Featsbeyond50

Active Member

How long before this thing can put together a Power Point presentation?I wouldn't ignore all analysts.

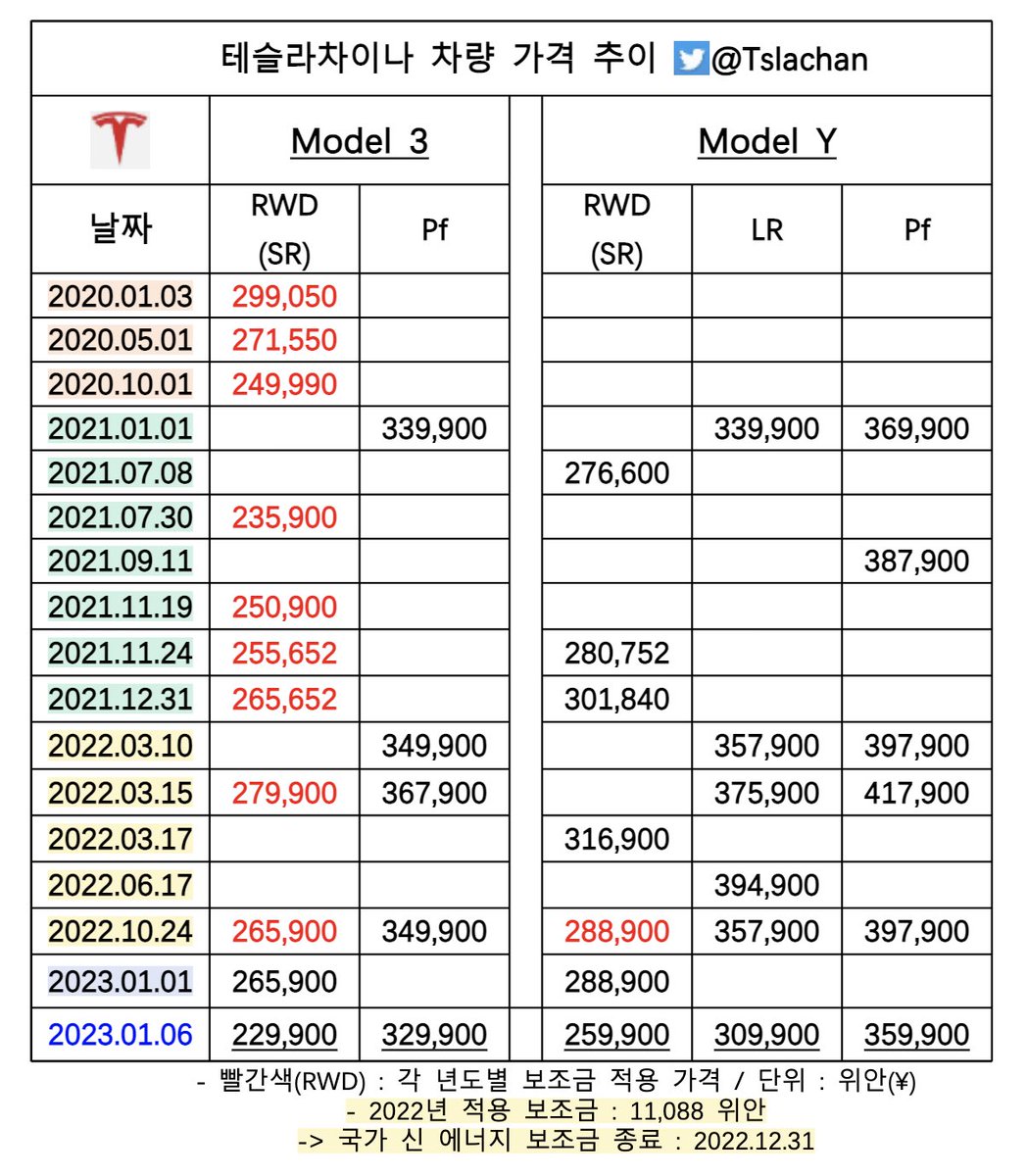

View attachment 892724

Asking for a friend.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

How long before this thing can put together a Power Point presentation?I wouldn't ignore all analysts.

View attachment 892724

I just wish Tesla markets the ecosystem further. When buying any Tesla, an option for their smallest PV panel should pop up asking if they want to add the option for 8k which provides energy for the car for life.One thing is for certain, Tesla will not compete in a commoditised market. Look for Tesla to reinvent and integrate the power wall into a more complete eco system. Now, solar roof, grid and cars. In the mid term future, perhaps a home hvac. And in the far future, the Tesla bot.

His investing isn't going to change any of that. Seems like a smart hedge to me.Buffett owns a lot of car dealerships too.

There's a reason he hasn't invested in Tesla. They're success degrades a lot of his businesses: Oil, insurance, car dealerships, utilities, even trains (autonomous Semis). Literally the opposite of Tesla.

"Insanely low" is a matter of perspective. I'll take my $0.01/kWh Super Off-Peak, thankyouverymuchBut, that super off-peak is super low for CA utility. My “favorable” TOU rate may not be as high as SDGE at $0.58/kWh, but my super off-peak rate is $0.27/kWh. Give and take. I’d rather have that insanely low off-peak rate to charge the car and batteries.

Might bother me if I had natural gas, but my house is all electric. If I had rates like you guys out there, I'd be in trouble.I know we’re talking about electricity prices and aware that rates on that side of the country is low. But, on the flip side, your guys’ gas prices is about double the gas rate on the West.

EV charging stations alone will provide a lot of growth for the energy storage market. When you have a charging location with 20, 30, 50 stalls the energy demand gets very high very fast. On top of that you have the opportunity to fill the packs from during off-peak times. Some of the larger demand rates don't have as much differentiation for off vs on peak so that may or may not apply depending on the utility and tariff that the network is receiving, but then your total demand is greater so you save on that end.Why is there so much hoopla about energy storage? Predicting what is going to happen is futile while all suppliers will be selling everything they can make for like a decade regardless of price. Energy is like an endless TAM. I don't even understand why anyone is predicting doom for Tesla energy when we are at like 0.0001% replacement during this transition.

The true competition is the cost of solar+storage vs current plants+natural gas.

electrek.co

electrek.co

"Insanely low" is a matter of perspective. I'll take my $0.01/kWh Super Off-Peak, thankyouverymuch

14:53 spike that hardly moved the price up at all, actually it fell after that

View attachment 892695

Try living in your mom's basement. 0 cents per kWh off or on peak!EV charging stations alone will provide a lot of growth for the energy storage market. When you have a charging location with 20, 30, 50 stalls the energy demand gets very high very fast. On top of that you have the opportunity to fill the packs from during off-peak times. Some of the larger demand rates don't have as much differentiation for off vs on peak so that may or may not apply depending on the utility and tariff that the network is receiving, but then your total demand is greater so you save on that end.

Even the competition needs them.

Electrify America has now deployed Tesla Powerpacks at over 140 charging stations

Electrify America announced that it has now deployed over 30 MW of battery capacity using Tesla Powerpacks at over 140...electrek.co

That's crazy low! I thought my 4 cent super off peak was cheap.

That’d make no sense. The wash sale rule is needed to prevent investors from realizing losses for tax purposes without those investors taking real risk. E.g. a TSLA investor sells shares at a 50% loss then immediately buys them back.On that note, can anyone confirm that the IRS 30-day Wash Rule precludes buying more shares, even in retirement accounts, if you had sold shares in a "trading account" within the last 30 days? That's what my research suggests so I have to sit on my hands for another few weeks, which is painful.

I sure as heck didn't want to sell as these were shares purchased around a decade ago, but had no choice (at ~$151, thankfully) after feeding the margin monster for oh so many months . . . .

Can't afford to risk any more damage from the IRS if I buy back in too early!

If this market continues like this...Try living in your mom's basement. 0 cents per kWh off or on peak!

@Ogre and others, rather than employing the thumbs down, I'll reply: Some of our best posters over the years have written in depth and with an authority based on experience, as our friend Petit Bateau has. We are lucky to have him contributing to our forum. Your words "long winded" and "authoritative sounding" are uncollegial and dismissive. There is no reason to be so, and the tone you employ is not welcome on this forum.I think the point has been made long since myself. Nothing @petit_bateau has said makes me worry about whether Tesla Energy can sell every thing they make. He won’t even talk about that. As has been said before, the energy storage market is absolutely massive and deep. There is plenty of room for Chinese companies to fill niches while Tesla focuses on their assessable markets. Neither are likely to run out of low hanging fruit for a decade or more.

I thought I was clear I was talking about the whole discussion, not just one half of it.

Just because a person is long winded and authoritative sounding doesn’t mean we have to keep going deeper and deeper down a rabbit hole of obscurity and irrelevance.

I am not going to go back and look at all the post's, but there has been plenty of "uncollegial and dismissive" terms used by him as well.Your words "long winded" and "authoritative sounding" are uncollegial and dismissive.

This whole area of hedging is very interesting to speculate on.His investing isn't going to change any of that. Seems like a smart hedge to me.

It comes into play if you buy the same stock in a regular account and tax free account, you can't sell for a loss in one and buy under 30 days in the other trying to avoid the wash rule. At least that's my understanding.That’d make no sense. The wash sale rule is needed to prevent investors from realizing losses for tax purposes without those investors taking real risk. E.g. a TSLA investor sells shares at a 50% loss then immediately buys them back.

Since losses within pension accounts do nothing to reduce tax exposure there would be no reason for the existence of the wash sale rule for them.