Congrats! But you know, never say never ...Yes! I’m so glad I went all in, every last dollar I had to my name, last year right after the pandemic market decline! I remember everyone saying I was crazy and would lose it all but that just encouraged me even more lol. That was just the start of me buying consistently every quarter to finally reaching my goal shares (yesterday I bought my last). It feels so good to have accomplished this goal. Now time to save for a house and maybe live life a little bit less frugally now

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

--- 8< ---It is a long-standing, yearly TMC tradition since I started investing two years ago (almost to the day) that I review how the previous year was for me.

I spend at least one hour each day studying things Tesla,

Thank you very much for kickstarting me; have been pondering doing up a will for quite some time, and with progressing age and wealth it gets more and more urgent.I’m in the process of changing my will should my heart unionize and go on a permanent strike. Most of my net worth will go to a foundation dedicated to implementing renewable energy solutions, and spent in line with ideas I have. (For example, a Tesla semi could be bought and rented out for a week at a low rates so truck companies can try it out and not spew out CO2 while they use it, hopefully resulting in accelerated adoption. The rent money can also be spent on renewable energy, so it is a double action plan. The same goes for a solar parking lot, where the solar reduces CO2 output and the money resulting from the sale of power can be put to good use.) The mission must continue until the goal is reached, even if a soldier dies.

Kudos for making it this far. Expect my next report in October 2022.

So, I just jotted down a few key points to go into it and should go and get it properly finalized soon, like next week! (Unless I croak first ...)

I REALLY don't want to pass away intestate when there actually exists a family, albeit not formally heirs by law, and let all of the spoils go to a wastefully spending government. Prefer to leave the goods with people I know, love and trust, plus some other worthy causes. As long as it was only modest sums it didn't matter so much as it does now after TSLA growth. Thanks again!

ZeApelido

Active Member

For those of us dreaming of SP at 3,000 "soon" - For those of us dreaming of SP at 3,000 "soon" - A potential limiting factor for stock growth in the next few years is a significant macro pull-back which seems likely when you look at 90 year historical market PE ratio. We have only been this high two other times, and there has been a pullback following it. So how much can TSLA climb if we find ourselves in a market correction? Obviously, HODL, but private Islands and Mountains might take a little longer....

Can’t compare PE ratios historically without considering interest rates. Current earnings yield considering ultra low interest rates is arguably a bargain vs historical levels.

The Accountant

Active Member

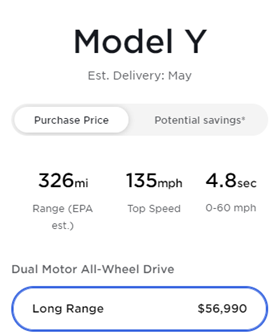

In the US, the Model Y LR delivery date has now moved to May 2022.

#nodemand

#nodemand

Benzinga - 4 hours ago: Why Tesla Is Potentially Disruptive For Legacy Players (A $15,000 EV Is One Of The Reasons)

Excerpt:

The Tesla Thesis: Tesla is the most valuable and highest margin major car company in the world, Jonas said in a note. The company is also striving to be the cost leader in EVs, he added.

The combination, the analyst said, is potentially disruptive for the legacy players.

Tesla is in a position to be a cost leader in the EV market due to its manufacturing innovation, battery innovation and scale, Jonas said. The company has the potential to market a vehicle at a $15,000 price point or less, likely this decade, if not before 2025, he added.

Excerpt:

The Tesla Thesis: Tesla is the most valuable and highest margin major car company in the world, Jonas said in a note. The company is also striving to be the cost leader in EVs, he added.

The combination, the analyst said, is potentially disruptive for the legacy players.

Tesla is in a position to be a cost leader in the EV market due to its manufacturing innovation, battery innovation and scale, Jonas said. The company has the potential to market a vehicle at a $15,000 price point or less, likely this decade, if not before 2025, he added.

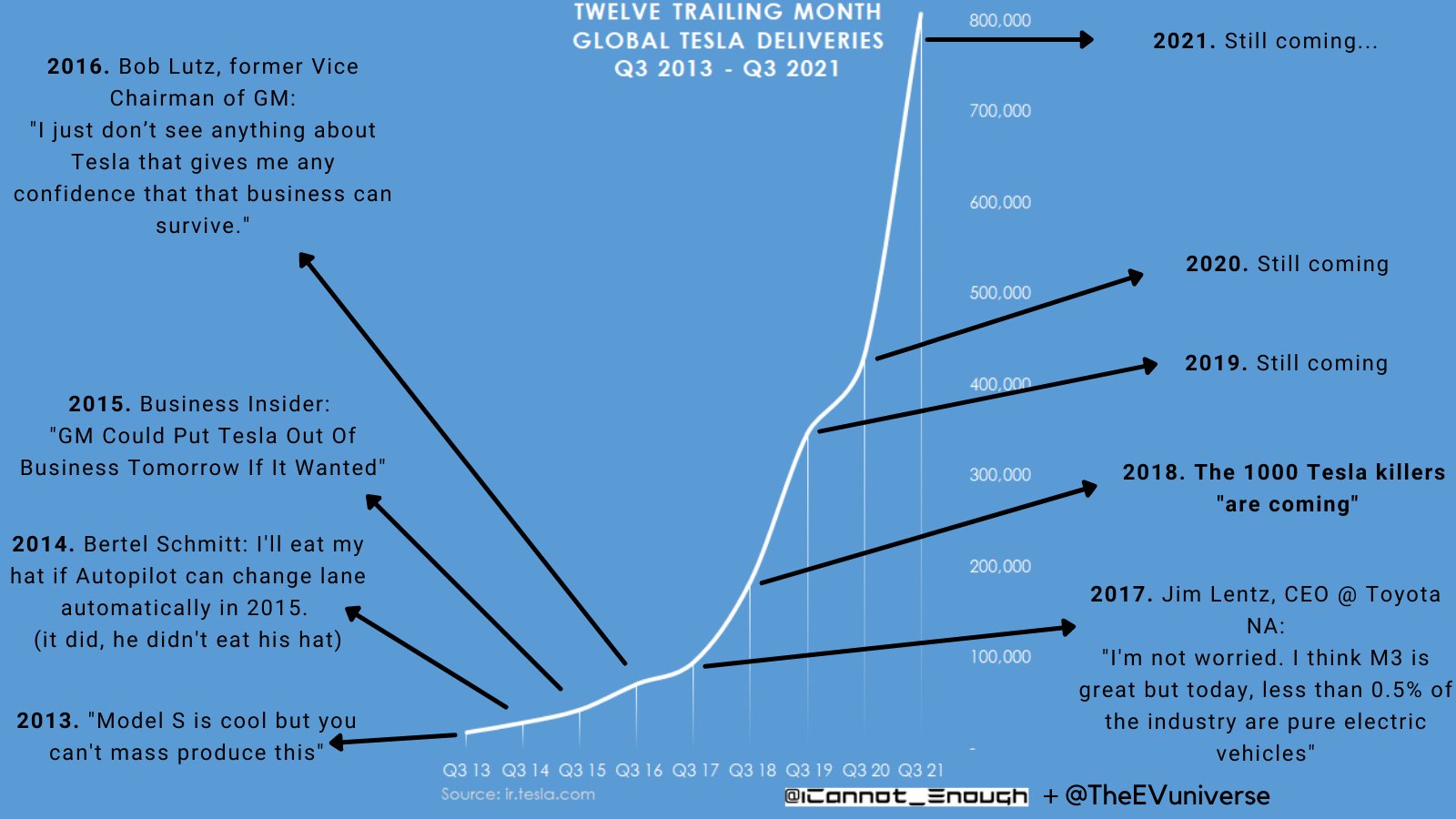

So… essentially a busted growth story?and this version with comments

(I love that graph. I really, really love it!

loquitur

Member

Great reference, though I haven't read it. I was going to mention Prof. Simons but

you did first. I notice in the "Read Inside" blurb a mention of Simons colleague

Elwyn Berkelamp, who advised on some grad work I did in college,

taught me how to juggle 5 balls there at Cal, and was an all-round triple-threat propeller-head.

Among other things he was dean of three departments

there -- computer science, mathematics/statistics, and electrical engineering

(but not all at the same time!)

I'm wondering if the Simons book discussed the Renaissance hedge fund

strategies in much detail. The knock on any quant system (noted by Burton Malkiel

of "Random Walk Down Wall Street" fame) is that once a (currently) winning system is known,

it is copied and then is undermined because everyone is doing the same thing.

So if everyone buys TSLA (because it's a winning strategy), does that mean the value will go down?The knock on any quant system (noted by Burton Malkiel

of "Random Walk Down Wall Street" fame) is that once a (currently) winning system is known,

it is copied and then is undermined because everyone is doing the same thing.

I went down the rabbit hole and came to this article about the founder and CEO of Binance Changpeng Zhao (CZ):Oh cheeseburgers. I'm going to assume the Tesla Accounting bitcoin imparement calculation will ignore this momentary algorithm induced flash crash to $8,200.

Bitcoin's Price Crashed 87% on a Major Exchange Thanks to a Bug

Bloomberg: Binance CEO Goes All-in on Tokens: ‘I Just Want to Keep Crypto’

CZ is a true hodler: close to 100% net worth in crypto, no fiat of any form and no intention to convert into fiat; owns no house, no car and most luxurious things bought were 5 or 6 laptops and doesn't own much anything else, physically.

"So I’m one of those guys who value liquidity much more than owning something. I actually prefer not to own anything."

This gives me a new perspective of those talks of buying mountains, islands, boats, etc. I also want to look into Mr. Money Mustache again.

StealthP3D

Well-Known Member

A few years ago I was a less of a Tesla bull than I am now. I found the very polarized camps regarding the expected value of TSLA fascinating and indicated an opportunity to make money if I could figure out what side was right. So I read a lot of bull and bear posts and tried to reformulate the arguments and see what counter arguments I got. But I really struggled to find any bear that I had what I thought to be good arguments. Almost all the bears were fishing for arguments, had very little real life experience of driving Teslas or talking with owners and arguments would be all over the place. Often they would loud and argumentative and doing Gish gallops as a way of winning the debate rather than to try to find out how the world was or what would happen.

So the more I tried to get bears to clarify their reasonings, the more bullish I became. If you listen to for example a debate between Rob Mauer and GoJo, you will hear that Gordon talks a lot, moves between topics very quickly and generally sounds very desperate, while Rob is relaxed and confident, talks about each point in turn. We live in a political climate where the GoJo types win elections, which is sad, but they generally are wrong about factually describing reality or prediction the future.

Look at GoJo now, he is predicting 1.5M deliveries for 2021 while claiming that Tesla is not growing. Clearly he will need to confuse his listeners a lot to win that argument. But a bull that is claiming that Tesla is growing and just cites the numbers from previous years and makes a prediction based on just extrapolating current production numbers and adding a little capacity can make that argument without confusing any listeners and without being too upset about any disagreement. No need to use ad hominems, Gish gallops or interrupting to make your case.

So when you are trying to decide if TMC or TSLAQ is a cult, which is a valid sanity check to do now and then, imo don’t only look at the arguments, also look on the form they are being delivered. Are the posters calm and relaxed, are the arguments clear and to the point etc. You would never see a physics professor being upset that his student have alternative viewpoints and start yelling at them, but you will see freshman students being upset with their biology professor for having non-popular viewpoints. The person throwing poop is generally wrong.

I'm really glad you finally came around. I remember wondering if you just didn't get it or were being purposefully negative on Tesla. I saw a positive change happen with your posts in the somewhat recent past. At first you surprised me with your new-found positive Tesla outlook and I wasn't sure if you were being sincere because I was accustomed to you being a stick in the mud for anything Tesla. I can see now you just didn't know any better so my apologies if I was ever short or harsh with you. I should have given you the benefit of the doubt and this is a good learning for me because I was really having a hard time understanding that you didn't see the value.

That said, I would suggest that the form in which arguments are delivered are not as reliable an indicator as the substance of the arguments. I lost about 10% of my portfolio shortly after the turn of the millennium by listening to well presented arguments that were countered by haters. Sometimes people are just plain wrong even though they are being as polite and informative as possible. My mistake was listening to well-presented bullish arguments while discounting more abrasive persons and misjudging the number of people were willing to pay a high price for satellite voice (and data) communications. Satellite networks required heavy borrowing 20 years ago (before SpaceX). The business was well run but it was too soon and the offerings were too expensive to create a viable market large enough to cover the debt and operating expenses. Details like the price of the product matters. This is one reason I became so bullish on Tesla in early 2019 - I could see the business was almost profitable and there were huge cost savings to be had with increases in volume and decreases in component costs.

early_adapter

New Member

Lars has just done a good video with that data. He does a great Tesla show and should have many more subscribers.I'm looking for information on projections on EV production for top auto manufactures, similar to the image below. Does anyone have this info. Thx

View attachment 724686

Theoretically, yes. But we are a long long way from mass acceptance. This might sound crazy given how far TSLA has come, but the vast majority of people I talk to still dont have the slightest clue about what it is. I didnt have much faith in humanity before but conversations regarding Tesla took me to a whole new level. I guess it is true that the cast majority of people should put their money in index funds without messing around with individual companies.So if everyone buys TSLA (because it's a winning strategy), does that mean the value will go down?

A person who values liquidity more than almost anything is a person out of balance.I went down the rabbit hole and came to this article about the founder and CEO of Binance Changpeng Zhao (CZ):

Bloomberg: Binance CEO Goes All-in on Tokens: ‘I Just Want to Keep Crypto’

CZ is a true hodler: close to 100% net worth in crypto, no fiat of any form and no intention to convert into fiat; owns no house, no car and most luxurious things bought were 5 or 6 laptops and doesn't own much anything else, physically.

"So I’m one of those guys who value liquidity much more than owning something. I actually prefer not to own anything."

This gives me a new perspective of those talks of buying mountains, islands, boats, etc. I also want to look into Mr. Money Mustache again.

The only reason for having a large amount of net worth is because of the freedom it gives.

Access is granted to those with means. However, If all one wants to do is acquire more liquidity...it begs the question....why?

Idk, ask Elon, with his 50k house and company cars as his non liquid assets.A person who values liquidity more than almost anything is a person out of balance.

The only reason for having a large amount of net worth is because of the freedom it gives.

Access is granted to those with means. However, If all one wants to do is acquire more liquidity...it begs the question....why?

True...but in that case we are talking about a unique person.Idk, ask Elon, with his 50k house and company cars as his non liquid assets.

Artful Dodger

"Neko no me"

IMO, there's really only two things those foundation could be for, the new CATL bty plant or the Model 2 plant. I don't have enough knowledge of civil engineer or earthworks prep to judge, but there are several Civil Engineers on this board that may share an opinion.

Operationally, I'd prefer to have the more complex site needing the most engineering oversite closer to my R&D facility, so that's why my take is that the earthworks are in preparation for the Model 2 factory (ground compression through weigh of earth / compaction).

Tesla will be in no rush to announce what it is. The whole R&D building has been finished for months now. WuWa (who's videos we depend upon) though the R&D Center was what we are now calling a Logistics building on the North edge of the Model Y Assembly hall. So we just have to make an informed guess, while remaining open to new information.

Cheers!

Well, now at least we know that the earthworks under construction on the NE side of Giga Shanghai are NOT for the new CATL bty factory:

CATL factory nears completion 3 km from Tesla factory\Teslashanghai\4K # 365 | Wu Wa

Cheers!

Words of HABIT

Active Member

However it only works when TSLA is red, unfortunately not available for the foreseeable future.OMG! Thank you for posting that screenshot. I didn’t know TMC had a dark mode!!!

jhm

Well-Known Member

That's not exactly the issue. If quantities are trying to chase down arbitrage opportunities, then the more they pile on, the more those arbitrage spreads narrow. But quantities generally don't spend much time trying chase down arbitrage opportunities. Rather, they tend to work with arbitrage free pricing models. The point is to avoid mispricing the market and thereby enable arbitrage ops for others. That's why quants can command huge compensation they help firms avoid getting eaten alive by the market.So if everyone buys TSLA (because it's a winning strategy), does that mean the value will go down?

SageBrush

REJECT Fascism

I didnt have much faith in humanity before but conversations regarding Tesla took me to a whole new level. I guess it is true that the cast majority of people should put their money in index funds without messing around with individual companies.

Imagine their horror if they find out that the largest holding of their index funds is TSLA

loquitur

Member

Chuckle, no. I recall that it applies to systems that tried to arbitrage small price differencesSo if everyone buys TSLA (because it's a winning strategy), does that mean the value will go down?

(say bid vs. ask) for an advantage; the new copycat player might come to the game with slightly

different parameters at different times and randomly go in and out of phase to help

destroy the differences. You are right -- if everyone buys (or conversely sells) TSLA

with no counterforce it will go the same direction, with negative feedback loops adding "in phase."

This is all from vague memory, so I'll have to revisit Malkiel's paper and the Jim Simons book.

Think of the phenomenon as the one Yogi Berra opined upon about a popular restaurant --

"nobody goes there anymore -- it's too crowded". I guess stock trades get crowded, too!

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K