Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

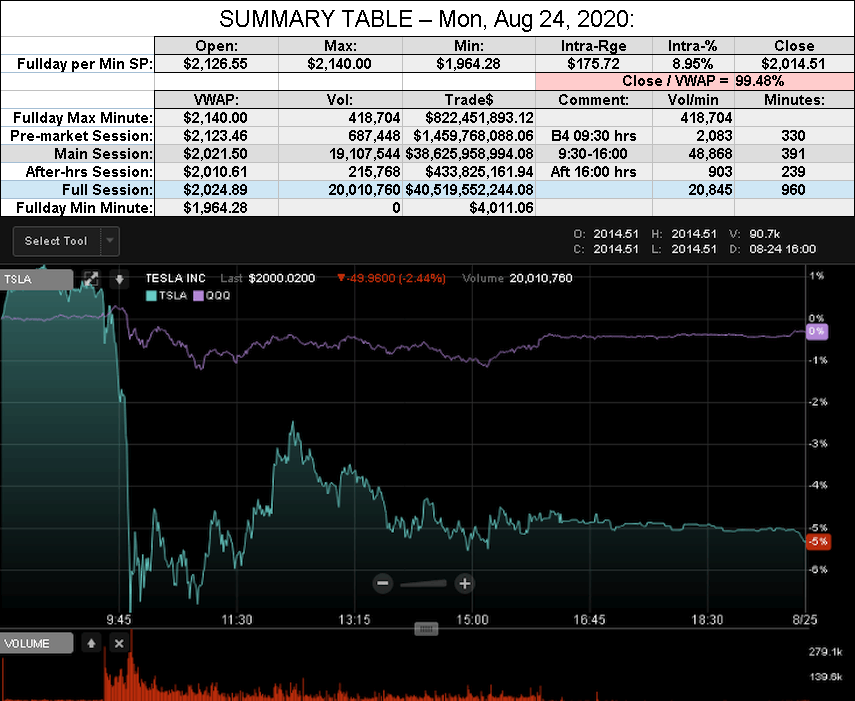

After-action Report: Mon, Aug 24, 2020: (Full-Day's Trading)

Headline: "2 New ATHs for TSLA; Highest Opening SP, Highest Intraday SP"

TSLA 1-mth Moving Avg Market Cap: $302.60B

TSLA 6-mth Moving Avg Market Cap: $182.52B

Nota Bene: Mkt Cap on pace to unlock CEO comp. 3rd tranche Sep 07, 2020

'Short' Report:

Comment: "Shortzes take huge dump; reverses to a drip of 1.75%"

View all Lodger's After-Action Reports

Cheers!

Headline: "2 New ATHs for TSLA; Highest Opening SP, Highest Intraday SP"

Traded: $40,519,552,244.08 ($40.52 B)

Volume: 20,010,760

VWAP: $2,024.89

Closing SP / VWAP: 99.48%

(TSLA closed BELOW today's Avg SP)

Mkt Cap: TSLA / TM = $375.370B / $188.777B = 198.84%

Volume: 20,010,760

VWAP: $2,024.89

Closing SP / VWAP: 99.48%

(TSLA closed BELOW today's Avg SP)

Mkt Cap: TSLA / TM = $375.370B / $188.777B = 198.84%

TSLA 1-mth Moving Avg Market Cap: $302.60B

TSLA 6-mth Moving Avg Market Cap: $182.52B

Nota Bene: Mkt Cap on pace to unlock CEO comp. 3rd tranche Sep 07, 2020

'Short' Report:

FINRA Volume / Total NASDAQ Vol = 49.3% (49th Percentile rank FINRA Reporting)

FINRA Short/Total Volume = 58.6% (54th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.63% of Short Volume (45th Percentile Rank)

FINRA Short/Total Volume = 58.6% (54th Percentile rank Shorting)

FINRA Short Exempt Volume was 0.63% of Short Volume (45th Percentile Rank)

Comment: "Shortzes take huge dump; reverses to a drip of 1.75%"

View all Lodger's After-Action Reports

Cheers!

OP “Those looking for a stock price growth of 40% will probably be somewhat disappointed due to P/E compression over time as the company gets bigger. People will be skeptical that a $1T company can continue to grow 50% in a year.”

I agree that the stock price increase will not be consistent. But if they can consistently execute at the 50% growth rate then eventually the stock over the course of several years should balance out to an average 50% growth rate as well.

HODL

I agree that the stock price increase will not be consistent. But if they can consistently execute at the 50% growth rate then eventually the stock over the course of several years should balance out to an average 50% growth rate as well.

HODL

Wow. Exxon was the last oil company in the DJIA.Something to look forward to when $TSLA gets into the S&P:

View attachment 580302

View attachment 580303

View attachment 580304

View attachment 580305

View attachment 580309

A 4% move would be +$80 for $TSLA

MTL_HABS1909

Active Member

Gives some perspective.

Reality check for me dreaming about ridiculous numbers for battery day.

Meanwhile if true crazy good.

It is useful to understand what are the most critical parameters, the ones worthy of optimizing for. We already have seen that battery energy density and specific energy (capacity per unit of volume and per unit of mass, Wh/kg and Wh/L) for automotive is no longer the critical path. That is revealed by Tesla willing to install CATL's LFP batteries in Chinese-made M3. From what I can tell those are far from the best in those terms but they're cheap and they last a long time. Sure, lighter battery is going to have a cascading effect on the rest of the car but 80/20, we're already there.

Personally I expect battery day to be somewhat disappointing to people looking for some kinda crazy battery break-through, but good for someone looking at the business fundamentals. That would be

1. Efficiency of capital deployment improvements -- cheap and quick to build out battery production

2. Efficiency of resulting battery capacity per dollar of raw materials utilized

So in short, what is needed is a way to quickly ramp up production capacity to make a sugarload of batteries that are cheap to make, from readily available raw materials. It is pretty clear to me that Tesla will deliver on that front, just not clear exactly how much of an improvement did they manage.

I am 70 , on Friday I sold some of our Tesla shares and that sale brought us back to our 12/31/19 share holdings. The sale, among other stuff,allowed us to alleviate our retirement cash concerns.Wanted to elaborate on the stress of being suddenly stupid rich and how to cope. Seriously we have seen a ton of members here wanting to sell, just because the share price finally, finally went ballistic. I also get dizzy looking at the adding of zeros in my account at a breathtaking rate. It can get to you, you start to have fear of loss, panic, exuberance etc.. Then you might want to sell just because of that. Then there' s your broker, friend (fill in whomever) pestering you to lock in gains, as in "nobody went bankrupt selling at a profit" and such utter BS.

Volatility will remain crazy and MM manipulation might be a thing or not, fact is (IMO) you cannot swing trade succesfully over a long period of time, you will miss out because the big swings occur out of the blue mostly. Shorting is a thing, but I could not care less, since I cannot control it. But the volatility can get to you as we all now. It should not lead to bad emotional selling. You will miss the opportunity of a lifetime.

Here's how I started to try to cope with this problem in order to make decisions as rational as possible.

I allocate a price tag to TSLA by end of 2020 (out of thin air, gut feeling, car sales etc., just to be pessimistic) and then I come up with a truly basic model. The model is just believing what Elon says and has delivered upon in the past, always. Then I reduce the projection, just to be on the safe side, sort of real bearish. With the said number my account looks less dramatic and I cut out the noise.

Elon says Tesla (the company) will grow 50% YOY over the coming years barring a black swan event, so my model: YOY growth 40%

Base price end of 2020 (all numbers to be seen pre split) = 1'500 USD

So here you have my model for TSLA which keeps me sane and remain patient:

2020 1’500

2021 2’100

2022 2’940

2023 4’116

2024 5’762

It becomes evident that the share price might have appreciated to quick, but the compounded growth in the coming years shows that 2000 something is still a steal. This way of allocating a lower price to TSLA in my account together with the outlook over 5 to 10 years gives me piece of mind, I stop thinking of selling, and the dizzyness due to the crazy runup becomes less. Try it out !

Disclaimer: I have gathered insight here since 2009, and have been invested since IPO, accumulating over time, barring stupid selling when the stock doubled from 17 to 38, then again at 180.. have regretted these sales and got wiser. Bought everything back at around 230 on average.

Good luck to you all, stay long !

PS: Of course selling because of personal needs / aquisitions etc. are OK

Edit: Typo, clarification / distinction TSLA (stock) and Tesla (company)

A wild 2020 Tesla call option market helped a lot

My children are now (although they don't know it yet) are, long, long term Tesla shareholders.

Not investment advice, but it helps me sleep.

(I do have a call Tesla option cash reserve balance that I plan to continue on playing with)

Last edited:

MC3OZ

Active Member

It is useful to understand what are the most critical parameters, the ones worthy of optimizing for. We already have seen that battery energy density and specific energy (capacity per unit of volume and per unit of mass, Wh/kg and Wh/L) for automotive is no longer the critical path. That is revealed by Tesla willing to install CATL's LFP batteries in Chinese-made M3. From what I can tell those are far from the best in those terms but they're cheap and they last a long time. Sure, lighter battery is going to have a cascading effect on the rest of the car but 80/20, we're already there.

Personally I expect battery day to be somewhat disappointing to people looking for some kinda crazy battery break-through, but good for someone looking at the business fundamentals. That would be

1. Efficiency of capital deployment improvements -- cheap and quick to build out battery production

2. Efficiency of resulting battery capacity per dollar of raw materials utilized

So in short, what is needed is a way to quickly ramp up production capacity to make a sugarload of batteries that are cheap to make, from readily available raw materials. It is pretty clear to me that Tesla will deliver on that front, just not clear exactly how much of an improvement did they manage.

I'm in total agreement here.

I am sure Battery Day will deliver enough of an improvement to be significant..

I am expecting multiple paths with some in volume production, and others in R&D, or even early R&D, multiple processes and chemistries are likely. some mix of in house manufacture and outside supply is likely.

The only people that will be disappointed are those expecting a single ""silver-bullet" immediate solution to all problems.

As long as the Delta is reasonable, considering leverage how are Jun 22 calls not a better value than shares?

@FrankSG has talked about this before. He can correct me if I'm wrong but he means that the extra possible gains from Jun 22 calls if the SP were to rise are not worth it in comparison to the (much) greater risk of LEAPS vs stock. (i.e. stock you can hold forever through any dip, LEAPS have a time limit)

Comparing current Jun'22s to common stock in the same way as I did in My TSLA Investment Strategy blog post:

To get a measly 40% ROI on a Jun'22 option compared to holding common stock requires a stock price of $4,000+ upon expiration. In case of the $3,500s, it'd require a stock price of $5,000+.

In return, you take on a lot more risk than you do holding common stock, and you are unable to take advantage of dips. If you hold the common stock and there is a massive macro crisis and TSLA goes back to $1,000, you'll be able to take advantage and buy some LEAPs at much more attractive prices. You are not able to do this if your money is already invested in LEAPs.

The only reason I haven't sold my Jun'22s yet is because I expect I'll be able to sell them for a better price in the coming 6 months. If we reach $3,000, I'm most definitely converting all my options (excl. some Sep'20 $2,750s if not expired yet) to common stock. I might start doing this as early as ~$2,500. It depends a bit on how things go.

Wow. Exxon was the last oil company in the DJIA.

Chevron is still there. What the DJIA lacks is an alternative energy company and an automaker. Any ideas?

vwman111

Member

Jim Cramer favorably discusses Apple and Tesla.

CNBC - hour ago:

The battery can go for "ages" without charging...does he think that it can go 1,000,000 miles on a charge? I'm not sure he understands the battery fundamentals.

The downward push in AH makes me think they’re going to try the same shenanigans tomorrow morning....

I usually check to see if there's some kind of transitioning going on when not just Tesla but my other stocks also took a dump at the same time(all being high PE high growth). There is indeed a transition today to Covid battered stocks.

If you look at the meteoric rise of Carnival and American Airlines, they all happened precisely at 9:40am today to 8+% just when my Shopify, Tesla, and Fiverr took a dump.

Yes, he thinks Tesla is going to announce a 800-1000 mile battery. Rob already explained to him it's about scaling battery production. But that's too fundamentals and boring for him. Battery day is gearing to be a sell the news moment unless Musk shows the world something flashy vs just the run of the mill we can scale up to 2 TWHr. Tesla is a stock that gets a 10% boost because astronauts went to the space station. If you want that spike up, Musk better show off some alien technology. I think a revamp Model S may do the trick with plaid (but it has to look different too at least externally).The battery can go for "ages" without charging...does he think that it can go 1,000,000 miles on a charge? I'm not sure he understands the battery fundamentals.

You find "it's pretty hard to imagine Tesla proceeding with a 40%-50% delivery CAGR year after year and the stock staying flat or going down". That's a bizarre statement. That's what Tesla and TSLA just did for the past five years, before its recent belated run-up.

Yes. That was pretty bizarre!

(Though, I would guess that capping was to some extent driven by skepticism and the short thesis which has largely evaporated now -- I think it would be a lot harder to hold TSLA at $2000-pre-split for the next five years.)

vwman111

Member

Comparing current Jun'22s to common stock in the same way as I did in My TSLA Investment Strategy blog post:

View attachment 580345

To get a measly 40% ROI on a Jun'22 option compared to holding common stock requires a stock price of $4,000+ upon expiration. In case of the $3,500s, it'd require a stock price of $5,000+.

In return, you take on a lot more risk than you do holding common stock, and you are unable to take advantage of dips. If you hold the common stock and there is a massive macro crisis and TSLA goes back to $1,000, you'll be able to take advantage and buy some LEAPs at much more attractive prices. You are not able to do this if your money is already invested in LEAPs.

The only reason I haven't sold my Jun'22s yet is because I expect I'll be able to sell them for a better price in the coming 6 months. If we reach $3,000, I'm most definitely converting all my options (excl. some Sep'20 $2,750s if not expired yet) to common stock. I might start doing this as early as ~$2,500. It depends a bit on how things go.

@FrankSG

How do you decide whether to sell your Jun 22's with current premium (I assume they are deep ITM at this point) vs, riding it out and exercising a portion of them. Wouldn't the ability to purchase the stock at the lower strike price be more beneficial than selling options and buying stock at current price?

@FrankSG

How do you decide whether to sell your Jun 22's with current premium (I assume they are deep ITM at this point) vs, riding it out and exercising a portion of them. Wouldn't the ability to purchase the stock at the lower strike price be more beneficial than selling options and buying stock at current price?

Bulk of my options are $900 - $1,400, so fairly deep ITM yes.

I assume you mean with regards to (short term) cap gains taxes? That really depends on where you live. In the US/Canada, maybe avoiding those will have to be taken into consideration when making decisions like this.

But even then, you might be able to effectively close out the options by selling calls at a slightly higher strike. Say you hold Jun'22 $1,090s, you could sell Jun'22 $1,100s, turn them into a spread, and effectively close out the position without paying short term capital gains taxes. I'm not an expert on this, so you may need to double check with a professional, but I believe this is legal and works.

EDIT: Some people have pointed out in the following 2 pages that, at least in the US, this is not a viable way to avoid short-term cap gain taxes.

Last edited:

Comparing current Jun'22s to common stock in the same way as I did in My TSLA Investment Strategy blog post:

View attachment 580345

To get a measly 40% ROI on a Jun'22 option compared to holding common stock requires a stock price of $4,000+ upon expiration. In case of the $3,500s, it'd require a stock price of $5,000+.

In return, you take on a lot more risk than you do holding common stock, and you are unable to take advantage of dips. If you hold the common stock and there is a massive macro crisis and TSLA goes back to $1,000, you'll be able to take advantage and buy some LEAPs at much more attractive prices. You are not able to do this if your money is already invested in LEAPs.

The only reason I haven't sold my Jun'22s yet is because I expect I'll be able to sell them for a better price in the coming 6 months. If we reach $3,000, I'm most definitely converting all my options (excl. some Sep'20 $2,750s if not expired yet) to common stock. I might start doing this as early as ~$2,500. It depends a bit on how things go.

Maybe I'm not understanding your table right, but looks to me it's not apples to apples. The question folks would want to answer is, given $X, how will my ROI look like if I compare stock and LEAPS of various strikes? Which means we'd have to scale option returns based on how many of these contracts you could buy for the same price as 100 shares.

MTL_HABS1909

Active Member

I usually check to see if there's some kind of transitioning going on when not just Tesla but my other stocks also took a dump at the same time(all being high PE high growth). There is indeed a transition today to Covid battered stocks.

If you look at the meteoric rise of Carnival and American Airlines, they all happened precisely at 9:40am today to 8+% just when my Shopify, Tesla, and Fiverr took a dump.

And how many of your other stocks dropped ~10% this morning in a 15 min span?

But even then, you might be able to effectively close out the options by selling calls at a slightly higher strike. Say you hold Jun'22 $1,090s, you could sell Jun'22 $1,100s, turn them into a spread, and effectively close out the position without paying short term capital gains taxes. I'm not an expert on this, so you may need to double check with a professional, but I believe this is legal and works.

Umm...

Sold Call Options Tax Implications

The premiums received from selling call options are classified as capital gains. A gain is not realized until an option expires or is bought back with an off-setting buy order. If sold call options expire worthless, the whole premium received is classified as a short-term capital gain. If call options are bought back, the transaction generates either a short-term capital gain or loss, depending on the price paid to buy the options.

and

if you are the writer of a put or call option (you sold the option) and you buy it back before it expires, your gain or loss is considered short-term no matter how long you held the option.

And how many of your other stocks dropped ~10% this morning in a 15 min span?

Zero?

If you are talking about intraday high(coming from AH) to intraday lows, Tesla is at 8%, same with Fiverr. SHOP had a 4% swing. But then again only Tesla was up 3.6% AH on lower volume than normal trading so I usually take those numbers with a grain of salt anyways. Also Tesla had the largest run up out of all of these stocks as well so it's the most "over bought" stock out of all of them as well.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K