Oh, I don’t know. I understand the President disagrees with his Counsel at times, and things seem to be going along swimmingly......

But when it comes to legal advice there's really no room for significant disagreement: either client and lawyer are on the same page or it's not going to work out.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Dan Detweiler

Active Member

I wish you the best. I would say that basing the investment future of this stock on a month or a quarter or even a year's financial data may be considered "a fools errand" to use Elon's words. However, I also understand that financial futures of TSLA, based on accepted methods and practices, doesn't look particularly appetizing and it is certainly your right to invest as you see fit.Did exactly that a month ago.

But the decision to dump my position had nothing to do with liking or disliking Elon. Actually, I admire, love him for all of his accomplishments – after all he was one of the main reasons why I had a sizable TSLA position and why I'm posting here.

I strongly believed he and Tesla could pull it off.

But the last few months showed me that they were simply not able to execute their own plans over and over and over again. I have zero trust left in Elon and Tesla, hence why I'm (temporarily) out.

I'm also not saying another CEO, COO, etc. would be guaranteed do a better job than Elon but at this point, I wouldn't mind if they'd just give it a shot.

Well, guess what: This is a discussion forum, not a superbull echo-chamber, yet. If you don't like my arguments, feel free to put me on your ignore list.

Okay, I guess?

Dan

humbaba

sleeping until $7000

True.

But, to me, I think of someone who is “struggling” as barely getting by to pay monthly bills. And “destitute” as someone is who behind on bills. Maybe different people interpret those words differently. Financially, both these people should not be buying a $50-60K car.

I'm surprised no one has pointed out a high priority reason for a family to get a Tesla. The Y isn't in production yet, but it will very likely be one of the four safest cars ever tested.

Believe it or not, some of us with families value that.

Forgive me if this is a sore subject, but are cars sold in the UK subject to the EU emission rules, I.e., could UK Teslas count towards the FCA pool? Sorry for my ignorance.I find quite a lot of stuff to brighten my mood regarding this stock right now. Here is my list:

1) Elon seems happy, not depressed. Always a good sign, and less danger of him losing it on twitter.

2) We are super-close to april registration stats, which I think will be pretty good

3) The competition is still absolutely ****ing nowhere

4) S/X range boost is welcome, and may tip some people over the edge to buying.

5) No bad news about SEC or the maxwell affair.

6) UK orders & even deliveries coming very soon.

I'm in the UK and can suggest that this will be a BIG market for the model 3 for the following reasons:

1) We haven't bought *any* yet, so expect a lot of high-end and high margin orders.

2) S & X are both popular here, this isn't rolling-coal land. people don't hate EVs here.

3) our roads are NARROW and our car parks TINY. My S is a BEAST and very inconvenient. lots of potential S buyers are waiting for a smaller version: The performance 3.

4) Our fuel prices are high, and our commutes short: perfect combination for EVs.

5) We are currently swept up in climate change concern. its on TV, protests blocking roads etc. green vehicles are with the zeitgeist right now.

I expect M3 sales in the UK to do very nicely. I have zero demand concerns. FFS they have spent $0 on advertising, and are even banned from selling in certain states, and the FUD from desperate competitors is staggering and yet still they sell every car they make...

Of course the stock market is as irrational as **** but I'm still super bullish. Knowing that HW3 is not only locked down, and in production but actually *SHIPPING IN CARS NOW* is just super icing.

Oh and I had 2 interactions with tesla support recently (one about a screen issue that they seemed very knowledgeable about, and another about my referral wheels) which were pretty on-the-ball and helpful. Thats a good sign.

Last edited:

Anstandswauwau

Member

I wish you the best. I would say that basing the investment future of this stock on a month or a quarter or even a year's financial data may be considered "a fools errand" to use Elon's words. However, I also understand that financial futures of TSLA, based on accepted methods and practices, doesn't look particularly appetizing and it is certainly your right to invest as you see fit.

Dan

Thanks.

FYI: I bought my first TSLA shares in mid 2015 and accumulated throughout early 2019 (bought those dips). Sold my position with minimal loss in March. I've originally planned to hold a long position for at least 10 years but again, as things stand right now, I'm not seeing it. No offense to anyone.

j6Lpi429@3j

Closed

Forgive me if this is a sore subject, but are cars sold in the UK subject to the EU emission rules, I.e., do UK Teslas count towards the FCA pool? Sorry for my ignorance.

I assume so we are still (for now!) in the EU

Plus dieselgate annoyed people here. We dont have the same admiration for german cars as the germans do, so the dieselgate thing was pretty bad.

Mike Smith

Active Member

Softbank bought into GM's Cruise Automation at a valuation of 14.6B. All of Tesla is valued at only 42B. How does this make any sense

j6Lpi429@3j

Closed

plus Uber thinks its worth $90 billion apparently. investors are just idiots.

Dan Detweiler

Active Member

It's interesting how people can view the same situations and see radically different outcomes. I guess that is at the heart of investing in general and TSLA specifically. The difference between Jim Chanos and Cathie Wood. I am looking at jumping back in once my retirement is squared away in May. I see this as an opportunity to get back in at a ridiculously undervalued price. I guess one of us is right and one of us is wrong and only time will tell which.Thanks.

FYI: I bought my first TSLA shares in mid 2015 and accumulated throughout early 2019 (bought those dips). Sold my position with minimal loss in March. I've originally planned to hold a long position for at least 10 years but again, as things stand right now, I'm not seeing it. No offense to anyone.

Good luck to you.

Dan

HG Wells

Martian Embassy

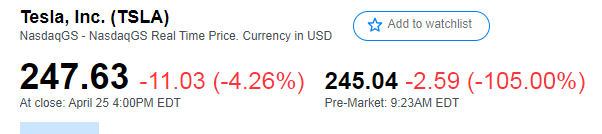

WOW TSLA down 105%

Isn't Yahoo wonderful ?

Isn't Yahoo wonderful ?

That was not actually the scene I was thinking of, but hey, whatever.Show me the monkey!

Dan Detweiler

Active Member

BUY!BUY!BUY!

Dan

Artful Dodger

"Neko no me"

So let's see if we can hold $244.59 which was last year's low, reached in April 2018.

Something tells me we need an agreement with the SEC before institutions will move back in. GLTA.

Cheers!

Something tells me we need an agreement with the SEC before institutions will move back in. GLTA.

Cheers!

So let's see if we can hold $244.59 which was last year's low, reached in April 2018.

Something tells me we need an agreement with the SEC before institutions will move back in. GLTA.

Cheers!

..And it's gone. Why selling now at a loss, I can't fanthom this.

Dan Detweiler

Active Member

I want to see an agreement with the SEC that forces Alabama to be an independent school. Then maybe everyone else might have a chance. lol!So let's see if we can hold $244.59 which was last year's low, reached in April 2018.

Something tells me we need an agreement with the SEC before institutions will move back in. GLTA.

Cheers!

Dan

Thanks. Didn’t know the status of all that getting unwound.I assume so we are still (for now!) in the EU. Oh and another thing, we have the london congestion charge (EVs exempt) and the new ultra-low-emissions zone coming in, and a bunch of towns are considering new low emissions zones too. EVs opt you ouit of all those concerns.

Plus dieselgate annoyed people here. We dont have the same admiration for german cars as the germans do, so the dieselgate thing was pretty bad.

anthonyj

Stonks

Tesla's cash on hand is too low for the level of growth that they are promising, and they have proven that they can’t be self funding. Capital raise from equity would give a huge boost to investor sentiment and stock price..And it's gone. Why selling now at a loss, I can't fanthom this.

Tslynk67

Well-Known Member

If that was the case I'd buy 100m shares, right now!

Mike Smith

Active Member

This is right around the price Tencent was buying shares..

Tesla's cash on hand is too low for the level of growth that they are promising, and they have proven that they can’t be self funding. Capital raise from equity would give a huge boost to investor sentiment and stock price

Cash on hand is same level as June 2018 and now there is 500 Mio worth more inventory with accounts payable "only" 200 Mio higher with a positive Q2 2018 cash flow from solar recognised (see previous pages) ; yet they didn't raise then.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M