Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

cdebenedittis

New Member

LN1_Casey

Draco dormiens nunquam titillandus

Ha-ha, well, it's near 35% but just wait a few months!

BTW, I've been retired since I was 37 (now 57) and I have very little income that doesn't originate from my brokerage account (mostly capital gains, some dividends). So, yeah, 35% is a pretty strong vote of confidence.

Ok. I will bite. What did you do to allow you to retire so early?

Jesus...20k € penalty in France for SUVs/trucks next year while some cheaper EVs get 6k € credit

Bloomberg - Are you a robot?

Sounds like death to gas SUVs.

Not true. That tax hike won't impact most of SUV sales in France (probably less than 0.01% for any noticeable added cost) . You can check the g/km levels of super malus and the g/km of the top selling SUV yourself and discover that, oh, somehow, almost all vehicles end up below the point where the super malus would have an effect on car purchase decision. Start by searching some French SUV like Peugeot 5008, for instance. Forget pickups, no one buy them here.

JusRelax

Active Member

It seems like the new software update with driving visualizations et al is rolling out to everyone with hw 3.0 now. There are reports of those not in early access getting the update.

Did you sell your $400 call? (I am the same guy asking you about your blog on Reddit)

I meant this blog from you, which is an awesome blog and did inspire me a lot!

Tesla in 2020 & 2021: My bet on TSLA Jan'22 Call Options

Thanks so much!! What's your Reddit name?

And yes, after the Cybertruck dip I updated my numbers with:

- Increased operating efficiency and larger profit margins, because of what Tesla showed in Q3'19 financials.

- An earlier Model Y ramp, because of all the rumors and signs that Model Y is going to reach volume production much sooner than I initially anticipated.

As for the $600s you're thinking of buying, I don't know your exact situation, so it's hard to give specific advice. Right now is not the best time to buy options, because premiums are very high. However, those $600s might very well still be profitable, but you have to believe there is a high likelihood of the SP going to $800 or more by then, because otherwise the risk just isn't worth it in my opinion. Simply holding the stock will also net you good returns, and is basically risk-free (if you are long term bullish on Tesla).

Again, this is not investment advice and is what I would do based on my life situation and my tolerance for risk, but if I were not holding any options right now, I might put a very small amount of money in the Jan'22 $600s. When I bought most of my options, the SP was $220-240 and there was some risk associated with buying them, but a lot less at a strike price of $400, and the potential pay off was far greater too. So I invested a fairly large amount into them. Right now premiums are much higher though, risk is also much higher at a strike price of $600, and worst of all the potential pay off is much lower as well. For you to make 10x on those, stock would have to go to $1100.

EDIT: I just noticed you said you already have 12% of your portfolio in options. I personally would not be looking to double down on that at this point in time, because the premiums are very high. Again, not investment advice, I don't know your situation, but that's what I would do in my situation. It's easy to get excited when the stock price is on a run like it is right now, but if Q4 is under expectations, and macro-economics are bad in Q1, we could be back to $350 in a few months.

Last edited:

I said I'd buy 20k options and I did. I got too excited in a.m. on Fri and overpaid compared to the afternoon drop, so these are my results for today:

View attachment 492287

Compared to the results over the end-of-day price for Friday, it was like this(not my case):

View attachment 492288

So, it seems speculative bets earn more short term(when stock movement is in your favor). This is what I figured is the case sometimes.

That is why @Thekiwi was asking for $1,000 strikes and that is why TT007 and anthonij are making 20x on 690 strikes and probably some other penny calls.

The key here is your tolerance to risk. If you bet 5% of your holdings on something very unlikely and make 20x, good for you. If you bet 50% of what you have on this very unlikely outcome and lose it all, well, not so good, is it? Then you are TT007, who first lost millions and now is making 9x.

You can make out nicely if the stock movement is in your favor. Otherwise, you can lose everything, especially on short term bets, like many of us learnt on the way to $180.

Example I posted today, I made 3x in 5 days on 420 call I bought for lolz. If we were on the way to $180 (to help you relate, imagine there's a macro downtown or an earthquake leveling Fremont, or in Elon's scheme of things he decided that taking a hit in one quarter is not important in the grand plan), the same bet would cause me to lose 100% of what I paid.

So, personally, I feel more comfortable going long term and also this is not bet the farm. I used to do 90% shares in my trading account(after some burn going to $180), but just added calls to 30% of account value. I like to think of my calls as not necessarily beating stock performance (see what @FrankSG said), but as sort of insurance against super-breakouts, like FSD. So, if FSD happens, then I get to leverage and capture more upside.

If it doesn't happen, then maybe those calls perform as shares or similar. If something bad happens, then I get to lose more compared to shares, but not everything.

Shares survived the $180 downfall with no loss. Some of the short term calls got wiped out - 100% loss.

Keep in mind I learnt about options ~ last Oct and the experience is mine. I have not seen any long term shareholders share this detail with comparable clarity.

Ballsy at current premiums! Hope it works out for you! So far so good

It seems like the new software update with driving visualizations et al is rolling out to everyone with hw 3.0 now. There are reports of those not in early access getting the update.

I believe it's 2019.40.50.1. I'm downloading it now for my HW3 Model S P100D. I'm not on the early access program and live in Finland.

JusRelax

Active Member

I believe it's 2019.40.50.1. I'm downloading it now for my HW3 Model S P100D. I'm not on the early access program and live in Finland.

If/when you're able, please report back on the driving visualizations. Are any stop sign/lights missed?

sundaymorning

Active Member

Artful Dodger

"Neko no me"

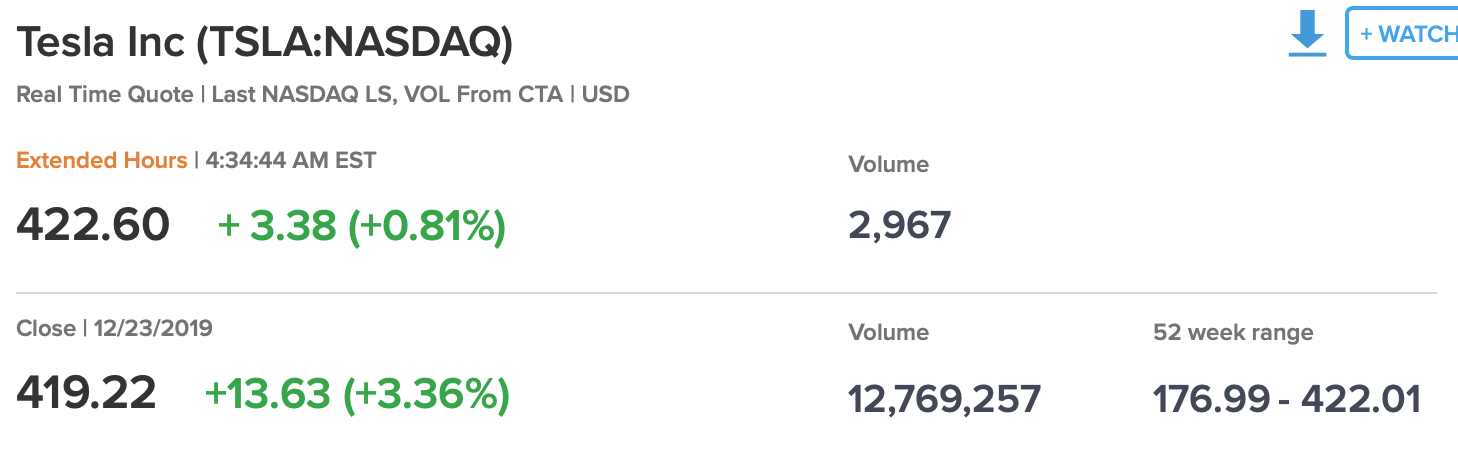

I don't think Frankfurt is open yet. That seems to be yesterday's closing price.$421 in Frankfurt/US pre-market.

Does any of our European members know what hours Frankfurt will be open for Christmas Eve Day (Dec 24)?

Pre-Market trading open in NYC:

Pre-Market High:

$423.38

(05:07:22 AM)

$423.38

(05:07:22 AM)

Cheers!

Last edited:

Mars ☰mperor

Member

ATH in pre-market every freaking day

Hell yeah!

Hell yeah!

We're closed. December 27th is next trading day.Does any of our European members know what hours Frankfurt will be open for Christmas Eve Day (Dec 24)?

Cult Member

Born on the 4th of July

Not at all today. Back to business on 27th.I don't think Frankfurt is open yet. That seems to be yesterday's closing price.

Does any of our European members know what hours Frankfurt will be open for Christmas Eve Day (Dec 24)?

Pre-Market trading open in NYC now:

Pre-Market High:

$422.20

(04:16:29 AM)

Cheers!

Merry Christmas!

Artful Dodger

"Neko no me"

Lord, dey say white people can't jump? White people can't DANCE!

Tslynk67

Well-Known Member

Hey gang, what gives?

It's Xmas eve here in Europe - two lazy weeks off work now

Talking of lazy, it's 10:40AM and I'm still in bed, catching up on this thread and Twitter, plus watching pre-market. 430 today, anyone?

It's Xmas eve here in Europe - two lazy weeks off work now

Talking of lazy, it's 10:40AM and I'm still in bed, catching up on this thread and Twitter, plus watching pre-market. 430 today, anyone?

EV Promoter

Member

Well, not so much a baseless conjecture, the repeating pattern consideration is within the theoretical frame of the Chaos Theory for stock prediction, which personally i follow with interest having noticed quite a few correlations.Where is the price going next? I don't know, but here's a baseless conjecture.

Tesla tends to trade in a wide interval for several years before breaking into the next interval.

First, $20 to $36.

Second, $190 to $270

Third, $270 to $370

Fourth, $370 to ???

There was a transition from first interval to second. Likewise from the third to fourth, we've had a dal segno to $180 and back. Now we appear to be headed into the fourth interval.

So let's suppose that a certain interval will prevail over the next several years. What would be that range. Here's my totally baseless guess.

In Tesla case, the module would be a concentrated large spike (the one we're in now) and a period of stabilization going sideways.

The large oscillation of 100-120$ take in account quite large pos and neg occurences although not the most extremes.

I have similar numbers applying that approach:

- Highs at 480 to 470 (slightly descending in a 1,5 yrs period)

- Lows from 365 to 355 (same)

- a 1 and half year period for the next spike around 550.

One of the many theories of course.

Tslynk67

Well-Known Member

An AI can't actually bake a cake. She got herself into a corner and needed an excuse for no cake post.

Can probably 3DPrint one though

JusRelax

Active Member

423.90, another ATH in premarket

EDIT: 424.75

EDIT: 424.75

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K