So the ships en route to Europe will dump those Model 3’s in the Atlantic ocean?One of the things to watch for me will be February delivery numbers in Europe. Our working theory last year was, that the Netherlands were sucking up a huge chunk of production allocated for this continent, but once the year ends, Dutch deliveries will scale back, but the rest of the market will pick up the extra production capacity available. Shorts were saying, that once Dutch deliveries are done, European sales will collapse.

Moment of truth coming soon.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Do you have an update to the RO-RO quarterly ship count chart you recently posted perhaps - is the 10 times late start relative to Q4 still present?

I was going to update it as soon as Morning Cara leaves.

Causalien

Prime 8 ball Oracle

I had assume the IV crush would have come immediately after earnings, and that the continued high premiums was a result of continued volatility with increased volume...

Was anyone expecting this to happen this week? Did anyone sell options (puts) to capture the drop?

Yep. Sell both put and calls when IV > 100

GF4: The cavalry is arriving

Giga Berlin / Gigafactory 4 on Twitter

They plan to use 7 harvesters total and clear 10ha per day, to clear 154 of the 300 hectares in the first stage:

Giga-Fabrik: Umweltausschuss hat viele Fragen zum Tesla-Wald

Tesla has already put down a bank deposit for replanting the new forest. Apparently the replanting wasn't a requirement by the government - Tesla volunteered that. There are no hindrances to the clearing with respect to the species protection law.

Giga Berlin / Gigafactory 4 on Twitter

They plan to use 7 harvesters total and clear 10ha per day, to clear 154 of the 300 hectares in the first stage:

Giga-Fabrik: Umweltausschuss hat viele Fragen zum Tesla-Wald

Tesla has already put down a bank deposit for replanting the new forest. Apparently the replanting wasn't a requirement by the government - Tesla volunteered that. There are no hindrances to the clearing with respect to the species protection law.

they are trapped in the "Innovators Dilemma" some will be slow , others will be quick , some might survive as niche players... looks to me like most OEMs are already walking deadThe auto industry wants to catch Tesla with their half assed attempts at going electric. Idk if they are waiting for Musk to stop expanding so they can copy his homework, or they are trapped between watching their companies die a slow death or a quick one.

Fact Checking

Well-Known Member

Here's yesterday's change in the open interest for this week's options expiry:

Edit, I miscalculated the first version:

27k new calls versus 27k new puts so far, so I'd expect market makers to prefer flat trading and intraday capping going into Friday, but should there be any positive (or negative) catalyst the delta hedging effect could be significant as the price is above most of the puts.

The IV crush today in particular might have given market makers enough excess TSLA inventory to cap the price with relatively low risk.

Code:

Monday open: 2020/Feb/14: PUTs: 96,471 ; CALLs: 115,780

Monday close: 2020/Feb/14: PUTs: 123,883 ; CALLs: 142,816Edit, I miscalculated the first version:

27k new calls versus 27k new puts so far, so I'd expect market makers to prefer flat trading and intraday capping going into Friday, but should there be any positive (or negative) catalyst the delta hedging effect could be significant as the price is above most of the puts.

The IV crush today in particular might have given market makers enough excess TSLA inventory to cap the price with relatively low risk.

Last edited:

Too big to deploy: How GPT-2 is breaking production

I am starting to feel this represents where we are going and what will be needed for FSD. That may mean that to get to full FSD we need the next iteration of the FSD board that was alluded to in the autonomy day presentation.

So Dojo (also custom board methinks) for training and then FSD 3.0 with huge memory/compute for processing the what will become enormous neural nets to drive the car.

This is especially true now that they are baking more control into the DL net, so these things will likely end up huge with many billions of parameters to handle the driving task, which is complex.

Not sure if you pay attention to comma.ai but they are particularly amazing given that they drive pretty damn well with single cell phone camera and camera CPU/GPU + car radar. Imagine what savvy people could do with 8 cams, ultrasonic sensors and radar + serious dedicated board?

So still waiting on order of mag improvement release...hope its in 2020.

I am starting to feel this represents where we are going and what will be needed for FSD. That may mean that to get to full FSD we need the next iteration of the FSD board that was alluded to in the autonomy day presentation.

So Dojo (also custom board methinks) for training and then FSD 3.0 with huge memory/compute for processing the what will become enormous neural nets to drive the car.

This is especially true now that they are baking more control into the DL net, so these things will likely end up huge with many billions of parameters to handle the driving task, which is complex.

Not sure if you pay attention to comma.ai but they are particularly amazing given that they drive pretty damn well with single cell phone camera and camera CPU/GPU + car radar. Imagine what savvy people could do with 8 cams, ultrasonic sensors and radar + serious dedicated board?

So still waiting on order of mag improvement release...hope its in 2020.

Etna

Member

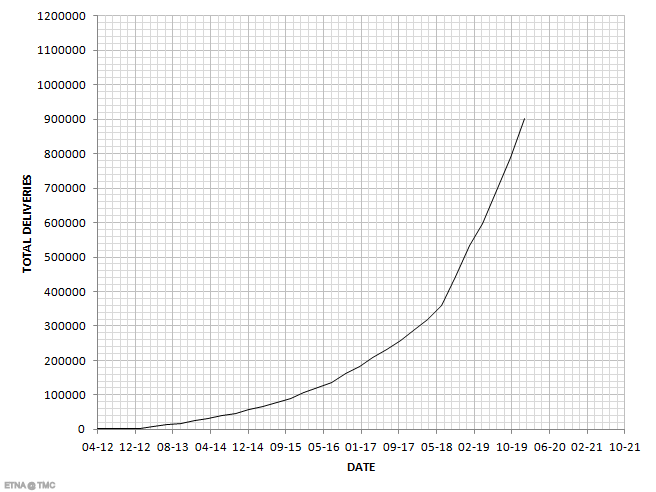

Graph of cumulative quarterly deliveries since 2012.

The millionth delivery may take place sometime in March, Tesla should make a big deal out of it.

The millionth delivery may take place sometime in March, Tesla should make a big deal out of it.

Do you have an update to the RO-RO quarterly ship count chart you recently posted perhaps - is the 10 times late start relative to Q4 still present?

Here. The downtick at day 50 is an anomaly in the data. It should be at 12 ships by day 50 based on available data.

Fact Checking

Well-Known Member

Here. The downtick at day 50 is an anomaly in the data. It should be at 12 ships by day 50 based on available data.

View attachment 510201

Thanks. Is this your own chart, or available somewhere online?

"Now we’ve learned that Tesla is building a battery cell pilot production line in Fremont, according to a new ‘Pilot Line Production Engineer, Cell Engineering’ job listing."-Fred Lambert by way of Electrek

Tesla is building a pilot battery cell manufacturing line in Fremont - getting into the cell business - Electrek

Tesla is building a pilot battery cell manufacturing line in Fremont - getting into the cell business - Electrek

Tslynk67

Well-Known Member

Ugh, what a frustrating day. Low volume compared what we were getting last weeks.

I don't know, ask the shorts. I don't buy into their fearmongering.So the ships en route to Europe will dump those Model 3’s in the Atlantic ocean?

To be fair, last quarter we had 8 ships to Europe, right now we are tracking 4 and of course we don't know yet how many more will come or how many Teslas are on board. Also, Q1 is normally the weakest time in the industry.

Having said that, it's Tesla so you never know. The fact there have been no price cuts so far this quarter is very encouraging.

I guess I should have added aDon't count on Friday being down. If you want to buy more stock, do so. While no one knows the future, the price on Friday is not likely to be appreciably less than it is now and it could be appreciably more. There were people who were "waiting for the drop" at $500 and they're still waiting...

If you don't want to pay current prices for whatever reason, that's fine. For example, I decided I was too heavy on $TSLA and put money elsewhere. If the shorts/MM/whoever knock the price down far enough it will become a deal that is too good to resist and I'll sell the other and buy more $TSLA. But, for me, they'll have to reach for a nice big discount and I'm not really expecting it. (It helps that this is in an IRA so I don't have to worry about taxes on short term trades.)

In short, trying to time the market is foolish: if you want $TSLA buy $TSLA. Being flexible with your assets is fine, but keep in your mind that holding it as cash is an implicit belief that doing so will provide higher returns -- but your post seems to lack conviction in that regard.

I'm picking up shares almost weekly since June. Just trying to pick which moment in the week is the best. So far, I had better luck on Fridays (expiration Friday perhaps?).

Thanks for the advice!

Fact Checking

Well-Known Member

"Now we’ve learned that Tesla is building a battery cell pilot production line in Fremont, according to a new ‘Pilot Line Production Engineer, Cell Engineering’ job listing."-Fred Lambert by way of Electrek

Tesla is building a pilot battery cell manufacturing line in Fremont - getting into the cell business - Electrek

This conclusively proves that Fred has an about ~4 days long TMC investor forum comment reading backlog:

This new position in particular, which opened two days ago:

Technical Program Manager, Cell Engineering | TeslaPowder mixing is the first of many steps of li-ion cell production.

Technical Program Manager, Cell Engineering

Job Category: Manufacturing

Location: Fremont, California

Qualifications:

- 5-10 years working with development of manufacturing equipment preferably in powder mixing and conveyance.

Also:

"You will drive the development and deployment of new manufacturing equipment and processes, as well as planning and execution of new cell manufacturing expansion within Europe. "

GF4 cell production confirmed.

Hurry up Fred!

sundaymorning

Active Member

Concerned for the quarter itself. I think numbers will disappoint, but there seems to be a bigger picture forming. Elon has spent most of 2020 at SpaceX, so that’s a great sign that things are going according to plan.

All the cars being back ordered 6-8 weeks is strange if demand is a thing. The China stuff will hurt a bit, but what can you do. We’ll see this could be a big end of quarter push that Musk alluded to during earnings call. If they post decent numbers with a small profit that’s a huge victory

Even if we have a single bad quarter in 2020 it won’t stop buyers from piling in to position themselves for the imminent S&P500 inclusion. We already know what kind of profits 2020 will bring, so selling is out of the question.

humbaba

sleeping until $7000

Well, not everyone can afford to quit their job and ignore everything else in order to keep up with this threadThis conclusively proves that Fred has an about ~4 days long TMC investor forum reading backlog:

Hurry up Fred!

Ugh, what a frustrating day. Low volume compared what we were getting last weeks.

At these SP levels and considering my total holdings in TSLA, a +1% move is about 60% of my monthly take-home pay. So, yeah, days like today are kinda frustrating when I know I have to come in to the office...

JusRelax

Active Member

At these SP levels and considering my total holdings in TSLA, a +1% move is about 60% of my monthly take-home pay. So, yeah, days like today are kinda frustrating when I know I have to come in to the office...

Wait.. we're up 1% today.. so didn't you make 60% of 1 month's worth of salary today even if you didn't come to work?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K