed in yet and certainly not the few influential ones (GS and MS).

I think we are witnessing the "get my clients in cheap" tactic. WeI've seen this before with TSLA.

Here's what analysts moves I've got so far:

TSLA analysts

PT Increases:

Baird/ Ben Kallo. 300 to 338

RBC 180 to 252

Deutsche Bank 280 to 290

BEARS:

Standpoint reiterates 180-180

PacificCrest/Brad Erickson. ?

Thesis update

Look. I am sorry that I am very rude and insensitive, and goodness knows nobody likes a know it all. Yet the fact remains that I continue to call this stock on-point without fail where making money or not losing money by being right with clarity in advance can perhaps stand against a multitude of social skill shortcomings in an investment forum?

The current stock movement is not irrational. Tesla in the cold light of day has committed a strategic error with respect to the stock market and in respect to any classic model of fundraising. My first instinct is to question why they could not wait to lay a strong quarter and a strengthened business plan on the markets simultaneously because why on Earth do they need to do more right now than to plan their CapEx and OpEx for Model 3 and raise the actual cash later in the year on an ATH run.

The answer to that I think is that they need to have it in the bank to nail down supplier commitments and uncommitted suppliers at this stage would cause a delay on the critical path.

So they have a real problem, not an imaginary one.

Now I said that this was not irrational. Conversely the market response is classically rational. Yet rationality is not the bottom line. Spock is not the Captain of the Enterprise for a very good reason because it is entirely possible to be 100% logical and 100% wrong - as in good or bad - right and wrong - kind of wrong. People respond much more powerfully to right and wrong than they do to logic including sufficient people in the viscosity of Tesla that command an awful lot of money. Like Fidelity, like Draper Fischer Juvetson, like Y-Combinator and Sequoia Capital, like Musk himself and not just a few of his friends - like Larry Page that he just credited for turning him on to Bioweapon defense mode in Tesla vehicles. Some of these people are so rich that making another $million is meaningless compared to doing something to be proud of.

So I would predict that Tesla will escape from its presumed capital trap with some huge amount of stunningly cheap bond financing that nobody else could possibly raise under the circumstances.

While the opportunity seems to exist for bad actors to leverage Tesla with miserable financing terms, the simple truth remains that not all actors are bad and for good actors of wealth that would be only to glad to bury bad actors of wealth: There is an absolute killing to be made in return for the leap of faith involved in giving Musk a few $Billion right now. Given the choice of trying to screw Musk over and letting Musk make you much richer Option B is actually much better and un calculated by the TSLA Bears, Musk is entirely free to simply ignore the Option A crowd because he has other options.

Then TSLA will go up, maybe it even hits the $400 before the end of 2016 after all.

As for an entry. Unlike the GF unveil trigger for a Q3 Squeeze there will be little or no pre-announced date for this raise. One day you will look at the stock at up it went $30 because the Street found out first. Here at $214 is as good a place as any. Thursdays are good days for fundraisers - no better idea or way of finding out. All that can probably be said is that it will happen in May and the longer they wait while people speculate on Tesla's doom the worse it will get so now would be good.

JC

Last edited:

You forget one important signal.Here's what I got so far.

Analyst PTs:

Baird/ Ben Kallo. 300 to 338 Up

RBC 180 to 252 Up

Deutsche Bank 280 to 290 Up

Goldman Sachs 245 to 250 Up

Morgan Stanley 335 to 335. Unchanged

In an unique way Andrea James gave us a very bullish perspective on TSLA.

Being an analyst didn't allow her to invest in the stocks she followed.

For reasons unknown to us, she chose exactly this ER date to switch to another career that does allow her to invest in TSLA.

Here's what I got so far.

Analyst PTs:

Baird/ Ben Kallo. 300 to 338 Up

RBC 180 to 252 Up

Deutsche Bank 280 to 290 Up

Goldman Sachs 245 to 250 Up

Morgan Stanley 335 to 335. Unchanged

Can you provide their 2018 production estimates or just focus on the positives?

Perfectlogic

Member

I'm pretty much with wallaby on this one. Personally I like that Tesla moved the 500k goal 2 years forward, and I think the reservations proves the demand is there. But in the medium term the new strategy will give the bears a lot to work with, they are all about the cash burn which will go up even further over the coming 18 months. Tesla will probably need at least an additional $2-3B, which on top of fueling the bears will increase the float (downwards pressure on the stock, just like a short attack increases the float).

I think there is at least a 50% chance that we see $150 again before we see the first Model 3. I hope it will happen, I don't own any shares at the moment but I will definately be ready at the $120-150 level. Tesla really is the swingtraders dream.

I think there is at least a 50% chance that we see $150 again before we see the first Model 3. I hope it will happen, I don't own any shares at the moment but I will definately be ready at the $120-150 level. Tesla really is the swingtraders dream.

schonelucht

Well-Known Member

Give the ER, the stock price action today is totally understandable. Short's thesis that cash flow positive was a pipe dream got confirmed (in a big way) while longs are once again on the defense. Elon just asked them to trade in one broken promise in exchange for a different one to be fulfilled 18 months down the line. Not a problem for the true believers but those with reservations are getting of the ride.

FredTMC

Model S VIN #4925

Can you provide their 2018 production estimates or just focus on the positives?

Haven't spent the time. That said:

MS production est was unchanged at ~108k cars in 2018

DB was 335k cars in 2018

That's all I got.

lango

Member

I'm pretty much with wallaby on this one. Personally I like that Tesla moved the 500k goal 2 years forward, and I think the reservations proves the demand is there. But in the medium term the new strategy will give the bears a lot to work with, they are all about the cash burn which will go up even further over the coming 18 months. Tesla will probably need at least an additional $2-3B, which on top of fueling the bears will increase the float (downwards pressure on the stock, just like a short attack increases the float).

I think there is at least a 50% chance that we see $150 again before we see the first Model 3. I hope it will happen, I don't own any shares at the moment but I will definately be ready at the $120-150 level. Tesla really is the swingtraders dream.

It is very hard to say how much additional capital they need. Second half of 2016 they are going to produce maybe 45k S+X at ASP 90k which gives about 4B revenue at a GM of 20% about 810M in "profit".

The Model 3 production ramp seems to be mostly about installing lines in Fremont and this is critical. I assume they have developed the manufacturing line in parallel with design and engineering of the car and I also assumes the lines are going to be run in parallel and not just one mega fast line. This probably means they need to tune and buy one line first, and then can rapidly order and install others? So maybe the CAPEX for 2016 is not going to be that high for this in 2016 as the other lines will be installed in 2017. First half of 2017 the S and X gross profit should be higher than second half 2016. There will most likely be no additional car factories or battery factories required.

FredTMC

Model S VIN #4925

Give the ER, the stock price action today is totally understandable. Short's thesis that cash flow positive was a pipe dream got confirmed (in a big way) while longs are once again on the defense. Elon just asked them to trade in one broken promise in exchange for a different one to be fulfilled 18 months down the line. Not a problem for the true believers but those with reservations are getting of the ride.

Not those with "model 3" reservations. Ha. They are very happy about getting "in" their ride sooner than expected.

This is just classic. MS (like others) is essentially refusing to even model TSLA using Tesla's own projections, and instead predicts it will grow at a small fraction (e.g., 25% or less) of the Company's own relatively near-term projections (2 years).

So even if Tesla completely muffs it and sells "only" 250,000 cars in 2018, it will be on track to double the projections. If Tesla hits the targets, it will quadruple those projections (or more). And investors don't have to sit around until 2020 waiting for this to play out. This is a tough week if you are long on a short-term trade, but for a long-term (or medium-term) investment, wow.

I mean, we are talking about mass producing a car, not sending a rocket to Mars or something crazy like that! : )

So even if Tesla completely muffs it and sells "only" 250,000 cars in 2018, it will be on track to double the projections. If Tesla hits the targets, it will quadruple those projections (or more). And investors don't have to sit around until 2020 waiting for this to play out. This is a tough week if you are long on a short-term trade, but for a long-term (or medium-term) investment, wow.

I mean, we are talking about mass producing a car, not sending a rocket to Mars or something crazy like that! : )

Adam Jonas also a non-believer:

While not impossible, we view 500k units of volume by 2018 as too high to model as a base case. We would even describe 500k units as above any bull case we would be prepared to model at this stage. Again, while we are not in a position to rule out the theoretical or even physical possibility of achieving such volume targets, we believe the motivation to express such an ambitious view is driven by very strong early interest in the Model 3 and a commitment to bring all critical pieces of the vehicle’s supply chain (both internal and outsourced) into a production-ready position as soon as possible. Given the very high capital commitments to such levels of volume, we believe Tesla management wish to make every effort to establish the most ambitious launch plan possible while allowing for the inevitable unknown hiccups that invariably occur with launches on such scale. Going further, Elon Musk expressed a view that as many as 1 million units of vehicle production could be achieved by 2020, a level that is more than 4x higher than our forecast of 248k units. On our current forecasts, we do not predict Tesla will achieve 500k units of volume before 2025 (7 years after their current target) and we do not reach 1 million units in our forecasts at any time before 2030.

Tesla could have waited one quarter to tell us this. The strange thing is to announce this without announcing the debt or equity offering. Now we are in a bit of a limbo. Everything else positive is currently discounted due to execution issues with the Model X. Hopefully that will clear up within a few weeks or a couple of months - if they aren't going to offer the debt/equity this quarter, they would be better served to hold off the public announcement until after a solid quarter of X deliveries.

In any case, the weak hands will be shaken out and we'll see where we are after the dust settles a bit. Hopefully solid Model X deliveries of flawless vehicles becomes the norm soon enough.

In any case, the weak hands will be shaken out and we'll see where we are after the dust settles a bit. Hopefully solid Model X deliveries of flawless vehicles becomes the norm soon enough.

Perfectlogic

Member

It is very hard to say how much additional capital they need. Second half of 2016 they are going to produce maybe 45k S+X at ASP 90k which gives about 4B revenue at a GM of 20% about 810M in "profit".

The Model 3 production ramp seems to be mostly about installing lines in Fremont and this is critical. I assume they have developed the manufacturing line in parallel with design and engineering of the car and I also assumes the lines are going to be run in parallel and not just one mega fast line. This probably means they need to tune and buy one line first, and then can rapidly order and install others? So maybe the CAPEX for 2016 is not going to be that high for this in 2016 as the other lines will be installed in 2017. First half of 2017 the S and X gross profit should be higher than second half 2016. There will most likely be no additional car factories or battery factories required.

The problem is that gross profit isn't net profit. Currently Tesla is burning nearly $300M/quarter and they just announced capex going up by 50%, which means something like $200M extra in cash burn per quarter. Even with the gross margin improving slightly every quarter for the S and X that cash flow won't be close to cover the capex anytime soon. This is pretty much a fact and accepted by nearly everyone (outside this forum at least).

FredTMC

Model S VIN #4925

It is very hard to say how much additional capital they need. Second half of 2016 they are going to produce maybe 45k S+X at ASP 90k which gives about 4B revenue at a GM of 20% about 810M in "profit".

The Model 3 production ramp seems to be mostly about installing lines in Fremont and this is critical. I assume they have developed the manufacturing line in parallel with design and engineering of the car and I also assumes the lines are going to be run in parallel and not just one mega fast line. This probably means they need to tune and buy one line first, and then can rapidly order and install others? So maybe the CAPEX for 2016 is not going to be that high for this in 2016 as the other lines will be installed in 2017. First half of 2017 the S and X gross profit should be higher than second half 2016. There will most likely be no additional car factories or battery factories required.

Thx. Couple thoughts:

CapEx plans: They said they'd go from $1.5B in 2016 to $2.25B. 50% increase

Cap Raise timing: No idea. I think soon. Month or so. Doesn't have to be huge round. Stages...

Production line: For now, I think they only need to ONE high rate human-assembly line for M3. I think this single line will be capable of >200k cars/year. (Disclaimer: I don't know anything about auto mfg, other than factory tour). Seems to me there are assembly lines in the world that do over 200k/year on a single line. Someone knowledgeable please weigh in.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 967

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K