You know, I sometimes feel that nobody actually believes these analyst recommendations, unless they're really out of the ordinary. I think it's sort of like technical analysis in general: most of its adherents only believe in it to the extent that they think other people believe in it - and in effect create a self-fulfilling prophecy.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

mspohr

Well-Known Member

The Chinese already know how to build electric cars.Random thought after thinking about GF3, how does Tesla plan to prevent Chinese business espionage and stealing some of Tesla's proprietary methods?

Fact Checking

Well-Known Member

Random thought after thinking about GF3, how does Tesla plan to prevent Chinese business espionage and stealing some of Tesla's proprietary methods?

A couple of ways I believe:

- Tesla won't be making some key components, such as the drive train, in China.

- They'll be keeping their cell making R&D results in Nevada as well.

- As China's economy matures, so might its legal system.

- But most importantly, they'll compete the "Tesla way": not by building a patent portfolio, but by being a fast moving target.

I liked that one:

Elon :

"(...) my guess is demand is somewhere on the order - in a strong economy is on the order of 700,000 or 800,000 units a year for Model 3 (...) we're thinking about demand almost zero right now (...) our factory is like, right now, only making cars for China and Europe. (...)"

Everything they produce goes right now to China and Europe. Those are all the Premium P LR AWD with AP and a high margin. Today I talked to Tesla Sales offering receiving my car in Q1 (March) despite my plan to take it in Q2 (April) to do my bid as an investor to help the company with good Q1 numbers.

Sales said I can choose but they do not really care. Thats a sign of high confidence. They have enough high premium orders for Q1.

Thoughts about demand:

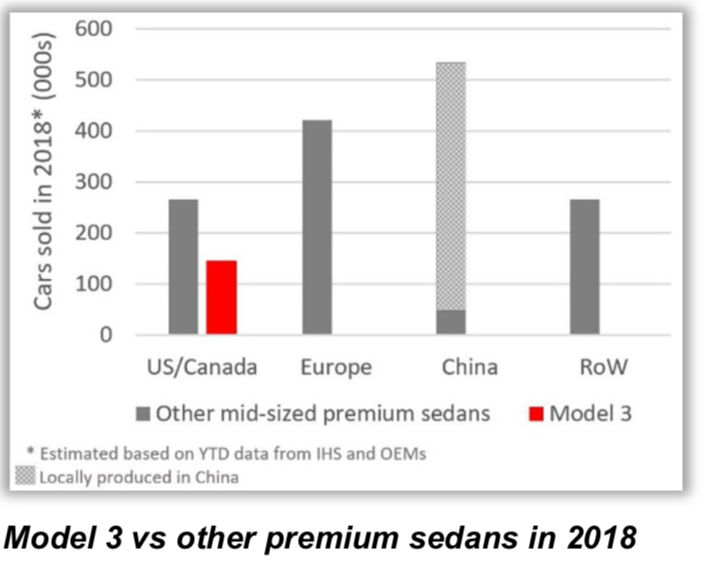

The Q4 letter graph above with an EU mid size premium sedan market of +400k in 2018.Multiply with conservative 50% like U.S market who has 80% share but consider the 3 attracts people from higher & lower segments so add 25% to that and you get 250k p.a. demand for EU alone. Therefore Likely up to 100k reservation in EU today.

That actually 1/3 of the total demand Elon predicted just for EU.

Elon :

"(...) my guess is demand is somewhere on the order - in a strong economy is on the order of 700,000 or 800,000 units a year for Model 3 (...) we're thinking about demand almost zero right now (...) our factory is like, right now, only making cars for China and Europe. (...)"

Everything they produce goes right now to China and Europe. Those are all the Premium P LR AWD with AP and a high margin. Today I talked to Tesla Sales offering receiving my car in Q1 (March) despite my plan to take it in Q2 (April) to do my bid as an investor to help the company with good Q1 numbers.

Sales said I can choose but they do not really care. Thats a sign of high confidence. They have enough high premium orders for Q1.

Thoughts about demand:

The Q4 letter graph above with an EU mid size premium sedan market of +400k in 2018.Multiply with conservative 50% like U.S market who has 80% share but consider the 3 attracts people from higher & lower segments so add 25% to that and you get 250k p.a. demand for EU alone. Therefore Likely up to 100k reservation in EU today.

That actually 1/3 of the total demand Elon predicted just for EU.

EVNow

Well-Known Member

Now the stock is just following Nasdaq - the volume is low as well. So, no more fire works for today, until the last 30 minutes ? I hope SP ends above 310.

For those Europeans interested the attached link to a google file shows that Tesla is quickly adding the CCS charger to the SC in order to make the M3 owner happy and easy to charge and go.

Looks to me like Norway and Netherlands did get a priority which is no surprise as they will have high demand and supply versus other EU countries.

Tracker CCS on Superchargers

Daniel Bönnighausen on Twitter

Looks to me like Norway and Netherlands did get a priority which is no surprise as they will have high demand and supply versus other EU countries.

Tracker CCS on Superchargers

Daniel Bönnighausen on Twitter

EVNow

Well-Known Member

Tesla 'leaving intensive care' but CFO departure, demand worry investors

MARKETWATCH 9:28 AM ET 1/31/2019

As usual, Tesla offers enough for bulls and bears

Tesla Inc. (TSLA) stock gained on Thursday, reversing course as analysts weighed in on the company's fourth-quarter earnings released late Wednesday (http://www.marketwatch.com/story/tesla-stock-falls-after-earnings-miss-but-sales-better-than- expected-2019-01-30) and news that longtime Chief Financial Officer Deepak Ahuja is retiring.

Tesla (TSLA) reported mixed quarterly results but showed it was "leaving intensive care" and as usual offering something for bulls and bears, analysts at ISI Evercore said in a note Thursday.

MARKETWATCH 9:28 AM ET 1/31/2019

As usual, Tesla offers enough for bulls and bears

Tesla Inc. (TSLA) stock gained on Thursday, reversing course as analysts weighed in on the company's fourth-quarter earnings released late Wednesday (http://www.marketwatch.com/story/tesla-stock-falls-after-earnings-miss-but-sales-better-than- expected-2019-01-30) and news that longtime Chief Financial Officer Deepak Ahuja is retiring.

Tesla (TSLA) reported mixed quarterly results but showed it was "leaving intensive care" and as usual offering something for bulls and bears, analysts at ISI Evercore said in a note Thursday.

Now you see why Elon wanted to take the company private. He'd have a huge money tap and far fewer hassles.Truly honest question here. Does Tesla even need to care about what the stock is doing any more?

Don't get me wrong, I fully understand that many many people have many many dollars invested in what the stock is doing. I get it, but, does Tesla the company really need the stock market anymore? Yes, certainly the market allows them access to needed funding that they normally wouldn't have and they can grow and expand faster than without but if they are now profitable, can pay off their debt in cash, can create continued demand, go as fast or as slow as they want in regards to R&D and expansion, have Chinese banks frothing at the mouth to lend them money, and probably will never have to rely on the markets for cash, why sweat it at all?

Just seems like Tesla truly controls its own destiny at this point...markets, analysts, and journalists be damned.

Dan

Amazon sold books online, that's where I feel we are with the Model 3. It's hard to visualize a world where Tesla supplies a good chunk of residential energy and transport needs, but that's clearly where we're headed.

I think "grid services" will eventually flow to others and Tesla will focus on the consumers side(microgrids, solar aggregation, etc). That's where they'll be needed most and where the money will be.

Amazon owns retail, energy is a much bigger market.

True, but remember, Amazon's success is because of process innovations. They reduced friction in the buying process, the innovated with logistics, they made efficiency gains which all translated into things that attracted customers: speed, selection and price. I am not sure that's Tesla's gig--they are delivering actual product innovation. I see them being more like the Disney with multiple loosely related lines of business that feed each other.

GBleck

Member

Also you can use the system to make money as a grid stabilization system when it's not in peak demand.Agreed. As mentioned before, it's also possible that the direct DC-DC hardware (simple relays on whole bricks of cells) saves money over high-power direct AC-DC conversion hardware (requires high-power high-speed switching and big capacitors); reduced power requirements for the transformers feeding the cabinets; cooling needs might be reduced due to greater efficiencies; and at the very least they won't need to pay for as large of a power feed to be installed. There'll also be no need for reduced powers (aka, decreased throughput) when splitting a cabinet's power between multiple stalls.

There's a lot of potential savings and throughput increases to offset the cell costs.

Thekiwi

Active Member

Truly honest question here. Does Tesla even need to care about what the stock is doing any more?

Don't get me wrong, I fully understand that many many people have many many dollars invested in what the stock is doing. I get it, but, does Tesla the company really need the stock market anymore? Yes, certainly the market allows them access to needed funding that they normally wouldn't have and they can grow and expand faster than without but if they are now profitable, can pay off their debt in cash, can create continued demand, go as fast or as slow as they want in regards to R&D and expansion, have Chinese banks frothing at the mouth to lend them money, and probably will never have to rely on the markets for cash, why sweat it at all?

Just seems like Tesla truly controls its own destiny at this point...markets, analysts, and journalists be damned.

Dan

True to some degree - Tesla no longer needs to care about funding etc from Wall Street. But they do need to still care about share price when it comes to attracting and retaining employees (stock options/RSUs etc), and of course Elon still no doubt has a big interest in a good stock price given his borrowings against his ownership stake and perhaps his future funding needs for SpaceX/Starship.

(off topic - What happens when Musk takes his first Dragon or Starship journey (orbital or moon) in the next year or two - will Tesla be required to name a temporary acting CEO?)

Last edited:

For those Europeans interested the attached link to a google file shows that Tesla is quickly adding the CCS charger to the SC in order to make the M3 owner happy and easy to charge and go.

Looks to me like Norway and Netherlands did get a priority which is no surprise as they will have high demand and supply versus other EU countries.

Tracker CCS on Superchargers

Daniel Bönnighausen on Twitter

Quick number: Since Christmas, they retrofitted 25% of European supercharger locations with CCS (usually half of the charge points).

Antonio Wooman

Banned

Solid cash flow 2 quarters in a row. Any concern on how wall street will respond to a drop in cash flow in Q1 earnings?

One thing that is sort of a mistery to me is why they are ramping up the 3 so slowly?

We've heard from Elon that demand is not a concern and they are not even thinking about it;

We heard that 7k/week is achievable with minimal capex like a quarter ago from some analysts who took a factory tour and then the same from Elon;

We know that 7k "extrapolated" was achieved back in December 2018(paint shop) and comfirmed by Elon yesterday.

Then why target EOY 2019 for 7k/week? Shouldn't they be interested in ramping up quicker and making more money and helping environment by putting more M3s into the hands of people?

We've heard from Elon that demand is not a concern and they are not even thinking about it;

We heard that 7k/week is achievable with minimal capex like a quarter ago from some analysts who took a factory tour and then the same from Elon;

We know that 7k "extrapolated" was achieved back in December 2018(paint shop) and comfirmed by Elon yesterday.

Then why target EOY 2019 for 7k/week? Shouldn't they be interested in ramping up quicker and making more money and helping environment by putting more M3s into the hands of people?

True to some degree - Tesla no longer needs to care about fundiimg etc from Wall Street. But they do need to still care about share price when it comes to attracting and retaining employees (stock options/RSUs etc), and of course Elon still no doubt has a big interest in a good stock price given his borrowings against his ownership stake and perhaps his future funding needs for SpaceX/Starship.

Not sure if this will ever be a concern for Tesla, but a healthy stock price on a stable-ish vector is useful when doing acquisitions.

EVNow

Well-Known Member

Cost. Cost. Cost.Then why target EOY 2019 for 7k/week? Shouldn't they be interested in ramping up quicker and making more money and helping environment by putting more M3s into the hands of people?

They want to ramp up efficiently and sustainably - not by just throwing money at it, like they did in 2018. That is the way they can have high margins even with SR.

BTW, Green, again.

Quick number: Since Christmas, they retrofitted 25% of European supercharger locations with CCS (usually half of the charge points).

The real question is how many amps the Tesla CCS cables can do... if they're limited to 200A like the CCSv1 standard, then that's going to be an annoying charge-rate cut. CCSv2 cables are hard to come by, unless Tesla is making their own. There's also the possibility that Tesla pulled another "embrace and extend" and its cables can take more than the standard 200A.

You also seem to know quite a bit about the matrix. Coincidence?No, I gave up my physical body long ago.

The real question is how many amps the Tesla CCS cables can do...

... when it's 120 degrees in Az.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K