There’s a dangerous tendency on this forum for any questioning of demand to be treated as a thought crime.

Firstly, in regard to Model S/X demand no such thing happened - here's my prediction of 12k-15k Model S/X deliveries back on January 25:

So yes, falling S/X demand in Q1'19 was entirely predictable and

@luvb2b predicted it a number of times.

If the 100D/P100D variants remain the only options for the rest of the quarter, and if China new orders do not make up for the shortfall,

then I'd expect Q1 S/X deliveries to be as low as 12-15k units - 55-75% of the 22k deliveries in Q1'2018. That could hit revenue in the $500-$700m range, cash flow in the $150m-$200m range and profits in the $50m-$75m range - assuming that the remaining units sold are high margin, high-trim variants.

I believe the resulting revenue shortfall can be balanced with more Model 3 deliveries at higher ASP, but this requires good execution of cross-continent logistics.

As it happened Tesla didn't introduce a new battery pack beyond the 100D pack and didn't introduce any S/X refresh - they probably

knew the demand cliff is too large and wanted those measures to benefit Q2 instead. Cross-continent logistics wasn't entirely hick-up free either.

Deliveries of 12.1k were at the low end of the 12k-15k range I gave.

(Alas my revenue and cash flow shortfall estimates were optimistic:

@Doggydogworld's and

@luvb2b's latest should be believed instead.)

@neroden has posted his demand model too, predicting a similar Q1 outcome for S/X deliveries.

But in terms of Model 3 demand in the U.S. I mostly agree with you: I have to plead guilty jumping on people who questioned Model 3 demand in the U.S. in good faith. (In my defense most of the time it was not presented in good faith, but by the well known concern trolls who cried wolf in Q2, Q3, Q4 and Q1, until the wolf finally came.)

With all that out of the way, I disagree how you are characterizing what happened in Q1, not because it's a "thought crime", but because I think it's commingling temporary and permanent trends of demand:

Saying demand is peaking doesn’t mean there’s no more demand. It means that overall across all markets there may be limited growth potential in demand for premium M3s. The first differential is approaching zero if you prefer.

I disagree with the "peak" characterization, mainly because it is missing the sophisticated, multi-component nature of Tesla demand:

- There's "pent-up demand": delayed demand from past quarters - customers who couldn't buy a Tesla for one reason or another, such as Tesla not selling to them. This group is substantial in size and can be considered a 'piggy bank' of billions of dollars that Tesla can unlock whenever they decide to.

- There's "deferred demand": delayed demand from past quarters where customers voluntarily defer buying a Tesla:

- due to rising economic uncertainty,

- bad weather and slippery roads with higher risks of fender-benders,

- or waiting for a refresh or free HW3.

- There's "externally triggered pull forward demand": accelerated demand from future quarters where customers accelerate their purchase for various externalities not influenced by Tesla:

- such as a tax credit expiring,

- or a business year ending to account a new corporate car as expense against profits and reduce tax obligations.

- There's "internally triggered pull forward demand": accelerated demand from future quarters where customers accelerate their purchase for reasons influenced by Tesla, also called 'demand levers':

- Price reductions,

- early lease termination offers,

- OTA update that implements a particularly epic feature that pushes someone over the fence,

- introduction of a refresh, new battery packs,

- phasing out an older battery pack or other options, etc.

- And finally, there's the steady stream of "base-load or organic demand" of people having to buy a car:

- New or growing family members make the old car too small.

- Improving family financials allow a better car.

- Relocation from one coast to another makes the transportation of the old car uneconomical.

- Old car breaks down and repairs are not economical anymore.

- ~3 year lease is expiring.

Firstly, let's note that Q1 deliveries were a

sum of all these five main factors of demand, where the non-organic demand is

consumed from next quarter's organic demand in a one-time shift of demand.

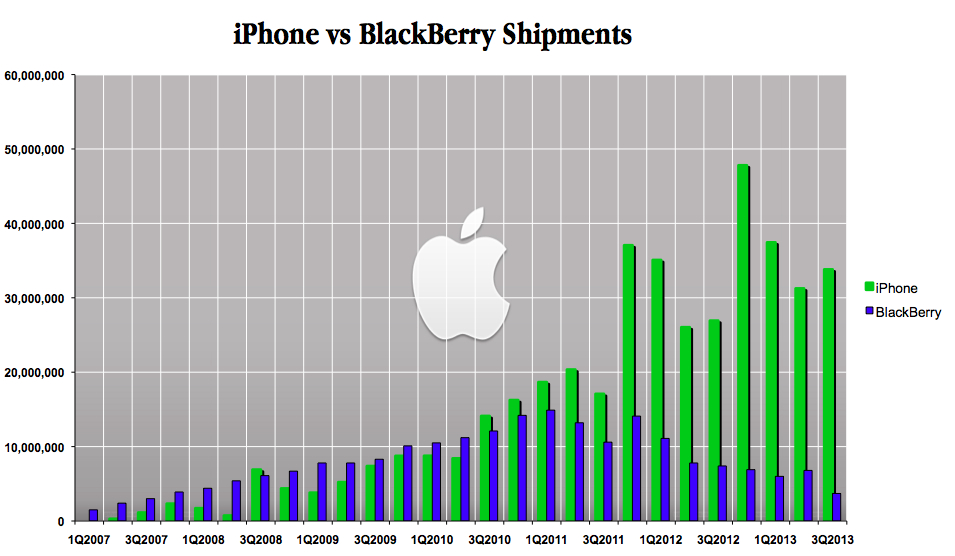

Such fluctuations happen with every product, for example when the iPhone was still growing and Apple wasn't a trillion dollar company yet. Here's the excellent chart

@Do It posted:

Look at the two blockbuster quarters around Q1'2012, and the drop after that. Had you decided that iPhone sales 'peaked' and demand was not sustainable above 20 million unit shipment levels just based on a one-dimensional metric of sum of sales in a quarter, you'd have missed out on a 300%-400% upside in the next 5 years.

Secondly, let's realize how brutal the various temporary demand shifting and organic demand consuming factors were in Q1:

- Tesla stopped making the most popular S/X model that was 50% of all deliveries, the 75D altogether in Q1 and it was removed from the configurator. This redirected half of the potential Model S/X sales either to the Model 3, to other carmakers, or put them into 'deferred demand' group who might buy in future quarters. While 75D was available in inventory in a number of places and some units are still available, it wasn't well advertised and many people would only buy what is in the configurator.

- U.S. economic uncertainty was at a peak in late January: the record long government shutdown, China trade war, NASDAQ crash of 30%, worsening housing market numbers together with the 'polar vortex' chilled the U.S. car market to a fair degree. The SEC suing Tesla on February 25 created additional Tesla specific uncertainty.

- Tesla pulled a number of Model 3 demand levers but didn't pull many S/X demand levers other than the price drops - which are a two edged sword as many people will suspect not a genuine deal but an imminent major refresh.

- The $7,500 tax cliff was probably very significant pull-forward force in Q4, which consumed Q1 organic demand. Tesla also pulled some S/X demand levers in Q3 and Q4, such as early lease terminations, which consumed Q1 organic demand.

@neroden's demand model expects a bounce-back in S/X organic demand in April-May. Model 3 demand, while much lower than us the bullish estimates I gave, was actually pretty OK in comparison to Q4 and should bounce back in Q2, with the additional pull-forward factor of the $3,750 tax credit ending on June 30.

So yes, Q2 could be a record Model 3 quarter and a healthier S/X quarter with deliveries back into the 20k ± 2k historic Q2 deliveries range.

Finally, let's note that the ceiling for Tesla's organic demand is

huge, it's much farther away than Apple was from the ceiling of the premium smartphone market back in 2012:

- There's over 100,000 car purchases over $35k ASPs in the U.S. alone, every single week.

- There's over 100,000 similar car purchases in the EU as well over €35k, every single week.

- There's over 100,000 such purchases in China as well, every single week.

Even 10,000/week would only be scratching the surface of global automotive organic demand in the price range and form factors that Tesla is offering.

There's various indicators that the Model 3 "organic demand" baseline is growing - not the least that it's spring and summer in Europe now, the strongest two seasons for new model sales in Europe.