Yeah not a fan of that clown at all.Latest SMR video recalling Cramer comments right before Tesla IPO. Interesting and humorous.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

That dude changes positions on stocks like i do underwear.....lost respect for him when he slammed Cathie W esrliermthisnyesr when growth stocks sold off....Always seems to pitch what he’s getting sponsored on...Cramer calling out that Tesla is back in growth mode as part of support for his theme of “breakout”. Sees they have a window while competition has yet to fully gear up.

Take a peek at the discussion back about June 6 related to CUM rights.Enforced by brokerage houses?

mltv

Member

Tesla Model S Plaid reaches 140 MPH during first place run at Pikes Peak Hill Climb

The Tesla Model S Plaid, driven by veteran Unplugged Performance team member Randy Probst, continues its domination of the Exhibition Divison at the Pikes Peak International Hill Climb. The Unplugged Model S Plaid recently took down the fastest practice lap time during the Wednesday session...

Dancing Lemur

Hoopy Frood

Best I've found: The Essential Options Trading Guide

But a great way to learn is this thread: Applying options strategy 'the wheel' to TSLA (start with page 1 young padawan)

Mostly you learn options by losing money. Repeatedly.

So we can expect a close at 699 tomorrow, and 700s next week?I'd wait for more info from max-pain.com at 7 am tomorrow (unless you have another source). BTW, there were over 200K Call contracts traded at the $700 stike today. How many are still open, we won't know until tomorrow at 7:00

Artful Dodger

"Neko no me"

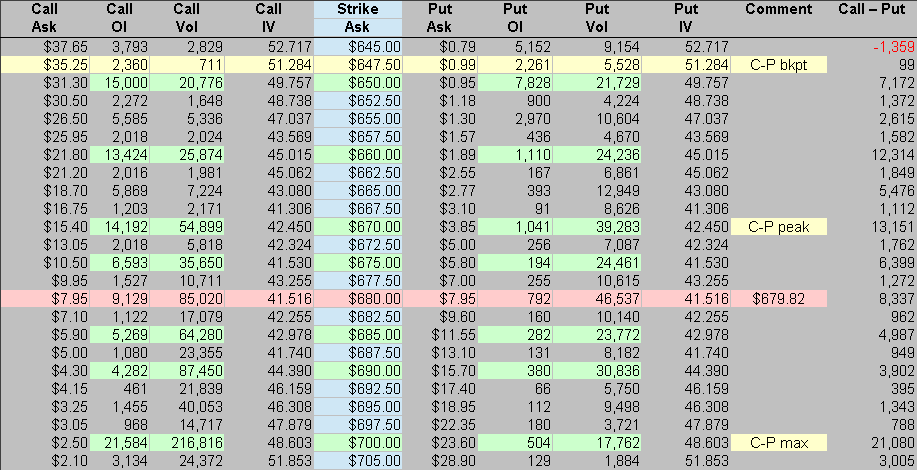

Today, over 1.07 million Option contracts expiring tomorrow traded just in the Strike range 650 - 700 (745K Call contracts + 332K Put contracts). Together, they control over 100 Million shares (over 10% of the total equity in TSLA).

Here is the data: (highlights show locations for some potential Call or Put "walls" - the SP that MMs tend to defend, or traders attempt to achieve)

N.B. the OI or "Open Interest" data is from end-of-day on Wed, and specifically NOT for today's trading. The next OI update from this data source is Fri at around 7 a.m. ET (updates once/day).

Of particular interest will be the Put OI levels. I compare them to the Call OI by simple subtraction. This gives a sum which should be informative of the MMs interest in moving the SP through that increment, when ever the SP is at an adjacent strike price level.

A "Put wall" can be very helpful. But we won't know if any formed today until 7 a.m. tomorrow.

"C-P" is a technique which doesn't always work, but does add some simple empirical analysis to thecacophony mix of emotions and strategy that is Options trading. GLTA.

Cheers!

Here is the data: (highlights show locations for some potential Call or Put "walls" - the SP that MMs tend to defend, or traders attempt to achieve)

N.B. the OI or "Open Interest" data is from end-of-day on Wed, and specifically NOT for today's trading. The next OI update from this data source is Fri at around 7 a.m. ET (updates once/day).

Of particular interest will be the Put OI levels. I compare them to the Call OI by simple subtraction. This gives a sum which should be informative of the MMs interest in moving the SP through that increment, when ever the SP is at an adjacent strike price level.

A "Put wall" can be very helpful. But we won't know if any formed today until 7 a.m. tomorrow.

"C-P" is a technique which doesn't always work, but does add some simple empirical analysis to the

Cheers!

Last edited:

Artful Dodger

"Neko no me"

Mostly you learn options by losing money. Repeatedly.

Pain is the best teacher, but no body wants to go to his class...

Cheers!

Thekiwi

Active Member

Bloomberg/Nikkei: Panasonic sold all its Tesla shares by end of March.

asia.nikkei.com

asia.nikkei.com

Panasonic unloads entire Tesla stake

Exclusive: Japanese electronics company says relationship "will not change"

So far this year I have made over $1.5m selling options (including my trades where I closed them out for a loss and rolled them because the stock moved against me too much). It has taken me 6 years to get to the point where I believe I won't lose money selling them anymore (the first few years were rough). The biggest power you have as an investor is selling covered calls against your shares ($1m of the 1.5 was CC, the rest selling margin secured Puts). I don't typically buy them because I just lose money. It is really easy to make money selling Puts if you have enough cash. My mother's IRA has over $2m in cash, and I have been making her around $20k/month to live off of selling very safe, way OTM monthly Puts secured by her cash. I have 40 530 strike Puts that I have sold for her expiring at different times over the next 30 days. As those get close to expiration, I either let them expire worthless, or I roll them another month out, maybe change the strike a little, and make her more spending money. At her age, I don't want to buy TSLA stock with her funds just in case.Mostly you learn options by losing money. Repeatedly.

Does anyone know if there is precedent for what Elon is proposing?

Airbnb IPO offered hosts shares. Earliest hosts were offered the most if I recall correctly. I think the most you (or we) could buy was like $12K, maybe $17K. I could not come up with a back of napkin valuation so did not partake. I think the shares have tripled from the IPO price. I bet I can model Starlink!

Mercedes did that. Panasonic will also come to regret it, unless they are buying back in now....Bloomberg/Nikkei: Panasonic sold all its Tesla shares by end of March.

Panasonic unloads entire Tesla stake

Exclusive: Japanese electronics company says relationship "will not change"asia.nikkei.com

D

dm28997

Guest

Odd that no news reports on this increasing level of sea level rise. I guess they wish to avoid the elephant in the roomEV adaptation should be rushed. From all the reports I've read we are headed to over 1.5 degrees C. 122 F and rising in some areas of the US. The US government needs to look at the reality of continuing to fund fossil fuels and pass bills to remove ICE vehicles and promote BEVs powered by Solar.

Not sure if this is due to sea level rising but this Florida Condo just collapsed(water in the foundation region perhaps?)

From the article

Sea level rise is speeding up

The sea level around Virginia Key, Florida, has risen by 8 inches since 1950. Its speed of rise has accelerated over the last ten years and it’s now rising by 1 inch every 3 years.2 Scientists know this because sea levels are measured every 6 minutes using equipment like satellites, floating buoys off the coast, and tidal gauges to accurately measure the local sea level as it accelerates and changes.4

Florida's Sea Level Is Rising

Sea levels around Florida have risen up to 8 inches since 1950, and are now rising as much as 1 inch every 3 years, mainly due to a slowing Gulf Stream. Because of sea level rise, tidal flooding in some areas of the state has increased by 352% since 2000, and communities are spending over $4...

dgodfrey

Member

There’s a few of us these past few days that wished we didn’t.I wish I had any family member that knew what a covered call was. Our 12yo son knows what a short put is though. He’ll learn covered calls when his account gets bigger.

Artful Dodger

"Neko no me"

So far this year I have made over $1.5m selling options (including my trades where I closed them out for a loss and rolled them because the stock moved against me too much). It has taken me 6 years to get to the point where I believe I won't lose money selling them anymore (the first few years were rough). The biggest power you have as an investor is selling covered calls against your shares ($1m of the 1.5 was CC, the rest selling margin secured Puts). I don't typically buy them because I just lose money. It is really easy to make money selling Puts if you have enough cash. My mother's IRA has over $2m in cash, and I have been making her around $20k/month to live off of selling very safe, way OTM monthly Puts secured by her cash. I have 40 530 strike Puts that I have sold for her expiring at different times over the next 30 days. As those get close to expiration, I either let them expire worthless, or I roll them another month out, maybe change the strike a little, and make her more spending money. At her age, I don't want to buy TSLA stock with her funds just in case.

What is your Broker's fee per Contract? With my Broker's $20 per contract fee, the above strategy would be quite costly (especially while learning Options trading). Eg: those 40 Puts alone would represent around 800/mth in fees, but it sounds like that's not the majority of your activity.

How do you manage the fees? What's your "win/loss" ratio? What does it need to be to break even? TIA

Cheers!

Last edited:

Featsbeyond50

Active Member

He was brilliant in those clips except the parts where he recommended not buying tesla.Yeah not a fan of that clown at all.

From weak hands to stronger ones.Mercedes did that. Panasonic will also come to regret it, unless they are buying back in now....

Didn't watch any of them. Never liked him ...don't like him now.He was brilliant in those clips except the parts where he recommended not buying tesla.

Screaming horn honking button smashing showmen aren't my cup of beer.

Pain is the best teacher, but no body wants to go to his class...

Cheers!

It is the best class I ever went to. One has to open themselves up honestly, stare hard into the mirror, lean into the depression. My failures have been great teachers in the market. I did the math once, owned like 30M worth of NFLX, perhaps similar in AAPL, not all the long ago. But I sold them with short term visceral fear. I made easy bull market money then kept trading the same as the market hit the crapper, gave all my gains up and also took cash/margin account to ZERO. I stopped trading for months. Came to realize I should focus on great growth story companies, with great products, great leadership, business models I could understand. Ergo TSLA. Not sure I will ever get 30M, fully expect 20 before I die.

"cup of beer", who are you?Didn't watch any of them. Never liked him ...don't like him now.

Screaming horn honking button smashing showmen aren't my cup of beer.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K