After that msg, it appears I am waiting for a lower price but haven't bought in a while, and I could have more with 1/2 sac of dry powder in hand. Balancing greed vs stress I guess. Still hv my $666 buy order, but getting stale."Why I'm Buying Tesla Stock Near All Time Highs" | Solving The Money Problem (28 minutes ago)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

feigen66

Member

This.

For Texas to come up with its reopening plan, the Governor put together a 39-member task force made up of business leaders, politicians and medical experts. They came up with a plan, with associated execution dates in a week. The plan was implemented almost immediately.

While Newsom had press conference in a florist shop just for a show.

Meanwhile I attended all the zoom meeting from bay area counties for Shelter in Place hearing, only public health officers were presented. Every other voices were sidelined.

A data driven policy cannot have tunnel vision.

What a shame.

MTL_HABS1909

Active Member

While Newsom had press conference in a florist shop just for a show.

Meanwhile I attended all the zoom meeting from bay area counties for Shelter in Place hearing, only public health officers were presented. Every other voices were sidelined.

A data driven policy cannot have tunnel vision.

What a shame.

They’re probably opening florists because Mother’s Day is their biggest/most profitable day of the year....

They’re probably opening florists because Mother’s Day is their biggest/most profitable day of the year....

And, it is an ideal industry to support early reopen. Perishable product with extremely short shelf life. Reciprocal economic hit down the supply chain in a labor intensive industry that is a benchmark JIT process. Absence of commodity would provoke breaking quarantine; you are more likely to forestall a visit to mum if sending flowers is still an option. Very low personal contact component, hundreds of orders are serviced by single outlets that do drop off delivery.

I know I will say the impossible for people raised in US culture, but I'm coming from a different background. I truly believe it is fine to disobey orders, especially in that situation when people giving orders do not know what the f are they doing (and probably are amazed that people still obey). If Tesla and others will carefully ignore BS orders like they are hard of hearing and nothing happens, orders will probably just disappear. If everyone will keep obeying like robots, we soon will wake up in multiple layers of 1984 on fed, state, local levels - your couple of weeks will become months and so on. There are so many things you can do "just in case" in a "better safe than sorry" and "we do this to you for your own safety" culture.I know this won't be popular here but I don't care.

At this point, re-opening in Northern CA is only a few weeks away as a worst case scenario. Pushing this opening isn't necessary for all the negative PR.

Yes, cases in that county are low, but that could also be due to the steps that have been taken. If the health officials feel a few more weeks is necessary, it won't make a bit of difference in Tesla's long term story. Maybe it's all the day traders on this forum that are pushing for it but as a long term holder I can wait a few more weeks.

I know even Elon wouldn't agree with me but sometimes patience is appropriate .... it's remarkable how far Tesla and Elon have come ... they can see a finish line and they are ahead by leaps and bounds ... no need to trip here. Long term is what is important.

Cheers to the longs ....

Jack6591

Active Member

"Feature complete" FSD is an artificial milestone that, from most aspects, will be a big nothing-burger. What matters is how well it works and when it can be put into service. While I'm probably more bullish than most on the timing of FSD regulatory approval (and less bullish than Musk appears to be), I do think feature-complete will be a big letdown for anyone who is assigning any importance to it.

Agreed. I like Jim Keller’s quote:

“Progress disappoints in the short run, surprises in the long run.”

Tesla Self-Driving Computer architect Jim Keller is confident about solving autonomous driving - Electrek

Did Shanghai resume production today?

Does Tesla Have a Parts Problem? Investors Don’t Seem Worried.

Does Tesla Have a Parts Problem? Investors Don't Seem Worried.

'Roth Capital analyst Craig Irwin wrote Friday the reports of a production halt [GigaShanghai] “seem to be confirmed,” adding he believes the extended downtime “was unplanned.”

...

Details are thin. Irwin isn’t sure if the reported delays are because of parts availability, something speculated in multiple media reports. Few on Wall Street, besides Irwin, have written about the issue.

...

He rates shares the equivalent of Sell and has a $350 price target for the stock.'

Artful Dodger

"Neko no me"

Joe Rogan Experience #1470 - Elon Musk

May 7, 2020

7,510,750 views

Yeah, that's about a million views in the past 4 hrs...

Cheers!

May 7, 2020

7,510,750 views

Yeah, that's about a million views in the past 4 hrs...

Cheers!

The Accountant

Active Member

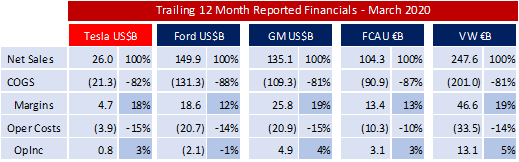

Operating Income is a great measure of a company’s ability to execute. It differs from Net Income because it excludes interest exp, taxes, FX, restructuring charges, etc ; in other words, it excludes items that have nothing to due with the pure operations of the entity.

For the Trailing 12 Month results, Tesla’s Operating Income as a % of Sales was 3%. This is on par with its competitors despite having only 20% to 25% of the Sales of Ford, GM, FCA and about 10% of the Sales of VW.

As Tesla grows, it will continue to leverage its cost structure and will easily surpass its competitors on OpInc % of Sales.

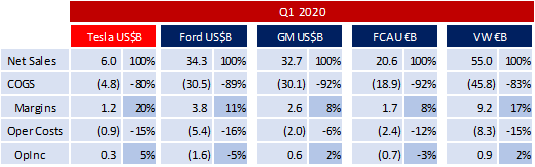

In Q1 2020, it did just that:

For the Trailing 12 Month results, Tesla’s Operating Income as a % of Sales was 3%. This is on par with its competitors despite having only 20% to 25% of the Sales of Ford, GM, FCA and about 10% of the Sales of VW.

As Tesla grows, it will continue to leverage its cost structure and will easily surpass its competitors on OpInc % of Sales.

In Q1 2020, it did just that:

Congo Line

(not the dance)

SF Bay area is still shut down because of a failure of the public health departments and the political leadership to fund them.

"Case counts and hospitalization reports, two key gauges of the status of the outbreak, have either stabilized or are starting to decline. That means counties are starting to slow or even stop the spread of the virus.

But testing in all six counties is far below the goals set for the region — in some places it needs to increase seven-fold to meet targets. Most of the counties do not yet have a strong enough contact tracing program to effectively prevent future outbreaks. And most, if not all, do not have a large enough stockpile of protective equipment to safeguard health care workers if the number of patients rises.

Without those key resources in place, the region can’t lift shelter-in-place orders, say public health and infectious disease experts."

"Public health officers said it’s possible they will loosen further restrictions before the end of the month. On Friday, Gov. Gavin Newsom said at a briefing that the state could be “many days, not weeks” from lifting some shelter-in-place directives.

But those decisions depend on state and regional metrics moving in the right directions, and much of that progress is in the hands of public health authorities — to increase testing capacity, for example, and to hire workers to do labor-intensive contact tracing."

Added: This really irks me. We are like 15 to 20 weeks into this situation. The government public health departments established metrics at least 6 weeks ago. And we need to be increasing public capabilities in some areas still by 7 times?

I would like Elon Musk to temporarily run these counties, he would get the resources allocated and replace the people who aren't getting their jobs done!

Bay Area has 6 criteria for loosening coronavirus restrictions. Here’s where each county is now

So do they even have a plan to meet these conditions, and are they making progress to increase the testing? Because if they don’t, then it implies that they’ll essentially never open.

J

jbcarioca

Guest

Regarding Alameda County:

The guidance offered was minimal and they declined any specific County approval process, if my reading is correct.

Unlike many jurisdictions it seems they have been unwilling to have joint planning for prudent reopening by any category of business.

They do make several explicit exceptions to their orders;

"Businesses may also operate to manufacture distributed energy resource components, like solar panels."

For interested Tesla investors it might be worthwhile to ready the entirely of the Alameda County rules:

http://www.acphd.org/2019-ncov.aspx

They permit some related manufacturing, construction, auto dealerships services and sales, so long as vehicles are delivered to the purchaser.

It becomes quite interesting that most Tesla-related activities are permitted. Tesla's own published opening procedures are quite obviously well more extensive that those included in the Alameda County order.

Tesla is the second largest direct taxpayer in Alameda County, just after PG&E;

https://treasurer.acgov.org/treasurer-assets/docs/top10secure18-19.pdf

Despite having ~10,000 employees in the county (almost all the East Bay Tesla employees work in Alameda County);

https://www.bizjournals.com/sanfran...2019/10/18/top-employers-in-the-east-bay.html

and the largest non-health care one in the East Bay,

It seems Alameda County really does not want Tesla to be there.

Regardless of that history one would be foolish not to imagine that Tesla will begin a process of systematically reducing their dependence on Fremont. After all it hardly would have been high on a location list had it not been lying fallow after first GM, then NUMMI, then Toyota directly gave up on it. The recent events will inevitably speed taht process.

Perhaps that is actually what Alameda County wants. I wonder what the City of Fremont or the State of California thinks?

Perhaps one might reflect that when California had the chance to allow vehicles bought for use outside the Sates be delivered with temporary license, without Sales tax the State declined. Of course that would have brought tourist dollars and increased employment to process deliveries. Otherwise it would have cost nothing. It could have benefited

some buyers of Asian vehicles imported through California that could have a holiday trip, and quite a few Canadian buyers too. Things like that just make just a trifle more negative vibration, not a big deal but...

California taxes, County/City real estate and employment taxes, highly bureaucratic tax filing and compliance systems.

Pretty soon that makes California businesses gradually move their growing business elsewhere. Slowly, almost invisibly but inexorably.

This situation does place some more nails in the coffin. Tesla already does significant design and manufacturing elsewhere. That is accelerating rapidly in Germany (two Munich-based friends, materials engineers, are now being interviewed following headhunting), China (I have a photo of that recruiting image of a new small car) and elsewhere, as we'll soon see with GF-5. ok, maybe bigger than G.

California manufacturing will not disappear, but it is rapidly becoming less critical. Does anybody imagine that other major businesses are not growing more skittish.

Not long ago the South Bay was the epicenter of North American operations for non-US firms. Nissan, Toyota, Mazda, Hyundai, Isuzu- big and small they were mostly in and around Torrance. One by one they've decamped elsewhere bit by bit with Texas a big beneficiary. One can list names, dates and functions, but i doubt it's necessary.

Aerospace was a Los Angeles center too. Hughes, Douglas (then most McDonnell Douglas), Lockheed, Northrup Grumman. Northrup was last to leave, so Palos Verdes had a temporary real estate glut, lucky for me since I bought a house I could not have afforded from a departing Northrup exec. SpaceX began by mopping up all that talent that wanted to stay, giving Elon a taste for bargains that he repeated with Fremont.

This is a long post that may seem off topic, but I think it is central to longer term Tesla value. The longer term effect of Alameda County recalcitrance will to speed the transition to more efficiency and higher margins. It will take time.

The guidance offered was minimal and they declined any specific County approval process, if my reading is correct.

Unlike many jurisdictions it seems they have been unwilling to have joint planning for prudent reopening by any category of business.

They do make several explicit exceptions to their orders;

"Businesses may also operate to manufacture distributed energy resource components, like solar panels."

For interested Tesla investors it might be worthwhile to ready the entirely of the Alameda County rules:

http://www.acphd.org/2019-ncov.aspx

They permit some related manufacturing, construction, auto dealerships services and sales, so long as vehicles are delivered to the purchaser.

It becomes quite interesting that most Tesla-related activities are permitted. Tesla's own published opening procedures are quite obviously well more extensive that those included in the Alameda County order.

Tesla is the second largest direct taxpayer in Alameda County, just after PG&E;

https://treasurer.acgov.org/treasurer-assets/docs/top10secure18-19.pdf

Despite having ~10,000 employees in the county (almost all the East Bay Tesla employees work in Alameda County);

https://www.bizjournals.com/sanfran...2019/10/18/top-employers-in-the-east-bay.html

and the largest non-health care one in the East Bay,

It seems Alameda County really does not want Tesla to be there.

Regardless of that history one would be foolish not to imagine that Tesla will begin a process of systematically reducing their dependence on Fremont. After all it hardly would have been high on a location list had it not been lying fallow after first GM, then NUMMI, then Toyota directly gave up on it. The recent events will inevitably speed taht process.

Perhaps that is actually what Alameda County wants. I wonder what the City of Fremont or the State of California thinks?

Perhaps one might reflect that when California had the chance to allow vehicles bought for use outside the Sates be delivered with temporary license, without Sales tax the State declined. Of course that would have brought tourist dollars and increased employment to process deliveries. Otherwise it would have cost nothing. It could have benefited

some buyers of Asian vehicles imported through California that could have a holiday trip, and quite a few Canadian buyers too. Things like that just make just a trifle more negative vibration, not a big deal but...

California taxes, County/City real estate and employment taxes, highly bureaucratic tax filing and compliance systems.

Pretty soon that makes California businesses gradually move their growing business elsewhere. Slowly, almost invisibly but inexorably.

This situation does place some more nails in the coffin. Tesla already does significant design and manufacturing elsewhere. That is accelerating rapidly in Germany (two Munich-based friends, materials engineers, are now being interviewed following headhunting), China (I have a photo of that recruiting image of a new small car) and elsewhere, as we'll soon see with GF-5. ok, maybe bigger than G.

California manufacturing will not disappear, but it is rapidly becoming less critical. Does anybody imagine that other major businesses are not growing more skittish.

Not long ago the South Bay was the epicenter of North American operations for non-US firms. Nissan, Toyota, Mazda, Hyundai, Isuzu- big and small they were mostly in and around Torrance. One by one they've decamped elsewhere bit by bit with Texas a big beneficiary. One can list names, dates and functions, but i doubt it's necessary.

Aerospace was a Los Angeles center too. Hughes, Douglas (then most McDonnell Douglas), Lockheed, Northrup Grumman. Northrup was last to leave, so Palos Verdes had a temporary real estate glut, lucky for me since I bought a house I could not have afforded from a departing Northrup exec. SpaceX began by mopping up all that talent that wanted to stay, giving Elon a taste for bargains that he repeated with Fremont.

This is a long post that may seem off topic, but I think it is central to longer term Tesla value. The longer term effect of Alameda County recalcitrance will to speed the transition to more efficiency and higher margins. It will take time.

Big Dog

Active Member

IMO for an important factory like Fremont ....

Facts not in evidence. (Hint: manufacturing is not considered "important" in the highly populated areas of California.)

While us Tesla fans -- car and/or stockholders -- believe in the product's value, NIMBY's that control the Bay Area do not. Elon could power those cars with cold fusion and people would not like them bcos they are cars. Sure, they may help clean the air, but more cars clog the roads, cause congestion, and (egads) encourage growth. Only the former is good, the rest are bad (to those in charge). Plus, Elon is a billionaire, one of those types that Progressives have railed against for years. Why does he need help to make more money? (Just being cynical here, but that's how the powers-that-be think, while they ignore all the furloughed workers.)

J

jbcarioca

Guest

Imagine the effect as Tesla gradually moves R&D and production to better places than the Bay area and California.Operating Income is a great measure of a company’s ability to execute. It differs from Net Income because it excludes interest exp, taxes, FX, restructuring charges, etc ; in other words, it excludes items that have nothing to due with the pure operations of the entity.

For the Trailing 12 Month results, Tesla’s Operating Income as a % of Sales was 3%. This is on par with its competitors despite having only 20% to 25% of the Sales of Ford, GM, FCA and about 10% of the Sales of VW.

View attachment 540050

As Tesla grows, it will continue to leverage its cost structure and will easily surpass its competitors on OpInc % of Sales.

In Q1 2020, it did just that:

View attachment 540051

MarketWatch - this morning: Tesla’s stock could see new peaks thanks to these 3 catalysts

Big Dog

Active Member

Imagine the effect as Tesla gradually moves R&D and production to better places than the Bay area and California.

I predict that overtime, Fremont continues to produce the Model S while it evolves into the primary R&D center, a place to try out what the engineers can design, not only product, but the robotics, and then mass produce somewhere else. (hello Techsus) CA leadership, particularly Alameda County, is very pro-union and it won't be long before that chasm gets crossed; the tent will be closed.

Last edited:

Navin

Active Member

Hi. Can someone pls post a link to when someone goes by Fremont factory today and determines whether there are any cars and folks working today? It’s 9:30am and just curious what’s the state of the union over there sorta speak.

dc_h

Active Member

Well said. These country health officials are not elected, they don't have as much pressure from the economic impacts. Besides, most bay area companies do fine with work at home.

There are actually 6 criteria for loosening the restrictions. The three directly related to Corvid-19 spread and hospital capacity are all checked, and the three not yet checked are all tied to bureaucratic operations (not enough testing, not enough staff for contact tracing, and not enough PPE).

Bay Area has 6 criteria for loosening coronavirus restrictions. Here’s where each county is now

It would be cool if Elon could setup antibody and infection testing for employees. He could handle his own contact tracing and is already providing PPE. It's sad that the Federal gov't has not put way more into testing and less into corporate bailouts. 50 billion was setup for testing and 3 trillion for keeping people and companies afloat. We could be hiring 10s or 100's of thousands of people for testing and contact tracing, hiring every CE and pharmacy major in the country to help staff labs as well as underemployed hospital workers, all focusing on administering and processing testing. I think we need to start reopening faster, not because we are ready, but because the federal government is not likely to get it's act together under this administration, EVER, and we can't afford to wait until next year.

jhm

Well-Known Member

I don't believe it is circular. It does reframe how stock analysts go about their work. For example, options analysts will discuss changes in IV as reflection in how the market perceives value, risk or volatility.That's like a circular argument. An analyst's job is to attempt to assign a value. Then the customers of the brokerage firm can see whether a stock is under, over or fairly valued. But using the market prices to determine a discount rate ensures the analysis is flawed. In other words, the analyst's estimation of value cannot use market prices as one of the inputs without the product becoming useless.

The same can be said of implied discounts. In particular, I envision an analyst tracking changes in implied discount over time. Moreover, the modeling of expected cash flows can follow more faithfully the guidance of management, rather than as opportunity for the analyst to inject their own opinions and biases. Thus, tracking implied discounts givens the analysts the means to track how well the market believes management's outlook. So when sentiment improves or declines, the stock analyst can opine on why investors might want to adjust their sentiment.

Does this sort of analysis give analysts the ability to say when the stock is underpriced or overpriced? Absolutely, when sentiment is too high (implied discount too low), the stock is overvalued. When sentiment is too low (implied discount too high), then the stock is undervalued. Moreover, implied discounts can be benchmarked against interest rates, CAPM betas, VIX or industry piers. This would reveal a kind of premium or discount to benchmark, while adjusting for changes in the rate environment. This is done quite a bit in the bond markets where analysts will calculate the risk premium implied by comparison of the yield to the yield curve. A stock analysts using implied discounts could likewise speak of a risk premium that is baked in current pricing.

Certainly an analyst could produce price targets based on differing risk premia levels. Traders can easily apply this approach to buying when sentiment is low and selling with sentiment is high. For example, serious options traders buy and sell on IV, not price. Price is simply a function of IV and a bunch of market derived inputs that change in real-time. So it is easier to execute on a strategy that says buy at this IV, sell at that IV and do dynamic hedging that this other IV.

So I believe this approach would substantially enhance the value that stock analysts create. Right now, you've got a lot of analyst that are little more than op-ed writers. They give you little more than their opinion about how they think about the stock. They've got a "view" to sell you. What I would rather see is more of a quant finance approach which dominates in options and bond markets. Quants are constantly calibrating their pricing models to market prices, giving traders access to arbitrage-free pricing, enabling better hedging.

this is the weirdo in charge.... Erica Pan.. smh

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K