I'll be back in a jif. Gotta go do my 93 million mile (O/W) annual maintenance duty.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

jhm

Well-Known Member

Good question. 50% is the long-term annual growth rate that Musk aims to maintain, whether unit sales or revenue. Not every year will hit this target, but it does seem to work out over longer time horizons. This year was a break out year in terms of profitability and free cash generation, so as a shareholder, I'm willing to over look that unit growth was not quite up to target. Growth in 2021 very well could make up for this slowness in 2020.So I got to ask

367500 to 499550 is only 40% growth? We keep talking about 50% growth. Is there something I am missing?

Edit. Specifically, if Tesla sells 827k units in 2021 it will have maintained a CAGR of 50% since 2019. Tesla looks to have built out enough production capacity over the last year to exceed this 827k level. A big part of the discipline around 50% annual growth is planning out capacity growth years in advance.

Last edited:

Maybe while you’re there turn down the output a teeny bit. Buy us a little time.I'll be back in a jif. Gotta go do my 93 million mile (O/W) annual maintenance duty.

HG Wells

Martian Embassy

Maybe while you’re there turn down the output a teeny bit. Buy us a little time.

WHAT, you will ruin my Canadian Orange grove !

I have an ancient gem for you guys

"Tesla's broke. Elon Musk, Tesla's CEO, is broke. Now Musk is traveling the country, hat in hand, begging for cash in a series of secret, closed-door meetings. One unimpressed insider shared this exclusive, behind-the-scenes look with us."

Inside the Secret $178 Million Tesla IPO Presentation (jalopnik.com)

"Tesla's broke. Elon Musk, Tesla's CEO, is broke. Now Musk is traveling the country, hat in hand, begging for cash in a series of secret, closed-door meetings. One unimpressed insider shared this exclusive, behind-the-scenes look with us."

Inside the Secret $178 Million Tesla IPO Presentation (jalopnik.com)

Featsbeyond50

Active Member

Someone with a Twitter account should save Elon from dying on Mars by pointing out that someday, that fusion reactor in the sky will stop working.

StarFoxisDown!

Well-Known Member

I think they announced P&D today so then S/X refresh will gets more time to shine tomorrow or Monday.

Would be a pretty amusing move for sure.....late Sunday night....."And here's one more thing"

So early in the year and already I'm confused. With WHAT, @Green Pete, of the above can you possibly be in disagreement?No.

Unless, and I really hope this does not come to pass, Tesla first purchases 100% of Ford Motor Company, who already put the kibosh on Tesla's use of "Model E".

StealthP3D

Well-Known Member

2022 should see the start of factory construction for the "model 2" given Elon mentioned deliveries starting in 2023 at battery day.

Between now and 2023 we are likely to see multiple giant facilities spring to life:

All told, there could be up to 10 facilities/expansions required between now and the end of 2023 (excluding current construction) to meet bullish interpretations of guidance. I'm excited to hear what capex guidance we get from the Q4 call around these plans.

- Model 2 facilities - potentially concurrent construction in China, EU, US given likely demand for the vehicle

- Tesla still needs to produce buildings for the 4680 cells in the US and possibly other regions - potential for 2-3 facilities

- The precursor materials may also need refineries (wording?) assuming Tesla takes it in house - numbers could match the number of 4680 facilities.

- Semi production will need a new building in Nevada or eslewhere

I'm a little alarmed by the singularity of focus on auto production when we are all aware that Tesla is much more than just an automaker. In the end, valuation depends upon revenue growth and profit margins and it doesn't care that much exactly where it comes from. Solar and energy has the ability to greatly increase revenues and FSD and auto-bidder has the ability to greatly transform profit margins.

So, it's really about batteries and software, more so than cars.

I’ve noticed some interesting year end decisions that may have artificially reduced 2020 numbers in exchange for supercharging 2021 volume.

Q4 2020 production (509,737) more than 10,000 over deliveries (499,550). Stockpiling?

Elon opened MIC Model Y online ordering on New Years Eve with 30% price drop, rumored over 100,000 orders, then started shipping just hours after midnight Jan 1.

.

There were hundreds of MY already on the lot - why wait until Jan 1?

Elon’s relatively low intensity year end email push.

Imminent MS refresh (Plaid?) announcement

Giga Shanghai at 550,000 capacity by end of 2021 (250,000 now). Tesla Giga Shanghai Production Capacity To Hit 550,000 In 2021

50% YOY growth would be 750,000 deliveries in 2021. But Q4 2020 was already a run rate of 722,280 (180,570 X 4).

I think this artificially supercharged start to 2021 tells me he’s reaching higher - 1,000,000 in 2021. Wow.

Q4 2020 production (509,737) more than 10,000 over deliveries (499,550). Stockpiling?

Elon opened MIC Model Y online ordering on New Years Eve with 30% price drop, rumored over 100,000 orders, then started shipping just hours after midnight Jan 1.

There were hundreds of MY already on the lot - why wait until Jan 1?

Elon’s relatively low intensity year end email push.

Imminent MS refresh (Plaid?) announcement

Giga Shanghai at 550,000 capacity by end of 2021 (250,000 now). Tesla Giga Shanghai Production Capacity To Hit 550,000 In 2021

50% YOY growth would be 750,000 deliveries in 2021. But Q4 2020 was already a run rate of 722,280 (180,570 X 4).

I think this artificially supercharged start to 2021 tells me he’s reaching higher - 1,000,000 in 2021. Wow.

StealthP3D

Well-Known Member

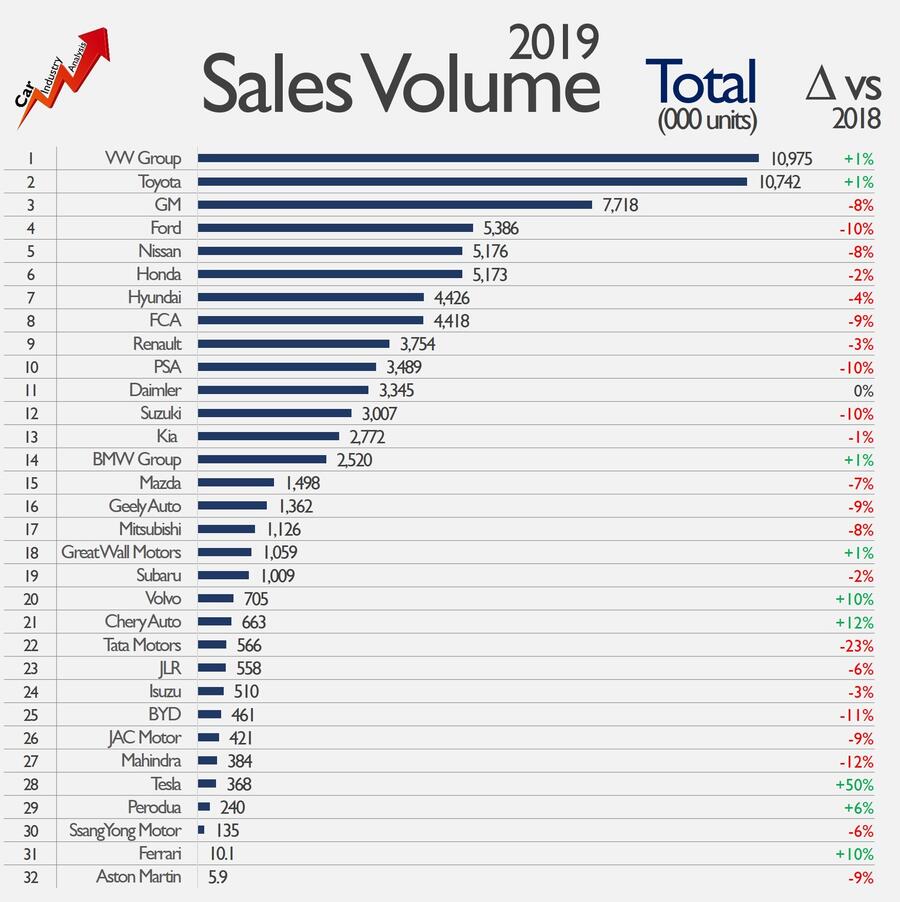

This represents global number of cars sold in 2019. I post it to put into context where Tesla sits and in particular to demonstrate the size of the 'pie' that Tesla can eat. When the 2020 figures are produced Tesla will have overtaken JLR. In 2021 Tesla should have risen to 20th position and will have overtaken Tata Motors and Volvo. Onwards and upwards.

I think most, almost all, automakers on that list will experience shrinking sales in both 2020 and 2021 when compared to 2019. This means Tesla will move up the list more quickly than your analysis indicates.

G

goinfraftw

Guest

Holy did anyone read these?

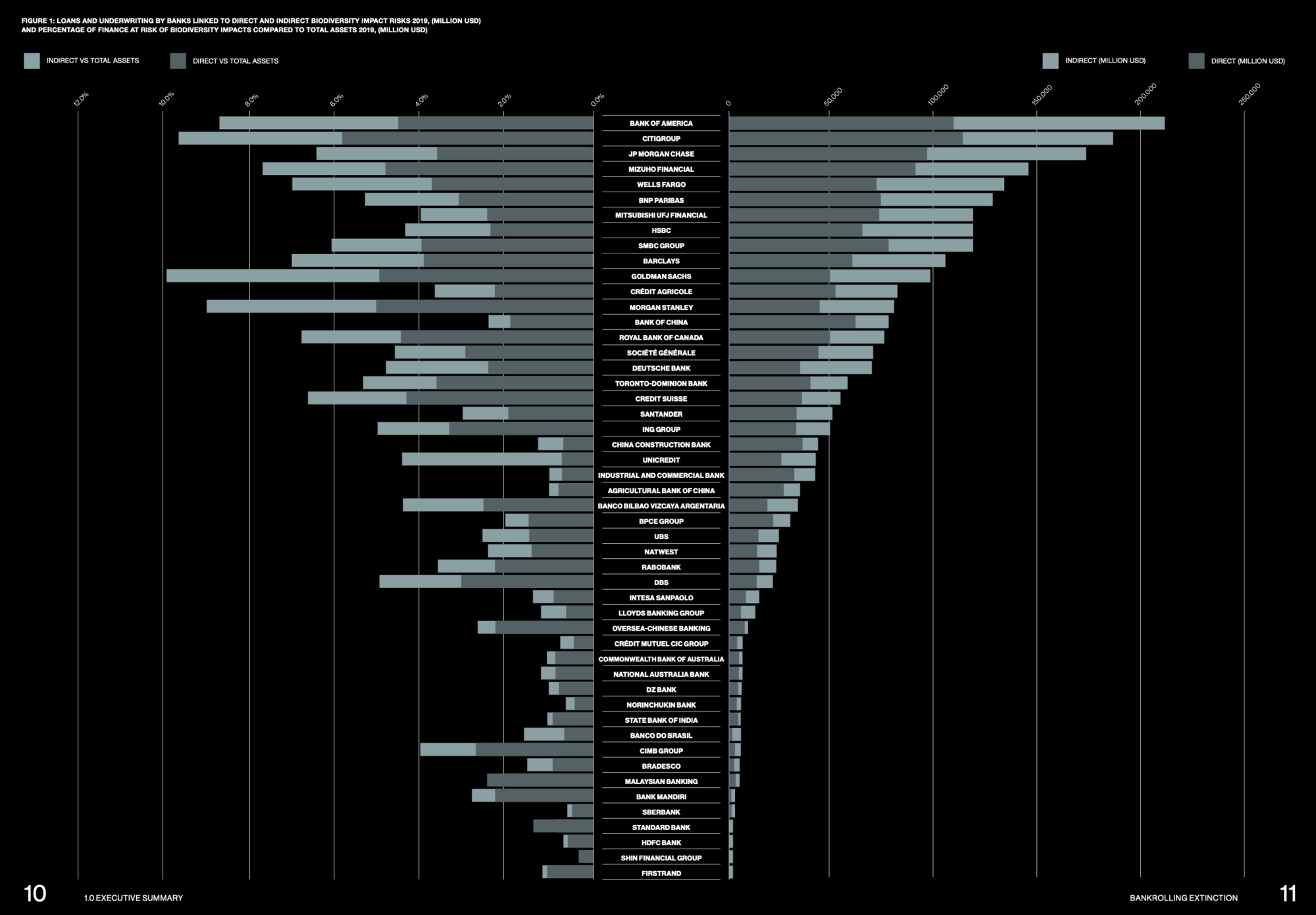

"Led by Wall Street giants Bank of America, Citigroup and JP Morgan Chase, 50 top investment banks provided financial services to sectors driving mass extinctions and biodiversity loss worth more than the GDP of Canada in 2019, the analysis found."

The world's banks must start to value nature and stop paying for its destruction

Banks lent $2.6tn linked to ecosystem and wildlife destruction in 2019 – report

The first article is written by the head of the IPCC between the late 90's early 00's. From one of the reports linked to in the 2nd article:

- Report at Portfolio Earth | Bankrolling Extinction

"Led by Wall Street giants Bank of America, Citigroup and JP Morgan Chase, 50 top investment banks provided financial services to sectors driving mass extinctions and biodiversity loss worth more than the GDP of Canada in 2019, the analysis found."

The world's banks must start to value nature and stop paying for its destruction

Banks lent $2.6tn linked to ecosystem and wildlife destruction in 2019 – report

The first article is written by the head of the IPCC between the late 90's early 00's. From one of the reports linked to in the 2nd article:

- Report at Portfolio Earth | Bankrolling Extinction

Attachments

Last edited by a moderator:

chronopublish

2008 Roadster #VP27

Yeah, something's wrong with the IPO system: no retail investor can ever buy shares at that price.

My CAGR is based on TSLA's Closing Price on it's first day of trading, July 2nd 2010.

Retail HODL'rs actually COULD have those gains. Paging @Krugerrand and a few others I think...

Cheers!

Original Roadster owners were invited to the IPO. I still have my shares. The numbers are beyond all human comprehension at this point.

Zhelko Dimic

Careful bull

Oh my, I really screwed it up with between 600% and 2500% on various accounts5,394% was my final number for 2020, an unbelievable and never-to-be-repeated-by-me return. And I imagine that’s probably not very impressive compared to many here.

Stretch2727

Engineer and Car Nut

I’ve noticed some interesting year end decisions that may have artificially reduced 2020 numbers in exchange for supercharging 2021 volume.

Q4 2020 production (509,737) more than 10,000 over deliveries (499,550). Stockpiling?

Elon opened MIC Model Y online ordering on New Years Eve with 30% price drop, rumored over 100,000 orders, then started shipping just hours after midnight Jan 1.

There were hundreds of MY already on the lot - why wait until Jan 1?

Elon’s relatively low intensity year end email push.

Imminent MS refresh (Plaid?) announcement

Giga Shanghai at 550,000 capacity by end of 2021 (250,000 now). Tesla Giga Shanghai Production Capacity To Hit 550,000 In 2021

50% YOY growth would be 750,000 deliveries in 2021. But Q4 2020 was already a run rate of 722,280 (180,570 X 4).

I think this artificially supercharged start to 2021 tells me he’s reaching higher - 1,000,000 in 2021. Wow.

I think they held back the Model Y in China to also help with the typically weak Q1. Also, it is unusual for them to produce more than they delivered in Q4. I think they purposely held back once they knew they were close to 500K.

My wife got me this program for Christmas, I haven't tried it yet (I forgot my sign in info).Do you have any tips for improving one's long-term memory? Because I'm having trouble remembering that long ago!

BrainHQ from Posit Science

loquitur

Member

That's why I bank at Charles Schwab, who doesn't lend to fossil fuel Neanderthals (or anyone else), andHoly did anyone read these?

"Led by Wall Street giants Bank of America, Citigroup and JP Morgan Chase, 50 top investment banks provided financial services to sectors driving mass extinctions and biodiversity loss worth more than the GDP of Canada in 2019, the analysis found."

The world's banks must start to value nature and stop paying for its destruction

Banks lent $2.6tn linked to ecosystem and wildlife destruction in 2019 – report

The first article is written by the head of the IPCC between the late 90's early 00's. From one of the reports linked to in the 2nd article:

View attachment 623646

- Report at Portfolio Earth | Bankrolling Extinction

good enough for free ATM, check writing, and $0 stock trades. Except, well old Chuckie is a Republican, but of the never-Trumper variety, hopefully.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M