Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla Model Y-LR in Australia

- Thread starter Leconte

- Start date

Stuart2023

Member

While the LCT limit is updated on the ATO website for 2023-24, for EV’a to $89,332 from July (+5.2%), so far the Luxury Vehicle Adjustment ATO depreciation guide Table 2: Yearly car limit, has not been published though should be possible for the gov to calculate as appears to be indexed annually in line with movements in the motor vehicle purchase sub-group of the consumer price index march-march, currently $64714 for 2022-23 (=further reductions in Novated lease costs in July).

I changed my MY LR colour to red and chose the white interior. Thanks, ATO!ATO have just published 2023-24 LCT Limit increases, bring on the MY LR Colours now under limit, just need to time delivery to July

YAnthony

Member

Lucky.. mines so close i dont think i'll change it now.. i'd love to get blue and the wheels.. but oh well.

Ridiculous. Carcinogen spewing vehicles get a more generous percentage increase.I know a few people are watching this closely. Might allow a few extra options on the LR after July.

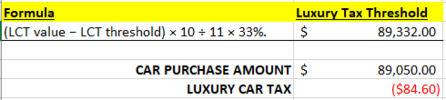

View attachment 938812

YAnthony

Member

about damn time though..Ridiculous. Carcinogen spewing vehicles get a more generous percentage increase.

Power Hungry

Member

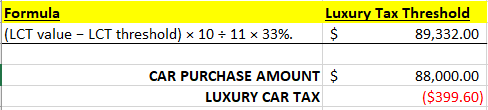

Okay, I ordered white with black and Induction wheels. LCT of just over $300. Not too much considering a $89K vehicle. For a few extra $$$ I’d rather get what I want.Lucky.. mines so close i dont think i'll change it now.. i'd love to get blue and the wheels.. but oh well.

Fill your boots if you don't care about FBT.Okay, I ordered white with black and Induction wheels. LCT of just over $300. Not too much considering a $89K vehicle. For a few extra $$$ I’d rather get what I want.

Hi all

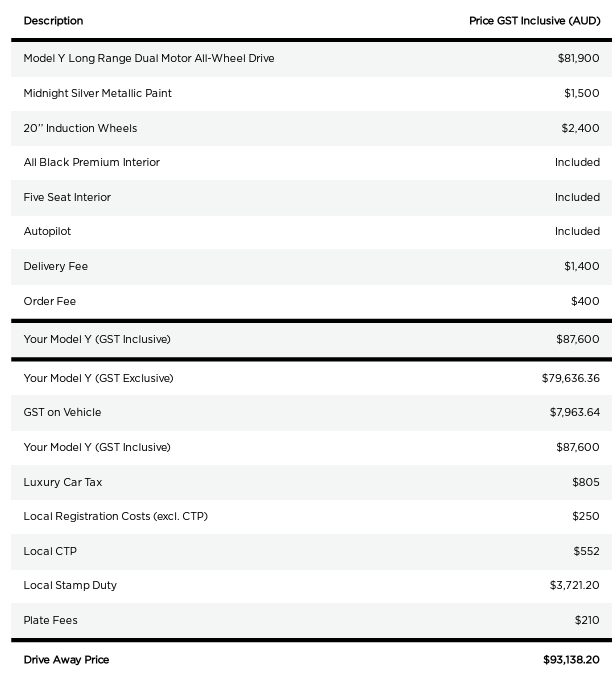

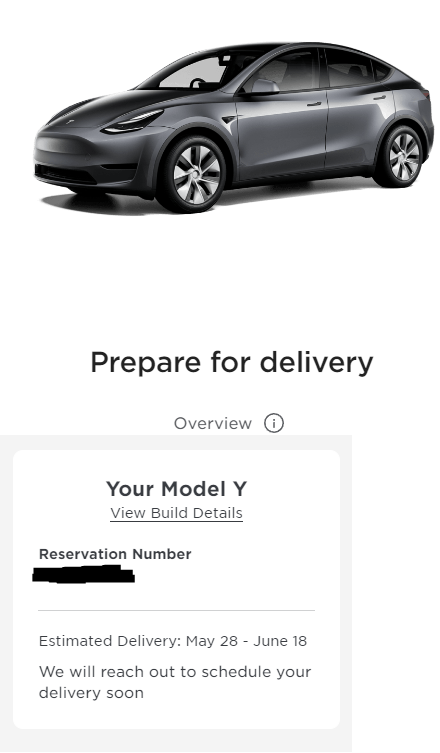

Just hoping to get a bit of a sense check and confirmation here please. Based on the increase of the Luxury Car Tax threshold increase to $89,332, I changed my stock White/19" order to my dream car and colour as below.

Based on my calculations, this configuration should fall JUST under the newly announced threshold by about $400, hopefully enough wiggle room.

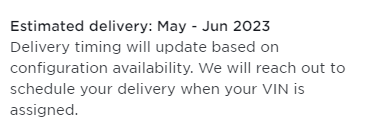

I ordered in April and changed my configuration yesterday, my ETA is as below, so I am fairly confident that I will have the opportunity to request my final invoice post 1 July.

EDIT: Also forgot to mention, my financing is valid up until 14 August 2023.

Is there anything I'm missing?

Thanks lads and gals!

Just hoping to get a bit of a sense check and confirmation here please. Based on the increase of the Luxury Car Tax threshold increase to $89,332, I changed my stock White/19" order to my dream car and colour as below.

Based on my calculations, this configuration should fall JUST under the newly announced threshold by about $400, hopefully enough wiggle room.

I ordered in April and changed my configuration yesterday, my ETA is as below, so I am fairly confident that I will have the opportunity to request my final invoice post 1 July.

EDIT: Also forgot to mention, my financing is valid up until 14 August 2023.

Is there anything I'm missing?

Thanks lads and gals!

Attachments

I might be missing something here, but isn't the vehicle subtotal shown on your config ($88,000) i.e. no need for the calc?

As a side note, on the unlikely event Tesla sends me an invoice in this FY, has anyone had any luck having invoices reissued closer to delivery date?

As a side note, on the unlikely event Tesla sends me an invoice in this FY, has anyone had any luck having invoices reissued closer to delivery date?

I might be missing something here, but isn't the vehicle subtotal shown on your config ($88,000) i.e. no need for the calc?

As a side note, on the unlikely event Tesla sends me an invoice in this FY, has anyone had any luck having invoices reissued closer to delivery date?

You're definitely not missing anything, I just like to do the calculations and see the impact/differences.

I'm hoping that if you leave the invoice outstanding until very close to delivery date, and then ask them to amend it, they would, because the Luxury Car Tax is obviously not revenue for Tesla so they don't care if it's charged or not (as long as it legally is when its supposed to obviously).

Furthermore, in my case, since my car will be a Novated Lease, my invoice will 100% need to be amended once its generated so that it's addressed to the leasing company (because I put down that I'm paying cash...because I've heard it makes no real difference, hehe). So for this reason, because the invoice is being addressed to someone completely different, I'm hoping it can be regenerated with a new date, which would be post 1 July and then I will argue that Luxury Car Tax is not applicable (if it exists on the invoice).

However all of the above is purely speculation and I'm hoping someone has experience in asking for amendments to an invoice, and whether the date on the face of the invoice changed once a new invoice was generated?

You're definitely not missing anything, I just like to do the calculations and see the impact/differences.

I'm hoping that if you leave the invoice outstanding until very close to delivery date, and then ask them to amend it, they would, because the Luxury Car Tax is obviously not revenue for Tesla so they don't care if it's charged or not (as long as it legally is when its supposed to obviously).

Furthermore, in my case, since my car will be a Novated Lease, my invoice will 100% need to be amended once its generated so that it's addressed to the leasing company (because I put down that I'm paying cash...because I've heard it makes no real difference, hehe). So for this reason, because the invoice is being addressed to someone completely different, I'm hoping it can be regenerated with a new date, which would be post 1 July and then I will argue that Luxury Car Tax is not applicable (if it exists on the invoice).

However all of the above is purely speculation and I'm hoping someone has experience in asking for amendments to an invoice, and whether the date on the face of the invoice changed once a new invoice was generated?

My invoice was amended to add the NL billing details and the invoice date did change;

Originally issued 5/5/23; after they amended it now reads 8/5/23

Further to that...I managed to snap up this MYRW in my colour from the Victoria Inventory...very very lucky. I did this just before the new Luxury Car Threshold increase was announced so I'm a little unsure what to do now.

My overall feel is that a July/August delivery for my MYLR above is possible!? But at the same time, who knows...

Unchartered terrority for me here...

My overall feel is that a July/August delivery for my MYLR above is possible!? But at the same time, who knows...

Unchartered terrority for me here...

My invoice was amended to add the NL billing details and the invoice date did change;

Originally issued 5/5/23; after they amended it now reads 8/5/23

View attachment 939890

Fantastic thanks blonky, that's really good news! (and pretty standard practice in business in general..) In that case if the magic happens before 30 June, I'll try to delay having it amended and addressed to the Leasing Company until 1 July in which case the date should change and LCT can't be applied!

My invoice was amended to add the NL billing details and the invoice date did change;

Originally issued 5/5/23; after they amended it now reads 8/5/23

View attachment 939890

Thanks again for posting this, so it looks like the invoice arrived more than a month before expected delivery-ish? Is there a due date on the invoice? I've heard of people not paying it until several days before collection?

The date on the invoice doesn't matter anyway, the car isn't sold until they actually deliver it to you.

If you pay the invoice in full with the luxury car tax on the face of the invoice, I imagine you could cause yourself some headaches with the FBT exemption regardless of delivery date? You won't be eligble for the exemption I'm pretty sure, you'll run yourself into trouble.

Delivery date does not matter, what's listed on invoice is. Any invoice prior to July will not have the new LCT limits applied for next FY, will show LCT applied to current threshold. Invoice has to show no LCT paid for the FBT exemption.

This was my standing as well, agreed.

The date on the invoice doesn't matter anyway, the car isn't sold until they actually deliver it to you.

Putting complicated company tax law aside, I guess a good analogy is buying something overseas that's shipped to you. If you purchase it on 30 June 2023, and it takes 4 months to arrive, the date of purchase is still the 30 June 2023, not the day it arrived at your house.

Similar threads

- Replies

- 0

- Views

- 410

- Replies

- 1

- Views

- 2K