Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

Wasn´t aware of this, 25k car anyone?

The South extention to Giga Texas main building was discussed by Elon about two years ago. Joe Tegtmeyer posted the civic planning permits on twitter shortly after Tesla filed the application with Austin city development board. All this long predates the decision to begin initial production at Giga Texas, which according to Walter Isaacson, was reached in late May 2023. BTW, the South Extention is almost certainly an Office buidling. Note also the new multi-floor parking structure being built simultaneously on the SE side of the main building (closest to the new office bldg).

Todd Burch

14-Year Member

No he doesn’t. You mischaracterize Elon. Refer to (I think) the Lex Fridman podcast from just a few days ago, where he specifically talks about his perspective on rules.The irony is that Elon thinks rules are dumb...yet, at times, he too is the bringer of dumb rules. So the most likely outcome is the most ironic one, I forget who said that but...

He believes many rules are necessary, but also thinks it’s imporrant to minimize how much they get in the way of innovation.

After all, he is the one lobbying for governments to establish a governing set of rules to ensure that AI is developed safely.

The South extention to Giga Texas main building was discussed by Elon about two years ago.

Yep. Tesla said they were gonna expand south end by almost 500,000 sq feet even before the building perimeter was completed. I couldn't figure out why they poured such a thick heavily reinforced slab there just to use it as a staging lot initially. They ended up saw cutting sections and removing them whole rather than crush and dig out rubble, after a day or two of very slow progress. That must be some particularly spongy soil there.

phoggy123

Member

The biggest loser with this caveat is Munro. I suppose if they were willing to fork over the 50K along with a steep fee someone might give it to them. It would be really awesome if Tesla sold them one of the first ones, but I assume they want it to stay out of their hands for a few months to keep working kinks out.This is unusual. Tesla has a clause in the Cybertruck purchase that you can't resell it to a third party within a year or face a potential $50K lawsuit from Tesla. Tesla has the right of first refusal to repurchase it from buyer.

Artful Dodger

"Neko no me"

The biggest loser with this caveat is Munro. I suppose if they were willing to fork over the 50K along with a steep fee someone might give it to them.

Agreed. I find it interesting that Tesla did not include a "no reverse engineering" clause in their (leaked) sales contract (if its authentic). This is common with software products from other tech. companies, and should probably be included with ALL Tesla cars that include Autopilot/FSD technology.

I guess this can only be policed if the official ownership changes - so if Munro wanted to get a CT from someone then that person could charge $100k "consultancy fee" and lend the truck for free?The biggest loser with this caveat is Munro. I suppose if they were willing to fork over the 50K along with a steep fee someone might give it to them. It would be really awesome if Tesla sold them one of the first ones, but I assume they want it to stay out of their hands for a few months to keep working kinks out.

Krugerrand

Meow

People. There’s no need to discuss this to death. It’ll be a limited time frame clause until vehicles are coming off the line like clockwork. Tesla not wanting people to financially benefit at the beginning of the line isn’t a big deal, it’s actually very thoughtful on Tesla’s part and it wouldn’t need to happen if some of us humans weren’t crooks looking to make an easy buck.

The wait has been long, the line up long for this vehicle. It’s not fair that a few people who don’t actually want the vehicle get to make out like bandits because they were able to put their deposit down quicker than thousands of others. Tesla is simply telling those thieves, not so fast.

The wait has been long, the line up long for this vehicle. It’s not fair that a few people who don’t actually want the vehicle get to make out like bandits because they were able to put their deposit down quicker than thousands of others. Tesla is simply telling those thieves, not so fast.

That clause for the Cybertruck is interesting mostly because similar clauses have been around for a while but only for very limited-run productions, people are drawing parallels to John Cena and the Ford GT but that GT was limited to 1000 units worldwide, that was the entire production run. With the EV Hummer, well we all know to poke fun at the 2 that sell per quarter.

People up in arms over this might be aghast at what is required to get allocations for high-demand models/trims from companies like Ferrari or even Porsche these days with the GT3 or GT4 RS, and then be told you need to pay insane amounts above MSRP.

People up in arms over this might be aghast at what is required to get allocations for high-demand models/trims from companies like Ferrari or even Porsche these days with the GT3 or GT4 RS, and then be told you need to pay insane amounts above MSRP.

Perhaps we might also consider that:Total addressable market is the total annual sales of all cars in the vehicle categories, which would expand into the truck and lower priced segments.

Tesla's share of that market has way more room for growth than the TAM increase.

From Wikipedia:

View attachment 989919

1. the Total Available market assumes status quo. What happens if the EV proportion expands the total market. In effect, making the market expand by lowering present fleet age. Similar things have happened in many other markets when technological advances engendered more rapid replacement cycles. Rotary dial vs touch dial phones, internet vs land line, turbojet vs piston aircraft;

2. Served Available Market also presents serious definitional problems. Does New York State count as served when limited to five stores? Does Texas count when prohibited from conventional direct sales? Such calculations always demand very careful definitions;

3. Target Market has the same definitional issues as do the other two.

After having done hundreds of such analyses on behalf of clients in many industries, my view is that these charts are irresistible. Frankly I have used them over and over, despite the problems. They, by their very convenience invariably understate the potential of really new products or overstate the potential for revolutionary solutions. One or the other happens…

In the TSLA investor context we must have clear understand of which category we are facing.

Later today I will show my assessment of Total Available Market for TSLA in presently served categories, Tesla Energy Peaker Replacement and Passenger Cars.

I will exclude Optimus, energy sales, FSD, subscriptions, etc. Not because those are ‘de minimus’ or likely to remain so, but because those do not fit a replacement market typology.

Hint: There is a reason why Elon says TE will probably be larger than cars. That is both obvious and easily quantifiable.

Hint #2: When Tesla invented Superchargers it was explicit recognition that charging infrastructure is THE LIMITING FACTOR in EV adoption. Hence Hint #1 stands as a gigantic impediment to mass conversion to EV.

I suppose Munro could work out a deal where the Cybertruck owner agrees to a teardown in exchange for a cut of the revenue from YouTube and engineering reports. I don't think Tesla could stop that from happening.The biggest loser with this caveat is Munro. I suppose if they were willing to fork over the 50K along with a steep fee someone might give it to them. It would be really awesome if Tesla sold them one of the first ones, but I assume they want it to stay out of their hands for a few months to keep working kinks out.

I think the difference there might be that software is typically licensed and not owned. Since the Cybertruck is owned it is harder to restrict what the owner can do with it.Agreed. I find it interesting that Tesla did not include a "no reverse engineering" clause in their (leaked) sales contract (if its authentic). This is common with software products from other tech. companies, and should probably be included with ALL Tesla cars that include Autopilot/FSD technology.

Tesla might be able to get away with some sort of "no reverse engineering" clause for the licensed FSD software but it would be harder for the car itself.

As for restricting the sale for one year, Tesla is able to do this with the "right of first refusal" clause. This kind of thing is common and has apparently been upheld by the courts.

Disclaimer: I'm not a lawyer, but it's sometimes fun to try to think like one.

I guess you can 'gift' it to someone and have that person 'loan' you the 'agreed gifted amount'People. There’s no need to discuss this to death. It’ll be a limited time frame clause until vehicles are coming off the line like clockwork. Tesla not wanting people to financially benefit at the beginning of the line isn’t a big deal, it’s actually very thoughtful on Tesla’s part and it wouldn’t need to happen if some of us humans weren’t crooks looking to make an easy buck.

The wait has been long, the line up long for this vehicle. It’s not fair that a few people who don’t actually want the vehicle get to make out like bandits because they were able to put their deposit down quicker than thousands of others. Tesla is simply telling those thieves, not so fast.

Perhaps we might also consider that:

1. the Total Available market assumes status quo. What happens if the EV proportion expands the total market. In effect, making the market expand by lowering present fleet age. Similar things have happened in many other markets when technological advances engendered more rapid replacement cycles. Rotary dial vs touch dial phones, internet vs land line, turbojet vs piston aircraft;

2. Served Available Market also presents serious definitional problems. Does New York State count as served when limited to five stores? Does Texas count when prohibited from conventional direct sales? Such calculations always demand very careful definitions;

3. Target Market has the same definitional issues as do the other two.

After having done hundreds of such analyses on behalf of clients in many industries, my view is that these charts are irresistible. Frankly I have used them over and over, despite the problems. They, by their very convenience invariably understate the potential of really new products or overstate the potential for revolutionary solutions. One or the other happens…

In the TSLA investor context we must have clear understand of which category we are facing.

Later today I will show my assessment of Total Available Market for TSLA in presently served categories, Tesla Energy Peaker Replacement and Passenger Cars.

I will exclude Optimus, energy sales, FSD, subscriptions, etc. Not because those are ‘de minimus’ or likely to remain so, but because those do not fit a replacement market typology.

Hint: There is a reason why Elon says TE will probably be larger than cars. That is both obvious and easily quantifiable.

Hint #2: When Tesla invented Superchargers it was explicit recognition that charging infrastructure is THE LIMITING FACTOR in EV adoption. Hence Hint #1 stands as a gigantic impediment to mass conversion to EV.

As the two attached files show, the expectations are for weaker plower plants to grow substantially during the next few years. According to the International Energy Agency there were roughly 1800 GW of peaked plants worldwide in 2019. The growth alone will be in excess of 50GW per year, but the replacements for obsolete plants are likely to be about three times that size.

The peaker plant lead time for a battery storage solution is less than half that of the next fastest turbine installation and much cheaper. Further the battery storage solution can and does act as near-instantaneous grid services solutions to stabilize both frequency and voltage, something no other solution can accomplish. That, in turn, reduces power outages and maintenance requirements for other infrastructure, whether state-of-the-art or decrepit. (For copies documentation just search for Hornsdale Power Reserve, which acts as a Tesla Energy reference.

So, now that even the traditional peaker plant /utility/grid services providers are moving into this field.

How much can Tesla penetrate this business? Bluntly the answer is how much can Tesla supply? Tesla is expanding Lathrop and negotiating for other factories and battery supplies to build more Megapacks and increase the capacity of present ones. The recent quarterly reports show a >20% margin, quite remarkable.

I expect this business to grow by an average of 40% PA with stable >20% margins for the next several years, with Tesla market share never exceeding 20%. Why? Simply, the traditional solutions are becoming more expensive, less reliable and far less effective than are battery storage facilities. More importantly, hydroelectric is becoming less stable due to climate change (search for Itaipu and Three Gorges for two dramatic cases in point) natural gas supplies are becoming more volatile, and energy demands become more unstable due to growth in air conditioning and other factors. Those all suggest that weaker requirements will grow even faster than the forecasts.

Since InsideEVs has made a handy little chart it's easy to see what happens when Tesla makes a deal with CATL for battery supply. Now just imagine what will happen as all those battery plants come into production and it's easy to imagine that Elon is quite correct it seeing a BESS (Battery Energy Storage System) future growth that is nearly limitless, even aided by the many other entrants.

Just for context, the competitors are less the traditional utility system providers than they are Chinese entrants, aided by State Grid, CATL and others which have been responsible for building and operating the only major national grid that is truly modern. Such are the benefits of coming from no grid at all to a completely new one.

Perhaps oddly, Tesla probably benefits from success in dealing with China and Chinese companies when thinking of near-global grid support needs.

Attachments

Last edited:

Skryll

Active Member

All this could be avoided by using an auction model for the first batch to allow initial price finding by supply and demand.That clause for the Cybertruck is interesting mostly because similar clauses have been around for a while but only for very limited-run productions, people are drawing parallels to John Cena and the Ford GT but that GT was limited to 1000 units worldwide, that was the entire production run. With the EV Hummer, well we all know to poke fun at the 2 that sell per quarter.

People up in arms over this might be aghast at what is required to get allocations for high-demand models/trims from companies like Ferrari or even Porsche these days with the GT3 or GT4 RS, and then be told you need to pay insane amounts above MSRP.

Rivian should have done that rather than a hard reprice suddenly

Munro will just start a goFundMe with x'tra 50K needsI think the difference there might be that software is typically licensed and not owned. Since the Cybertruck is owned it is harder to restrict what the owner can do with it.

Tesla might be able to get away with some sort of "no reverse engineering" clause for the licensed FSD software but it would be harder for the car itself.

As for restricting the sale for one year, Tesla is able to do this with the "right of first refusal" clause. This kind of thing is common and has apparently been upheld by the courts.

Disclaimer: I'm not a lawyer, but it's sometimes fun to try to think like one.

teardown ... each part will be sold off for 1.5 times prior price,

then blue prints will also be made available for all Tesla competitors (esp in China) .... and all Tsla fanbois (us) will still be cheering on this move

Dude, edit those typos. Took me a while to understand “weaker plower plants”View attachment 990097

As the two attached files show, the expectations are for weaker plower plants to grow substantially during the next few years. According to the International Energy Agency there were roughly 1800 GW of peaked plants worldwide in 2019. The growth alone will be in excess of 50GW per year, but the replacements for obsolete plants are likely to be about three times that size.

The peaker plant lead time for a battery storage solution is less than half that of the next fastest turbine installation and much cheaper. Further the battery storage solution can and does act as near-instantaneous grid services solutions to stabilize both frequency and voltage, something no other solution can accomplish. That, in turn, reduces power outages and maintenance requirements for other infrastructure, whether state-of-the-art or decrepit. (For copies documentation just search for Hornsdale Power Reserve, which acts as a Tesla Energy reference.

So, now that even the traditional peaker plant /utility/grid services providers are moving into this field.

How much can Tesla penetrate this business? Bluntly the answer is how much can Tesla supply? Tesla is expanding Lathrop and negotiating for other factories and battery supplies to build more Megabucks and increase the capacity of present ones. The recent quarterly reports show a >20% margin, quite remarkable.

I expect this business to grow by an average of 40% PA with stable >20% margins for the next several years, with Tesla market share never exceeding 20%. Why? Simply, the traditional solutions are becoming more expensive, less reliable and far less effective than are battery storage facilities. More importantly, hydroelectric is becoming less stable due to climate change (search for Itaipu and Three Gorges for two dramatic cases in point) natural gas supplies are becoming more volatile, and energy demands become more unstable due to growth in air conditioning and other factors. Those all suggest that weaker requirements will grow even faster than the forecasts.

View attachment 990108

Since InsideEVs has made a handy little chart it's easy to see what happens when Tesla makes a deal with CATL for battery supply. Now just imagine what will happen as all those battery plants come into production and it's easy to imagine that Elon is quite correct it seeing a BESS (Battery Energy Storage System) future growth that is nearly limitless, even aided by the many other entrants.

Just for context, the competitors are less the traditional utility system providers than they are Chinese entrants, aided by State Grid, CATL and others which have been responsible for building and operating the only major national grid that is truly modern. Such are the benefits of coming from no grid at all to a completely new one.

Perhaps oddly, Tesla probably benefits from success in dealing with China and Chinese companies when thinking of near-global grid support needs.

Ron Baron expects SpaceX to conduct an IPO for StarLink within 4 yrs (by 2027). He says SpaceX is currently valued at $150B privately, and expects it to be worth $250B to $300B by the Starlink IPO, and $500B by 2030. At (2:25) into this clip, Ron says Morgan Stanley and Goldman Sachs estimate the TAM for StarLink services at $1.2T annually:

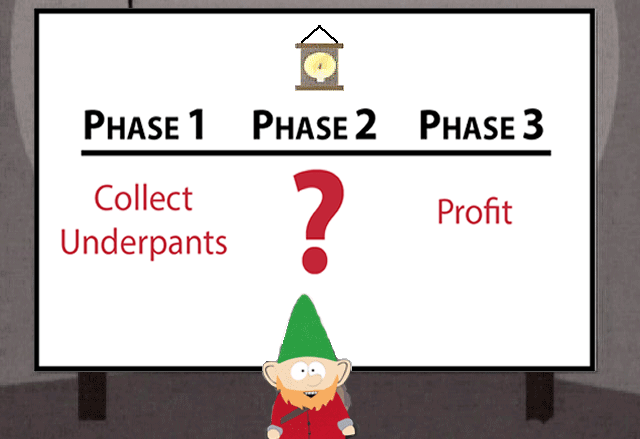

Here's the fun part:

- Elon owns roughly half of SpaceX shares. The StarLink IPO could easily raise $500B (if valued at 20x Fwd PE), giving Elon access to roughly $250B in cash (or equity to support borrowing power)

- Elon has to execute his 2018 Tesla CEO stock options no later than April 2028 (Plan approved by the Tesla BoD and passed by a vote of shareholders at the 2018 AGM)

- Due to their ballooning value, these stock options will cost ~$200B+ to execute (paging @mongo for the Executive Summary)

- Tesla short-sellers extracted > 10x the value in TSLA Market Cap last time Elon sold shares to finance executing his 2012 CEO Comp. package

- the threat is that shortzes will again gang-tackle TSLA when Elon inevitably executes his 2018 CEO Comp package (which must be done within 4.5 yrs)

- What if Elon has cash in hand instead from a 2027 Starlink IPO and doesn't need to sell any TSLA shares to execute his stock options?

- Profit. (jus' sayin')

(after hours, so just a little fun)

cliff harris

Member

18 days now until cybertruck delivery day. What are people's latest thoughts on announcement of pricing etc?

I cannot imagine them delivering < 100 trucks on the day now. They are frankly making too many of them otherwise, and they will start to get in the way!, sure they might ship some to showrooms around the US, but how many? 100?

Are we assuming that everyone who gets one on the 30th is an employee, and thus covered by NDA regarding pricing? I guess this is possible, given how many employees are at gigatexas, and would allow Tesla to announce pricing to the public on the same day... Do we know how many model Ys were sold to employees on the first day? or model 3's?

I cannot imagine them delivering < 100 trucks on the day now. They are frankly making too many of them otherwise, and they will start to get in the way!, sure they might ship some to showrooms around the US, but how many? 100?

Are we assuming that everyone who gets one on the 30th is an employee, and thus covered by NDA regarding pricing? I guess this is possible, given how many employees are at gigatexas, and would allow Tesla to announce pricing to the public on the same day... Do we know how many model Ys were sold to employees on the first day? or model 3's?

Given the existing orders, there is not much to be gained by new orders but …18 days now until cybertruck delivery day. What are people's latest thoughts on announcement of pricing etc?

I cannot imagine them delivering < 100 trucks on the day now. They are frankly making too many of them otherwise, and they will start to get in the way!, sure they might ship some to showrooms around the US, but how many? 100?

Are we assuming that everyone who gets one on the 30th is an employee, and thus covered by NDA regarding pricing? I guess this is possible, given how many employees are at gigatexas, and would allow Tesla to announce pricing to the public on the same day... Do we know how many model Ys were sold to employees on the first day? or model 3's? Th

Taking 5% of production and allocating it as twofer orders where buying a model Y gets a fresh place in line for a Twofer CT. This could be used to smooth over transitions to refreshed lines of 3 and Y or whatever.

As for pricing, I am expecting a $7k bump over original announcement. The surprise will be the number of accessories which will sweeten the margins. YMMV

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K