Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I rarely ever watch the drag racing videos - not too much into the speed crazeThis rocks...

Drag Race: Tesla Model Y Performance Smokes BMW X3 M Competition & Mercedes Benz GLC63 S

(Edmunds via Tesmanian)

But this video is fabulous!!!

Well, Labor Day tomorrow in the States (would be "Labour Day" elsewhere if celebrated?), and while we in the US may be spared the compulsive look at our phones or computers to check TSLA stock price on the NASDAQ, not so at the markets in the rest of the world.

I check Berlin and Frankfurt often, but are there any other spots that TSLA addicts can turn to for a fix?

Asking for a friend ;-)

I check Berlin and Frankfurt often, but are there any other spots that TSLA addicts can turn to for a fix?

Asking for a friend ;-)

Sorry for posting about this again, but on page 20-22 of this report there's a really good rebuttal of solid-state batteries. I was aware that solid state batteries work in small lab batteries and had trouble with mass-fabrication, but I didn't know any details. This makes it much more clear why Tesla's strategy of focusing on getting li-ion $/kWh costs down is the right path forward.I know this sila nano doc has been posted a couple of times in the middle of last week's frenzy. But if you didn't have a chance to read it then this is a good way to spend a part of your labor day weekend. Or a Sunday evening for those not stateside.

Must read for those who what to get a birds eyeview of what's going to transpire in the next decade or so, in the batteries space.

Joe F

Disruption is hard.

I know for a fact that my S has major panel gaps. All of them in fact,; Collectively they’re between me and all the slow ICE speed racers that try and beat my out on a highway. Biggest gap ever.

Doing my part in Tesla advertising. It’s like those signs outside of an apartment complex, “If you lived here, you’d already be home.” Only, “If you drove a Tesla, you’d hate what you’re driving now.”

Doing my part in Tesla advertising. It’s like those signs outside of an apartment complex, “If you lived here, you’d already be home.” Only, “If you drove a Tesla, you’d hate what you’re driving now.”

Warning: anecdotal evidence but...

In the Swedish Tesla fb owners groups there is a lot of talk lately about “phantom braking” on the latest versions of the firmware in their Teslas. What happens is that the car slams the brakes on the highway scaring the driver and passengers and the traffic behind them. No accident yet fortunately.

Doesn’t seem to be similar widespread mentions of this in the national Tesla society forums (not on Facebook but a forum similar to this one), but a quick search on the Swedish forum I found some recent discussion threads mentioning that this has gotten worse since firmware 2020.32.x (I think the latest is .5). Some people are experiencing this often, others not so much it seems.

Two hypotheses:

1. This problem is greater in Europe or Scandinavia or Sweden because of something particular about the construction of roads here.

2. Experienced Tesla owners are more aware of that phantom braking can happen sometimes but have learned to counteract phantom braking and are not as surprised by it. Facebook groups are more populated by new owners while the Tesla society is more populated by long-term Tesla owners.

In any case I find this a bit worrying. Some of the stories I read on fb indicated that serious accidents on the highways were dangerously close due to phantom braking events. Something to look out for and hopefully that Tesla will prioritize fixing soon.

Nothing new. Comes in one firmware version, gone in the next.. Not good, but also not worrisome.

Tslynk67

Well-Known Member

Three of my favourites:

Shostakovich violin concerto - I'm particularly fond of the Sarah Chang interpretation

Sibelius VC - Anne-Sophie Mutter (in fact anything by ASM is amazing, Carmen Fantasie was my first introduction to her approach)

Philip Glass VC - the Dennis Russell-Davies with Arnaud Capuchin is particularly spectacular, not least because they play it slooowwww

Somebody else's perspective

The $400B Front Run with the Index Funds Holding the Bag – Part III | The Bear Traps Report Blog

The $400B Front Run with the Index Funds Holding the Bag – Part III | The Bear Traps Report Blog

FTFY

With fleet size growing exponentially, any problem would appear to be worsening in online forums.

My own experience is phantom braking has been steadily improving, and had got so much better over the past year or so.

It used to brake for overhead bridges etc, but with latest few releases I never experienced those at the same places.

So have no doubt experiences vary, but for me on the GCP of NYC my FSD sucks. And it is not a good place at all for phantom breaking. People on your butt relentlessly.

I am prepared for great improvements. I can see the outline, details really suck for me.

Tes La Ferrari

Active Member

I like your idea to get out of the S&P 500 Index but this might not be the right time to enter the International Growth Fund (after such excellent performance over the last 9 months). A good way to de-risk at this stage of the markets would be S&P 500 to Russel 2000 (which also has TSLA, although a lesser percentage).

Since you already have the ability to invest directly in TSLA in whatever percentage you feel appropriate, the TSLA weight in a fund should not even be a consideration. The Russel 2000 has a history of under-performing the S&P 500 but it also tends not to rise and fall as much so, having ridden the S&P 500 and the International Growth Fund so far up, it might be a good time to re-weight into a fund that is likely to fall less if we hit a period of negative returns.

Just a thought.

Sold out of the final bits of my S&P this week, and a most of it the week before.

Started converting it to TSLA in upper $400's which with the benefit of 20/20 hindsight - was a bit early), as the price has come off since I started buying. (bought in the low 400's too). I realize it won't matter 10 years from now, but the sport of getting a great TSLA deal is tempting.

Timing markets has never been my forte but it's nice to end up with a decent entry point. I am happy with my core position for now - but love buying TSLA on sale.

Giving credit it where it is due - you prognosticated well @StealthP3D with your decision to sell a bit at the high. What say you about possible "TSLA on sale" periods between now and Battery Day ?

You left out ‘wealth gaps’ from the TSLAQ crowd.....Gaps are indeed worrying, but the only ones worthy of such worry are the TSLAQ knowledge/reality gaps.

Some-Some

Body

Off

The

Chain

Silly

Boy

On

The

Cramer

Silicone

Battery

Or

The

Cathode

Some

Bodies

Of

TeslaQ

Cremated

Body

Ought

To

Capitulate

True - again you are right and these small differences will probably make a difference in the long run. Maybe I will switch everything to BPTIX if I can. In my defense, I am usually doing these research late at night, when the family if gone to bed - doesn't always help with accuracy

One thing to watch out for is transaction fees. In my retirement plan BPTRX is transaction fee-free as long as you don't sell shares within 60 days of purchasing them. However, BPTIX has a $49.95 transaction fee, so I don't invest in it with my paycheck contributions. I'm thinking about selling BPTRX and buying BPTIX when the balance gets high enough to make the fee have less impact, but I don't know if it is really worth it. (Over a long time it probably does make a difference.) The bad part is that they don't let me do it same day, so I have to sell one day and buy the next. Which risks losing, or gaining, one days worth of change.

Kinda weird, I just noticed on my E*TRADE account that tesla SP reset to what it was at closing on Friday instead of after hours trading.

Normally this figure would not be revised until trading resumed on the next trading day. Anyone else seeing this bug on their end? Just a glitch I assume.

Normally this figure would not be revised until trading resumed on the next trading day. Anyone else seeing this bug on their end? Just a glitch I assume.

Jack6591

Active Member

MC3OZ

Active Member

For the made in Berlin Model Y we might see:-

If we consider COVID-19 restrictions on travel, doing next level automation at Berlin makes sense as the Grohmann team can be actively and easily involved.

In terms of the final product the advantage are :-

More Automation also makes sense in Berlin as the local area has low population, new workers need to migrate to the area, solving issues by hiring more staff might not be optimal.

What is different this time around from the initial sub-optimal automation in the Fremont Model 3 ramp?

Of course this is all speculation.... but it is on a level that justifies the hints dropped by Elon.

I think what Elon may be most excited about boils down to one thing :- Faster Line Speed.

- Casting front and rear/possibly sides

- Automated single pass 3 layer paint - 3 stations

- Automated installation of new wiring harness

- Automated marriage - motor and pack installation

- More automated GA process.

If we consider COVID-19 restrictions on travel, doing next level automation at Berlin makes sense as the Grohmann team can be actively and easily involved.

In terms of the final product the advantage are :-

- Casting - simplified faster production, lower weight, better QA (locating pins and mounting points in castings),

- Wire hardness - faster installation - lower cost - lower weight

- Paint :- better quality paint, faster line speed

- Automated Marriage and GA - faster line speed

More Automation also makes sense in Berlin as the local area has low population, new workers need to migrate to the area, solving issues by hiring more staff might not be optimal.

What is different this time around from the initial sub-optimal automation in the Fremont Model 3 ramp?

- Tesla has learnt from their mistakes and has vastly more experience.

- Tesla Grohmann can be intimately involved in all phases.

- This is not a bet-the-company situation - very important.

Of course this is all speculation.... but it is on a level that justifies the hints dropped by Elon.

I think what Elon may be most excited about boils down to one thing :- Faster Line Speed.

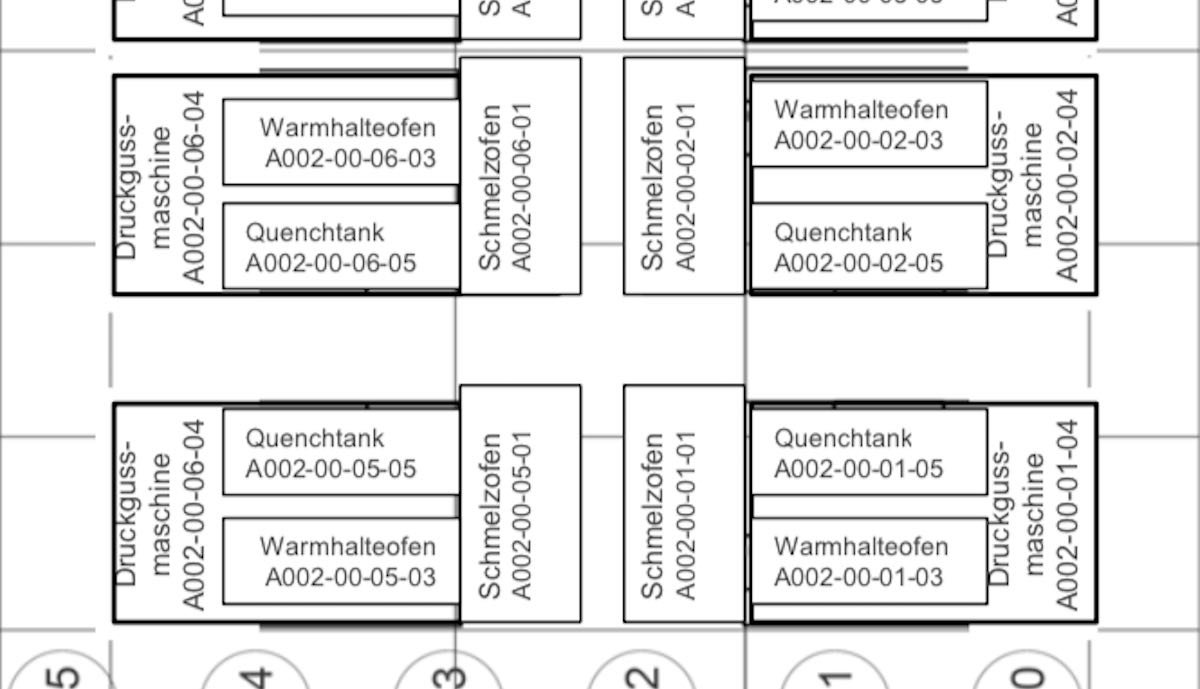

From Teslamag.de:

8 Giga presses in Gigafactory Berlin

Tesla boss announces radical new technology for production in Giga Berlin: This is what it looks like:

One of the new Giga presses was recently installed in Fremont and in Tesla's second new Gigafactory building in China . And for Tesla's German Gigfactory in Grünheide, Brandenburg, eight of these hundred-ton machines are planned.

"There are 8 die-casting machines with a maximum operating capacity of 73.1 t / d per machine", says one of the thousands of pages of Tesla applications for the German Gigafactory , which were officially laid out on the Internet and documented by a Twitter user .

Source: Tesla-Chef: Transformation in Giga Berlin – Pläne zeigen sie > teslamag.de

8 Giga presses in Gigafactory Berlin

Tesla boss announces radical new technology for production in Giga Berlin: This is what it looks like:

One of the new Giga presses was recently installed in Fremont and in Tesla's second new Gigafactory building in China . And for Tesla's German Gigfactory in Grünheide, Brandenburg, eight of these hundred-ton machines are planned.

"There are 8 die-casting machines with a maximum operating capacity of 73.1 t / d per machine", says one of the thousands of pages of Tesla applications for the German Gigafactory , which were officially laid out on the Internet and documented by a Twitter user .

Source: Tesla-Chef: Transformation in Giga Berlin – Pläne zeigen sie > teslamag.de

S

Sofie

Guest

I have TD Ameritrade and have the same exact thing. I noticed it last night. It reset to the price at close of Friday and didn’t include the Friday after hours price. Hmmmm....Kinda weird, I just noticed on my E*TRADE account that tesla SP reset to what it was at closing on Friday instead of after hours trading.

Normally this figure would not be revised until trading resumed on the next trading day. Anyone else seeing this bug on their end? Just a glitch I assume.

Kinda weird, I just noticed on my E*TRADE account that tesla SP reset to what it was at closing on Friday instead of after hours trading.

Normally this figure would not be revised until trading resumed on the next trading day. Anyone else seeing this bug on their end? Just a glitch I assume.

Me too. $418.32.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M