Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Its completely normal to meet from time to time and I do not read anything else into it.

Elon mentioned at the show in Berlin last year that they meet and talk regularly.

Nothing to see here.

They might not be co-operating in technology, but at least they both benefit from media publicity.

What VW got: Elon Musk driving the ID.3 is a perfect ad for VW after all the mess. Until now most potential buyers have only seen photos of VW stockpiling the ID.3s on airfields and reports on deep software problems.

What Tesla got: Positive airtime in German/European media. Not that it's relevant to current Tesla sales, but brand building is always a long term process.

Diess has already done favor to Tesla by giving numerous positive statements in media. Now Elon paid back by advertising ID.3. for free.

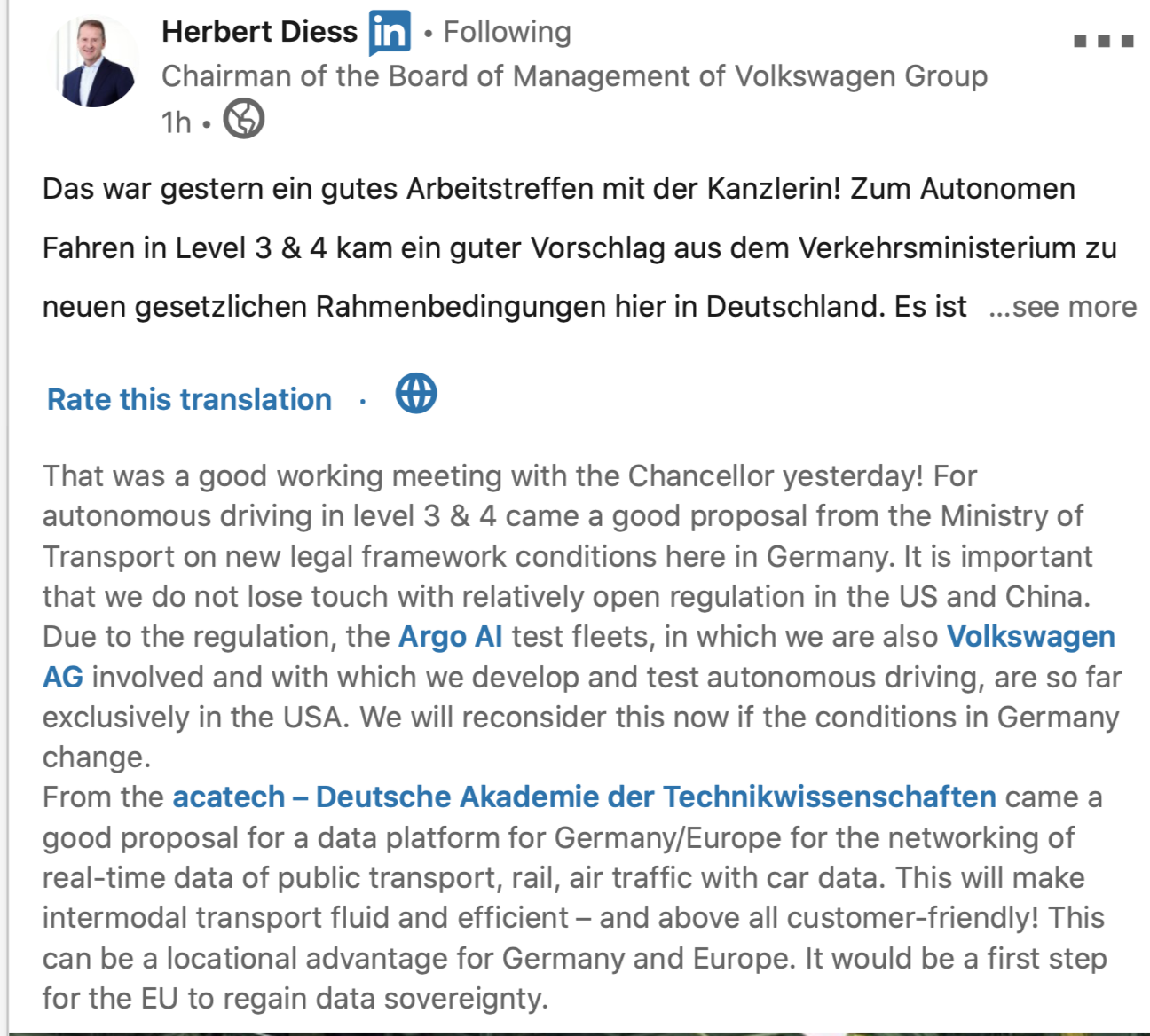

Positive developments in Germany about autonomous driving. In the top meeting between industry, lobby groups, unions, and the government yesterday it was decided that Germany wants to enable an autonomous driving regulation that allows L3 and L4 in 2022. The Ministry of Transport was endorsing a proposal that has been welcomed from Herbert Diess.

I am delighted to read that and have high hopes in that approach as the Ministry has been a key blocking part so far. VW considers putting his Argo vehicles that operate in the US into Germany in the future. Diess pointed out how important it is not to lose touch with the US and China in that regard.

The implication for Tesla can't be underestimated. With Tesla the most advanced in autonomous driving if the German market would open up to its abilities, Europe will likely follow. The voice from Germany in the recent UNECE regulation that included 53 countries globally was strong.

Right now AP is restricted in its abilities here in Germany to a point where its sometimes hard to use it at all. I drive usually always with NoAP but because of the restriction it does not work as smoothly as in the US and many functions are simply blocked.

If Germany makes a change with autonomous driving and the meeting concluded that as an official statement the value case for every Tesla owner is increasing by a large factor and the competitive edge of Tesla is increasing further.

That's encouraging!

I am delighted to read that and have high hopes in that approach as the Ministry has been a key blocking part so far. VW considers putting his Argo vehicles that operate in the US into Germany in the future. Diess pointed out how important it is not to lose touch with the US and China in that regard.

The implication for Tesla can't be underestimated. With Tesla the most advanced in autonomous driving if the German market would open up to its abilities, Europe will likely follow. The voice from Germany in the recent UNECE regulation that included 53 countries globally was strong.

Right now AP is restricted in its abilities here in Germany to a point where its sometimes hard to use it at all. I drive usually always with NoAP but because of the restriction it does not work as smoothly as in the US and many functions are simply blocked.

If Germany makes a change with autonomous driving and the meeting concluded that as an official statement the value case for every Tesla owner is increasing by a large factor and the competitive edge of Tesla is increasing further.

That's encouraging!

j6Lpi429@3j

Closed

doesnt anybody else realize the Diess just *desperately* wants a job at tesla?

Diess: Elon! Can we meet!

Elon: I'm busy

Diess: I can come to you!

Elon: Im flying back now

Diess: I'll meet you by your private jet!

Elon *sigh* I suppose so

Diess: I made an electric car too! Can I show you?

Elon: "Yawn* you have until my jets engines warm up.

Diess: Elon! Can we meet!

Elon: I'm busy

Diess: I can come to you!

Elon: Im flying back now

Diess: I'll meet you by your private jet!

Elon *sigh* I suppose so

Diess: I made an electric car too! Can I show you?

Elon: "Yawn* you have until my jets engines warm up.

doesnt anybody else realize the Diess just *desperately* wants a job at tesla?

...

Herbert Diess,

Vice-president Tesla Europe

I know... I've posted this before

Brian Sullivan on CNBC commented on exotic option constructs unwinding in Tesla stock. Derivative like.

Favguy

Member

Yes - I follow him onTwitter. He did sell all is LEAPS last week and moved into common stock.

Yesterday's thoughts:

View attachment 586155

I follow him on Twitter, just for the entertainment value, the way he behaves and talks sometimes, it disturbs me knowing he's a psychiatrist. But he's personally confirmed he's one of the best in the world, so that's comforting to know.

Featsbeyond50

Active Member

They might not be co-operating in technology

Elon might be. Remember, his mission is sustainable transportation, not beating the competition.

you care a bit too much, if you catch my drift.Tesla 336 usd in Germany atm I really feel like the worst is over let's pray

???Brian Sullivan on CNBC commented on exotic option constructs unwinding in Tesla stock. Derivative like.

Not unexpected. CNBS, Gloomberg & mainstream media in general have been starved of Tesla FUD clickbait for months and will milk this to the maximum extent.

Also remember that S&P 500 non-inclusion “due to regulatory credits” is a media creation with no basis in fact.

By that token, before adding oil companies to the index, did the S&P committee strip out government subsidies from the profits and add back the carbon pollution costs?

Also remember that S&P 500 non-inclusion “due to regulatory credits” is a media creation with no basis in fact.

By that token, before adding oil companies to the index, did the S&P committee strip out government subsidies from the profits and add back the carbon pollution costs?

LN1_Casey

Draco dormiens nunquam titillandus

Nasdaq futures +2%, Tesla pre-market +6%, I pick up my Model 3, and it's world EV day (apparently). So far, so good.

Congrats! Where are you getting your Model 3 at? Heading to Manchester's Tesla station? I've tried to stalk, er, I mean, visit, various Tesla show rooms and didn't think Liverpool had any. Or are you getting it delivered to your door?

Missed the beginning as was just tuning in. Brian is a host and as the early morning show “Worldwide Exchange” (I think) was drawing to a close there was a Market discussion when he made the Tesla and options comment.

It would be good for the comment to be confirmed in case I got it wrong.

This show comes on before Squawkbox and is IMO good/better at getting to the nitty gritty. Hope this clarifies a bit.

Much as I hate this S&P stuff at this point, it is the elephant in the room insofar as the SP is concerned.

As many have pointed out, the S&P really must add TSLA at some point. But the time frame is totally up to the S&P. Could be today. Could possibly be a year from now, although I would consider that highly doubtful. Much sooner than that would be a reasonable assumption. Could well be the 3rd Q earnings blowout that may force the issue. But if plays out as such, then again the S&P is in a bind.

Regardless of when the inclusion is made, the problem will be the same: no S&P index funds own TSLA at all in any of their indexes. They will be forced to purchase what appears to be about 100 million shares (probably more). There WILL be an explosive move up. And when it is done it is done, there is likely to be an explosive move down (that has never happened to TSLA, has it?).

How does the S&P deal with this fact? I am at a loss. But the whole scenario seems to guarantee high volatility in TSLA until this is settled.

Meanwhile, the fundamentals of the company are screaming upwards. And everyone wants a Model Y.

As many have pointed out, the S&P really must add TSLA at some point. But the time frame is totally up to the S&P. Could be today. Could possibly be a year from now, although I would consider that highly doubtful. Much sooner than that would be a reasonable assumption. Could well be the 3rd Q earnings blowout that may force the issue. But if plays out as such, then again the S&P is in a bind.

Regardless of when the inclusion is made, the problem will be the same: no S&P index funds own TSLA at all in any of their indexes. They will be forced to purchase what appears to be about 100 million shares (probably more). There WILL be an explosive move up. And when it is done it is done, there is likely to be an explosive move down (that has never happened to TSLA, has it?).

How does the S&P deal with this fact? I am at a loss. But the whole scenario seems to guarantee high volatility in TSLA until this is settled.

Meanwhile, the fundamentals of the company are screaming upwards. And everyone wants a Model Y.

Much as I hate this S&P stuff at this point, it is the elephant in the room insofar as the SP is concerned.

As many have pointed out, the S&P really must add TSLA at some point. But the time frame is totally up to the S&P. Could be today. Could possibly be a year from now, although I would consider that highly doubtful. Much sooner than that would be a reasonable assumption. Could well be the 3rd Q earnings blowout that may force the issue. But if plays out as such, then again the S&P is in a bind.

Regardless of when the inclusion is made, the problem will be the same: no S&P index funds own TSLA at all in any of their indexes. They will be forced to purchase what appears to be about 100 million shares (probably more). There WILL be an explosive move up. And when it is done it is done, there is likely to be an explosive move down (that has never happened to TSLA, has it?).

How does the S&P deal with this fact? I am at a loss. But the whole scenario seems to guarantee high volatility in TSLA until this is settled.

Meanwhile, the fundamentals of the company are screaming upwards. And everyone wants a Model Y.

Now would be a good time for Elon to tweet, in his inscrutable way, something about the negative influence of the S&P 500 inclusion model as it unavoidably affects the market place in an undesirably manipulative way

My proposal to S&P - make a one time exception by staggering the inclusion. Say 10% initially working to 100% eventually.How does the S&P deal with this fact?

That makes no sense. Inclusion in an index is binary. You are either included or you are not included.My proposal to S&P - make a one time exception by staggering the inclusion. Say 10% initially working to 100% eventually.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K