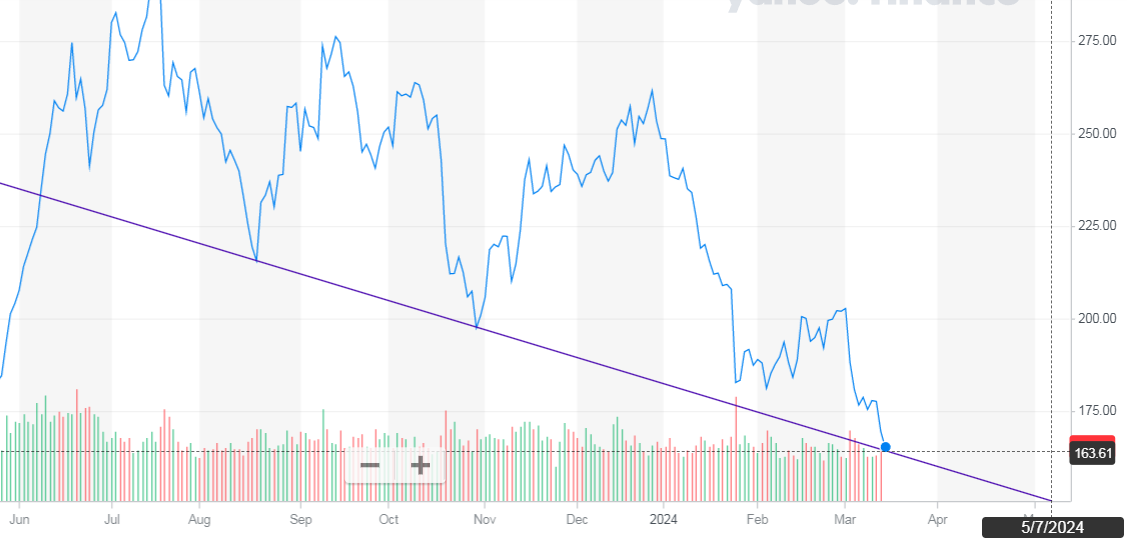

Disheartening how an apparently weak qtr can break the stock by

This magnitude.

This is inspite of US EV manufactures cratering and tesla just

Finishing the December qtr with record sales.

.

Even the starship success has no positive halo effect.

Irrational pessimism

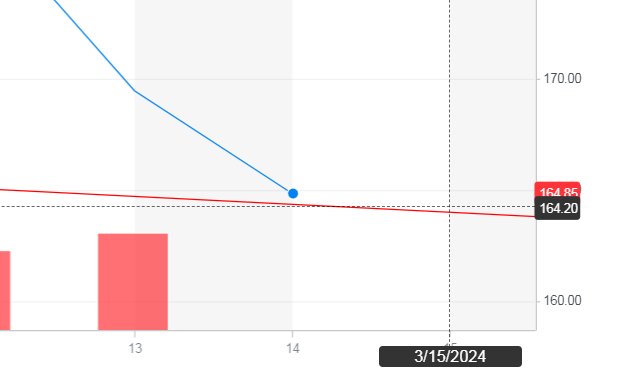

I think - and I'm not an expert so feel free to disregard - that the price action so far this year has to due with lack of guidance. Jonas and maybe Gary Black (I get them all confused) said Tesla held an investor day and reading the tea leaves, they're suggesting that Tesla forecasted to them for minimal growth in 2024, hence a bunch of revisions down in estimates.

So, yes, Q1 looks like it'll come in below the 490k-500k that many were anticipating just a couple months ago, but in addition it sounds like it'll be tough to achieve 2m units in FY2024 (per

@Troy). This is causing analysts to further reduce their out year estimates, to the extent they model beyond 2025.

Imo (which is, admittedly, worth nothing) we're in for a bumpy ride sideways or even down until a couple of the following start to occur - stabilized to even increased gross margins over a couple quarters, a clear timeline of Gen 2 ~$25k vehicle, clear progress with a stated timeline on Optimus (plus anticipated pricing, production, etc.), and/or clear plans in preparation of the rollout of a robotaxi network. Even hitting on a couple of those I think would boost the stock price, but for now it's mostly vague or unclear on all of them - at least for 2024. We probably start seeing some movement there in 2025 with CT ramping to something material to the financials.

Again, just my opinion, I'm not an expert, and so you should probably just disregard this post. Cheers.