Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Good lord it has been over two hours since this info was released and none of you slackers posted it!

View attachment 506204

Tesla Reveals Model 3 Deliveries By Region

That is because it is from Tesla's Q4 presentation that was released yesterday. So old news.

As far as decoding the new Tesla AI page, shouldn't we move that discussion into this forum?

Autopilot & Autonomous/FSD

Autopilot & Autonomous/FSD

Forgive me if this has already been covered, there rate of posts these days makes holding a job and keeping up near impossible. Was there some explanation as to how the stock was so uncharacteristically stable today.

I realize this is so unlikely that it's absurd but it looks like those two big buys yesterday was some institutional buyer all that upcleaned out the weak longs and that nobody wants to sell anymore.

Stock price looks like when JAB bought Keurig in contrast to it normally looking like a Nordic coastline.

I don't think anyone has posted a reason, unless I missed it in thousands of posts today. But that pattern is not unusual for stocks the day after a massive sentiment change. Amazon's stock will also look like that tomorrow I am willing to bet. As to why, the only guess I can come up with is that the volume is so effing massive that no amount of buying or selling can move the stock. Buyers and sellers can be matched at the open price no matter how many shares you want to buy or sell.

StealthP3D

Well-Known Member

I believe the technical term for that stock movement is called...

The El Capitan.

Isn't that a bilingual stutter?

But I like it: El Capitan.

How do we know when the next summit is not a false summit? This is the first time I was not 99% confident that it would continue to soar. That said, still holding every share.

You do know that there are bottomless pocketed Tesla haters who would love for this to happen so they could drive the SP down and take away a huge chunk of that cash so Tesla couldn't function? The oil interests, the automakers have billions to do this. They could use part of their marketing budget they use to bribe the media. When Tesla has a mountains of cash and little debt, then they can buy back shares.Random thought. Tesla spent only $1.3bil on CAPEX in 2019 but is enough to fuel 50% growth in 2020.

Elon says Tesla is spending as much as they need. With $6.3bil in the bank and spending less than half of their operating cash flows on CAPEX, wouldn't it be a good idea to dump the rest of the cash to buy back its own stock?

Especially if TSLA doubles in a year or two. It'd be a good investment for them just to buy now at $640 and then sell it back as a capital raise for $1500.

Seems like a good idea but am I thinking about this in a wrong way?

Sparky

Member

Sweet. While we're on this subject, three things:[

i wish that were true for me but I never had a salary of over 2 million dollars

1) Spouse and I visited the financial advisor. Just a general physical because spouse is thinking about retiring (way) early. FA looked at TSLA holdings and said, "Wow! I may have you pick some stocks for me". Now that's a turning point. 9 mos ago, doubt that's the response we would get.

2) To the FA, I did not offer that I first bought TSLA in 2010 for sub $20 and sold most of it months later at ~$35 declaring myself a genius. Did same with AMZN, In at $8. Out at $28. Similar with GOOG. But, with APPL, I held and saw the benefits. With APPL I guess that I had a personal connection to products that I liked, and I just kept increasing my stake. My largest single purchase of TSLA shares was after I took home my Model S in '13; $40k spent at ~$70. I still have those shares. My most recent purchase was at $561. Another $10k well placed.

3) A short time ago, a work colleague who knows I'm into Teslas and TSLA came up to me excitedly to announce they'd just bought as many shares as they could at $410. It was 10 shares. We talk about the cars, & solar and AP whenever we meet and today they asked if I thought they should sell and take some profits. I said "I don't give stock advice. But once upon a time I sold most of my TSLA at $35. Not doing that again".

Are those RORO equipped hulls? In case you have to get those awesome things off the islands.Meh. I can quantify it, easy peasy. It’s 7 private islands with full scale @Unpilot repellant @Lycanthrope built walls (roll with it, Buddy), robotic sentinel run turrets, tigers, lions and border collies, oh, my!, 1/4 mile drag strips, Supercharger Network, Cybertruck, Roadster 2.0, 2 yachts...

Yeah, I can quantify it all day long, every day. Booyah!

EVNow

Well-Known Member

I think you are making too much of the cheap loan to build GF3 and reuse of Model 3 expensive capex for Model Y. Lets see how much GF4 costs.I agree with you about buybacks but Tesla spent only $1.3B in capex in 2019 while building GF3 and getting Model Y into production.

With the drastic reductions in capex per unit production for GF3 and Model Y I don't think Tesla is "capital heavy" like a traditional auto business.

Tesla's ability to scale using significantly reduced capital is a big deal that for some reason is overlooked by almost everyone.

I mean if you look at MSFT/AAPL/GOOG - they have 100B in cash. Tesla should get to that level before thinking of buying back shares.

anthonyj

Stonks

Bull markets climb a wall of worry. It’s truehmm, so the World Health Organization declares global emergency on coronavirus and the markets turn green?

Coronavirus update: US records first human-to-human transmission as WHO declares global emergency

I'm confused.

anthonyj

Stonks

You sure about this? Remember the Friday after Q3 2018 and 2019? I remember them because I had 20-100 bagger weekliesTake advantage of what you know. Sell 650 Calls at tomorrow's expiry. I got $7. You know the MMs aren't going to let 8,240 Call Options expire in the money tomorrow.

new_sneakers

Member

To expand on @ReflexFunds excellent post quoting Part 2 of the Third Row Tesla podcast "Elon's Story" available now on Youtube, here is what he said before and after:

Elon begins: "It’ll be able to do crazy manoeuvres, like a high-speed chase technically. You always want to bias to be conservative in the actions that it takes."

Then after the quote from @ReflexFunds , Elon continues: "a 2 or 3 order of magnitude in labelling efficiency and a significant improvement in labelling accuracy, as opposed to having to label individual frames from 8 cameras at 36 frames per second, just drive through the scene, rebuild that scene as a 3D thing, with – it’s like there might be 1000 frames we use to create that scene, and then you can label them all at once."

(Gali asks: Is that like the Dojo thing that you mentioned at Autonomy Day?) (Elon shakes his head)

Omar Qazi: "No Dojo’s for learning – for training the neural net. That’s like, when you try to build the neural net that you ship into the car, Dojo speeds that up by hardware-accelerating it." (Elon says, “Yeah, exactly.”)

(Omar: Is that up and running yet?”)

Elon: "No, it might be – we might have the first one at the end of this year, or next year – I think it’s very likely next year, but maybe this year, but it’s essentially meant to absorb massive amounts of video input, and then train against vast amounts of data, so that it can be used in the inference engine in the car. It’s just like a human really, it’s like how long does it take you to learn a subject, versus do a subject. It’s hard to learn, say calculus, but then once you’ve learnt it, you can integrate something fast, or something. It’s really the same basic thing.

(Omar: Yeah, that’ll really tighten the feedback loop. At some point it becomes just impossible to catch you guys. Like, the rest of the people haven’t even really started – the rest of the auto industry, and the feedback loop is getting so tight now, it makes it easier.)

Elon: "I think they will catch up eventually, at least they’ll catch up to where Tesla is now. I don’t know – things like, like for example we were talking about maps and navigation, and how today, like computer-based maps and navigation is considered trivial, but back in ’95 it was not trivial – it was considered very hard, and like the compute power was tiny the code had to be super-tight. You couldn’t have fluffy code, if you were trying to execute something on a 386, very very puny amount of memory and compute. So now maps and directions are considered easy – at some point in the future, a decade or something, it [autonomy] will seem easy. It will be easy in ten years, but for a long time, there will be a long stretch there where there will be vast differences between cars. The auto industry is used to slow rates of improvement. There’s still not really a car yet that mentions[Mod: ¿matches?] the Model S. So that was 2012 and this is 2020. And it’s still pretty hard to get a car, like – there’s not a car available at the price of the Model S that has the capabilities of the Model S.

Mod-edited: question inserted

Elon begins: "It’ll be able to do crazy manoeuvres, like a high-speed chase technically. You always want to bias to be conservative in the actions that it takes."

Elon's comments on Autopilot in the second Third Row Podcast are extremely exciting.

This is probably the most important information we have got this week. It sounds like Tesla is almost done with the complicated pathway to Autonomy.

This could well be the game changer that dramatically reduces disengagement rates and makes people finally start to believe the Robotaxi story.

Elon Musk: "There’s quite a significant foundational re-write in the Tesla Autopilot system that’s almost complete.

Instead of having planning, perception, image recognition all being separate, they are all being combined.

Effectively the neural net is absorbing more and more of the problem.

Beyond if you see an image, is this a car or not, its what do you do from that information.

3D labelling is the next thing when a car can go through a scene with 8 cameras and paint a path and label the path in 3D.

This is probably a 2-3 orders of magnitude improvement in labelling efficiency and labelling accuracy. "

Then after the quote from @ReflexFunds , Elon continues: "a 2 or 3 order of magnitude in labelling efficiency and a significant improvement in labelling accuracy, as opposed to having to label individual frames from 8 cameras at 36 frames per second, just drive through the scene, rebuild that scene as a 3D thing, with – it’s like there might be 1000 frames we use to create that scene, and then you can label them all at once."

(Gali asks: Is that like the Dojo thing that you mentioned at Autonomy Day?) (Elon shakes his head)

Omar Qazi: "No Dojo’s for learning – for training the neural net. That’s like, when you try to build the neural net that you ship into the car, Dojo speeds that up by hardware-accelerating it." (Elon says, “Yeah, exactly.”)

(Omar: Is that up and running yet?”)

Elon: "No, it might be – we might have the first one at the end of this year, or next year – I think it’s very likely next year, but maybe this year, but it’s essentially meant to absorb massive amounts of video input, and then train against vast amounts of data, so that it can be used in the inference engine in the car. It’s just like a human really, it’s like how long does it take you to learn a subject, versus do a subject. It’s hard to learn, say calculus, but then once you’ve learnt it, you can integrate something fast, or something. It’s really the same basic thing.

(Omar: Yeah, that’ll really tighten the feedback loop. At some point it becomes just impossible to catch you guys. Like, the rest of the people haven’t even really started – the rest of the auto industry, and the feedback loop is getting so tight now, it makes it easier.)

Elon: "I think they will catch up eventually, at least they’ll catch up to where Tesla is now. I don’t know – things like, like for example we were talking about maps and navigation, and how today, like computer-based maps and navigation is considered trivial, but back in ’95 it was not trivial – it was considered very hard, and like the compute power was tiny the code had to be super-tight. You couldn’t have fluffy code, if you were trying to execute something on a 386, very very puny amount of memory and compute. So now maps and directions are considered easy – at some point in the future, a decade or something, it [autonomy] will seem easy. It will be easy in ten years, but for a long time, there will be a long stretch there where there will be vast differences between cars. The auto industry is used to slow rates of improvement. There’s still not really a car yet that mentions[Mod: ¿matches?] the Model S. So that was 2012 and this is 2020. And it’s still pretty hard to get a car, like – there’s not a car available at the price of the Model S that has the capabilities of the Model S.

Mod-edited: question inserted

Last edited by a moderator:

StealthP3D

Well-Known Member

Elon says Tesla is spending as much as they need. With $6.3bil in the bank and spending less than half of their operating cash flows on CAPEX, wouldn't it be a good idea to dump the rest of the cash to buy back its own stock?

Oh no. Here is another prediction that will illustrate just how short-sighted it would be to use that $6.3 billion to buy back stock:

The dominoes are being lined up as we grope about in the dark. The plan that will stun the investment world is already in motion. And it's going to take billions. An initial test line is probably being built right now as proof of concept of the new, more efficient manufacturing machines/techniques. With 1/3 the capital investment of traditional battery making equipment and 1/4 the space, Tesla will create at least 3 battery making plants, spread around the globe, that will crank out unfathomable quantities of batteries at unheard of low prices, low prices made possible by the very low capital expenses necessary (along with a faster and more efficient battery manufacturing process). This will stun the automotive and energy markets.

Musk doesn't want to let the cat out of the bag until the concept is proven with a test line. This will all be possible simply by applying first principles thinking to the problem of how to turn raw materials into cells as quickly and efficiently as possible. This plan also requires securing huge quantities of raw materials. It's hard. The timeline is uncertain. There will be problems along the way. They will solve them all in record time.

Welcome to The Machine

The benefits will be enormous. By vertically integrating the last and biggest component, margins will soar along with volumes.

Fact Checking

Well-Known Member

Take advantage of what you know. Sell 650 Calls at tomorrow's expiry. I got $7. You know the MMs aren't going to let 8,240 Call Options expire in the money tomorrow.

This is incredibly poor and dangerous investment advice.

Writing naked call options is incredibly risky, you can easily lose 20x-100x of the premium you collect - the losses are in fact unlimited and are escalating big time if the price moves against you due to options leverage.

Margin protection of retail brokerages does not and cannot protect against catastrophic losses, and I'd not be surprised if the SEC took action in the future to limit the availability of naked options writing to retail investors.

Here's an example of an entire investment firm with lots of wealthy clients not just going bankrupt overnight due to writing naked call options, but the clients ending up owing a lot of money:Here's a wealthy trader who apparently went bankrupt writing naked TSLA call options:

I.e. with naked options you can lose more than you have in your investment account - much more.

Here's a recent example of a trader losing big on writing naked Amazon calls just yesterday:

Only write options hedged calls (where the downside is limited by a long option), or shares covered calls (I.e. where you own 100 TSLA shares for every options contract you write), with the knowledge that the shares might be called away and you might miss a juicy breakout.

Finally, even if you turn out to be right and market makers succeed in controlling the price action today, writing naked calls is a very risky investment habit that is one of the leading examples of "picking up nickels in front of a steamroller" ...

Last edited:

Jeebus. These people are *just now* thinking about this?

I’m glad I have access to “retail investors”.

Probably not a coincidence they are parroting this point the day after Elon talked up the savvy of retail investors. Maybe some of them caught up on the blogs after all...

TradingInvest

Active Member

Sweet. While we're on this subject, three things:

1) Spouse and I visited the financial advisor. Just a general physical because spouse is thinking about retiring (way) early. FA looked at TSLA holdings and said, "Wow! I may have you pick some stocks for me". Now that's a turning point. 9 mos ago, doubt that's the response we would get.

2) To the FA, I did not offer that I first bought TSLA in 2010 for sub $20 and sold most of it months later at ~$35 declaring myself a genius. Did same with AMZN, In at $8. Out at $28. Similar with GOOG. But, with APPL, I held and saw the benefits. With APPL I guess that I had a personal connection to products that I liked, and I just kept increasing my stake. My largest single purchase of TSLA shares was after I took home my Model S in '13; $40k spent at ~$70. I still have those shares. My most recent purchase was at $561. Another $10k well placed.

3) A short time ago, a work colleague who knows I'm into Teslas and TSLA came up to me excitedly to announce they'd just bought as many shares as they could at $410. It was 10 shares. We talk about the cars, & solar and AP whenever we meet and today they asked if I thought they should sell and take some profits. I said "I don't give stock advice. But once upon a time I sold most of my TSLA at $35. Not doing that again".

Many investors could learn from this example. Compounding is very powerful. It's also very important to pick the right companies. I carefully go through a checklist before I decide which one to invest. One of the items on my list is "Given enough money, can I build a business and compete successfully?" Every time I go through this exercises, I find Tesla is the most difficult to defeat. I just can't figure out a way to compete against this company.

Artful Dodger

"Neko no me"

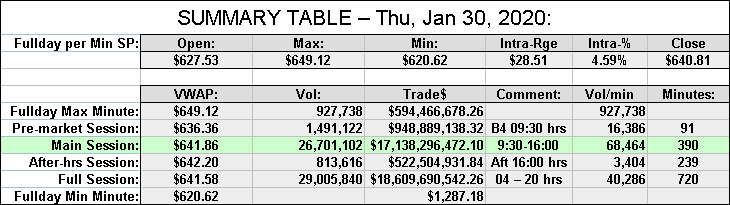

Here's today's after-action report for Thu, Jan 30, 2020:

BTW, I predict TSLA will exceed $770 by Apr 30, 2020.

Cheers!

BTW, I predict TSLA will exceed $770 by Apr 30, 2020.

Cheers!

Many investors could learn from this example. Compounding is very powerful. It's also very important to pick the right companies. I carefully go through a checklist before I decide which one to invest. One of the items on my list is "Given enough money, can I build a business and compete successfully?" Every time I go through this exercises, I find Tesla is the most difficult to defeat. I just can't figure out a way to compete against this company.

You buy stock in a growth company because you believe in the growth. You only sell a growth company stock if you are sick and tired of the dividends it's giving because it's at the end of its growth cycle, or you think you picked incorrectly and the company is going to zero. If it's the latter then it doesn't matter what the sp is, you should get out. If it's the former, then you already won so do whatever you want.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M