Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Sudre

Active Member

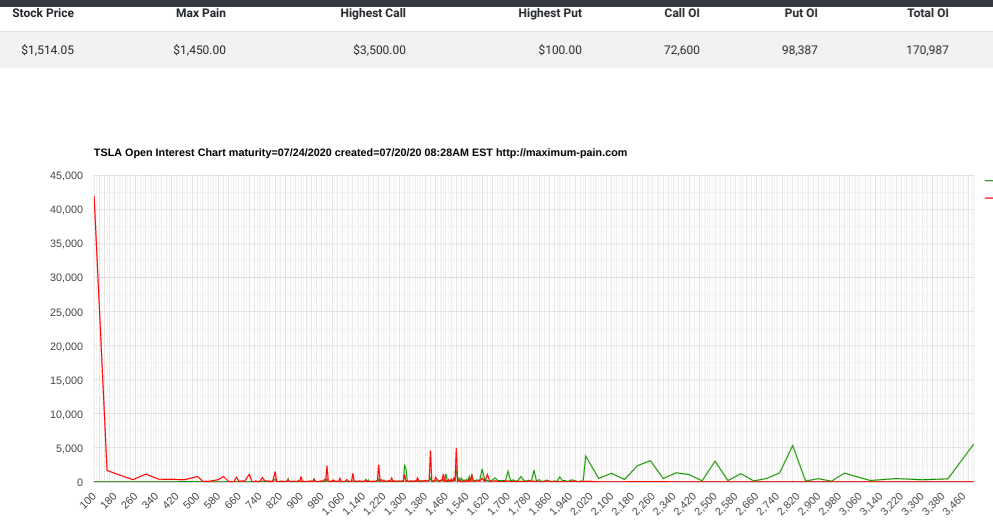

Open interest is flat so far this week. No one has picked a direction.

Sure the massive bankrupzy puts probably bought a year ago are making it difficult to read but even zo0ming in there isn't much out there.

Interest in Calls only really gets started at a $2000 strike and it's not much.

I am betting $1500 will be neutralized today.

Expectations in general are really high for an excellent ER. Everyone here seems to think a profit is in the bag. If there is a one time expense that cancels that profit even slightly the market will take it badly... I mean NFLX is getting punished mainly for future poor growth projections. Investors seem to hate honesty. On the bright side Elon and team seem to have aces up their sleeves. This will be an interesting week.

Sure the massive bankrupzy puts probably bought a year ago are making it difficult to read but even zo0ming in there isn't much out there.

Interest in Calls only really gets started at a $2000 strike and it's not much.

I am betting $1500 will be neutralized today.

Expectations in general are really high for an excellent ER. Everyone here seems to think a profit is in the bag. If there is a one time expense that cancels that profit even slightly the market will take it badly... I mean NFLX is getting punished mainly for future poor growth projections. Investors seem to hate honesty. On the bright side Elon and team seem to have aces up their sleeves. This will be an interesting week.

Captkerosene

Member

He has a poor record. Had to shut his hedge fund down.Anybody here subscribe to Whitney Tilson's "Empire Financial Research" newsletter? Worth the $50/month? I know he's a big proponent of TaaS, but in his sales pitch video he offers up GOOGL as his "free" stock suggestion (the path to investing in Waymo) to entice viewers to subscribe. The problem is that I don't buy the Waymo approach.

TIA

Jack6591

Active Member

Open interest is flat so far this week. No one has picked a direction.

Sure the massive bankrupzy puts probably bought a year ago are making it difficult to read but even zo0ming in there isn't much out there.

Interest in Calls only really gets started at a $2000 strike and it's not much.

I am betting $1500 will be neutralized today.

Expectations in general are really high for an excellent ER. Everyone here seems to think a profit is in the bag. If there is a one time expense that cancels that profit even slightly the market will take it badly... I mean NFLX is getting punished mainly for future poor growth projections. Investors seem to hate honesty. On the bright side Elon and team seem to have aces up their sleeves. This will be an interesting week.

View attachment 566634

Three days at $1,500 is gonna bore the hell out of me.

JRD1

Member

Works for me.

Getting occasional timeouts in the app

I'm having issues logging into it from my phone this morning. ToS seems to be working better, but is also glitchy.Is TD Ameritrade down for anybody else?

Open interest is flat so far this week. No one has picked a direction.

Sure the massive bankrupzy puts probably bought a year ago are making it difficult to read but even zo0ming in there isn't much out there.

Interest in Calls only really gets started at a $2000 strike and it's not much.

I am betting $1500 will be neutralized today.

Expectations in general are really high for an excellent ER. Everyone here seems to think a profit is in the bag. If there is a one time expense that cancels that profit even slightly the market will take it badly... I mean NFLX is getting punished mainly for future poor growth projections. Investors seem to hate honesty. On the bright side Elon and team seem to have aces up their sleeves. This will be an interesting week.

View attachment 566634

Are we sure that spike at the 100 strike is caused by 'bankrupcy puts'? I understood recently that a lot of those worthless (and therefore very cheap) puts are being bought to reduce margin on puts sold at a higher strike.

lafrisbee

Active Member

join the sucking clubDamn I suck at this

I'm having issues logging into it from my phone this morning. ToS seems to be working better, but is also glitchy.

It seems like most of the trading platforms are having some issues. I noticed the occasional slow down/glitches in my IBKR mobile app and even TDameritrade.

GBleck

Member

Anyone else think Tesla is going to issue stock at $1500 to add liquidity to the market on inclusion to the S&P?

lafrisbee

Active Member

Non-Market logic would say "no." The reason being that a measure of the rise due to limited supply should be baked in to the offer price.Anyone else think Tesla is going to issue stock at $1500 to add liquidity to the market on inclusion to the S&P?

Looks like Ford is going with Mobileye. Now all the profits for driving assist belong to Intel. This is the headline from CNBC.

Edit: The video goes into timelines of 2025 and cost for system of $15K for price on a premium car. Does Ford make a premium car?

Intel’s Mobileye and Ford sign deal on next-generation driving technology

Edit: The video goes into timelines of 2025 and cost for system of $15K for price on a premium car. Does Ford make a premium car?

Intel’s Mobileye and Ford sign deal on next-generation driving technology

Last edited:

dgodfrey

Member

Okay, have all the weak longs left the building? Let's do this.

HG Wells

Martian Embassy

Wanted to mention NKLA is down 17%

BOTS may equate TSLA so holding TSLA down.

I know, I know.

BOTS may equate TSLA so holding TSLA down.

I know, I know.

jhm

Well-Known Member

The bulk order with Nel gets the cost of electrolzers down to a reasonable price. Your best return on investment is only to operate when marginally profitable. So yes, close to a 50% load factor may be optimal regardless of the capex. You'll hear plenty of people argue that to get the all in cost per kg hydrogen down you need a high load factor. But all-in cost per kg is not what optimizes the return on investment. There is a sunk cost fallacy that gets people to think that minimizing all-in costs matters when it doesn't. Running electrolyzers only when power is cheap is the only real future for electrolyzers.When He's getting energy may only be half the time.. Therefore there would be a doubling of production systems to meet his production needs. His equipment may only be utilized half the time.

Long night of whisky last night...woke up, checked my phone and almost sharted in my pants when i saw TSLA up +$124..then i realized AMZN's ticker was right above TSLA....so im going back to sleep. I'll probably wake up Wednesday around 1pm PST.

TheTalkingMule

Distributed Energy Enthusiast

TSLA options reminder....

If you wanna get silly and try to time a SP bump on earnings....buy for NEXT Friday, not this Friday. TSLA short squeezes have recently had a delayed reaction of a couple days. Thoughts and prayers.

If you wanna get silly and try to time a SP bump on earnings....buy for NEXT Friday, not this Friday. TSLA short squeezes have recently had a delayed reaction of a couple days. Thoughts and prayers.

Jim Cramer interview: mobileye-and-ford-partner-on-next-generation-driving-technology

* It would be much easier for governments to approve a robo-taxi fleet operator then to approve selling of level 4/5 autonomy to consumer vehicles.

One more possible reason why Tesla does not allow buy-back of Model 3 after lease,

* It would be much easier for governments to approve a robo-taxi fleet operator then to approve selling of level 4/5 autonomy to consumer vehicles.

One more possible reason why Tesla does not allow buy-back of Model 3 after lease,

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K