Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

moe.salih

Member

Xpert

Member

Model 3 pics at san jose event...So beautiful.

Tesla Model 3 at Friends and Family Event • /r/teslamotors

Tesla Model 3 at Friends and Family Event • /r/teslamotors

dandurston

Member

I was actually just thinking the same thing, but a thin layer of asphalt is probably really cheap compared to what they're spending to speed up construction - probably considerably cuts down on the dust of all those cars coming and going throughout the day, and therefore cuts down on water truck use to keep dust down.I wonder why Tesla would pave that large parking area when the building is going to occupy that space in the next year or two, rather than paving the outer parking area which should be more permanent.

edit: also probably isn't hard to justify if you consider the amount of man hours spent walking between cars and the building, twice a day, for everyone commuting, over that timeframe.

I don't see why this is hard to understand. In Q3, Teslas suppliers gave Tesla an additional $628 million worth of car parts, that Tesla used to produce cars, then sold and collected $481 million* for (plus margin, labour, etc). Tesla has yet to pay these suppliers.

When you assume Tesla can continue to receive a cash flow of $460 million every quarter, you're assuming that the above is a viable business model that can be repeated every quarter. I think that going forward, Tesla should pay it's suppliers.

This doesn't sound right to me. For example... if I order $25 million dollar of parts in Q1, and due to 45 day payment terms, I leave $15 million in accounts payable. The next quarter, since I'm increase production by 50%, I order $37.5 million dollars of parts in Q2, and due to 45 day payment terms, I leave $22.5 million in accounts payable. In Q3, I am building another 50% increase in production, so I order $56.25 million in parts, and again, due to 45 day payment terms, I leave $33.75 million in accounts payable.

Sure, I could pay before the 45 day payment terms say I need to pay. I'm not stiffing these suppliers nor am I delaying their payments beyond the standard payment terms. As a function of my increased production, the amount of parts I'm ordering increases, and therefore the amount in accounts payable also increases.

Now in Q4, I'm increase production by 10% over Q3. So now I'm ordering $61.9 million in parts, and I leave $37 million in AP. The suppliers again get paid exactly by schedule. AP goes up as a function of the amount of parts being ordered for production. It would be a neat trick if Tesla could increase production by that much and not have a corresponding increase in AP. You can go back and see Tesla's AP as a function of automotive cost of revenues and the percentage in Q3 2016 doesn't seem outsized at all.

Of course, there's the actual variability that we can't actually see since we have only quarterly snapshots.

To frame it better for Tesla specifically, accounts payable went up $491 million from Q2 to Q3. Receivables went up $148 million, so the net effect is $343 million. The total automotive cost of revenues went from $909 million to $1,517 million, or up $608 million. Overall inventory levels remained relatively flat, with a decrease in raw materials but an increase in work in progress and finished goods. Subtracting out service parts, the rest of the inventory decreased by $6 million. So the net effect of $343 million more in payables has to framed by the increase in the cost of revenues of $608 million. It doesn't look like to me that they are delaying payment any more than would be expected by increasing production by this much.

What was the music for the G factory video? I cranked up my headphones and it sounded like I was a giant flying around to have a look at the factory. Real cowboy movie music. John Wayne on steroids, yada, yada.

It was giga music, ponderous as hell!

It was giga music, ponderous as hell!

racer26

Active Member

For those that didn't notice: Steering wheel in the pics linked here is different than the reveal event.Model 3 pics at san jose event...So beautiful.

Tesla Model 3 at Friends and Family Event • /r/teslamotors

Unclear if this is the same car we've seen before with a new steering wheel, or if this is a beta prototype, or what.

dennis

Model S Plaid

If she survived working for Jobs maybe she has a fighting chance at surviving under Elon.Sarah O'Brien as Senior Director of Communications! Many of us can attest to that as a position much in need of being filled.

Link: https://www.linkedin.com/in/saraho4

Do we have an estimates about how hard it is to update a 18650 line to 2170? @techmaven?

What percentage of equipment on the line can be modified vs needing to be replaced entirely?

Bump. Anybody have any guesses on this?

There seems to be a lot of talk of Model S/X generating cash for Model 3 cap ex. Not sure about that.

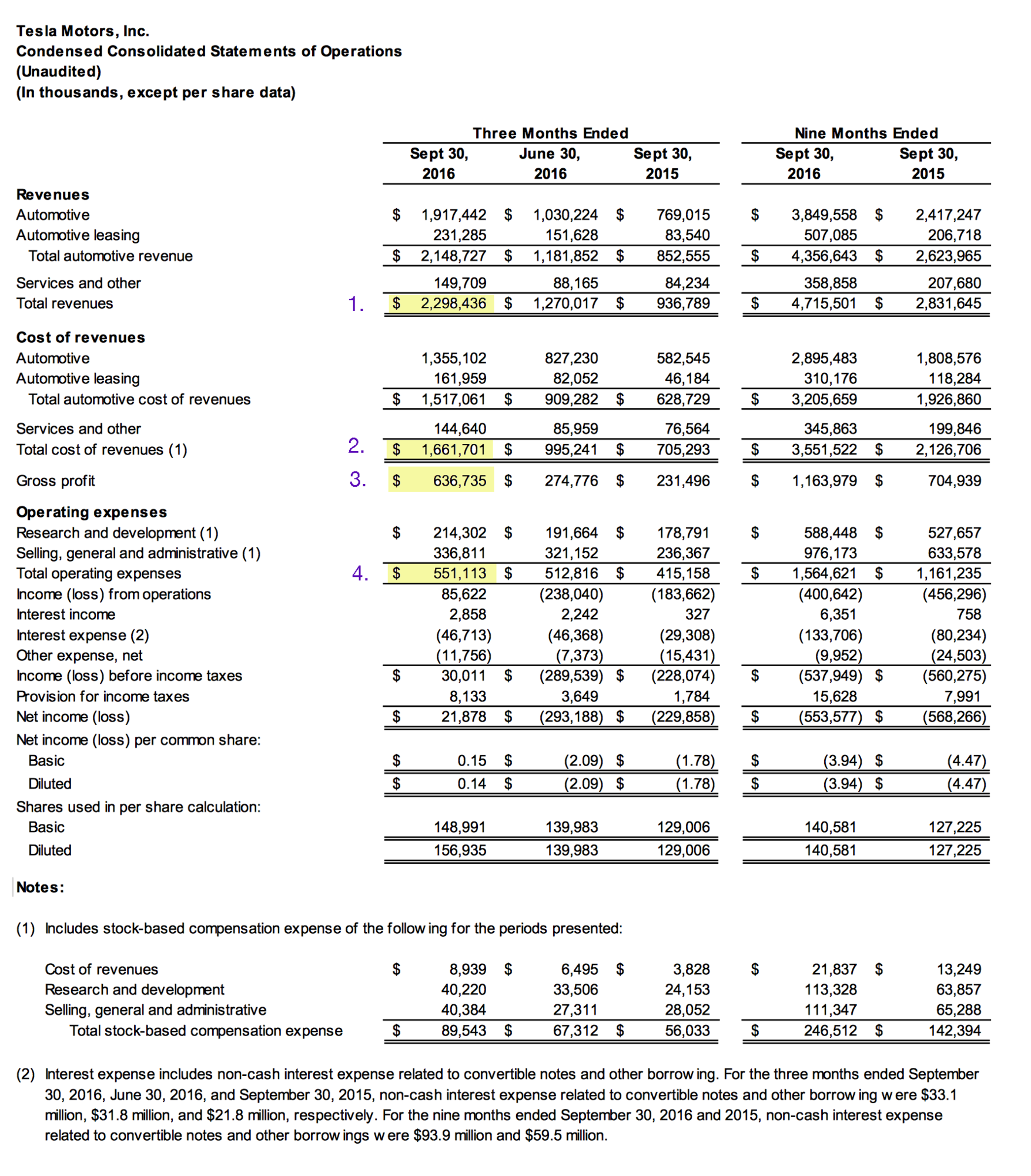

Here's what I'm seeing from the Q3 profit/loss statement.

1. $2.3 billion in revenue

2. $1.66 billion in cost of revenue

3. That leaves $636 million in gross profit

However, Q3 included $138 million in ZEV credit sales. So, assuming that following quarters won't have those ZEV credits (note: they might have some, but for argument sake let's ignore ZEV credits). Then, gross profit would be roughly $500 million.

Recap: $2.3 billion in revenue, gross profit $500 million.

4. $551 million in operating expenses (including R&D, and SG&A). (note: this includes stock-based compensation. we could exclude this and that would allow greater net profit, but stock-based compensation is not free as it dilutes stock and should be considered as expense. So, for argument's sake, let's leave the stock-based compensation expenses as part of operating expense).

So, you take gross profit of $500 million and minus $551 million in operating expenses, and you've got a loss of $51 million. And this is before interest expense, which last quarter was $46 million. If you include that, then it would be a $100 million loss.

Now these figures are for last quarter when they sold almost $25k vehicles.

If you assume in the next few quarters that they will sell roughly 25k vehicles per quarter, then I don't understand why some people here are saying that Model S/X will provide $1 billion+ in net profit over next few quarters. If you mean gross profit (before operating expenses), then sure, but that just keeps the company afloat and pays for R&D and SG&A but does not pay for any Model 3 cap ex, like equipment/tooling, GF, etc.

Now, if you're thinking Model S/X sales will increase substantially over the next few quarters, then maybe you have an argument but I'm not seeing how S/X will contribute to Model 3 cap ex. I can see S/X sales cover Tesla's R&D and SG&A but I don't see it contributing to Model 3 cap ex, even if Tesla is selling 26k vehicles in Q4, 28k vehicles in Q1 2017, 30k vehicles in Q2 2017, since Tesla's R&D and SG&A expenses are going to be increasing every quarter as well.

We did see an unique situation of significant positive cash flow in Q3 but quarterly cash flow is based on many factors and can be quite volatile. I think it's best to look at their quarterly profit/loss statement and see if what their operations are contributing after all operating expenses. And in this case, we've see that S/X sales cover Tesla's operating expenses but not much more. On the other hand, Tesla's R&D expenses include expenses for R&D for Model 3 and other initiatives so a lot of it is future growth-based.

Now, I've left out Tesla Energy here because of two reasons. We don't have a lot of clarity on the revenue and margin projections Tesla has for TE in 2017. Second, the point I'm making here is to address folks that are claiming that S/X sales are going to fund Model 3 cap ex.

Here's what I'm seeing from the Q3 profit/loss statement.

1. $2.3 billion in revenue

2. $1.66 billion in cost of revenue

3. That leaves $636 million in gross profit

However, Q3 included $138 million in ZEV credit sales. So, assuming that following quarters won't have those ZEV credits (note: they might have some, but for argument sake let's ignore ZEV credits). Then, gross profit would be roughly $500 million.

Recap: $2.3 billion in revenue, gross profit $500 million.

4. $551 million in operating expenses (including R&D, and SG&A). (note: this includes stock-based compensation. we could exclude this and that would allow greater net profit, but stock-based compensation is not free as it dilutes stock and should be considered as expense. So, for argument's sake, let's leave the stock-based compensation expenses as part of operating expense).

So, you take gross profit of $500 million and minus $551 million in operating expenses, and you've got a loss of $51 million. And this is before interest expense, which last quarter was $46 million. If you include that, then it would be a $100 million loss.

Now these figures are for last quarter when they sold almost $25k vehicles.

If you assume in the next few quarters that they will sell roughly 25k vehicles per quarter, then I don't understand why some people here are saying that Model S/X will provide $1 billion+ in net profit over next few quarters. If you mean gross profit (before operating expenses), then sure, but that just keeps the company afloat and pays for R&D and SG&A but does not pay for any Model 3 cap ex, like equipment/tooling, GF, etc.

Now, if you're thinking Model S/X sales will increase substantially over the next few quarters, then maybe you have an argument but I'm not seeing how S/X will contribute to Model 3 cap ex. I can see S/X sales cover Tesla's R&D and SG&A but I don't see it contributing to Model 3 cap ex, even if Tesla is selling 26k vehicles in Q4, 28k vehicles in Q1 2017, 30k vehicles in Q2 2017, since Tesla's R&D and SG&A expenses are going to be increasing every quarter as well.

We did see an unique situation of significant positive cash flow in Q3 but quarterly cash flow is based on many factors and can be quite volatile. I think it's best to look at their quarterly profit/loss statement and see if what their operations are contributing after all operating expenses. And in this case, we've see that S/X sales cover Tesla's operating expenses but not much more. On the other hand, Tesla's R&D expenses include expenses for R&D for Model 3 and other initiatives so a lot of it is future growth-based.

Now, I've left out Tesla Energy here because of two reasons. We don't have a lot of clarity on the revenue and margin projections Tesla has for TE in 2017. Second, the point I'm making here is to address folks that are claiming that S/X sales are going to fund Model 3 cap ex.

For those that didn't notice: Steering wheel in the pics linked here is different than the reveal event.

Unclear if this is the same car we've seen before with a new steering wheel, or if this is a beta prototype, or what.

Well, some things I didn't notice was a single item that one could think was a remote sensor - camera, radar, nada, other than the very standard lens near the rear license. Not even on the front mirror stalk or its fore-pad(¿term?). And what did others make of the lower outer seal of the rear window in pic #18? I couldn't figure out what the two-tone or two-texture seal there could signify.

Tesla held a party tonight for employees and friends/family of employees. Seems like it was to celebrate Q3.

Pics from Instagram:

Avaya Stadium • Instagram photos and videos

Video: Elon congratulating employees

https://www.instagram.com/p/BMdGVu9hELA

Video: Elon promising parties will get better as Tesla does better financially

Instagram video by Aleksandar Vukasinovic • Nov 6, 2016 at 2:22am UTC

Good to see Tesla doing this for their employees!

Pics from Instagram:

Avaya Stadium • Instagram photos and videos

Video: Elon congratulating employees

https://www.instagram.com/p/BMdGVu9hELA

Video: Elon promising parties will get better as Tesla does better financially

Instagram video by Aleksandar Vukasinovic • Nov 6, 2016 at 2:22am UTC

Good to see Tesla doing this for their employees!

I'm in the camp of 1M reservation before the first delivery.

But I think that most of us are underestimating the impact of the off-the-hook demand that will occur once the car starts to ship.

I'm in the camp of 1M reservation before the first delivery.

Time for another prediction thread?

everman

Member

I guess I'm the materialistic weasel of the group, but I posted that mainly because of the potential impact on the SP, not because of concerns about M3 funding.

But it seems like you're overlooking the impact of TE on Tesla's income.

Agreed! Incoming future TE revenues as well! My point was that they do indeed seem to be set up for multiple quarters of profitability. A sequential quarterly profit will end up being the real pie in the face...

Damn! I bet Tesla is prepping PR about the 2017 Model S that loses the headphone jack...

ajax

Member

Model 3 pics at san jose event...So beautiful.

Tesla Model 3 at Friends and Family Event • /r/teslamotors

I think this is the first time we've seen the Model 3 with Model X style tinting on the rear window.

There seems to be a lot of talk of Model S/X generating cash for Model 3 cap ex. Not sure about that.

Here's what I'm seeing from the Q3 profit/loss statement.

1. $2.3 billion in revenue

2. $1.66 billion in cost of revenue

3. That leaves $636 million in gross profit

However, Q3 included $138 million in ZEV credit sales. So, assuming that following quarters won't have those ZEV credits (note: they might have some, but for argument sake let's ignore ZEV credits). Then, gross profit would be roughly $500 million.

Recap: $2.3 billion in revenue, gross profit $500 million.

4. $551 million in operating expenses (including R&D, and SG&A). (note: this includes stock-based compensation. we could exclude this and that would allow greater net profit, but stock-based compensation is not free as it dilutes stock and should be considered as expense. So, for argument's sake, let's leave the stock-based compensation expenses as part of operating expense).

So, you take gross profit of $500 million and minus $551 million in operating expenses, and you've got a loss of $51 million. And this is before interest expense, which last quarter was $46 million. If you include that, then it would be a $100 million loss.

Now these figures are for last quarter when they sold almost $25k vehicles.

So... I've been meaning to reconcile the cash generation with the balance sheet. I suspect it has something to do with direct leasing, specifically the deferred revenue and expiration of resale value guarantees.

So the $2.3 billion in GAAP revenues has $231 million in automotive leasing, and cost of revenues as $162 million in automotive leasing. There was an increase of $224 million in RVG vehicles, and $191 million in leased vehicles. The deferred revenue was increased by $57 million.

Their cash flows from operating activities was a positive $424 million dollars in Q3, $597 million if you include the change in collateralized lease borrowing.

I'm not quite sure how to reconcile all of this, but I'm pretty sure that the calculations you made above do not fully reflect how Tesla has to account for leasing and RVG vehicles as opposed to the actual cash flow from those vehicles. In other words, while they can't account for all (or even most) of the revenue and the expense of those vehicles in the quarter they are sold or leased, there is actual cash that comes in from them. Plus, the ending of most of the RVG also has an effect.

I'm hoping someone smarter than me can sort this out and explain it... I've tried several times to sort through the various leasing and RVG items and how they interleave. It's the biggest source of error for my models.

@DaveT, how do you look at the cash flow versus GAAP net profit given the leasing, RVG, and overall deferred revenue?

BTW, the Q3 10-Q seems to only have 9 month data for cash flows, but the shareholder's letter does have 3 month data. Not sure why that is.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 991

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K