Remember, too, the South Australian battery farm was made out of individual PowerPacks, not MegaPacks. I don't think we have accurate costs published for things like this, but you can bet if they did the same again it would be cheaper and better now. Which, of course, they are doing in multiple places in California right now.Oh yeah man, come to Germany

In that case, the price target is too low.

I would be very much looking forward to the battery day to understand how fast they can scale up their mega packs. We need to remember that the Australian battery that costed around multi million euros was paid back within 3 years. If Tesla has figured out production of these mega packs, we are in for a crazy upwards in revenues.

Also, I prognose that the meeting with Diess could have been also about the mega packs since we know that Volkswagen is using those at their charger stations.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Virtual certainty. This is the earnings chart from Yahoo Finance on Friday:Rookie question re S&P 500. If Tesla doesn’t show a profit this quarter do they have to start over with four consecutive quarters of profit before being considered again?

Is there a likelihood they will show a profit again this quarter?

cheers.

They're predicting a better profit than Tesla has ever actually achieved. With car sales rebounding and Y shipping in quantity, and cheaper, how could they fail?

I believe Energy could be similar to Auto with FSD. The battery and solar market will grow fast, but eventually will be surpassed by the software grid market solution. TE will become a software grid, on top of the physical grid. It is possible they won't get to scale, but they seem best positioned to take an early lead. The software grid will allow car owners to share burst energy during premium demand and delay charging, commercial buildings to charge at night cheaply and run batteries during peak demand, consumer solar\battery customers to share their power during peak demand and for large scale utility providers to leverage peak demand solutions. If Tesla can capture some microtranasction payments by providing the market, it will provide tremendous value and profit for all of these participants and create a more resilient grid that will grow faster then the economy. The electricity market should grow faster then the overall energy market as fossil fuels decline, even as the cost per KWh falls over the next decade. This could be a trillion dollar market, with 10's of billions of profits annually by 2030.

I would expect Tesla to be forced to spin off energy from auto, as the scale of the company grows more powerful than governments will be comfortable to accept. From a value perspective that would be a rounding error once this business is at scale and could be more valuable to spin off.

I agree, that TE will become a significant income contributor. However, I would caution against modeling the current peak-demand energy price system as the basis of the long term future driver. Battery storage will smooth out the energy price curve eventually. The fact that the energy market places a high price on peak demand and there is crazy fluctuations sometimes going into negative when renewables are producing more than the demand is simply an artifact of the lack of energy storage.

In the short term, the price fluctuation will drive the TE business as companies (and also home owners) want to avoid crazy peak demand charges and utilities want to increase their profits. However, in the longer term once enough battery storage capacity is installed on the grid, the market will react and there will be no crazy swings in energy prices, it will smooth out, simply because there will not be crazy peak demand spikes as the battery storage becomes ubiquitous and buffers the fluctuations between production and demand.

Last edited:

Only about a dozen workers on site. Pumping of flooding continues. Possible outline of third factory building at 6:50 (which I don't is quite correct).

(too early) but is Texas GF gonna be able to be at Berlin GF construction speed (even without all the bat cave, ants, WW2 bomb detection, Trees .. issues) ?

This assumes that the utilities will be forward thinking enough to make the transition to battery storage before so many homeowners have solar that the utilities can no longer afford to do so. Utilities have never been known for forward thinking, any more than the legacy car manufacturers.In the short term, the price fluctuation will drive the TE business as companies (and also home owners) want to avoid crazy peak demand charges and utilities want to increase their profits. However, in the longer term once enough battery storage capacity is installed on the grid, the market will react and there will be no crazy swings in energy prices, it will smooth out, simply because there will not be crazy peak demand spikes as the battery storage becomes ubiquitous and buffers the fluctuations between production and demand.

No. That would make the power train supplier a competitor of Tesla and would cause a lot of redundancy. Redundancy only adds expense and more layers of management.If Tesla was to become battery/power train supplier to other OEMs - would it make sense for that part to be spun out to it's own subsidiary?

Has Tesla announced when Model Y is arriving in Europe? And whether it will be from Berlin or Fremont?

They haven't, and it likely means there is enough US/Canada demand to meet current production.

Knightshade

Well-Known Member

What about Tesla with a ride hailing service(Uber, lyft)? Maybe this is the middle ground.

I can't figure out why anyone thinks this'll help the stock- rideshare companies (the traditional kind relying on human drivers) do nothing but hemorrhage money.

Now, it'll help TESLA to work out bugs in their app and network back end for if robotaxis are ever a thing- but even treating their workers (I mean CONTRACTORS) like garbage Uber and Lyft still lose billions a year... assuming Tesla is gonna treat owners even marginally better I don't see how it's not a loser as well while humans are driving. Even if they magically do better than companies who've been at it a while that's maybe break even? Hardly stock-bump worthy.

Not to mention it's gonna drive up traffic to superchargers, which they're perpetually behind schedule building more of.

Addendum- I also don't see how they do it until they've got Tesla insurance going in the place they want to roll it out... which AFAIK is still just California (though IIRC a few more states and countries are coming).

Now THAT's potentially worth considering as an investor as a positive to the stock, if they get regular car insurance nationwide (and possibly in other nations too, though I know less about the profitability of insurance overseas).

Agree - the truth is, nobody outside of the FSD team knows how far along they really are. The 4d rewrite is a fundamentally new and different beast that no customer has experienced.

I expect many people extrapolate from self driving progress over the past 2-3 years and estimate that it’ll take at least a decade before robotaxis are ready. But this is misguided.

To be fair, many (including myself) made that exact argument about HW3.

Telling folks in the various self driving threads they couldn't judge progress based on HW2/2.5 behavior, since HW3 would enable so much more capability.

And it turned out, it did enable some more, but nothing like a quantum leap in FSD-is-almost-here-ness.

Now, will the re-write actually be a quantum leap? Sure could be. I certainly hope so. But fool me once and all that.

And even Elon mentioned it still requires interventions on his own daily drive- and it'll be at least another year before it does things like handle a roundabout well.

The thing to get from this very much in praise of Elon is he is repeatedly willing to abandon a dead end development path.

He was "confident" HW2 and the current development branch was sufficient for FSD. He found out that was wrong... so they made HW2.5 and some development tweaks he was THEN confident was sufficient for FSD.

He found out THAT was wrong (and even planned for it- insisting HW3 be a plug and play replacement for 2.x)- so they made HW3 and he was THEN confident that was sufficient for FSD.

He found out THAT was wrong, and they began the fundamental re-write of the code to create the 360 view instead of treating each frame independently.... he's confident THIS will be sufficient for FSD.... results TBD.

But note HW4 and Dojo are both in development-AND they've been seen testing a revised/expanded FSD sensor suite on cybertruck.... either to make it even more better, or in case his confidence is misplaced in this iteration of the solution.

If this were Toyota doing FSD development they'd still be stuck on their original, dead-end, path to FSD and probably would stay there for years going forward... (see how they kept thinking HFCs would be a thing long after it was obviously they wouldn't)

. How long will it take? I don’t know, but Elon Musk seems very confident that Tesla is much closer than people realize.

See above on Elons confidence.

Also he was also confident there'd be robotaxis approved in some jurisdictions this year

And confident they'd do an FSD cross country drive in 2017.

And a lot of other things around FSD that didn't happen in the timelines he was confident in.

Once again, Elons own words on why you shouldn't buy into what he says concerned dates for things he hasn't solved yet:

Elon Musk on 60 minutes said:People should not ascribe to malice that which can easily be explained by stupidity." (LAUGHTER) So-- so it's, like, just because I'm, like, dumb at-- at predicting dates does not mean I am untruthful. I don't know-- I-- we've-- I never made a mass-produced car. How am I supposed to know with precision when it's gonna get done?

Now sub "FSD" for "made a mass produced car"

There's whole other sections/threads about getting the weeds on how soon or likely FSD is if you wanna move the discussion over to em.

From an investor perspective though I think it's silly to include any of Elons FSD confidence in your planning, outside of the ability to recognize additional deferred FSD revenues (which should be possible for MUCH, but still not all, of it once they add autosteer on city streets, potentially by end of this year, even at L2)

JRP3

Hyperactive Member

Tesla Joins Cobalt Group That Supports Artisanal Congo Miners

"Tesla Inc. is backing a new initiative to support informal cobalt miners in the Democratic Republic of Congo as carmakers and miners seek to reassure customers about ethically mined supplies of the battery metal.

The company joined the fledgling Fair Cobalt Alliance, according to an updated list of members on the group’s website. The FCA aims to end the use of child labor at mining sites and improve working conditions in Congo."

"Tesla Inc. is backing a new initiative to support informal cobalt miners in the Democratic Republic of Congo as carmakers and miners seek to reassure customers about ethically mined supplies of the battery metal.

The company joined the fledgling Fair Cobalt Alliance, according to an updated list of members on the group’s website. The FCA aims to end the use of child labor at mining sites and improve working conditions in Congo."

MTL_HABS1909

Active Member

https://twitter.com/somospostpc/status/1302915230075420672?s=20 Elon Musk/Herbert Diess meeting at Braunschweig airport before leaving Germany

To me, this makes VW look like a little child looking to his big brother for approval.

Destination

Member

Hi.

Memes are fun.

So are theories.

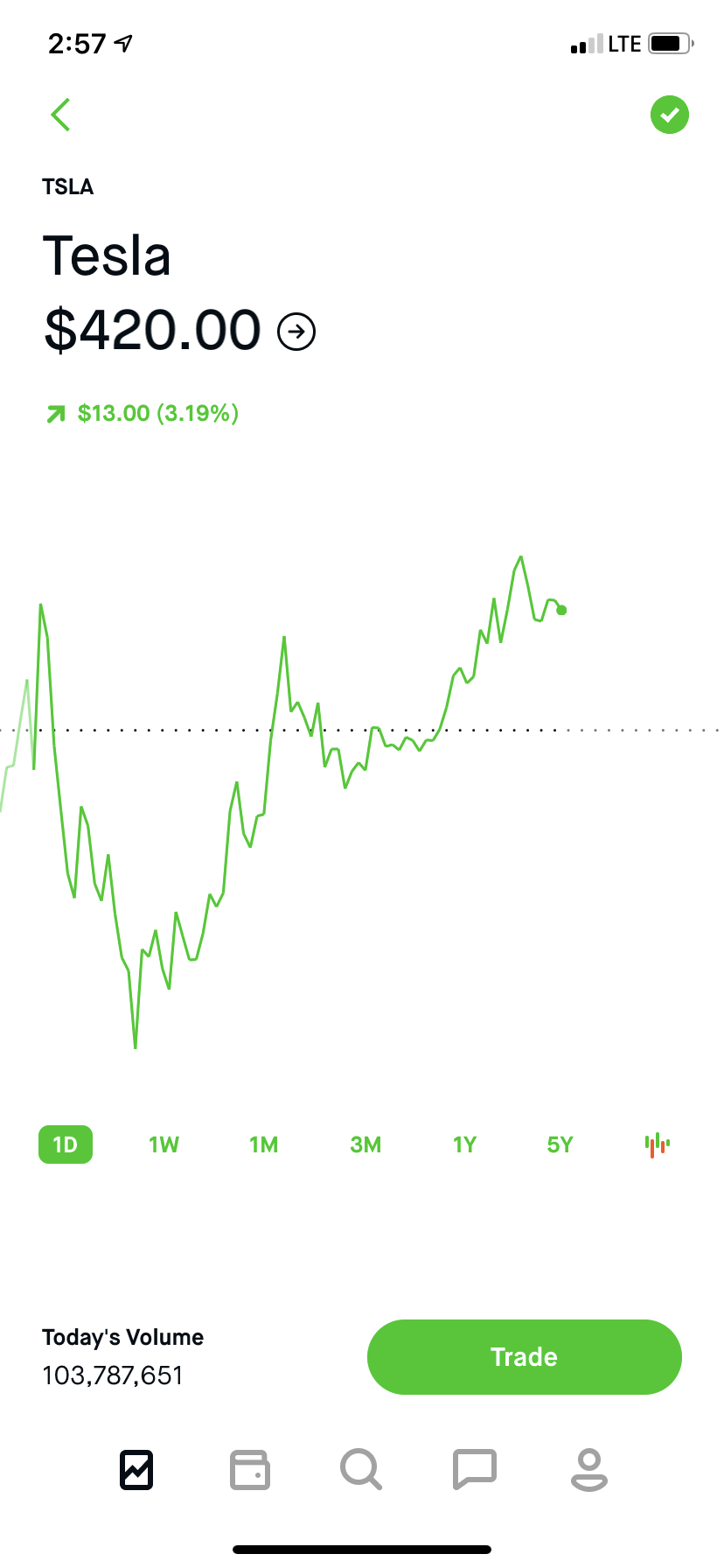

Was it fun to see TSLA magnetized towards SP 420 on Friday, so much so Jim Cramer stated shock at buying pressure on Twitter? That’s silly, right?

When Tesla made its secondary offering “at market price”, do you believe they had a target share price?

If you were Elon, having experienced “take private” episode, and you were forced to draw the line while your stock was squeezing...what SP would you pick?

It is likely $420 is the floor, and that everything below will just encourage more buying until that number is reached.

Memes are fun.

So are theories.

Was it fun to see TSLA magnetized towards SP 420 on Friday, so much so Jim Cramer stated shock at buying pressure on Twitter? That’s silly, right?

When Tesla made its secondary offering “at market price”, do you believe they had a target share price?

If you were Elon, having experienced “take private” episode, and you were forced to draw the line while your stock was squeezing...what SP would you pick?

It is likely $420 is the floor, and that everything below will just encourage more buying until that number is reached.

Yup. Also the value of each additional stored kwh decreases as more storage capacity is installed in that part of the power grid.The differences in supply and demand are driving the price differences. Traditionally, utilities have mitigated this to some extent by reducing supply at times of low demand but that comes at a certain cost, too, and won't save any for renewables. You can arbitrage if you have both the software and storage. The software can theoretically scale quite fast but storage is the limiting factor. In a business model where Tesla and storage owners split the arbitrage, this only makes sense when the payout to the storage owner compensates for the depreciation of the battery and then some. Therefore, this hinges on battery cost per kWh and charging cycles.

Even if some other party comes up with their version of auto bidder + virtual power plant, this doesn't work out if there is no remote controlled battery on the backend. And Tesla is limited by the amount of storage deployed that makes economical sense to participate in a VPP.

In other words: Cost for a stored kWh has to be less than the sum of compensation for pulling it out of the grid and feeding back in. And when energy prices are not far off from the mean, it only pays for the lowest cost batteries again taking lifetime cost into account).

Simply regulating demand by taking control over when vehicles charge is always viable.

When modelling Tesla energy, this kind of recurring revenue needs to be taken into account. As a positive side effect, it ensures that the market for private storage will get saturated at a lower pace: The owner is encouraged to charge and discharge beyond his own consumption and thus needing a replacement earlier than otherwise.

dc_h

Active Member

The graph below is taken from a teslarati article yesterday Tesla Model Y efficiency exceeds early-production Model 3, data shows.

View attachment 585313

I am not familiar with how MPGe ratings are worked out so wondered if any of you guys could help clarify if this means that there has been a 20% increase in range in Model 3s produced now vs 2020H1? There is a similar bump for Model Y

If this is correct am I right to infer that a significant part of this range increase will be due to battery improvements. Weight reduction seems unlikely to provide this improvement, especially as the 3 has been around for 2 years now. Efficiency from the other parts of the drivetrain (motor etc) also seem less likely for an improvement of this magnitude.

Not enough info in the article to know how software improvements are taken into account (is the data the current MPGe being reported by the vehicles - hence including the impact of software improvements - or the figures when the vehicle was new. I lean towards the first option as this info has been collected by an app).

Which brings me back to how MPGe is calculated. According to Google ' The EPA calculates that 33.7 kilowatt-hours of electricity is the equivalent to one gallon of gas, so an electric or hybrid vehicle that uses 29 kWh per 100 miles would get a combined 115 MPGe rating.' Is this based on a measured battery capacity? Just wondering what happens when Tesla improve battery chemistry and hence capacity. Is the new battery capacity taken into account in the calculation or is it still based on the original battery capacity (as originally measured by EPA).

Thoughts/feedback really welcome as this is not clear to me. I think this is positive news but want to understand exactly how it is positive

Octovalve

It was reported that the frunk of the model 3 was recently updated to possibly allow the addition of the Octovalve. Sandy Munro also noted the Octovalve has gone through several iterations their year. The latest appeared to be significant. This was the biggest factor in Model Y nearly meeting 3 efficiency despite larger size.

I expect battery day to include Plaid S and X and to include the Octovalve for both cars. Between improved battery performance, the Octovalve could add 10-15% range by itself. 500 miles seems very likely for the S and 400+ for the X.

I think specific products are likely for Battery Day to make sure analysts and the market understand the implications of the announcements. Battery Day isn’t an endpoint, but the beginning of a new chapter that is likely to bring 50% density improvements over the next 5 years and at least 50% decline in costs per KWh.

Bottom line, I don’t think the changes measured for 3 and Y are weather related.

hacer

Active Member

Apologies to @Artful Dodger - I was way behind on the thread when I saw @CorneliusXX 's post and did not know you had demolished it so well already. His post was so bad I immediately hit reply which trying to catch up on the thread. Truth is I work for a living and have a life so if I always waited to catch up before replying to something I would never be able to reply. While your post had everything necessary for @CorneliusXX to understand is error, he doesn't get it so I'm giving it another go:Any point in time reference is arbitrary, but that's the point I was trying to make. There can be huge swings in market cap regardless of company performance due to a myriad of factors outside their control. The market price doubling or halving because of these factors due to sentiment is not unreasonable in the short term...

Points in time reference are NOT arbitrary. You happened to choose a point in time that was basically the end of a very long range-bound trading period filled with many significant but underappreciated events and shortly before a number of new significant events. Corporate events such as earnings, new products, acquisitions, patents, new factories coming on line etc. are a thing which is why time reference points are not arbitrary.

I think we can all agree that market prices will fluctuate, even doubling or halving over short periods of time. The question is really whether those fluctuations represent mispricing or not. On that matter you chose to say:

Your analysis above assumes that the price was fairly valued 12 months ago because (you think) Tesla increased in value only 3 to 4 times but the stock price grew much more so you argued that the stock must be mispriced. You were clearly arguing for a massively overpriced stock. Many probably could agree with a much smaller level of overpricing (myself included) but very few on this board could or should agree with your view of massive overpricing. Most of us think TSLA has been dramatically under priced for a very long time and that's why we disagree with you.While Tesla is growing more valuable every day, it's underlying business has not grown 10x in value in the past 12 months. The stock price increase is a combination of many market and behavioural factors in addition to underlying company execution. I think it would be difficult to argue that, on a purely business execution basis Tesla has increased in value by more than 3x-4x in the past 12 months.

That means the remaining 6x-7x growth is due to the market and behavioural factors....

Has Tesla announced when Model Y is arriving in Europe? And whether it will be from Berlin or Fremont?

European Ys are going to come from Berlin around April 2021. Per ElonThey haven't, and it likely means there is enough US/Canada demand to meet current production.

Edit: given Austin is making east coast Y's, projected North American demand seems substantial.

Destination

Member

Hi.

Memes are fun.

So are theories.

Was it fun to see TSLA magnetized towards SP 420 on Friday, so much so Jim Cramer stated shock at buying pressure on Twitter? That’s silly, right?

When Tesla made its secondary offering “at market price”, do you believe they had a target share price?

If you were Elon, having experienced “take private” episode, and you were forced to draw the line while your stock was squeezing...what SP would you pick?

It is likely $420 is the floor, and that everything below will just encourage more buying until that number is reached.

View attachment 585426

It is also likely this buffer will be the S&P accumulation period. Every time a dip occurs the accumulation occurs. Shares from Tesla @ $420 or shares from the market below.

S&P is coming within 21 days. The immediate cliff dive then excessive volume to hit 420 SP Is my proof.

Elon himself has stated that European model Y will be produced in BerlinHas Tesla announced when Model Y is arriving in Europe? And whether it will be from Berlin or Fremont?

This assumes that the utilities will be forward thinking enough to make the transition to battery storage before so many homeowners have solar that the utilities can no longer afford to do so. Utilities have never been known for forward thinking, any more than the legacy car manufacturers.

Utilities don't need to. Usually Peaker plants are always the most expensive plants to maintain. they would be operational anywhere from 20-100 hours a year. If we completely disrupt even just these peaker plants with the megapacks, it would be a massive change to the grid and a great financial step forward. Forward thinking or not, money talks.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K