I think if there was another covid lockdown in China, they would be quick to allow closed loop setup. I doubt another lockdown would be as detrimental as the last.Happy July 4th weekend to the Americans amount this forum.

As we head into another quarter, I would caution to keep last quarters events in mind before entertaining scenarios about how this quarter may play out.

Yes hopefully Q3 will be a record quarter for production & delivery, but it only takes one proverbial Covid turd in the punch bowl for us to experience another multi-week Shanghai factory shutdown. Unfortunately China’s success in stamping out covid means Tesla remains exposed to random forced shutdowns in the event of another outbreak. This will come across as rather callous, but from Tesla’s perspective the success of the Shanghai shutdown was almost the worst possible outcome.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

nativewolf

Active Member

This, auto and energy are plenty plenty enough upside to be very bullish. They need to get back to focusing on battery production. It's the key to growing both sides of the business.The auto business by itself is already plenty to be bullish about with Tesla. Stuff like FSD and robot is just for pie in the sky daydreaming. It's nice if/when it happens but I don't need that to be bullish at all.

nativewolf

Active Member

Most posters don't understand just how right you are, Japan inc is indeed borked. The national economy of Japan could be threatened they are so borked.Japan Inc. is so borked…

ZachF

Active Member

Shouldn't Berlin in theory ramp up as fast or faster than Austin in 2023 as Austin will also have to split their focus on new products like the cyber, semi and roadster? Or are all the other advantages of Austin overshadowing this potential slowdown? Or won't the production of the newer models cause a slowdown of the 3/Y ramp up at all?

Austin is a larger facility than Berlin

I’m pretty sure Austin is the tallest of the three too, and it’s getting another 500k square feet.

My brother, who always dismissed EV's and rejected any suggestion to ever consider getting a Tesla when he was car shopping, recently just put a deposit on a Bolt. He said he's tired of paying $150 a week in gas and wants an economical commuter car.

I haven't really paid much attention to prices lately, but he's getting a new Bolt for about $30k and said GM will even pay up to $1k towards the installation of a home charging setup. It's crazy to think that the Bolt used to be a direct competitor to the Model 3, with a similar sticker price and now it's nearly $20k less.

I haven't really paid much attention to prices lately, but he's getting a new Bolt for about $30k and said GM will even pay up to $1k towards the installation of a home charging setup. It's crazy to think that the Bolt used to be a direct competitor to the Model 3, with a similar sticker price and now it's nearly $20k less.

ZachF

Active Member

Happy July 4th weekend to the Americans around this forum.

As we head into another quarter, I would caution to keep last quarters events in mind before entertaining scenarios about how this quarter may play out.

Yes hopefully Q3 will be a record quarter for production & delivery, but it only takes one proverbial Covid turd in the punch bowl for us to experience another multi-week Shanghai factory shutdown. Unfortunately China’s success in stamping out covid means Tesla remains exposed to random forced shutdowns in the event of another outbreak. This will come across as rather callous, but from Tesla’s perspective the success of the Shanghai shutdown was almost the worst possible outcome.

COVID appears to be seasonal, so another Shanghai shutdown, if one were to occur, probably wouldn’t happen until Q1/2 of 2023… however unless China abandons their dumb zero COVID policy I suspect the chance of that happening is probably better than not…

Gigapress

Trying to be less wrong

Batteries are the key to growing the business…in 2023.This, auto and energy are plenty plenty enough upside to be very bullish. They need to get back to focusing on battery production. It's the key to growing both sides of the business.

Tesla has repeatedly said chip supply is the constraint until Q1 ‘23 when 4680s need to be in mass production. In the Q1 call they even said they had an inventory of unused battery cells because they didn’t have enough chips.

Besides, there is no evidence I’m aware of that Tesla lacks focus on the 4680 ramp.

MC3OZ

Active Member

It will be handy to get an update on 4680 cell production in the earnings call.Batteries are the key to growing the business…in 2023.

Tesla has repeatedly said chip supply is the constraint until Q1 ‘23 when 4680s need to be in mass production. In the Q1 call they even said they had an inventory of unused battery cells because they didn’t have enough chips.

Besides, there is no evidence I’m aware of that Tesla lacks focus on the 4680 ramp.

It is highly likely that someone will ask the question.

Last edited:

ZachF

Active Member

jkirkwood001

Active Member

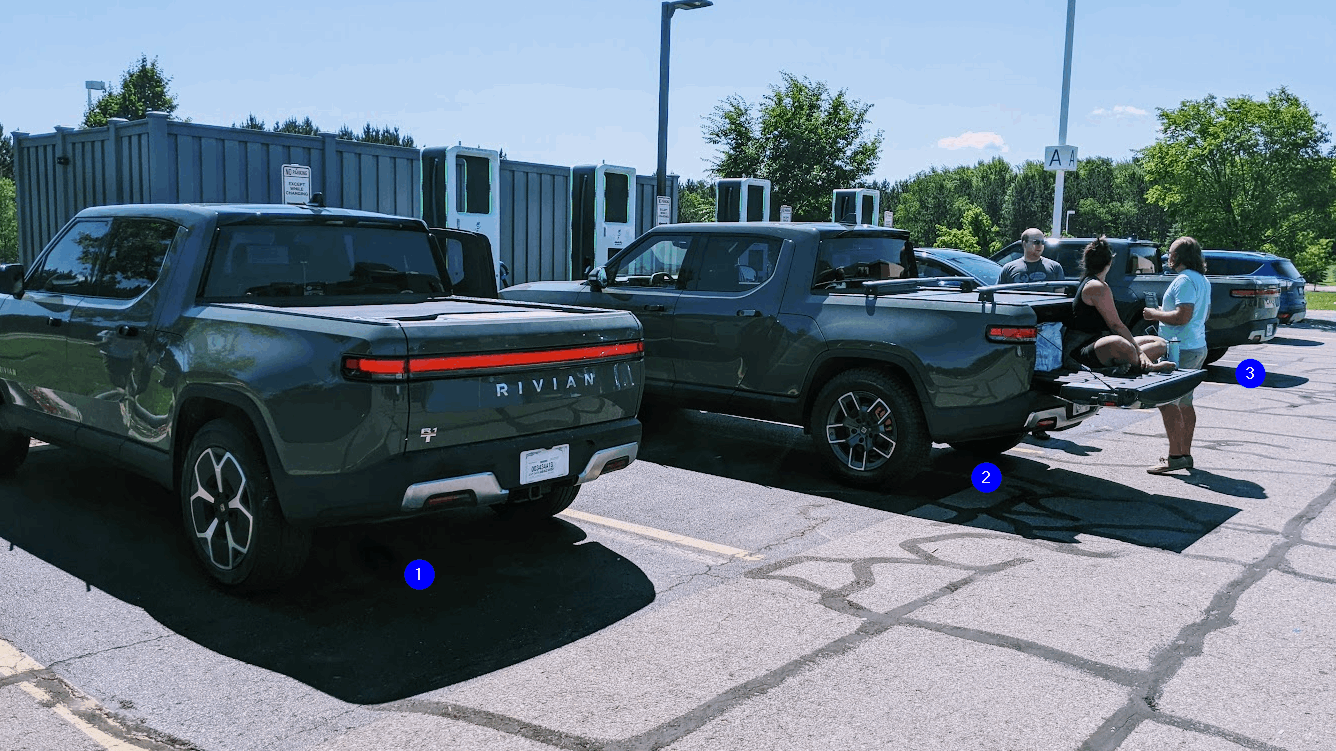

OT What are the chances?? I saw THREE Rivian trucks charging at the Electrify America site besides the Gaylord, MI Supercharger. (We're on a road trip from Ottawa, ON to Chicago and back.)

I was like a kid as - for a change - I had all the questions! The first two below are new buyers, and at far right is the third truck driven by two Rivian employees that I didn't meet. Comments the middle owner gave me:

As someone who cares most about the environment vs. beating other EV manufacturers, I say bring it on, Rivian. That said, I feel like I saw half of their June production in one place!

I was like a kid as - for a change - I had all the questions! The first two below are new buyers, and at far right is the third truck driven by two Rivian employees that I didn't meet. Comments the middle owner gave me:

- "It's exceeded all my expectations"

- "It's totally modern and well thought-out, just like my Model Y"

- "The range is pretty good, and the truck estimates better than my Model Y does, which tends to over-estimate range"

- "Rivian's working on a full kitchen add-in that slides out of the compartment behind the seats"

- "The only thing I'm a bit disappointed in is the automatic trunk cover - see? it's rubbing here, and the motor really grinds, I feel like it's going to break"

- "I like the extra front camera pointing down off the front- there are 11 cameras or something, so their Sentry Mode equivalent is pretty amazing"

- "I bought it because I want to be able to haul stuff from the store, and also to go camping, like we're doing this weekend. We're heading to Markette in UP (Michigan Upper Peninsula, 244 miles). I'm a bit worried as they're no chargers up there!"

As someone who cares most about the environment vs. beating other EV manufacturers, I say bring it on, Rivian. That said, I feel like I saw half of their June production in one place!

Last edited:

Nolimits

Member

What are the probabilities of seeing the 500s with those delivery numbers? I am guessing TSLa should follow macros

Since the number were pretty much on par with that analysts expected.

Gary Black felt that wall street will see the delivery numbers as positive since June was back to normal essentially. WS now Will focus on Q3/4. He thinks it may trade sideways till ER 7/20

Two of many things Elon said on stage at Delivery Day that I clearly remember.@Knightshade has the encyclopedic brain to comment on this for sure, but I thought it was confirmed the new S was cheaper to produce than the old? And S/X were historically higher margin.

Depends on what you mean by “all that high,” I guess.

Edit: just saw @StarFoxisDown! message above. Seems someone else remembers the same.

- Pallidium S is less expensive to build than previous generation.

- No 4680s for S for several years to come.

- No active spoiler (so far)

- No matrix headlights (oops)

- No new tail lights (oops)

StarFoxisDown!

Well-Known Member

I would probably mentally prepare yourself for at least testing the 600 low if the macros don’t hold steady. Any weakness in the macros is probably gonna embolden hedgies to take another stab at dropping TSLA to another leg lower and set a lower low.What are the probabilities of seeing the 500s with those delivery numbers? I am guessing TSLa should follow macros

Since the number were pretty much on par with that analysts expected.

From a technical analysis level, it would be very bearish for the stock to set a new low and unless TSLA comes out with blowout earnings and/or the macros go on a major rally, I think it would probably mean the stock is going to be down in the 500/600’s until late Aug/early Sept

Carl Raymond

Active Member

Most tweets and comments that begin “Tesla should focus on…” can be ignored imho.

100,000 employees. Billions to spend on cap ex. Tesla are focused on a hundred different things, none of which slows the other 99.

Bottlenecks only occur where there’s a conflict, such as right now in Shanghai - a choice between making cars today and making cars at a faster rate next week. Easily resolved with a spreadsheet.

100,000 employees. Billions to spend on cap ex. Tesla are focused on a hundred different things, none of which slows the other 99.

Bottlenecks only occur where there’s a conflict, such as right now in Shanghai - a choice between making cars today and making cars at a faster rate next week. Easily resolved with a spreadsheet.

ZeApelido

Active Member

Austin is a larger facility than Berlin

View attachment 824527View attachment 824528View attachment 824529View attachment 824532

I’m pretty sure Austin is the tallest of the three too, and it’s getting another 500k square feet.

I dunno, my wife has repeatedly reassured me that size doesn’t matter.

We need a "too much information" icon.I dunno, my wife has repeatedly reassured me that size doesn’t matter.

TN Mtn Man

Member

Oops, bad typo/autocorrect!Are you saying that production line employees believed the indecent proposal allegations against Elon and that impacted production line efficiency?

We took a mini vacation this weekend. Three Teslas. Me, Plaid. Wife, MYP. My sister, dad’s older Y. Only about 250 miles total for first two cars and 175 for other.

Both Plaid and MYP charged to 100% just before departure. Y was 30%. Sister’s first time long drive in Tesla.

Her first charging experience. At SuperCharger location in Newport Beach, she went to ChargePoint stall by mistake. Pathetic charging rate, hour later 8% to <50%. She was furious. Was going to cancel her order for a Y.

On way back, we all charged at proper Destination Charger in Irvine (though she again pulled up to a non/Tesla Charger initially). First time charging for this trip for both me and wife. I was at 60%, wife at 30%, and sis well below that.

I charged 30kwh. Wife, 43kwh. Don’t have figures for the Y.

She was impressed by the community atmosphere (I was helping and chatting with a new Plaid owner), the dedicated space, and the rate of her charge. I told her this was the slowest that Tesla had.

Super Charger network a Tesla differentiator still? Damn right.

[Edit. Correction in red. It was not an EVGo stall but a ChargePoint one.]

Both Plaid and MYP charged to 100% just before departure. Y was 30%. Sister’s first time long drive in Tesla.

Her first charging experience. At SuperCharger location in Newport Beach, she went to ChargePoint stall by mistake. Pathetic charging rate, hour later 8% to <50%. She was furious. Was going to cancel her order for a Y.

On way back, we all charged at proper Destination Charger in Irvine (though she again pulled up to a non/Tesla Charger initially). First time charging for this trip for both me and wife. I was at 60%, wife at 30%, and sis well below that.

I charged 30kwh. Wife, 43kwh. Don’t have figures for the Y.

She was impressed by the community atmosphere (I was helping and chatting with a new Plaid owner), the dedicated space, and the rate of her charge. I told her this was the slowest that Tesla had.

Super Charger network a Tesla differentiator still? Damn right.

[Edit. Correction in red. It was not an EVGo stall but a ChargePoint one.]

Last edited:

That is a very logical expectation.What are the probabilities of seeing the 500s with those delivery numbers? I am guessing TSLa should follow macros

Since the number were pretty much on par with that analysts expected.

Unfortunately, the market rarely follows logic...

So I am bracing for impact anyway.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K