Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

There is a price for everythingLol it’s crazy to me to see others selling their shares because I really can’t fathom letting go of mine, no matter how high.

Eye of newt, willy of bat, ocelot's testicles, Lark's Tongues in Aspic, etc.

engle

Member

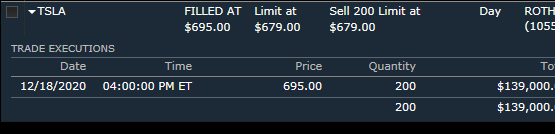

The $695 trade was real. Here is mine. I got lucky. The jump from my $679 limit to $695 makes no sense to me. I'd placed this order at 2:01 PM EST. Perhaps it was executed as part of the "closing cross"? The 3:59 PM high was $665.

Yes, just sold 10% at $695. At 3:57PM I put in an order for $673 for extended hours and the price from 3:57 to 3:59 never reached $670. Yet my broker said I sold at 4:00PM at $695.

Now put in an order to buy them back after-hours.

i had RBC on the go, and never saw above 665 or so in those closing minutes.

There is a price for everything

Much against any financial advisor's advice, I have some short term savings for our first home in TSLA. So of course it'll be worth more in the future, but this is a nice price to sell a bit knowing I need the cash anyway. Not sure about OTHER people, but there are certainly situations where folks may want to sell now, at an ATH, with no massive catalysts on the very near-term horizon (except maaaybe FSD, that is just rapidly getting better).

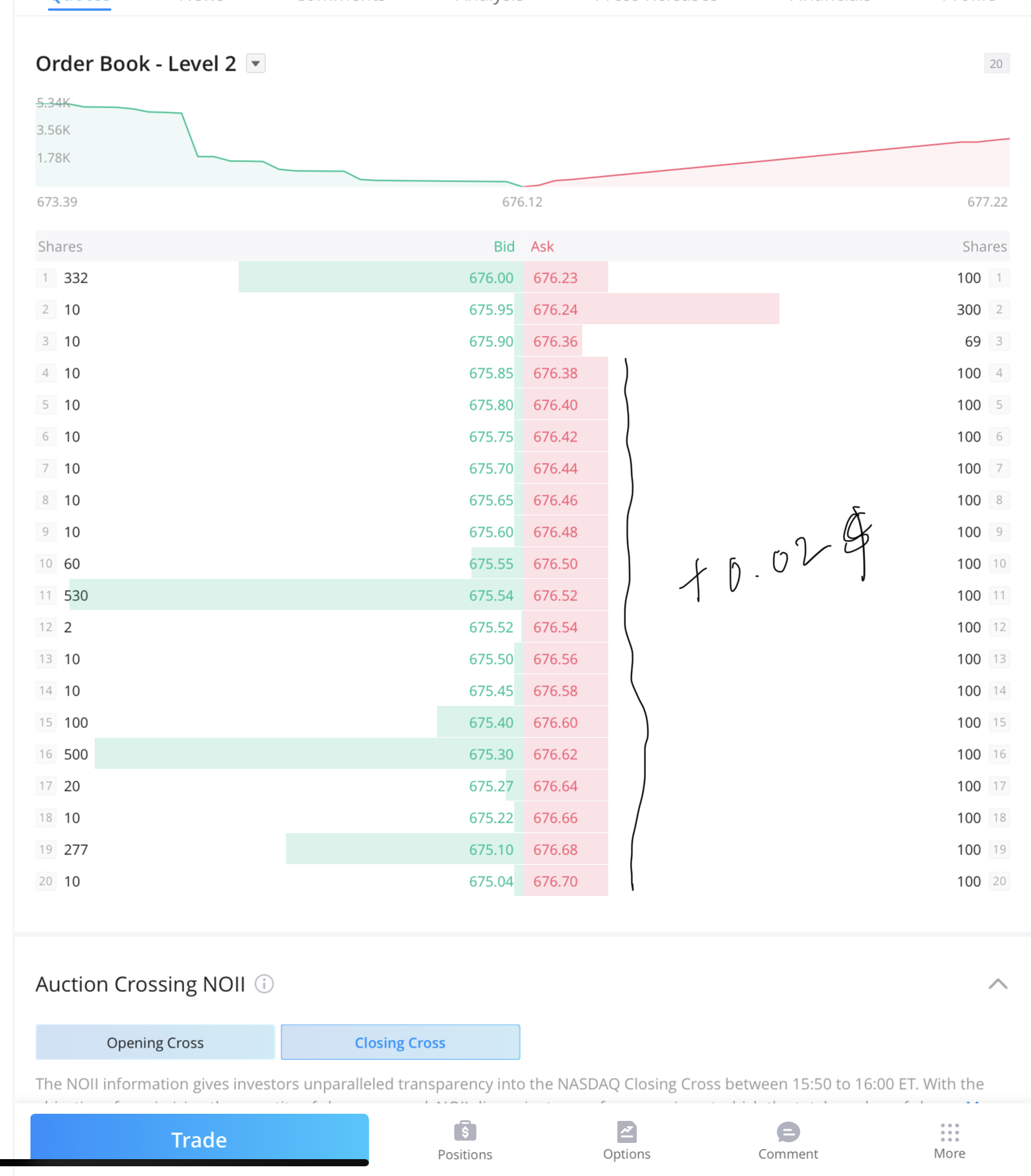

Huh, what is the deal with pinning at 680? Guess this is the price indexers and benchmarkers should buy in to have the least tracking errors?

It looks as if someone is scooping up everything at 680.00. That bid price keeps popping up.

I wonder if benchmarked funds are the buyers at $680 - they are generating alpha for every share they buy below the on-close price of $695.

Sure is stable at 680

My guess is that was determined as the price for purposes of expiring options.

I believe this is getting pinned at 680 primarily because of options. Remember option holders can exercise until 5:30 PM EST.

If my theory is right I expect the lid to be lifted after 5:30. Let’s see.

Regardless the fact that indices were not able to buy the required shares will mean that there will be more buying next week. Plus we could also see the active benchmark funds jump in provide support on any dip.

closing cross price was then set at 695. Still about 11m shares short on the buy side

Helpful history. Thank you. Where is the 11 million number or how was it derived?

BTW if anybody was watching the closing cross it was clearly showing a near indicative clearing price of 700$ and far closing price of 720$ around 3:52 PM or so. Stock was trading the 630s.

I bought a couple of hundred shares for around 638$ short term trading based on that information. I plan to hold these shares over the weekend. Cheers.

I bought a couple of hundred shares for around 638$ short term trading based on that information. I plan to hold these shares over the weekend. Cheers.

I don't think that's what we're seeing here. The vast majority of the 120M required seems like it's going to be bought at crosses to avoid variance to market prices. Which makes sense now that everyone here has explained it to me 20x and I've actually just SEEN one that I care about.

I don't think that's how it works. TSLA has been added at $695 to the S&P 500. Any purchase below or above this figure will introduce a tracking error.

Hence the couple of spikes to 695 in AH.

Ignoring the time value of the money (which is anyway very close to 0) for those funds that right now hold cash instead of TSLA because they didn't manage to acquire all the shares they need, if they buy at 695 on Monday, their tracking error should be very minimal.

I do not believe they'd insist on buying just at the opening/closing cross as this would not guarantee the 695.

adiggs

Well-Known Member

I think none of the above. It'll be based on the Opening Cross, Monday morning.

That'll be the indexes next chance to get the shares they need.

I love the Disagrees - I really do. I'm hoping for better information from anybody, including the ones that Disagree.

I'm far from an expert - more like most here that have been learning about this stuff for the first time the last few weeks. This is the best info I have - please improve my / our knowledge with better info.

Featsbeyond50

Active Member

Your idea of crazy must have been less crazy than mine.For everyone that suggested a crazy closing limit sell order, I thank you. I'll buy those shares back next week.

TheTalkingMule

Distributed Energy Enthusiast

Anything above the SP at 3:59($666ish), but below $695 was executed at $695 as one massive purchase in the closing cross. At least that's my understanding.The $695 trade was real. Here is mine. I got lucky. The jump from my $679 limit to $695 makes no sense to me. I'd placed this order at 2:01 PM EST. Perhaps it was executed as part of the "closing cross"? The 3:59 PM high was $665.

TheTalkingMule

Distributed Energy Enthusiast

It's the only thing that makes sense to me. Me AH orders are in. Don't even wake me up if we hit $1200 tonight, no need.I love the Disagrees - I really do. I'm hoping for better information from anybody, including the ones that Disagree.

I'm far from an expert - more like most here that have been learning about this stuff for the first time the last few weeks. This is the best info I have - please improve my / our knowledge with better info.

Dancing Lemur

Hoopy Frood

Benchmark funds that did not get their 1.5% of TSLA can generate alpha by buying anything under the index inclusion price of 695. That may become support next week and beyond.

agastya

Member

Helpful history. Thank you. Where is the 11 million number or how was it derived?

sorry, mistyped. closing cross at 1600ET was completed with an imbalance of 12.4m shares. I guess there weren't enough sellers at that 695 price... so none more could be brought to the table.

I don't think it is the case that there were not enough sellers at 705 etc, but maybe the MOC buy orders had to be kept under 700? the whole auction process is to exercise max liquidity at a price where both sellers and buyers agree on.

But why does it keep falling after hours then? 672 now.Benchmark funds that did not get their 1.5% of TSLA can generate alpha by buying anything under the index inclusion price of 695. That may become support next week and beyond.

Interesting bids and asks during AH. Do you see the pattern?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K