Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The Accountant

Active Member

Welcome to Stock Trends Amateur Hour

I hesitate to post this because there's no technical basis (nor fundamental basis) underlying this analysis.

But since I spent a few minutes on it and there's an interesting price movement, I thought I would share it.

Use this info at your own peril.

Q4 was a "so so" quarter. The more recent quarter where Tesla beat expectations was Q3 (a 17% beat).

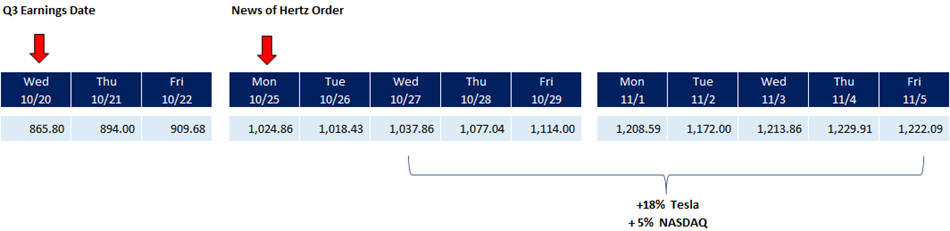

- Tesla reported Q3 earnings on Oct 20 and you can see that even with a 17% beat, the stock moved just slightly to $909 by Fri Oct 22.

- On Monday Oct 25, the 100k Hertz order was revealed and the stock popped to $1,024 but traded sideways for a couple of days to $1.037 on Wed.

- Then with no news it moved to $1,222 over the next 7 trading days. An 18% move while the NASDAQ was up 5%.

- Volume was very high on Nov 1 & 2 (likely a whale scooping up shares).

Perhaps we see a similar delayed response to this Q1 2022 beat.

I hesitate to post this because there's no technical basis (nor fundamental basis) underlying this analysis.

But since I spent a few minutes on it and there's an interesting price movement, I thought I would share it.

Use this info at your own peril.

Q4 was a "so so" quarter. The more recent quarter where Tesla beat expectations was Q3 (a 17% beat).

- Tesla reported Q3 earnings on Oct 20 and you can see that even with a 17% beat, the stock moved just slightly to $909 by Fri Oct 22.

- On Monday Oct 25, the 100k Hertz order was revealed and the stock popped to $1,024 but traded sideways for a couple of days to $1.037 on Wed.

- Then with no news it moved to $1,222 over the next 7 trading days. An 18% move while the NASDAQ was up 5%.

- Volume was very high on Nov 1 & 2 (likely a whale scooping up shares).

Perhaps we see a similar delayed response to this Q1 2022 beat.

The Accountant

Active Member

The media accounts I’ve seen of the Q1 earnings reflect a transformed mindset. The skeptical, uninformed media no longer can ignore the operational and financial success of this company. This media mindset will quickly trickle into the general public. It’s taken far too many years, but our forum’s point of view is now becoming mainstream.

That said, I doubt the media and general public will ever get to the next level of appreciating how vast the opportunity is for Tesla to expand, and so general skepticism over the stock price will be endemic.

Live with it. Profit from it.

Agree.

The new talking point is that although Tesla is very successful and has done a great job, the stock is grossly over-valued and more stock appreciation gains from here are unlikely and perhaps even a drop in share price.

Tesla is entering the 2nd inning but many analysts believe that Tesla is in the 9th inning.

No one’s discussing the fact that Elon may be selling 21M shares to fund the tender offer for Twitter? That would be larger than what he sold a few months ago when exercising his options and paying tax for 2021. Long term it doesn’t matter but would definitely be important for those playing options

Agree.

The new talking point is that although Tesla is very successful and has done a great job, the stock is grossly over-valued and more stock appreciation gains from here are unlikely and perhaps even a drop in share price.

Tesla is entering the 2nd inning but many analysts believe that Tesla is in the 9th inning.

For reference, Salesforce is at a PE of 120 with sustained 25% growth (vs. Tesla's 136 at 50%+ growth), and I haven't heard anybody screaming that it's wildly overvalued.

Artful Dodger

"Neko no me"

Link? Who produces that chart?

EDIT:

Yahoo Finance still has this for TSLA P/E: (Apr 22, 2022 10:00 ET)

| PE Ratio (TTM) | 209.20 |

Last edited:

ZachF

Active Member

For reference, Salesforce is at a PE of 120 with sustained 25% growth (vs. Tesla's 136 at 50%+ growth), and I haven't heard anybody screaming that it's wildly overvalued.

Salesforce is overvalued because their products are garbage though…

Bill Gates supposedly has another massive short on Tesla. Hopefully he’ll lose this one like he did the last.

StealthP3D

Well-Known Member

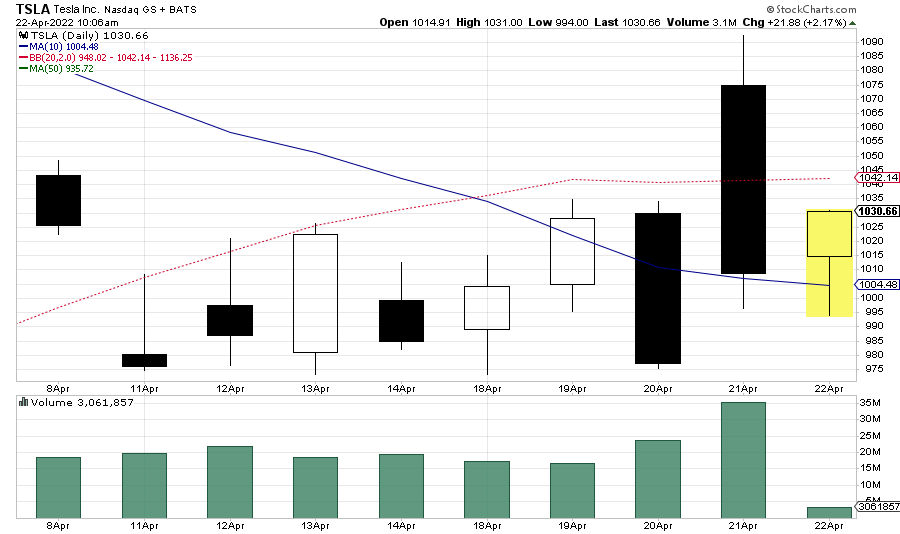

In the past the day Yahoo updates the PE the stock has had a bull run. They have updated the day after earnings or several days after in the past. Let’s see.

I think you assign too much influence on Yahoo Finance. And P/E ratios. Yahoo Finance is a joke and that's not how successful investors value growth stocks, especially ultra-high growth stocks.

Who has enough money to move markets? That's right, successful investors. In other words, any correlation between bull runs and Yahoo Finance updating TSLA's P/E ratio is merely a coincidence.

The Accountant

Active Member

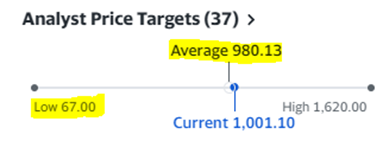

I found it odd that the average TSLA price target on Yahoo was $980 . . . .

. . . . .then I saw that Gordon's $67 PT is taking this average down.

If Yahoo includes Gordon's $67, they should at least include Trip Chowdhry's target of $2,300.

. . . . .then I saw that Gordon's $67 PT is taking this average down.

If Yahoo includes Gordon's $67, they should at least include Trip Chowdhry's target of $2,300.

ZachF

Active Member

I found it odd that the average TSLA price target on Yahoo was $980 . . . .

. . . . .then I saw that Gordon's $67 PT is taking this average down.

If Yahoo includes Gordon's $67, they should at least include Trip Chowdhry's target of $2,300.

View attachment 796387

Gordon thinks a P/E of ~20x just this quarter’s profit is reasonable…not this quarter annualized, just this quarter.

It does not...the editor came up with that headlineI'm sorry to keep posting these CNBC headlines, but this one's just too good.

Don't worry, they clarify that Tesla isn't one of the companies who can't open.....about 80 pages down in the article.

Unreal. Explain to me how this gets past an editor.

View attachment 796325

I think someone with $ just read your post!Welcome to Stock Trends Amateur Hour

I hesitate to post this because there's no technical basis (nor fundamental basis) underlying this analysis.

But since I spent a few minutes on it and there's an interesting price movement, I thought I would share it.

Use this info at your own peril.

Q4 was a "so so" quarter. The more recent quarter where Tesla beat expectations was Q3 (a 17% beat).

- Tesla reported Q3 earnings on Oct 20 and you can see that even with a 17% beat, the stock moved just slightly to $909 by Fri Oct 22.

- On Monday Oct 25, the 100k Hertz order was revealed and the stock popped to $1,024 but traded sideways for a couple of days to $1.037 on Wed.

- Then with no news it moved to $1,222 over the next 7 trading days. An 18% move while the NASDAQ was up 5%.

- Volume was very high on Nov 1 & 2 (likely a whale scooping up shares).

Perhaps we see a similar delayed response to this Q1 2022 beat.

View attachment 796375

Just trying to show what Wall Street thinks an appropriate PE should be for a large cap, 25% growth company.Salesforce is overvalued because their products are garbage though…

Artful Dodger

"Neko no me"

Whale buying this A.M.? TSLA far outperforming other U.S. Tech majors.

...musta bean the S**&Pee not-an-upgrade

EDIT: Can we mock a domestic name?

Cheers!

...musta bean the S**&Pee not-an-upgrade

EDIT: Can we mock a domestic name?

Cheers!

Last edited:

Or they should weight the targets by the star-rating of the "analysts".I found it odd that the average TSLA price target on Yahoo was $980 . . . .

. . . . .then I saw that Gordon's $67 PT is taking this average down.

If Yahoo includes Gordon's $67, they should at least include Trip Chowdhry's target of $2,300.

View attachment 796387

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M