Zaddy Daddy

Member

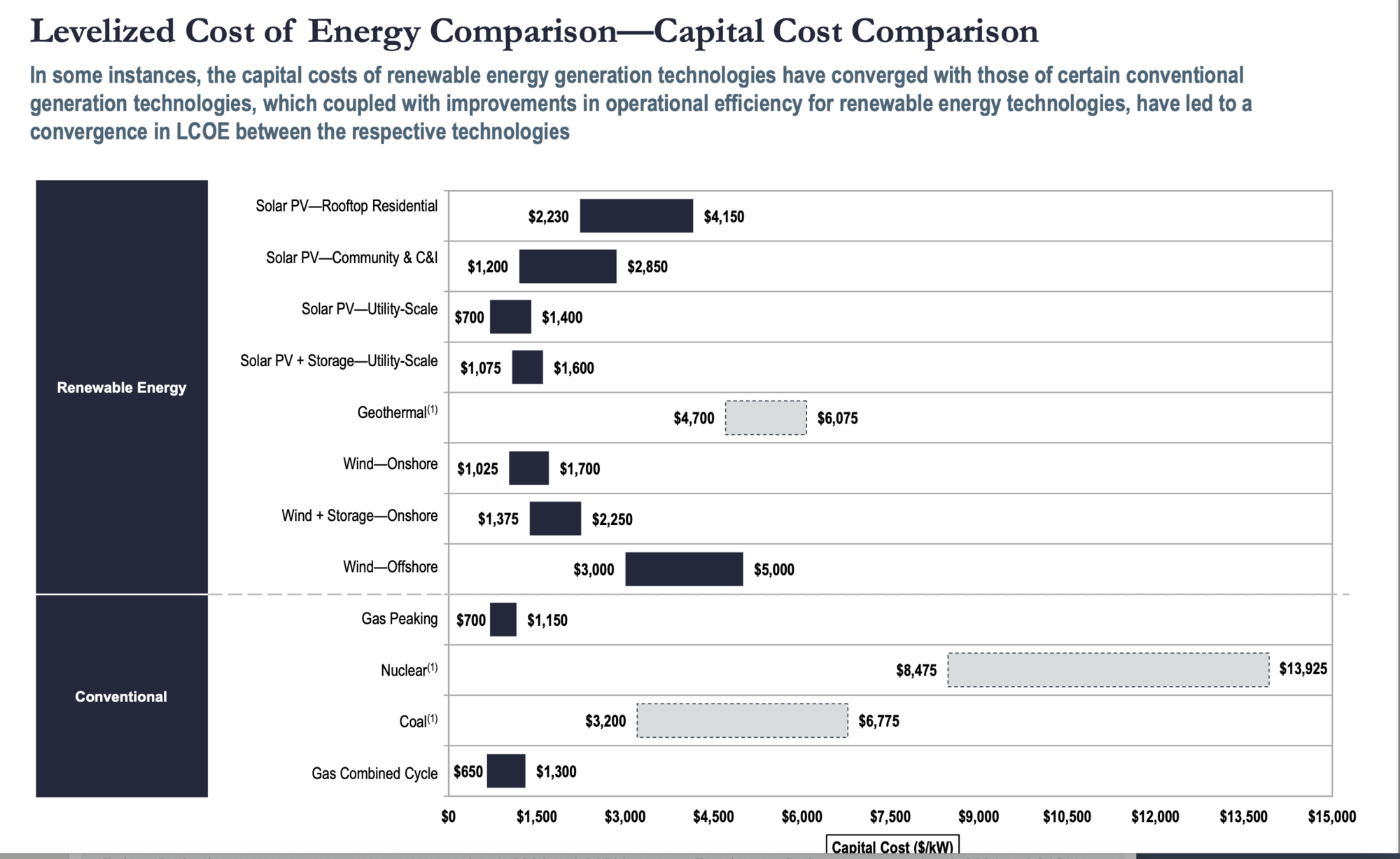

2023 Levelized Energy Costs. Solar + battery is better than many but there are still some cheaper options.

Battery costs for purchasers will have to come down signficantly (meaning lower ASPs) for the levelized costs to start making more financial sense for solar + battery systems.

Battery costs for purchasers will have to come down signficantly (meaning lower ASPs) for the levelized costs to start making more financial sense for solar + battery systems.