EDIT: I corrected some mistakes. So re-read if you have already read it.

So, here's the way I try to think about margins and squeezes. Your broker loans you 100 shares that you will sell at the current price because you believe the SP will go down. You get the proceeds from the sale of the shares. They want you to have enough money in your account at all times for them to be able to buy back the shares you borrowed from them. However, since they are smart enough to know there will be days like today and the day earnings were released, they not only want you to keep enough in your account to be able to buy the shares back TODAY, but also a nice buffer in there in case there is a big run-up. Typically, I think this number is like 25%.

So let's say you shorted 100 shares at $100. You would need to have $10,000 dollars (you got this from selling the shares) + $2500 ($12,500) in your account to do the transaction. If the stock goes down in price, obviously, you will hear nothing from your broker. However, if the price goes up, you no longer have a 25% cushion. So, if the price moves up to $110, you need to have $11,000 + $2750 ($13,750) in your account. They will send you a margin call for $1250 - if you don't deposit it, they will use the money in your account to buy the shares that you owe them. Whatever is left in the account is obviously yours.

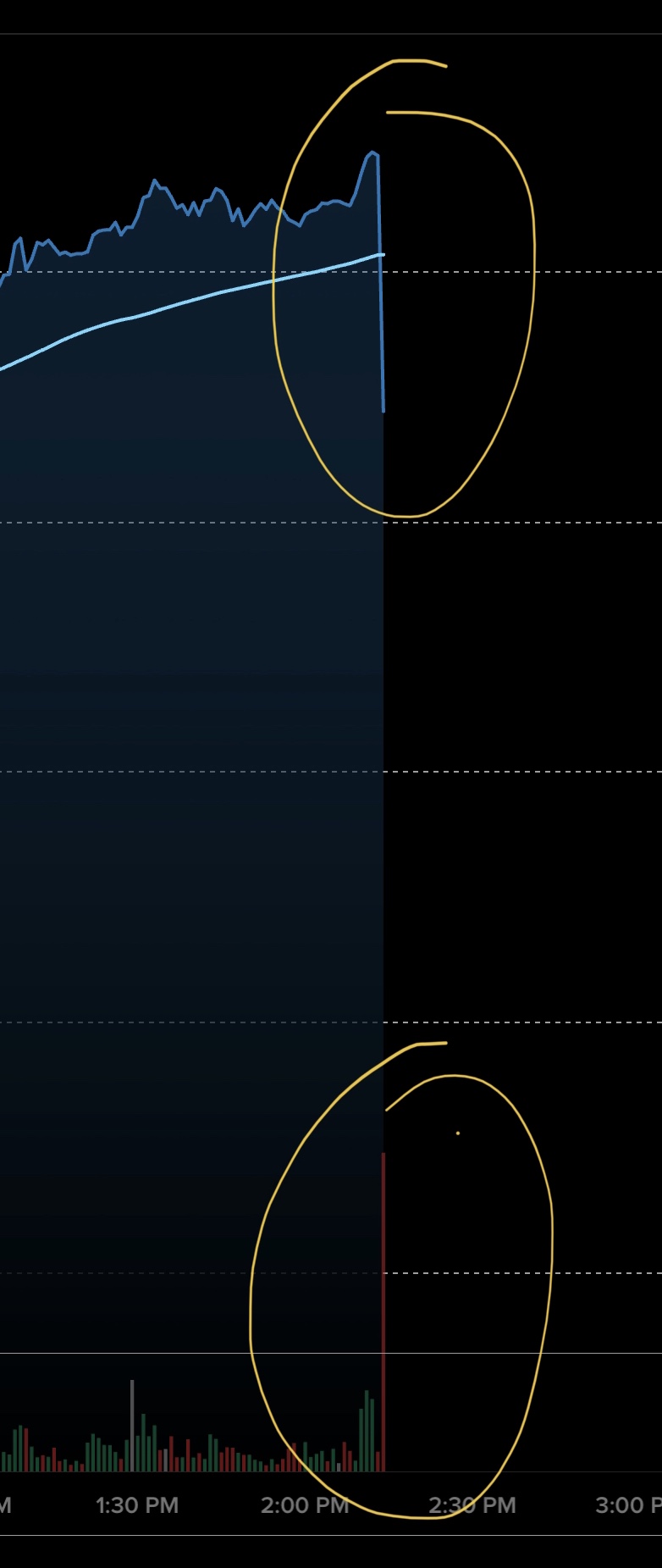

Now, you can see from this where, if you made a bad bet, you better have deep pockets to keep your margin satisfied (not just the margin, but the cost of the higher priced shares). That is where the short squeeze often gets started. Obviously, when a stock moves up quickly as TSLA has over the last couple months, it requires short sellers to constantly increase the money in their account to cover the buyback (+25% margin). At some point, for a lot of people, they either don't have any more money to put in their account, or they just give up. So, they close out their short position (buy back the shares at the higher price). This creates demand for the stock, and in theory, will make the price go higher, which will in turn put MORE pressure on other shorts. Every time the stock moves up, it is "squeezing" SOMEBODY out. And that person (I'm saying person to keep it simple) causes the price to go higher and squeezes more out.

It basically becomes like an Avalanche - once the squeeze starts, it just starts gathering steam, the more steam it gets, the faster the stock rises and the more steam it gathers (because it will collect more and more shorts).

The problem with this theory for TSLA is that this stock, and its short sellers are like NONE I have ever seen. They are not betting against TSLA based on fundamentals or technicals - nope, this is an emotional thing for them now. It is to the point of war. They would rather their kids go hungry and live under a bridge than lose this war against Elon Musk. They will hold on as long as they can find the money to cover their margin calls. I believe it would take $1000 to $1200 SP to trigger a squeeze. One can only hope!