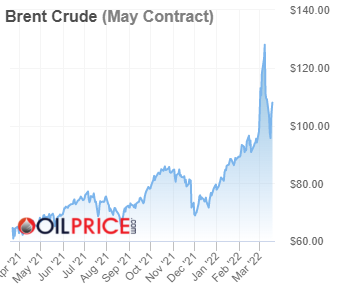

For christ's sake, the link was right in "she said", and it's straight from whitehouse.gov. How far in denial do you want to go?!?! As for the data, I don't have a convenient chart but I found the data off of macrotrends.net: Brent Crude Oil Prices - 10 Year Daily ChartAnecdote is not data. I provided data. Where's yours?

Transcript or video or it's just made up bull.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mspohr

Well-Known Member

What link?For christ's sake, the link was right in "she said", and it's straight from whitehouse.gov. How far in denial do you want to go?!?! As for the data, I don't have a convenient chart but I found the data off of macrotrends.net: Brent Crude Oil Prices - 10 Year Daily Chart

All I can find is your she said assertion with no link.

What link?

All I can find is your she said assertion with no link.

Go back to doggyworld's post that you had replied to stating that there was no link. And if you're too lazy, I've enlarged it for you:

Brent was consistently less than WTI for the vast majority of the time the export ban was in effect (1975-2010). Your chart shows the impact of fracking, which took off around 2010 and caused a surplus of light/sweet oil in the US. Especially in the TX/OK region (WTI is priced in Cushing, OK).

We could have repurposed our expensive, high complexity refineries to do the simple job of refining light, sweet oil, but that would be stupid. Furthermore, we import more than twice as much crude oil as we export (6m+ bpd vs. <3m bpd). The only reason we're close to neutral overall is we also export almost 3m bpd of NGLs (ethane, propane, etc.) and are a small net exporter of finished products.

Wrong transcript. On March 10 she said VZ was "the largest producer of oil in the world". As I said they're something like 25th. Some reporters gave her a WTF look so she quickly backpedaled to "one of them".

mspohr

Well-Known Member

If you read the transcript, you'll see that she immediately corrected her misstatement.Go back to doggyworld's post that you had replied to stating that there was no link. And if you're too lazy, I've enlarged it for you:

You're trying to make a mountain out of a molehill. It's irrelevant.

Is it time to move on to more relevant discussion?

TheTalkingMule

Distributed Energy Enthusiast

This is a fairly silly argument.

I don't know who this govt speaker was who said VZ was a top producer, but they almost certainly either meant VZ has "top reserves" or don't no much about it and were just poorly regurgitating the talking points they were prepped on.

Either way, debating an imports ban is silly. It would be way too disruptive geopolitically and not nearly worth the effort. Hell, we're down 27% in a week.....just figure out what did that and do more of it.

The supply/demand balance will NEVER AGAIN be anything near as crazy as the 70's, so stop trying to implement solutions to that very different problem.

I don't know who this govt speaker was who said VZ was a top producer, but they almost certainly either meant VZ has "top reserves" or don't no much about it and were just poorly regurgitating the talking points they were prepped on.

Either way, debating an imports ban is silly. It would be way too disruptive geopolitically and not nearly worth the effort. Hell, we're down 27% in a week.....just figure out what did that and do more of it.

The supply/demand balance will NEVER AGAIN be anything near as crazy as the 70's, so stop trying to implement solutions to that very different problem.

If you read the transcript, you'll see that she immediately corrected her misstatement.

You're trying to make a mountain out of a molehill. It's irrelevant.

Is it time to move on to more relevant discussion?

Does this mean you recant your accusation that it was "made up bull"?

Also that the brent vs. wti data does NOT (specifically from 1999-2004) support your claim? Which fundamentally brings all this back to the case that bringing back an oil export ban would NOT solve the chaotic gasoline prices for the sake of "the people"?

mspohr

Well-Known Member

I said video or transcript or it's made up bull... Transcript verifies that it's made up bull.Does this mean you recant your accusation that it was "made up bull"?

The chart I posted starts in 2010. Where is the data from earlier?Also that the brent vs. wti data does NOT (specifically from 1999-2004) support your claim? Which fundamentally brings all this back to the case that bringing back an oil export ban would NOT solve the chaotic gasoline prices for the sake of "the people"?

Export ban ensures US price doesn't exceed global price.

I said video or transcript or it's made up bull... Transcript verifies that it's made up bull.

The chart I posted starts in 2010. Where is the data from earlier?

Export ban ensures US price doesn't exceed global price.

transcript verified that she said it. Didn't matter if she read the teleprompter wrong or misspoke.

As for the data.

then click the plus sign near the top of the chart and add "brent", then click "25y" near the bottom of the chart to see the data going back to before 2000, when the export ban was still in effect. From there, you'll see the blue line (WTI) being slightly above brent for most of the decade before 2010.

... here ya go:

Last edited:

mspohr

Well-Known Member

Look the same to me. Disproves your assertion that banning exports increases prices.transcript verified that she said it. Didn't matter if she read the teleprompter wrong or misspoke.

As for the data.OMG, you are beyond lazy! Here, just for your highness's pleasure. Go here: Crude oil - 2022 Data - 1983-2021 Historical - 2023 Forecast - Price - Quote - Chart

then click the plus sign near the top of the chart and add "brent", then click "25y" near the bottom of the chart to see the data going back to before 2000, when the export ban was still in effect. From there, you'll see the blue line (WTI) being slightly above brent for most of the decade before 2010.

... here ya go:

View attachment 781887

Look the same to me. Disproves your assertion that banning exports increases prices.

Yes I wrote that initially (in response to your claim of "One "simple" measure to control production and prices would be to reinstate the law prohibiting export of oil and gas."), but I also added that it would increase to whatever the market would bear, which was determined by global oil prices.

The data clearly shows that WTI essentially tracked brent all the way through 2010 while an export ban was in place, regardless of what it cost the US producers to extract the oil.

TheTalkingMule

Distributed Energy Enthusiast

IEA claims "supplies will be tightening" based on absolutely nothing.....Brent pops 8%. Easy peasy!

I guess there's a chance 3mb/d of Russian oil never gets to the market, but I highly highly highly doubt it.

OXY up a whopping 9% today to within 40% of ATH. This'll be like shooting monkeys in a barrel 9-24 months from now.

I guess there's a chance 3mb/d of Russian oil never gets to the market, but I highly highly highly doubt it.

OXY up a whopping 9% today to within 40% of ATH. This'll be like shooting monkeys in a barrel 9-24 months from now.

mspohr

Well-Known Member

Great masses of money gets stuff done

capitalandmain.com

capitalandmain.com

Between 2018 and 2021, lobbying organizations representing oil and gas companies spent almost $77.5 million advocating for the industry’s interests in Sacramento. That’s approximately 400% more than environmental advocacy groups, which spent roughly $15 million over that same period. And it’s 560% more than the renewable energy sector, which spent $11.6 million. (All these figures and the other lobbying figures in this report are based on data from the California secretary of state’s office.)

Oil and Gas Industry Heavily Outspends Clean Energy and Environmental Groups on Lobbying in California

Over the past four years, fossil fuel companies paid almost $77.5 million to lobby lawmakers in Sacramento.

Between 2018 and 2021, lobbying organizations representing oil and gas companies spent almost $77.5 million advocating for the industry’s interests in Sacramento. That’s approximately 400% more than environmental advocacy groups, which spent roughly $15 million over that same period. And it’s 560% more than the renewable energy sector, which spent $11.6 million. (All these figures and the other lobbying figures in this report are based on data from the California secretary of state’s office.)

mspohr

Well-Known Member

Nations Should Conserve Fuel as Global Energy Crisis Looms, Agency Warns

The International Energy Agency said countries should encourage use of mass transit and car pooling, among other things. That could also help the climate crisis.

The International Energy Agency, which was formed in the wake of the 1973 oil crisis to ensure a stable worldwide energy market, said that the repercussions of Russia’s invasion of Ukraine were likely to intensify over the next several months as summer driving season got underway with inventories at historic lows. “Reducing demand is a way of addressing the situation without just pumping more oil,” said Fatih Birol, the agency’s executive director. It’s a message that has largely been absent from the conversation in the United States, the world’s largest oil producer, where fossil fuel companies are earning healthy profits and the response to elevated gasoline prices has been calls for more production.

ItsNotAboutTheMoney

Well-Known Member

Nations Should Conserve Fuel as Global Energy Crisis Looms, Agency Warns

The International Energy Agency said countries should encourage use of mass transit and car pooling, among other things. That could also help the climate crisis.www.nytimes.com

The International Energy Agency, which was formed in the wake of the 1973 oil crisis to ensure a stable worldwide energy market, said that the repercussions of Russia’s invasion of Ukraine were likely to intensify over the next several months as summer driving season got underway with inventories at historic lows. “Reducing demand is a way of addressing the situation without just pumping more oil,” said Fatih Birol, the agency’s executive director. It’s a message that has largely been absent from the conversation in the United States, the world’s largest oil producer, where fossil fuel companies are earning healthy profits and the response to elevated gasoline prices has been calls for more production.

I think countries are likely to be conserving fuel by virtue of people not having enough disposable income to go anywhere.

mspohr

Well-Known Member

Recession will definitely dampen demand.I think countries are likely to be conserving fuel by virtue of people not having enough disposable income to go anywhere.

mspohr

Well-Known Member

Here's another idea

Unless we act, escalating commodity prices will cause a decade of global turmoil | Rupert Russell

As these civil wars raged across a region populated by oil-exporting nations, commodity traders “priced in” a disruption to global oil production that never came. After a brief outage in Libya, the oil continued to flow. But the speculative oil bubble from 2011 to 2014 showered an awesome wave of black gold upon Hugo Chávez right before his re-election campaign, upon IS as their white Toyotas advanced through Iraq, and upon Vladimir Putin as he prepared for his first military incursion into Ukraine. Many of these petrodollars were also invested in western real estate, creating enormous wealth inequality, which, together with the refugee crisis, further fuelled the rise of rightwing populism across Europe and led a decisive swath of former Obama voters to pick Trump in 2016.

These doomsday scenarios are founded on one assumption: that market prices will be free to react to events, be they real or imagined. Wars are, by definition, times of extreme volatility. In such volatile times, policymakers have historically found it necessary to impose controls on prices until normality returns. The sooner politicians embrace this necessity, the sooner this engine of chaos can be dismantled. Each day of delay, the potential avalanche grows bigger. We must act to stop it now.

Unless we act, escalating commodity prices will cause a decade of global turmoil | Rupert Russell

As these civil wars raged across a region populated by oil-exporting nations, commodity traders “priced in” a disruption to global oil production that never came. After a brief outage in Libya, the oil continued to flow. But the speculative oil bubble from 2011 to 2014 showered an awesome wave of black gold upon Hugo Chávez right before his re-election campaign, upon IS as their white Toyotas advanced through Iraq, and upon Vladimir Putin as he prepared for his first military incursion into Ukraine. Many of these petrodollars were also invested in western real estate, creating enormous wealth inequality, which, together with the refugee crisis, further fuelled the rise of rightwing populism across Europe and led a decisive swath of former Obama voters to pick Trump in 2016.

These doomsday scenarios are founded on one assumption: that market prices will be free to react to events, be they real or imagined. Wars are, by definition, times of extreme volatility. In such volatile times, policymakers have historically found it necessary to impose controls on prices until normality returns. The sooner politicians embrace this necessity, the sooner this engine of chaos can be dismantled. Each day of delay, the potential avalanche grows bigger. We must act to stop it now.

TheTalkingMule

Distributed Energy Enthusiast

This thread isn't about climate change or politics, it's a thread about shorting oil as an investment.

Can we keep investment-based conversation here, move environmental conversation to the Environment/Energy forum, and leave politics off the site all together?

Can we keep investment-based conversation here, move environmental conversation to the Environment/Energy forum, and leave politics off the site all together?

TheTalkingMule

Distributed Energy Enthusiast

I was real surprised we didn't see more movement in Brent/WTI Friday when this story came out. This should kick off the next leg down for oil pricing and big oil equities.

Russia backs down on demands in Iran nuclear deal talks

www.cnbc.com

www.cnbc.com

Russia backs down on demands in Iran nuclear deal talks

Russia backs down on demands in Iran nuclear deal talks, making revival of 2015 pact imminent

A return to the 2015 deal would see the return of Iranian oil to the market at a time when crude prices have hit their highest levels in more than a decade.

Russian Foreign Minister Sergei Lavrov said Tuesday that he had “received written guarantees” from the U.S. that its demands would be met, meaning the talks will likely proceed. The nearly simultaneous release of British-Iranian dual nationals from years of Iranian detention back to the U.K. and a reported U.K. repayment of a decades-old $530 million debt to Iran have improved prospects for an agreement.

“Deal could come together quite quickly — potentially as soon as this week,” analysts at political risk consultancy Eurasia Group wrote in a note Wednesday.

mspohr

Well-Known Member

There’s a Messaging Battle Right Now Over America’s Energy Future

Climate scientists and fossil fuel executives use the same terms when they talk about an energy transition. But they mean starkly different things.

Climate scientists, oil executives, progressives and conservatives all agree on one thing these days: The energy transition is upon us.Efforts to move the world away from fossil fuels have been proceeding in slow motion for years, as nations and corporations advance scattershot efforts to reduce emissions. But the transformation is reaching an inflection point today, with Russia’s invasion of Ukraine prompting climate advocates and the oil and gas industry to advance dueling narratives about what the energy transition is and how it should be carried out.

At CERAWeek, a major energy industry conference in Houston last week, there were more than 100 panel discussions and presentations about the “energy transition,” and the term was used to describe programs articulating a broad range of visions from virtually eliminating the use of coal, gas and oil, to using all forms of energy, including fossil fuels, for the foreseeable future, but capturing the emissions that are damaging the planet.

Mr. Nasser lamented the lack of a cohesive intergovernmental plan for an energy transition and said that politicians were discouraging oil and gas production without allocating sufficient resources to develop renewable energy sources that could quickly replace fossil fuels. Mr. Nasser did not mention that oil companies have lobbied to weaken and block legislation that would address climate change, such as President Biden’s Build Back Better bill, which would dedicate $550 billion in tax incentives to clean energy.

Wow, I step away for a few days and WW3 breaks out on the "Shorting Oil" thread!

At least Brent is chilling out around $100/b. Hopefully, this is low enough to avoid a global recession, but high enough to curb growth in oil demand. The sharpness of the runup to and fallback from the $130/b peak suggest this spike may have been driven more by speculation than physical tightness of the oil supply. In the midst of a Russian-led war, speculators will tend to keep oil prices high. There is a lot of uncertainty, to be sure. But hopefully, we can avoid the excesses of uncertainty that could plunge the global economy into a recession.

At least Brent is chilling out around $100/b. Hopefully, this is low enough to avoid a global recession, but high enough to curb growth in oil demand. The sharpness of the runup to and fallback from the $130/b peak suggest this spike may have been driven more by speculation than physical tightness of the oil supply. In the midst of a Russian-led war, speculators will tend to keep oil prices high. There is a lot of uncertainty, to be sure. But hopefully, we can avoid the excesses of uncertainty that could plunge the global economy into a recession.

Similar threads

- Replies

- 101

- Views

- 2K

- Replies

- 1

- Views

- 508

- Replies

- 0

- Views

- 796

- Replies

- 19

- Views

- 4K