(Pssst, I don’t think she noticed the dog).Dang, that’s a Tesla ad not a real estate ad. They featured the car!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

J

jbcarioca

Guest

Só long as fossil fuels are subsidized so should be BEV. Better none at all, but good luck eliminating depletion allowances, for exampleI don't see the point in subsidies. I'd gut them all. EV's are here. Govt subsidies at this point only serve to protect weak OEMs that need to fail. At this point many OEMs have to fail in some manner. Either through mergers, bankruptcy, etc. They need to fail.

nativewolf

Active Member

You are conflating ICE/EV decisions with fossil fuel/renewables. The benefit to the average ICE owner (of fossil fuel subsidies) is marginal, the normal swings and falls and rises of oil pricing overshadow all the fossil fuel subsidies (which should go- I agree) they have impacts and are a subsidy to EV owners as well (as long as natural gas and oil provides grid power). The benefit to GM or Toyota of a $10k tax credit is huge, literally moves the argument - thus the bolt/volt series from GM. EV transition is going to require that many OEMs disappear, it's going to be a very difficult political and social transition, thus eliminating subsidies for EVs will at this time ensure that the OEM is committed to success no blindly relying on govt subsidies. It is time to let capitalism weed out the weak from the best producers.Só long as fossil fuels are subsidized so should be BEV. Better none at all, but good luck eliminating depletion allowances, for example

For the same reason I feel that subsidies for renewable generation have some merit.

J

jbcarioca

Guest

In all the discussion of the possible share price consequences from a investment grade rating all the comments seem to be oriented to mutual funds, mostly indexed ones. The two largest instructional investor classes have never been mentioned AFAIK.

The largest single investor class in public equities is pension funds

The second one is insurance companies

Third comes mutual funds

Various classes of trust companies, banks, etc also are represented in part by the first three, but also are massive investors on their own.

Hedge funds and investment managers sometimes are distinct categories.

Then there is Black Rock, little known but the World’s largest investment manager with >10 trillion dollars managed)

until nowI have referred to Institutional investors, not realizing many of us do not understand. these categories. Many of them adopt a ‘prudent investor’ rule by law or choice that limits investments below ‘investment grade’ by rating agencies.

In TSLA, the interest savings from investment grade is ‘de minimus’ because Tesla has little debt. The real consequence would be to massively open the worldwide institutional investor community to TSLA. If share price rise, lowered volatility and reduced influence of speculators are goals, the higher rating is important.

Probably the quickest way to get to a higher rating is to issue new debt that would, coincidentally, have Tesla pay rating agencies. The APPL approach has worked well, using long and medium term borrowing to reduce FX volatility. Tesla needs that now that Shanghai and Berlin are beginning and both sales and supplies are becoming important sources of FX volatility.

The largest single investor class in public equities is pension funds

The second one is insurance companies

Third comes mutual funds

Various classes of trust companies, banks, etc also are represented in part by the first three, but also are massive investors on their own.

Hedge funds and investment managers sometimes are distinct categories.

Then there is Black Rock, little known but the World’s largest investment manager with >10 trillion dollars managed)

until nowI have referred to Institutional investors, not realizing many of us do not understand. these categories. Many of them adopt a ‘prudent investor’ rule by law or choice that limits investments below ‘investment grade’ by rating agencies.

In TSLA, the interest savings from investment grade is ‘de minimus’ because Tesla has little debt. The real consequence would be to massively open the worldwide institutional investor community to TSLA. If share price rise, lowered volatility and reduced influence of speculators are goals, the higher rating is important.

Probably the quickest way to get to a higher rating is to issue new debt that would, coincidentally, have Tesla pay rating agencies. The APPL approach has worked well, using long and medium term borrowing to reduce FX volatility. Tesla needs that now that Shanghai and Berlin are beginning and both sales and supplies are becoming important sources of FX volatility.

Last edited by a moderator:

petit_bateau

Active Member

(out of interest, is it CRNGO or CRGO ?)Yes, I also noted the lack of loading docks.

One thing to consider is the economics, both Tesla and SpaceX need at lot of specialised cold-rolled Stainless Steel, even with a bulk supply contact, that might be expensive, especially if a highly-specialised formula, or process is needed.

Cybertruck needs to hit the production cost target price, and there is a lot of Stainless Steel in each body.

Hypothetically what might be needed are electric-arc furnaces, some sort of mixing facility, then the facility to do the cold-rolling. Perhaps the denial from SDI may have been cleverly worded, they seem to deny Stainless Steel shipments, but didn't necessarily rule out supplying Tesla with steel or other metals.

I'm speculating on a long shot here, it isn't that likely, but one way or another, Tesla needs to get a lot of Stainless Steel at a good price.

SDI said they would have 3 million tons/yr capacity.

Just for illustrative purposes, say Tesla Austin makes 500k Cybertrucks/yr and each consumes 500kg, that is 250,000 tonnes/yr of stainless.

Yes Starship will use a noticeable quantity, but not that much !

So SDI aren't exactly betting the farm on Tesla, important though Tesla may be.

SDI remains on track for mid-2021 startup at Texas steel mill

Steel Dynamics Inc. remains on track to begin operations at its new $1.9 billion flat rolled steel mill in Sinton, Texas in mid 2021 as the coronavirus pandemic has not impacted construction, SDI CEO

Todd Burch

14-Year Member

See yesterday’s Tesla Daily podcast on Youtube. SDI has publicly stated they have nothing to do with Tesla.(out of interest, is it CRNGO or CRGO ?)

SDI said they would have 3 million tons/yr capacity.

Just for illustrative purposes, say Tesla Austin makes 500k Cybertrucks/yr and each consumes 500kg, that is 250,000 tonnes/yr of stainless.

Yes Starship will use a noticeable quantity, but not that much !

So SDI aren't exactly betting the farm on Tesla, important though Tesla may be.

SDI remains on track for mid-2021 startup at Texas steel mill

Steel Dynamics Inc. remains on track to begin operations at its new $1.9 billion flat rolled steel mill in Sinton, Texas in mid 2021 as the coronavirus pandemic has not impacted construction, SDI CEOwww.spglobal.com

petit_bateau

Active Member

.... yetSee yesterday’s Tesla Daily podcast on Youtube. SDI has publicly stated they have nothing to do with Tesla.

J

jbcarioca

Guest

1. No I am not. I did say "for example" because the structure of direct subsidies, tax benefits, and so on for all fossil fuels is hugely complex and opaque. What is the actual cost of protecting the Arabian peninsula fossil fuel sources? What is the cost fo protecting Russian gas supplies to Western Europe?You are conflating ICE/EV decisions with fossil fuel/renewables. The benefit to the average ICE owner (of fossil fuel subsidies) is marginal, the normal swings and falls and rises of oil pricing overshadow all the fossil fuel subsidies (which should go- I agree) they have impacts and are a subsidy to EV owners as well (as long as natural gas and oil provides grid power). The benefit to GM or Toyota of a $10k tax credit is huge, literally moves the argument - thus the bolt/volt series from GM. EV transition is going to require that many OEMs disappear, it's going to be a very difficult political and social transition, thus eliminating subsidies for EVs will at this time ensure that the OEM is committed to success no blindly relying on govt subsidies. It is time to let capitalism weed out the weak from the best producers.

For the same reason I feel that subsidies for renewable generation have some merit.

For renewables we can quite easily quantify all those factors because the adoption and advances have been happening primarily in the least two decades.

2. Yes, I do conflate them because energy source and energy use are inextricably intertwined. They can be arbitrarily separated for some purposes. One major example of inevitable confusion is financing of construction and maintenance for roads and other vehicular services. In many places around the world that has been done by allocation of motor fuel taxes. Should BEV have a free ride?

So I do admit that I can give both answers truthfully depending on the level of vision. Almost all of us, including me, are prone to oversimplify the issues.

Thus, we need to watch Norway closely. They are first significant economy in the world to face all those issues today. Even for them, mass adoption has been the easy part. Now watch all those gasoline taxes diminish. What next? There is no easy answer.

J

jbcarioca

Guest

Do you have a strong idea how they'll source the "precut blanks/sheets" and how easy/cheap transporting them might be?I would wager you are correct. It makes no sense for Tesla to roll the steel themselves, the vendor should do that. It also would be VERY difficult to flatten the this particular SS after it had been coiled. So, yes - I agree, likely the SS for the body panels will come as precut blanks/sheets of appropriate sizes.

I have a single reference point from thirty years ago when buying blanks and shipping across oceans was cheaper and easier than rolls. IIRC the avoidance of processing rolls was essential because shipping and handling rolls was difficult enough, but have the capacity to prove finished products was overwhelming expensive. At that time producing blanks at production site was 'relatively easy' in comparison.

Have we an idea how SpaceX handles that issue? Obviously that is tiny volume compared with Cybertruck.

These questions probably demand another thread, They seem to me to be central to the economics of Cybertruck construction. This, unless they have some major technological breakthrough, this seems rather a giant leap, does it not?

Last edited by a moderator:

Anyone know if we are going to be able to submit questions through Say Q&A for the earnings call, it seems like the questions should be open now...

app.saytechnologies.com

app.saytechnologies.com

Say Q&A - Shareholder Questions for Earnings Calls, Shareholder Meetings, Investor Days and More

This is your place to ask questions you'd like companies to address on their next Q&A.

Samsung Electro-Mechanics is expected to win more orders this year than before as Tesla is expected to procure camera modules from more suppliers to cut unit prices, the source said.

The US EV maker is expected to ship up to 2 million units of EVs this year, they said.

Samsung and LG competing for camera module orders from Tesla

Electric vehicle (EV) giant Tesla has recently given out orders for camera modules, TheElec has learned.LG Innotek, Samsung Electro-Mechanics and their Taiwanese rivals are taking part in the bid to win orders, sources said.Tesla has given out orders for camera modules it plans to use in Model S, Mo

Elon at his best

OT: Just got word my terminal is being shipped. Should be interesting.

OT: Just got word my terminal is being shipped. Should be interesting.

ZachF

Active Member

You're missing one important piece: NFLX is guiding for only 10M new subs for 2022. That's a YOY growth of only 4%. I believe this is what's tanking the stock. Nobody wants a 40 PE stock that only guides for 4% growth.

Yep.

And the rate of growth continues to slow as well.

NFLX is at the top of its S curve while TSLA is at the bottom.

As I’ve said earlier this week I think macros are going to drag the market as a whole down medium term and maybe TSLA with it. Get powder ready if you can.

Last edited:

Cult Member

Born on the 4th of July

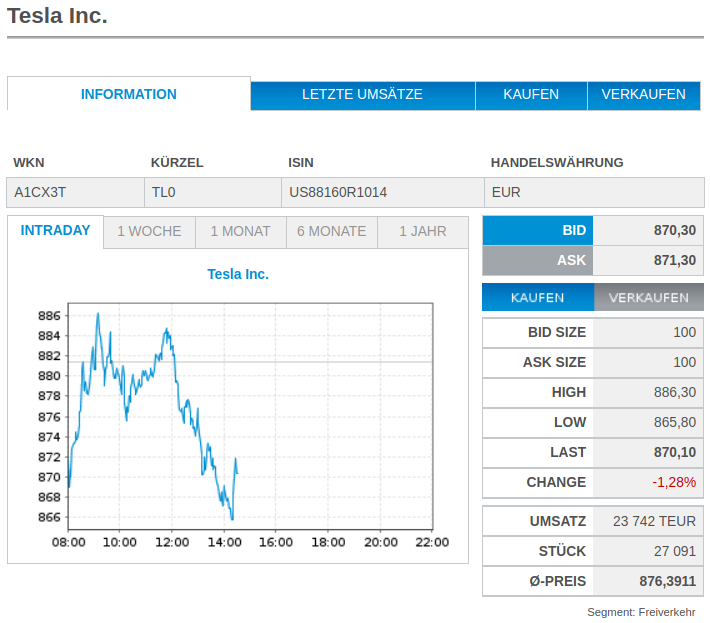

TSLA just traded below 983 USD = 866 EUR in Berlin.

Anybody waiting for 2 * 420 = 840 EUR (953 USD) today?

Anybody waiting for 2 * 420 = 840 EUR (953 USD) today?

Hard to imagine that the FED is hawkish next week. I'm hoping they tell everyone to chill out and we get a relief rally.

www.cnbc.com

www.cnbc.com

IMF chief says Fed rate hike could 'throw cold water' on global recovery

The IMF expects the global economic recovery to continue, Kristalina Georgieva said, but stressed that it was "losing some momentum."

ZachF

Active Member

Hard to imagine that the FED is hawkish next week. I'm hoping they tell everyone to chill out and we get a relief rally.

IMF chief says Fed rate hike could 'throw cold water' on global recovery

The IMF expects the global economic recovery to continue, Kristalina Georgieva said, but stressed that it was "losing some momentum."www.cnbc.com

The problem is that wage growth is now well below inflation, and the economy is inevitably going to stall if the purchasing power of its workers is declining. Stagflation.

The fed printed too much money, and lockdowns made the supply/inflation problem even worse. Now the fed is looking at a large market drop or stagflation.

Knightshade

Well-Known Member

Elon at his best

OT: Just got word my terminal is being shipped. Should be interesting.

I'm not sure using the internet to ask people who don't have internet if they need internet is "at his best"

I love Elon, but there's actually memes about people doing this very thing.

Which is confusing because labor is in huge demand. The FED is in a tough spot, and for some reason (gee I wonder) our government is relying on monetary policy to fix everything. I still believe that most of our price increases are due to lack of supply but it's going to be bumpy either way.The problem is that wage growth is now well below inflation, and the economy is inevitably going to stall if the purchasing power of its workers is declining. Stagflation.

Yeah yeah, but Tonga has already replied.I'm not sure using the internet to ask people who don't have internet if they need internet is "at his best"

I love Elon, but there's actually memes about people doing this very thing.

I propose using ships with dual ground stations to bounce the connection to the nearest backbone.

Edit: because the laser link sat to sat system is not fully functional/ high enough density .

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K