Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

corduroy

Active Member

On to the moon, mars, and beyond!

So Europa or Titan after the astroid belt?On to the moon, mars, and beyond!

woodisgood

Optimustic Pessimist

Motor Mouth

Member

Only Ford built gas stations, and that was only in the beginning. They feel entitled to government (or perhaps utility) supplied charging stations.It boggles my mind why traditional automakers are ok letting $10B+ EV programs fail because they won't spend $1B building out a fast charging network.

Great flight and landing but just a few feet to the side and it would be off the edge of the concrete.

In the first half it looked like maybe the 2 game skid would end, but in the second half they just couldn't maintain a rally and had several lead changes ultimately ending with another narrow loss to make it a 3 game losing streak. They are now back under .500 for the season.

| Today | ||

| Score: | 670.94 | |

| Margin of W/L: | -2.66 | |

| Attendance: | 21,843,701 | |

| High - Low: | 17.96 | |

| Season | ||

| Record: | 42-43 | |

| Total margin of wins: | 952.84 | |

| Total margin of losses: | -987.57 | |

| YTD gain/loss: | -34.73 | -4.92% |

| Best Win: | 110.58 | Mar 9 |

| Worst Loss: | -68.83 | Jan 11 |

| Last 10: | 3-7 | |

| Streak: | L3 | |

| Avg margin of victory: | 22.69 | |

| Avg margin of defeat: | -22.97 | |

| Avg Attendance: | 32,471,254 | |

| Avg Attendance of Last 10: | 30,560,858 | |

| Avg High - Low: | 40.19 | |

| Avg H - L of Last 10: | 26.22 |

UnknownSoldier

Unknown Member

Stuck the landing. Somewhere, Jeff Who is fuming.

EVNow

Well-Known Member

I don't think those old numbers from FCA call are correct. They must have paid more.The real question is of course if Stellantis, or previously FCA, didn't pay Tesla more than around $240 million for credits in 2020. WHERE THE FRACK DID THE OTHER $1,100 million in credit payments come from???

There is some car company out there that is desperate to keep quite how much they are paying Tesla.

Also, I feel this whole "we don't need Tesla anymore" might even be some kind of negotiation tactic for FCA for the next pooling arrangement.

nativewolf

Active Member

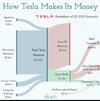

Could someone please send me to the graphic that broke down TSLA operating profits? Wondering what amounts were attributed to bitcoin, energy, auto, credit sales, q1 2021. I had wanted to go over this with my son this evening but can't find it.

This?Could someone please send me to the graphic that broke down TSLA operating profits? Wondering what amounts were attributed to bitcoin, energy, auto, credit sales, q1 2021. I had wanted to go over this with my son this evening but can't find it.

Attachments

I'm surprised at your take on this. REAL security is the subject travels in a bubble, there is no pressing of the flesh and movements and logistics are strictly hidden. Those guys in the background could have done nothing if somebody dropped their cell and pulled out a gun.I've been concerned about Elon's safety since 2018 but I think his security is more effective than it appears.

Some people's security is all-show, no-go. Dark glasses, bulges in their Italian suits where there are weapons, walkie-talkies, etc. But you can bet Elon has smart security. People extremely competent at what they do. Not because they are tough, heavily armed or dressed in fancy suits, but because they use first-principles thinking to protect from potential threats.

I think anyone trying something evil might end up in a bigger world of hurt than they could have imagined.

Presidents get shot. Cultural icons get killed. All with the best "security" that can be bought.

The future of the planet, and the species, is riding on a single life. We still need him, and if it was up to me, he'd never see the light of day again (not really, but can't help feeling that way).

Go Elon! (but safely, please!)

dano-oly

Member

Of course, this is not me. Hopefully this loser's gig is up now that he's publicizing his misdeeds.

Deleted the post, though, per Opus' suggestion.

Deleted the post, though, per Opus' suggestion.

If this is about the Jeep...then thanksOf course, this is not me. Hopefully this loser's gig is up now that he's publicizing his misdeeds.

Deleted the post, though, per Opus' suggestion.

MC3OZ

Active Member

One less joke for SNLStuck the landing. Somewhere, Jeff Who is fuming.

nativewolf

Active Member

So Teslas cash is getting out of hand? I mean they accounted for most of the EM tranche on the books but it did not hit cash did it? it was a stock award, no? Just seems to me that they may be buying more bitcoin in the future. In other news I am hearing that big banks are pressuring large depositors to reduce cash holdings- mainly large corp clients. It would seem to me that Tesla might not want to be holding cash.

Apply for the Master of Coin job.So Teslas cash is getting out of hand? I mean they accounted for most of the EM tranche on the books but it did not hit cash did it? it was a stock award, no? Just seems to me that they may be buying more bitcoin in the future. In other news I am hearing that big banks are pressuring large depositors to reduce cash holdings- mainly large corp clients. It would seem to me that Tesla might not want to be holding cash.

AimStellar

Member

Options gurus: I'm trying to figure out why the calls to puts ratio in ARKK is so skewed towards puts.

Is ARKK potentially being used as a "backdoor" short against its holdings, which of course includes Tesla at 10% weighting?

On the one hand I can understand utility in ARKK puts as a portfolio hedge if you own shares of its largest holdings (instead of owning the underlying holdings + owning the ETF as I do...but I digress), but the other (Tesla investor) side of me has grown to ask whether something more nefarious is going on. E.g., Would shorting ARKK create downward pressure on the ETF price, causing ARKK to sell off baskets of holdings, possibly including Tesla, leading to a domino effect of downward selling pressure in the share price of holdings ARKK has to sell?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K