Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

RobStark

Well-Known Member

They simply can't "promise" that! It will either be too expensive to buy, or won't actually have that kind of range, or will be a loss-making vehicle for Daimler. Model S is currently 380 miles on WLTP (on the German Tesla page). More than 435 miles WLTP is a fair target for end-of-2021. I just don't believe they will hit it... their current car does like 259 miles WLTP. Mercedes needs to start promoting what it is actually good at... luxury/interiors. At this stage they are no more than their own Maybach. If Tesla can produce an interior that rivals Mercedes, or at least neutralises the significant differences... Mercedes will be out of bullets. I'm not entirely sure Elon is interested in doing that though... he does whatever sells cars, and as we know, plenty of Mercedes faithful have happily moved over to Tesla for the other aspects. A person rode in the back of my car once. He said "it's nice, but nothing beats the ride quality in the back seat of a Mercedes." Maybe that's true. (for my 2013 car) But lots of real buyers are ditching Mercedes, so it doesn't matter about subjective back seat superiority.

Mercedes S Class starts at $95k.

I think they can afford a massive battery.

EQS is not trying to compete with Taycan or Model S on driving dynamics.

Elon ditched leather and not interested in luxury interiors or adding the weight it requires.

The BEV Brand alternate to EQS will be Lucid Air.

There is a significant difference in cost. I bought one of each...TSLA options reminder....

If you wanna get silly and try to time a SP bump on earnings....buy for NEXT Friday, not this Friday. TSLA short squeezes have recently had a delayed reaction of a couple days. Thoughts and prayers.

The bulk order with Nel gets the cost of electrolzers down to a reasonable price. Your best return on investment is only to operate when marginally profitable. So yes, close to a 50% load factor may be optimal regardless of the capex. You'll hear plenty of people argue that to get the all in cost per kg hydrogen down you need a high load factor. But all-in cost per kg is not what optimizes the return on investment. There is a sunk cost fallacy that gets people to think that minimizing all-in costs matters when it doesn't. Running electrolyzers only when power is cheap is the only real future for electrolyzers.

You also need to double the number of compressors, cooling systems, safety systems and even storage. All because of the surging nature of the production. Double the amount of equipment, you may double the size for the plant and double the maintenance. Also it may require running during high price times if there is any interruption of production during the cheap power times.

Mo City

Active Member

These tie-ups are expected but notice the distant time frame and limited rollout.Looks like Ford is going with Mobileye. Now all the profits for driving assist belong to Intel. This is the headline from CNBC.

Edit: The video goes into timelines of 2025 and cost for system of $15K for price on a premium car. Does Ford make a premium car?

Intel’s Mobileye and Ford sign deal on next-generation driving technology

Instant distribution is why Tesla would grind everyone else to powder if they are first to reach autonomy.

Buckminster

Well-Known Member

I sure hope so, I'm not mentally prepared to call in rich yet.Anyone else think Tesla is going to issue stock at $1500 to add liquidity to the market on inclusion to the S&P?

Stretch2727

Engineer and Car Nut

It's incredible, for me 1% today is equal to 50% of my total initial investment back in 2012, I'm still finding it hard to believe!

Just remember this on the downside as well. Personally I find if easier to stomach the large drops now that the stock price is higher, even though on some days it can be 50% of my original investment.

So what is the thought about today's price action thus far? People just holding their cards? A nice spike at open but a slow melt ever since, despite decent macros, which was unexpected.

Low volumes so not much to be read, IVs got crushed on Friday and some more today. Seems like nobody wants to sell so the bots are just happy selling to each other

It does feel weird when Tesla is not volatile, we are just not used to it at least on Mondays lol.

It's fun to see these big options trades... Someone bought ~2M worth of July 24 2020 1800c this morning

I _think_ this tx was part of a 1700/1800 bull spread because the 1800 traded on the bid and the 1700 closer to the ask, so the net premium was ~$1.25M

Navin

Active Member

IMO - 2500 this week is possible; no tears

I don't see any reason why the stock will move this week before earnings, without new information coming out. Everyone has their expectations and positions built up. On the plus side, sitting at $1500 for this long is definitely a good thing.

Stretch2727

Engineer and Car Nut

Anyone else think Tesla is going to issue stock at $1500 to add liquidity to the market on inclusion to the S&P?

Even a $5B is offering is only 3.3M shares. The indexes need to buy 26M shares. The benchmarked funds around 37M shares.

I don't see how a share offering makes a difference in liquidity unless it is an huge offering. I don't believe Elon would do a huge offering (>$10B) as they cannot put that much money to work. His target is 50% y/y sustainable growth and you can only go so fast due to people, learning curves etc.

So they may do an offering but I don't think it will matter much to the liquidity. He will just be taking advantage of the relatively high stock price make the balance sheet even more robust.

New Seeking something article:

Nikola, Rivian, NIO, Fisker - Tesla's Competition Is Arriving

Should not Ford, GM, BM, VW and everyone else already be here?

Arriving where? The land of slow and no?

GBleck

Member

I'm thinking a tinny 2-5 billion to appease the S&P people. Will still put buy pressure but just enough to say they did something. Also more cash is never a bad thing during volatile markets.Even a $5B is offering is only 3.3M shares. The indexes need to buy 26M shares. The benchmarked funds around 37M shares.

I don't see how a share offering makes a difference in liquidity unless it is an huge offering. I don't believe Elon would do a huge offering (>$10B) as they cannot put that much money to work. His target is 50% y/y sustainable growth and you can only go so fast due to people, learning curves etc.

So they may do an offering but I don't think it will matter much to the liquidity. He will just be taking advantage of the relatively high stock price make the balance sheet even more robust.

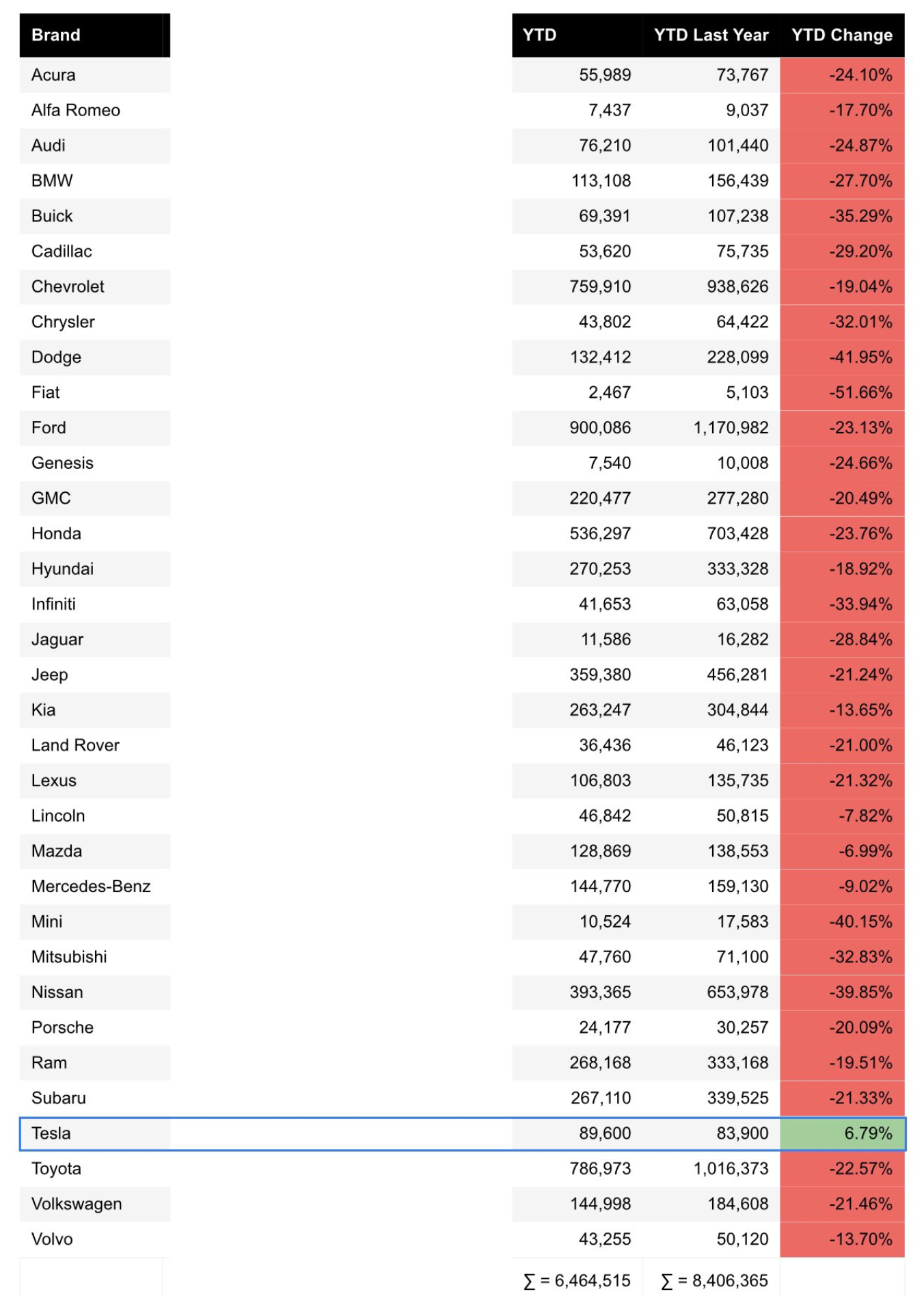

Tesla is the only brand to have increased auto sales from first half of 2019 to first half of 2020

https://twitter.com/jpr007/status/1285232227408687105

[EDIT : changed "company" to "brand" above since that is what chart is showing, but it is true for company as well]

https://twitter.com/jpr007/status/1285232227408687105

[EDIT : changed "company" to "brand" above since that is what chart is showing, but it is true for company as well]

Last edited:

StarFoxisDown!

Well-Known Member

I was going to start posting again this week since it's earning week but I see there's still some discussion about Tesla doing a offering......so I'm just gonna stay away to avoid arguments about how dumb it is to dilute BEFORE multiple catalysts in the next 4-5 months.

I look forward to Tesla's cash position increasing on Q2 earnings which will hopefully make people realize there's no immediate need for Tesla to have another 2-3 billion in cash.

I look forward to Tesla's cash position increasing on Q2 earnings which will hopefully make people realize there's no immediate need for Tesla to have another 2-3 billion in cash.

TheTalkingMule

Distributed Energy Enthusiast

If it's good for the mission, do it. Tesla(or any disruptor growing this fast) would be foolish not to take this opportunity to raise $10B or so. Hedge against a very likely massive global downturn for which we're long overdue, and if not.....expand faster. If there's a fat recession 12 months from now, this board will look like fools.

The only people who benefit from sitting tight through inclusion are investors. And who cares about that bunch of island-owning, orca-riding jerks?

The only people who benefit from sitting tight through inclusion are investors. And who cares about that bunch of island-owning, orca-riding jerks?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K